TIDMSPX

RNS Number : 6769G

Spirax-Sarco Engineering PLC

17 November 2022

News Release

Thursday 17(th) November 2022

TRADING UPDATE

Robust trading despite economic headwinds; profit guidance

unchanged

Thermal energy and niche pumping specialist, Spirax-Sarco

Engineering plc, issues the following trading update in respect of

the four months ended 31(st) October 2022.

Economic Environment

As expected, the macroeconomic outlook has continued to weaken.

Global industrial production growth(1) (IP) is now forecasted to be

2.9% in 2022, lower than 3.5% forecasted in July, although still

above pre-pandemic levels. For 2023, the IP forecast has also been

revised downwards to 1.0%, from 3.2% in July.

Trading

Underlying demand growth remained strong in the four months to

the end of October despite the weakening IP forecast, with orders

in Steam Specialties, Electric Thermal Solutions ("ETS") and

Watson-Marlow's Process Industries remaining above our expectations

at the Half Year Results in August.

Demand from Watson-Marlow's customers in the Pharmaceutical

& Biotechnology sector started normalising in the second

quarter of 2022, reflecting lower COVID-19 vaccine demand. This

trend continued in the four months to the end of October, with some

customers rescheduling deliveries into 2023.

Following the successful management of global supply chain

challenges, as well as increases to our manufacturing capacity,

Group organic sales grew strongly in the four months to the end of

October.

We remain focused on successfully addressing inflationary

pressures through active price management. Steam Specialties'

adjusted operating profit margins in the period were ahead of our

half-year expectations and offset lower adjusted operating profit

margins in ETS, where highly engineered solutions with longer

delivery lead-times were impacted by higher material inflation.

Watson-Marlow's adjusted operating profit margin in the period was

lower than anticipated due to the rephasing into 2023 of higher

margin sales to Pharmaceutical & Biotechnology customers, which

resulted in a Group adjusted operating profit margin below that of

the first half of 2022.

On 29(th) September, the Group completed the acquisition of

Vulcanic. For the 12 months to 31(st) August and on a comparable

basis, Vulcanic revenues were EUR99.9 million, EBITDA was EUR19.9

million and EBIT was EUR17.8 million. On 28(th) September the Group

also announced the acquisition of Durex , which is expected to

close on 30(th) November. For the 12 months to 31(st) August, Durex

revenues were US$74.5 million, EBITDA was US$25.3 million and EBIT

was US$23.5 million.

On 15(th) September, ETS closed its loss-making Chromalox plant

in Soissons (France), three months earlier than anticipated. The

ongoing order book is being deployed for fulfilment by neighbouring

Vulcanic manufacturing operations.

Currency effects had approximately a 3.5% positive impact on

both sales and operating profit in the four months to October

compared to the same period of 2021, as sterling weakened against

our basket of trade currencies. If current exchange rates were to

prevail for the remainder of the year, we anticipate close to a 4%

positive impact on full year 2022 sales and profit, compared with

the full year 2021.

Financial Position

Following the completion of the Vulcanic acquisition, our net

borrowings (excluding leases) on 31(st) October were GBP391

million, up from GBP203 million on 30(th) June. Following

completion of the Durex acquisition, net debt will increase further

resulting in a Group net debt to EBITDA ratio close to 1.5x, on a

pro-forma basis.

Outlook

Our guidance for the Group's full year 2022 adjusted operating

profit, excluding contributions from the recent acquisitions,

remains unchanged.

For the full year 2022, we anticipate close to 15% organic

growth for Watson-Marlow's sales to the Pharmaceutical &

Biotechnology sector, as well as growth very significantly above IP

for the remainder of the Group's organic revenues. Overall,

including currency effects and excluding contributions from

acquisitions, revenues in the second half of the year are trending

slightly above the typical 52% of full year revenues. Consistent

with the four months to the end of October, we anticipate the

Group's full year adjusted operating profit margin to be below that

of the first half of the year.

The Vulcanic and Durex acquisitions will add to Group revenue

and operating profit in 2022 as of their respective completion

dates.

Looking ahead to 2023, the global IP forecast has been revised

downwards to 1.0%, from 3.2% in July, while global inflation rates

are forecasted to remain high. We remain confident in the Group's

proven resilience in a weakening macro-economic climate,

underpinned by our strong order book carried forward and our

well-established price management practices to offset inflationary

cost pressure. On the basis of current economic forecasts, we

anticipate at least mid-single-digit Group organic sales growth,

together with a small operating margin progression.

Spirax-Sarco Engineering plc expects to publish its 2022 Full

Year results on 9(th) March 2023.

Enquiries:

Nicholas Anderson, Chief Operating Officer

Nimesh Patel, Chief Financial Officer

Tel: +44 (0)1242 248 515

About Spirax--Sarco Engineering plc

Spirax--Sarco Engineering plc is a thermal energy management and

niche pumping specialist. It comprises three world--leading

Businesses: Steam Specialties, for the control and management of

steam; Electric Thermal Solutions, for advanced electrical process

heating and temperature management solutions; and Watson-Marlow,

for peristaltic pumping and associated fluid path technologies. The

Steam Specialties and Electric Thermal Solutions Businesses provide

a broad range of fluid control and electrical process heating

products, engineered packages, site services and systems expertise

for a diverse range of industrial and institutional customers. Both

Businesses help their end users to improve production efficiency,

meet their environmental sustainability targets, improve product

quality and enhance the safety of their operations. Watson--Marlow

provides solutions for a wide variety of demanding fluid path

applications with highly accurate, controllable and virtually

maintenance-free pumps and associated technologies.

The Group is headquartered in Cheltenham, UK, has strategically

located manufacturing plants around the world and employs more than

9,900 people, including more than 2,000 direct sales and service

engineers. The Company's shares have been listed on the London

Stock Exchange since 1959 (symbol: SPX) and it is a constituent of

the FTSE 100 and the FTSE4Good indices.

Further information can be found at

www.spiraxsarcoengineering.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQQLFFLFLEFBL

(END) Dow Jones Newswires

November 17, 2022 02:00 ET (07:00 GMT)

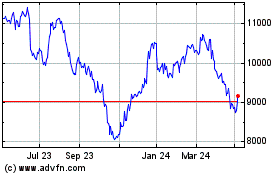

Spirax-sarco Engineering (LSE:SPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spirax-sarco Engineering (LSE:SPX)

Historical Stock Chart

From Apr 2023 to Apr 2024