Supply @ME Capital PLC Board Change (6640D)

04 March 2022 - 6:00PM

UK Regulatory

TIDMSYME

RNS Number : 6640D

Supply @ME Capital PLC

04 March 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMENDED. ON PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION

IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

4 March 2022

Supply@ME Capital plc

(The "Company" or "SYME")

Board Change

Supply@ME Capital plc, the innovative fintech platform which

provides the Inventory Monetisation(c) service to manufacturing and

trading companies, announces that James Coyle, Non-Executive

Chairman, has tendered his resignation as a Director of the

Company. Mr Coyle is leaving the company for personal reasons,

which will allow him to better balance existing time obligations

across his extensive portfolio of non-executive roles. The Board

has acknowledged Mr Coyle's personal reasons and has agreed with Mr

Coyle that his departure will take place with immediate effect.

In the RNS of 31 December 2021, the Company provided an update

on in-progress White Label and Inventory Monetisation initiatives.

Once the first transactions are complete, the Board expects an

increase in business volume. Due to the level of commitment this

will subsequently require, Mr Coyle has decided it is the right

time to step away from his role at SYME.

The Board is now actively seeking a permanent, long-term

successor to Mr Coyle. In the interim period, until a permanent

successor is in situ, the Board will appoint one of its existing

non-executive directors to chair future Board and Regulatory

meetings.

Additionally, the Company has appointed an independent adviser

(the "Adviser") to complete a strategic review of the Company, as

it prepares for the next phase of growth, which will focus upon the

delivery of its long-term business objectives, and its governance

system requirements. Upon completion of the Adviser's review, the

Adviser will make recommendations on any additional expertise and

capabilities required to ensure Supply@ME is positioned to realise

its planned global growth and diversification of revenue streams.

The Adviser will also make recommendations on the potential

appointment of a corporate broker and any additional advisers to

the Group.

Mr Coyle joined the Board at the end of October 2021 and has

since been instrumental in supporting the Company's progression.

During his time with the Company, TradeFlow Capital Management

("TradeFlow") signed a revenue-generating Investment Advisory

agreement with DP World, per the RNS of 18 February 2022. He has

also worked to improve SYME's corporate governance structure and

implement a refreshed investor relations strategy.

SYME Chief Executive, Alessandro Zamboni, said: "I am truly

grateful to Jim for his support and counsel. While his tenure with

us has been short, his impact has been immense. The level of

commitment he has given to the role far exceeded our expectations

and he leaves our business in a stronger position than he found it.

We are very sorry that demands on Jim's highly valuable time

prevent him from being able to provide the level of support

required for our next phase of our growth. On behalf of the Board,

I would like to thank him for his tremendous service to Supply@ME.

I wish Jim all the best for the future."

James Coyle said: " It is with deep regret that I have decided

to step down from my role at Supply@ME. Having worked closely with

the extremely dedicated team I wish the business every success in

the years to come."

Notes

Supply@ME Capital PLC and its operating subsidiaries (together

the "Group") provide an innovative fintech platform (the

"Platform") for use by manufacturing and trading companies to

access inventory trade solutions enabling their businesses to

generate cashflow, via a non-credit approach and without incurring

debt. This is achieved by their existing eligible inventory being

added to the Platform and then monetised via purchase by third

party Inventory Funders. The inventory to be monetised can include

warehouse goods waiting to be sold to end-customers or

goods/commodities that are part of a typical import/export

transaction. SYME announced in August 2021 the launch of a Global

Inventory Monetisation programme which will be focused on both

inventory in transit monetisation and warehouse goods monetisation.

This programme will be focused on creditworthy companies and not

those in distress or otherwise seeking to monetise illiquid

inventories.

Contacts

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780;

paul.vann@walbrookpr.com

Brian Norris, Cicero/AMO, +44 (0)20 7947 5317

brian.norris@cicero-group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOAJIMFTMTIMMIT

(END) Dow Jones Newswires

March 04, 2022 02:00 ET (07:00 GMT)

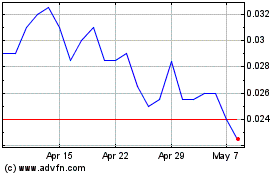

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024