TIDMSYME

RNS Number : 8483S

Supply @ME Capital PLC

18 July 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU, WHICH IS PART OF UNITED

KINGDOM DOMESTIC LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU

EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR)

IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Supply@ME Capital plc

(The "Company" or "SYME")

Share issuance and Total Voting Rights

Third tranche of new ordinary shares issued under equity funding

facility with Venus Capital SA; new ordinary shares issued to

TradeFlow directors; and to correct previous rounding issue

Capital Enhancement Plan deployment

SYME, the fintech business which provides an innovative Platform

for use by manufacturing and trading companies to access Inventory

Monetisation(c) solutions enabling their businesses to generate

cashflow, today announces that it is to issue the third mandatory

tranche ("Third Tranche") of new ordinary shares in the Company to

Venus Capital SA ("Venus Capital"), under the key terms of the

equity funding facility announced on 27 April 2022. The equity

funding facility with Venus Capital forms an integral part of the

Company's Capital Enhancement Plan, also announced on 27 April

2022.

The Third Tranche, comprising 1,350,000,000 new ordinary shares,

will be issued at a price of 0.05 pence per share, raising gross

proceeds for the Company of GBP675,000.

The Company will additionally issue to Venus Capital 1 warrant

for every 2 ordinary shares comprised in the Third Tranche. As

such, following the resolutions passed at the Company's Annual

General Meeting held on 30 June 2022, the Company will issue a

total of 5,585,000,000 warrants to Venus Capital in connection with

the signing of the binding agreement and the issue of the first

three tranches of new ordinary shares. The issue of warrants is in

line with the key terms of the equity funding facility announced on

27 April 2022. The exercise price of the warrants referred to above

is 0.065p with the warrants exercisable at any time up to 31

December 2025.

Additionally, with respect to the GBP1.95m bullet loan announced

on 27 April 2022, the Company:

-- has exercised its discretion to draw down GBP100,000 of Loan

Notes in order to support its working capital needs. In this

regard, the Company will continue to assess its working capital

needs and may, at its own discretionary, draw down further amounts

in the future;

-- will issue GBP308,500 of Loan Notes in order to settle the

over-all fees due to Venus Capital regarding the arrangement of the

Capital Enhancement Plan and the three mandatory tranches of equity

issues to date.

These Loan Notes are convertible into new ordinary shares with a

maturity date of 31 December 2025 at a 10% p.a. interest rate.

TradeFlow acquisition related earn-out payments

The Company will issue 106,762,760 new ordinary shares to each

of Tom James, Chief Executive Officer and Chief Investment Officer

of TradeFlow Capital Management ("TradeFlow"), and John Collis,

Chief Risk Officer and Head of Compliance at TradeFlow, who are

both executive directors of SYME, in relation to settlement of

post-acquisition earn out payments for the financial year ended 31

December 2021. The combined number of 213,525,520 new ordinary

shares was determined by reference to a pre-determined revenue

milestone, of which 80% was achieved by TradeFlow during 2021. As

detailed in the Company's Annual Report and Accounts for the year

ended 31 December 2021, there is an option for the Company to

settle the post-acquisition earn out payments in either cash or

shares and in this instance the option to settle through the issue

of new ordinary shares has been chosen.

Correction of discrepancy concerning number of new ordinary

shares in issue

The Company identified that a discrepancy of two ordinary share

had occurred between the number reported on its share register and

the number of shares in issue recorded at Companies House. This

discrepancy was caused due to rounding issues and resulted in two

ordinary shares being omitted from previous applications for

listing. The Company is seeking to correct this discrepancy through

the issue of an additional two new ordinary shares as part of the

current share issue.

Total voting rights

Applications has been made to the Financial Conduct Authority

(the "FCA") and to the London Stock Exchange plc (the "London Stock

Exchange") for admission of ordinary shares comprising the Third

Tranche, the TradeFlow new ordinary shares and the two new ordinary

shares to the standard segment of the Official List and to trading

on the London Stock Exchange's main market for listed securities,

respectively ("Admission"). It is expected that Admission will

occur at 8.00 a.m. on or around 19 July 2022.

The Company hereby notifies the market, in accordance with the

FCA's Disclosure Guidance and Transparency Rule 5.6.1, that

following the issue of the Third Tranche of new ordinary shares to

Venus Capital, the issue of new ordinary shares to TradeFlow

directors and to correct the previous discrepancy in the number of

shares, the Company's issued share capital will consist of

42,352,865,472 ordinary shares of GBP0.00002 per share ("ordinary

shares"), each with one vote. There are no shares held in Treasury.

Therefore, the total number of voting rights in the Company is

42,352,865,472 and this figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

For the purposes of UK MAR, the person responsible for arranging

release of this Announcement on behalf of SYME is Alessandro

Zamboni, CEO.

Contacts

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780;

paul.vann@walbrookpr.com

Chanice Smith, Cicero/AMO, +44 (0)20 7947 5317;

chanice.smith@cicero-group.com

Notes

Supply@ME Capital PLC and its operating subsidiaries (together

the "Group") provide an innovative fintech platform (the

"Platform") for use by manufacturing and trading companies to

access inventory trade solutions enabling their businesses to

generate cashflow, via a non-credit approach and without incurring

debt. This is achieved by their existing eligible inventory being

added to the Platform and then monetised via purchase by third

party Inventory Funders. The inventory to be monetised can include

warehouse goods waiting to be sold to end-customers or

goods/commodities that are part of a typical import/export

transaction. SYME announced in August 2021 the launch of a global

Inventory Monetisation programme which will be focused on both

inventory in transit monetisation and warehouse goods monetisation.

This program will be focused on creditworthy companies and not

those in distress or otherwise seeking to monetise illiquid

inventories.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOELVLFFLDLFBBB

(END) Dow Jones Newswires

July 18, 2022 08:13 ET (12:13 GMT)

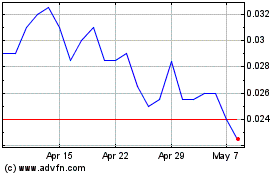

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024