Supply @ME Capital PLC Notice of General Meeting (8007U)

07 December 2021 - 6:00PM

UK Regulatory

TIDMSYME

RNS Number : 8007U

Supply @ME Capital PLC

07 December 2021

7 December 2021

Supply@ME Capital plc

(The "Company", "the Group" or "SYME")

Notice of General Meeting

Companies Act 2006: serious loss of capital which arose in

FY2014 when the Company was listed on AIM with the name Imaginatik

plc

Supply@ME Capital plc, the innovative fintech platform (the

"Platform") which provides the Inventory Monetisation(c) service to

manufacturing and trading companies, gives notice that a general

meeting of the Company's shareholders will be held at the offices

of Cicero/amo, HKX Building, 3 Pancras Square, London, N1C 4AG at

11 a.m. on 30 December 2021 ("the General Meeting").

The formal Notice of General Meeting and accompanying letter

from the Chair of the Audit Committee, David Bull, are today being

sent to all shareholders and will be available on the Company's

website, at www.supplymecapital.com.

Under the Companies Act 2006 (the "Act"), a "serious loss of

capital" occurs once the value of a company's net assets is less

than half of its called-up share capital. In such circumstances,

the directors are required, pursuant to section 656(1) of the Act,

to call a general meeting to consider whether any, and if so what,

steps should be taken to deal with the situation.

Having reviewed the historical financial information of the

Company, the current directors believe that the situation giving

rise to the serious loss of capital actually first arose in FY2014

when the Company was listed on AIM with the name Imaginatik plc.

The current directors have attempted to ascertain whether a general

meeting was held by the Company around that time and have contacted

a number of previous directors to obtain further information. They

have concluded from the results of these enquiries that it is

unclear whether the then-directors dealt with the issue as required

by the Act and accordingly are calling the General Meeting.

Accordingly, the board is calling the General Meeting to ensure

that this matter is addressed with shareholders as required by the

Act.

Although the directors are calling the General Meeting now, as

required by the Act, shareholders should be aware that the issue is

not specifically related to the Company's current business and

should note that:

-- The Company was incorporated in 2000, listed on AIM in 2006,

and, for the first 18 years of its existence was undertaking

operations in an unrelated sector to the Company's current

business;

-- In 2019, the Company disposed of its then undertaking to

become an AIM listed cash shell under the name Abal Group plc

before undertaking a reverse takeover of Supply@ME Srl and listing

on the London Stock Exchange's Main Market in March 2020;

-- The position of both its share capital and net assets derives

principally from operational results and corporate transactions

undertaken prior to the Company becoming Supply@ME Capital plc, and

before any of the current directors were appointed to the

Board;

-- This is not a new issue which has arisen since the

publication of the annual financial statements for the year ended

31 December 2020.

Notwithstanding the above, the directors consider that, as shown

in recent RNS announcements, the anticipated growth in revenues

will assist in alleviating the loss of capital and also consider

that the "serious loss of capital" does not itself have any

specific bearing on the Company's financial position or

performance.

The board always welcomes dialogue with shareholders and the

General Meeting will provide a forum for discussions on this issue

to take place. Shareholders will not be asked to vote on any

matters at the General Meeting as it is a discussion forum only.

There will be no other items discussed at the General Meeting in

line with the Act.

Notes

Supply@ME Capital PLC and its operating subsidiaries (together

the "Group") provide an innovative fintech platform (the

"Platform") for use by manufacturing and trading companies to

access inventory trade solutions enabling their businesses to

generate cashflow, via a non-credit approach and without incurring

debt. This is achieved by their existing eligible inventory being

added to the Platform and then monetised via purchase by third

party Inventory Funders. The inventory to be monetised can include

warehouse goods waiting to be sold to end-customers or

goods/commodities that are part of a typical import/ export

transaction. SYME announced in August 2021 the launch of a global

Inventory Monetisation program which will be focused on both

inventory in transit monetisation and warehouse goods monetisation.

This program will be focused on creditworthy companies and not

those in distress or otherwise seeking to monetise illiquid

inventories.

Contacts

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780,

paul.vann@walbrookpr.com

Brian Norris, Cicero/AMO, +44 (0)20 7947 5317,

brian.norris@cicero-group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGFSDSLWEFSEEE

(END) Dow Jones Newswires

December 07, 2021 02:00 ET (07:00 GMT)

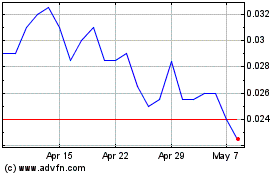

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024