Supply @ME Capital PLC First IM Transaction: Binding commitment signed (3303V)

09 August 2022 - 4:00PM

UK Regulatory

TIDMSYME

RNS Number : 3303V

Supply @ME Capital PLC

09 August 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU, WHICH IS PART OF UNITED

KINGDOM DOMESTIC LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU

EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR)

IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

9 August 2022

Supply@ME Capital plc

(The "Company" or "SYME")

Update on inaugural Inventory Monetisation(c): binding

commitment signed with the client company

Further to the Company's recent announcement on 29 July, SYME,

the fintech business which provides an innovative Platform for use

by manufacturing and trading companies to access Inventory

Monetisation(c) ("IM") solutions enabling their businesses to

generate cashflow, is pleased to confirm that the client company

has signed the binding commitment to execute the inaugural IM

transaction.

The Company will provide further updates regarding this and,

more broadly, its Captive Inventory Monetisation ("C-IM")

initiatives in due course, also considering the other traditional

inventory funding streams currently underway, aimed at deploying

new IM transactions. Additionally, further updates will be made in

due course regarding SYME's white-label proposition.

For the purposes of UK MAR, the person responsible for arranging

release of this announcement on behalf of SYME is Alessandro

Zamboni, CEO.

Contacts

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780;

paul.vann@walbrookpr.com

Chris Wimpress, Cicero/AMO, +44 (0)79 7013 7527,

chris.wimpress@cicero-group.com

Ed Saunders, Cicero/AMO, +44 (0)75 1017 4541, e

dward.saunders@cicero-group.com

Notes

Supply@ME Capital PLC and its operating subsidiaries (together

the " Group " ) provide an innovative fintech platform (the "

Platform " ) for use by manufacturing and trading companies to

access inventory trade solutions enabling their businesses to

generate cashflow, via a non-credit approach and without incurring

debt. This is achieved by their existing eligible inventory being

added to the Platform and then monetised via purchase by third

party Inventory Funders. The inventory to be monetised can include

warehouse goods waiting to be sold to end-customers or

goods/commodities that are part of a typical import/ export

transaction. SYME announced in August 2021 the launch of a global

Inventory Monetisation programme which will be focused on both

inventory in transit monetisation and warehoused goods

monetisation. This programme will be focused on creditworthy

companies and not those in distress or otherwise seeking to

monetise illiquid inventories.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRFVLLBLVLZBBV

(END) Dow Jones Newswires

August 09, 2022 02:00 ET (06:00 GMT)

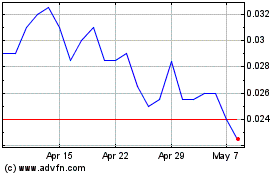

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

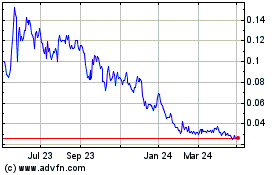

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024