SSE Swung to Fiscal Year 2023 Pretax Loss on Higher Costs; Retains Ownership of SSEN Distribution

24 May 2023 - 5:04PM

Dow Jones News

By Anthony O. Goriainoff

SSE said Wednesday that it swung to a pretax loss for fiscal

2023 after booking higher costs, and that retaining 100% ownership

of the SSEN distribution business was the right strategy at this

time.

The FTSE 100 company reported a pretax loss for the year ended

March 31 of 205.6 million pounds ($255.3 million) compared with a

pretax profit of GBP3.48 billion for fiscal 2022.

Adjusted pretax profit--a metric which strips out exceptional

and other one-off items--was GBP2.18 billion compared with GBP1.16

billion.

Revenue rose to GBP12.49 billion from GBP8.7 billion. Nine

analysts polled by FactSet had a revenue consensus of GBP10.59

billion.

Adjusted EPS rose to 166.0 pence a share from 95.4 pence. The

company had guided for an adjusted EPS of at least 160 pence for

fiscal 2023.

The group declared a final dividend of 67.7 pence a share,

taking the full-year dividend to 96.7 pence a share. The company

has guided for a full-year dividend of 85.7 pence a share.

The U.K. energy group said that adjusted EPS for fiscal 2024

will be over 150 pence a share, and that capital expenditure and

investment for the year will be over GBP2.8 billion.

"We have both the financial footing and capabilities to go after

high quality growth opportunities that will create value for years

to come," the company said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

May 24, 2023 02:49 ET (06:49 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

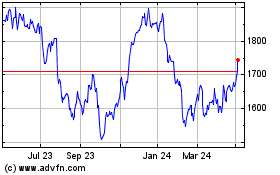

Sse (LSE:SSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

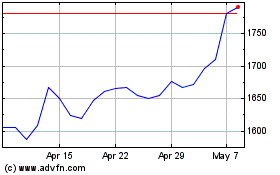

Sse (LSE:SSE)

Historical Stock Chart

From Apr 2023 to Apr 2024