Supply @ME Capital PLC Appointment of Independent Non-Executive Director (6060O)

13 June 2022 - 4:00PM

UK Regulatory

TIDMSYME

RNS Number : 6060O

Supply @ME Capital PLC

13 June 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMENDED. ON PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION

IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

13 June 2022

Supply@ME Capital plc

(The "Company" or "SYME")

Appointment of new Independent Non-Executive Director

Supply@ME Capital plc, the innovative fintech platform which

provides the Inventory Monetisation(c) service to manufacturing and

trading companies, is pleased to announce that the Board of

Directors proposes to appoint Mr Andrew Thomas as an Independent

Non-Executive Director with effect from the conclusion of the

Company's Annual General Meeting scheduled to take place at 11am on

30 June 2022.

Mr Thomas has over 20 years' experience in various business

advisory roles and during this time has worked across the US, UK,

EU and APAC regions, acquiring expertise of onshore and offshore

fund structuring and oversight, particularly in relation to tax and

regulatory issues. He also has extensive experience in mitigating

ESG risks while helping organisations to maximise ESG

opportunities. His proposed appointment to the Board follows the

RNS announcement of 6 June 2022 confirming the proposed appointment

of Mr Albert Ganyushin as the Company's new Independent

Non-Executive Chairman with effect from the conclusion of the

Company's Annual General Meeting.

SYME Chief Executive, Alessandro Zamboni, said:

"We continue to further strengthen the Supply@ME Board and are

looking forward to welcoming Andrew to the Company. We are

confident that his broad financial experience and specialist funds

expertise make him very well suited to helping guide the Company as

we move into the next stage of growth. I look forward to working

with him."

SYME Independent Non- Executive Director, Andrew Thomas,

said:

"I am pleased to be joining Supply@ME as an Independent

Non-Executive Director, having been drawn to its unique business

model and great potential. I am looking forward to working

alongside the current leadership team as the Company continues to

grow."

The following information is disclosed pursuant to the QCA

Corporate Governance Code and best practice:

Andrew Thomas holds or has held the following directorships,

partnerships and roles in the past five years:

Current Directorships or Partnerships Previous Roles

Transatlantic Regulatory Consulting Brandywine Global, an operating entity

of Franklin Templeton, Head of International

Legal and Chief Compliance Officer

Europe

---------------------------------------------

Close Brothers Asset Management,

General Counsel

---------------------------------------------

Katten Muchin Rosenman LLP, Global

Funds Lawyer

---------------------------------------------

Janus Henderson, Senior Lawyer

---------------------------------------------

Linklaters LLP, Lawyer

---------------------------------------------

Mr Thomas does not hold shares in the Company.

There is no further information to be disclosed pursuant to The

LSE Standard Listing Rulebook.

Notes

Supply@ME Capital PLC and its operating subsidiaries (together

the "Group") provide an innovative fintech platform (the

"Platform") for use by manufacturing and trading companies to

access inventory trade solutions enabling their businesses to

generate cashflow, via a non-credit approach and without incurring

debt. This is achieved by their existing eligible inventory being

added to the Platform and then monetised via purchase by third

party Inventory Funders. The inventory to be monetised can include

warehouse goods waiting to be sold to end-customers or

goods/commodities that are part of a typical import/export

transaction. SYME announced in August 2021 the launch of a global

Inventory Monetisation programme which will be focused on both

inventory in transit monetisation and warehouse goods monetisation.

This program will be focused on creditworthy companies and not

those in distress or otherwise seeking to monetise illiquid

inventories.

Contacts

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780;

paul.vann@walbrookpr.com

Chanice Smith, Cicero/AMO, +44 (0)207 947 5328,

chanice.smith@cicero-group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOAGPUMGQUPPUAW

(END) Dow Jones Newswires

June 13, 2022 02:00 ET (06:00 GMT)

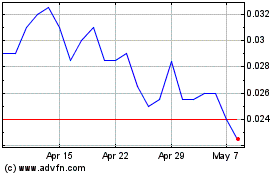

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024