Trending: Shell to Take $2 Billion Tax Hit for 4Q as Integrated Gas Trading Rose

07 January 2023 - 3:17AM

Dow Jones News

1547 GMT - Shell is among the most talked-about companies across

news items over the past eight hours, according to Factiva data,

after the energy giant said it expects to pay $2 billion in

European Union and U.K energy windfall tax in the fourth quarter

and report a significant increase in natural-gas profit. The

statement was met with mixed results from analysts after the

oil-and-gas company also lowered the top end of its upstream

production forecast for the fourth quarter to 1.9 million barrels a

day from 2.0 million and said it expects lower marketing results

compared with the third quarter. Citi said in a note the statement

was broadly in line with market expectations, adding that the

positives for the quarter are advantageous gas trading compared

with a difficult third quarter and good working capital inflows.

RBC Capital Markets in a note pointed to lower guidance for

liquefied natural gas volumes but higher-than-expected trading

results. Dow Jones & Co. owns Factiva.

(elena.vardon@wsj.com)

(END) Dow Jones Newswires

January 06, 2023 11:02 ET (16:02 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

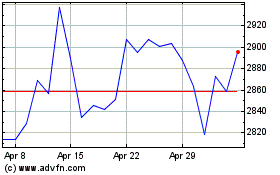

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

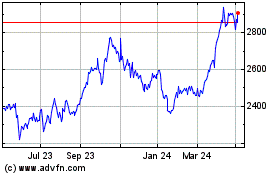

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024