SEGRO PLC: Segro Buys Slough Office Portfolio to Meet Increased and Changing Occupier Requirements

24 December 2021 - 1:07AM

UK Regulatory

TIDMSGRO

SEGRO plc ("SEGRO" or the "Group") has acquired a portfolio of

offices on the Bath Road, Slough, from clients of AEW for GBP425

million.

The portfolio represents 89,000 sq m of built space spread

across 39 acres of land with a passing rent of GBP20 million,

reflecting a net initial yield of 4.6 per cent.

SEGRO previously developed the office portfolio and sold it as

part of its strategy to dispose of non-core assets, with the

proceeds reinvested into the Group's highly profitable development

pipeline. Since January 2016, when the office portfolio was sold,

the Slough Trading Estate has delivered capital value growth of 59

per cent and was valued at GBP2.2 billion as of June 2021.

The ageing nature and relatively short lease terms of some of

the offices means that this acquisition will enhance SEGRO's

ability to satisfy growing customer demand for data centres,

creative industries, life science occupiers and other potential

users of industrial space in Slough.

David Sleath, SEGRO's Chief Executive, said:

"Over recent years we have seen a transformation in the nature

and level of occupier demand for industrial, data centre and other

uses of space in Slough. Since 2016, we have created over 96,000 sq

m of new industrial space on the Slough Trading Estate to meet this

demand, of which 58,000 sq m has been provided to support our

growing data centre customers.

"Developing the highest and best use of industrial land in

Slough has been core to our purpose as a business since 1920 and we

look forward to continuing to do so following the re-acquisition of

the office portfolio, allowing SEGRO to further invest and attract

new businesses into the local area."

The acquisition will be funded from cash and bank

facilities.

CONTACT DETAILS FOR INVESTOR / ANALYST AND MEDIA ENQUIRIES:

SEGRO Soumen Das (Chief Financial Tel: +44 (0) 20 7451 9110

Officer)

Claire Mogford (Head of Investor Tel: +44 (0) 20 7451 9048

Relations)

Gary Gaskarth (External Tel: +44 (0) 20 7451 9069

Communications Manager)

FTI Consulting Richard Sunderland / Claire Turvey Tel: +44 (0) 20 3727 1000

/ Eve Kirmatzis

Notes to editors:

ABOUT SEGRO

SEGRO is a UK Real Estate Investment Trust (REIT), listed on the

London Stock Exchange and Euronext Paris, and is a leading owner,

manager and developer of modern warehouses and industrial property.

It owns or manages 8.8 million square metres of space (95 million

square feet) valued at GBP17.1 billion serving customers from a

wide range of industry sectors. Its properties are located in and

around major cities and at key transportation hubs in the UK and in

seven other European countries.

For over 100 years SEGRO has been creating the space that

enables extraordinary things to happen. From modern big box

warehouses, used primarily for regional, national and international

distribution hubs, to urban warehousing located close to major

population centres and business districts, it provides high-quality

assets that allow its customers to thrive.

A commitment to be a force for societal and environmental good

is integral to SEGRO's purpose and strategy. Its Responsible SEGRO

framework focuses on three long-term priorities where the company

believes it can make the greatest impact: Championing Low-Carbon

Growth, Investing in Local Communities and Environments and

Nurturing Talent.

See www.SEGRO.com for further information.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20211223005284/en/

CONTACT:

SEGRO plc

SOURCE: Segro PLC

Copyright Business Wire 2021

(END) Dow Jones Newswires

December 23, 2021 09:07 ET (14:07 GMT)

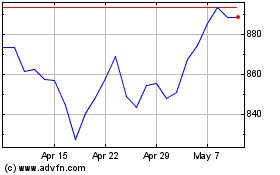

Segro (LSE:SGRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Segro (LSE:SGRO)

Historical Stock Chart

From Apr 2023 to Apr 2024