TIDMTHR

RNS Number : 8225Q

Thor Mining PLC

01 November 2021

1 November 2021

Thor Mining PLC

Pilot Mountain Project Sale - Option Exercised for $1.8m

The directors of Thor Mining Plc ("Thor") (AIM, ASX: THR, OTCQB:

THORF) are pleased to advise that Power Metal Resources Plc ("Power

Metal") (AIM: POW) has exercised the option to acquire 100%

interest in Pilot Mountain Tungsten Project ("Pilot Mountain") in

Nevada, USA for an agreed value of US$1.8 million.

HIGHLIGHTS

-- Power Metal Resources Plc and its wholly owned subsidiary

Golden Metal Resources Ltd ("Golden Metal") have exercised their

option (the "Option") to acquire a 100% interest in Pilot

Mountain.

-- Power Metal will pay US$115,000 in cash to Thor Mining and

US$1,650,000 payable through the issue to Thor of 48,118,920

Ordinary Shares at an issue price of 2.5 pence per share ("Initial

Consideration Shares").

-- In addition, Power Metal will issue to Thor 12.5 million

warrants to subscribe for Ordinary Shares with an exercise price of

4p per Ordinary Share and life to expiry of 3 years.

-- Furthermore, a US$500,000 milestone payment will become

payable in Ordinary Shares, if Golden Metal publishes a JORC or

43-101 compliant resource at Pilot Mountain which increases against

current declared levels by 25% across total indicated and inferred

categories within two years.

-- Proceeds from the sale will be directed towards further

exploration activities at the Company's copper and gold projects -

Alford East, SA and Ragged Range, WA.

Nicole Galloway Warland, Managing Director of Thor Mining,

commented:

"We are pleased to announce the completion of the due diligence

process by Power Metals and its written confirmation to exercise

the option to acquire the 100% of Pilot Mountain Project in Nevada,

USA.

This strategic divestment will allow Thor to focus on our copper

and gold projects and provide further capital to accelerate

exploration activities, including RC drilling, at Ragged Range

Project in the Pilbara WA and progress baseline studies for In-situ

Recovery for copper and gold at Alford East Project, SA.

This sale is also the right mix of cash and shares to provide

ongoing exposure to the Pilot Mountain Project."

TRANSACTION INFORMATION

As announced on 31 August 2021, Thor signed an Option Agreement

with Golden Metal to acquire a 100% interest in Pilot Mountain,

from Thor.

Option Period

Under this Agreement Golden Metal had 60 calendar days and Thor

received written confirmation from Power Metal by the Option Expiry

Date that it had concluded its due diligence with regard to Pilot

Mountain.

Power Metal paid US$25,000 in cash to Thor Mining and issue to

Thor Mining 500,000 new Power Metal Ordinary shares of 0.1p

("Ordinary Shares") at an issue price of 2.5p (GBP12,500 of

Ordinary Shares).

Terms

The terms of the agreement are as follows:

Power Metal will pay US$115,000 in cash to Thor Mining and

US$1,650,000 payable through issue to the THR of 48,118,920

Ordinary Shares at an issue price of 2.5 pence per share ("Initial

Consideration Shares"). Thor has been informed that application

will be made for the 48,118,920 Initial Consideration Shares to be

admitted to trading on AIM which is expected to occur on or around

8 November 2021. The Initial Consideration Shares will represent c.

3.6% of the Power Metals issued share capital following

Admission.

Thor Mining will hold the Initial Consideration Shares in full

for a minimum of 6 months after the Option Exercise date, and

thereafter the Initial Consideration Shares will become freely

tradable in 25% instalments (25% tradable 6 months after Option

Exercise date, 50% after 9 months, 75% after 12 months and 100%

after 15 months). This trading restriction period may be varied by

both parties with written agreement.

In addition, Power Metal will issue to Thor Mining 12.5 million

warrants to subscribe for Ordinary Shares with an exercise price of

4p per Ordinary Share and life to expiry of 3 years from the Option

Exercise date ("Initial Consideration Warrants"). Should the volume

weighted average price ("VWAP") of Power Metal shares meet or

exceed 10.0 (ten) pence for 5 consecutive trading days Power Metal

may serve notice on Thor Mining providing 14 calendar days to

exercise and pay for the Initial Consideration Warrants or the

Initial Consideration Warrants would be cancelled.

Should Thor Mining exercise the Initial Consideration Warrants

above within 12 months from the Option Exercise date, Thor Mining

will receive one for one replacement warrants to subscribe for

Ordinary Shares at a fixed price of 8p per Ordinary Share, and life

to expiry ending 3 years from the date of Option Exercise ("Super

Warrants"). Should the Power Metal volume weighted average share

price meet or exceed 20p for five consecutive trading days Power

Metal may at any time issue Thor Mining with a written notice

providing 14 days to exercise and pay for the Super Warrants or the

Super Warrant would be cancelled.

Tail Benefit

POW will issue Thor Mining with a further US$500,000 of Ordinary

Shares, if Golden Metal publishes a JORC or 43-101 compliant

resource at Pilot Mountain which increases against current declared

levels by 25% across total indicated and inferred categories within

two years after the Agreement date. The number of Ordinary Shares

to be issued will be calculated based on the volume weighted

average Power Metal share price in the ten trading days immediately

preceding the announcement by Golden Metal of the JORC or 43-101

compliant increase.

Additional Terms

Thor Mining and its professional corporate, licensing and

geological teams will continue to work with Power Metal and Golden

Metal to assist with Pilot Mountain ownership transfer and to

manage local corporate and exploration/development operations in

the 12 months following the Option Exercise date. Power Metal and

Golden Metal will pay for any assistance provided post Acquisition

on reasonable commercial terms to be agreed.

About Pilot Mountain Project

Pilot Mountain tungsten project in Nevada, USA which has a JORC

2012 Indicated and Inferred Resources Estimate on 2 of the 4 known

deposits.

The 5,908-acre Project is centered around four existing mineral

deposits including Garnet, Good Hope, Gunmetal and Desert Scheelite

all which possess skarn-style tungsten-copper-silver-zinc

mineralisation.

The Desert Scheelite Indicated and Inferred Resource comprises a

2012 JORC Compliant 9.9 million tonnes @ 0.26% WO3, 0.14% Copper,

and 19.4g/t (grams/tonne) Silver, announced on 22 May 2017. The

Garnet Inferred resource comprises a 2012 JORC Compliant 1.83

million tonnes @ 0.36% WO3, announced on 22 May 2017.

On 13 December 2018, Thor announced an upgraded and increased

mineral resource estimate showing the Desert Scheelite mineral

resource estimate comprises 10.7 million tonnes at 0.26% WO , 19.38

gram/tonne Silver (Ag), 0.15% copper (Cu), & 0.38% zinc (Zn)

(above cut-off grade of 0.15% WO3).

http://www.rns-pdf.londonstockexchange.com/rns/8225Q_1-2021-10-31.pdf

Table A: Pilot Mountain Project JORC (2012) compliant Mineral

Resource Estimate, 13 December 2018 (AIM: THR Announcement 13

December 2018)

-- All figures are rounded to reflect appropriate levels of

confidence. Apparent differences may occur due to rounding.

-- The Company is not aware of any information or data which

would materially affect this previously announced resource

estimate, and all assumptions and technical parameters relevant to

the estimate remain unchanged.

-- Garnet Resource reported 22 May 2017

Thor Mining plc holds 100% of Black Fire Industrial Minerals Pty

Ltd (Australian private company) which owns 100% of Industrial

Minerals Pty (USA) Pty Ltd (Australian private company) which owns

100% of BFM Resources Inc and Pilot Metals Inc (USA private

companies) which own tenements representing the entire Pilot

Mountain Project.

As at 30 June 2020 BFM Resources Inc had Gross Assets of

AUD$21,449 (circa GBP11,317) and incurred no profit or loss

(AUD$Nil) for the year ended 30 June 2020.

As at 30 June 2020 Pilot Metals Inc had Gross Assets of

US$3,055,411 (circa GBP2,226,602) and a loss of US$106,164 (circa

GBP77,366) for the year ended 30 June 2020.

As at 30 June 2020 Black Fire Industrial Minerals Pty Ltd on a

consolidated basis had Gross Assets of AUD$5,181,951 (circa

GBP2,738,397) and a loss of AUD$154,690 (circa GBP81,746) for the

year ended 30 June 2020.

Further details of the project are included on Thor's

website.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

- Ends -

For further information on the Company, please visit

www.thormining.com or contact the following:

Thor Mining PLC

Nicole Galloway Warland, Managing Director Tel: +61 (8) 7324 1935

Ray Ridge, CFO / Company Secretary Tel: +61 (8) 7324 1935

WH Ireland Limited (Nominated Adviser Tel: +44 (0) 207 220 1666

and Joint Broker)

Jessica Cave / Darshan Patel / Megan

Liddell

Jasper Berry (Corporate Broking)

SI Capital Limited (Joint Broker) Tel: +44 (0) 1483 413

500

Nick Emerson

Yellow Jersey (Financial PR) thor@yellowjerseypr.com

Sarah Hollins / Henry Wilkinson Tel: +44 (0) 20 3004 9512

Competent Person's Report

The information in this report that relates to exploration

results is based on information compiled by Nicole Galloway

Warland, who holds a BSc Applied geology (HONS) and who is a Member

of The Australian Institute of Geoscientists. Ms Galloway Warland

is an employee of Thor Mining PLC. She has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which she is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Nicole Galloway

Warland consents to the inclusion in the report of the matters

based on her information in the form and context in which it

appears.

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com , which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining .

About Thor Mining PLC

Thor Mining PLC (AIM, ASX: THR; OTCQB: THORF) is a diversified

resource company quoted on the AIM Market of the London Stock

Exchange, ASX in Australia and OTCQB Market in the United

States.

The Company is advancing its diversified portfolio of precious,

base, energy and strategic metal projects across USA and Australia.

Its focus is on progressing its copper, gold, uranium and vanadium

projects, while seeking investment/JV opportunities to develop its

tungsten assets.

Thor owns 100% of the Ragged Range Project, comprising 92 km(2)

of exploration licences with highly encouraging early stage gold

and nickel results in the Pilbara region of Western Australia, for

which drilling is currently underway.

At Alford East in South Australia, Thor is earning an 80%

interest in copper deposits considered amenable to extraction via

In Situ Recovery techniques (ISR). In January 2021, Thor announced

an Inferred Mineral Resource Estimate of 177,000 tonnes contained

copper & 71,000 oz gold(1).

Thor also holds a 30% interest in Australian copper development

company EnviroCopper Limited, which in turn holds rights to earn up

to a 75% interest in the mineral rights and claims over the

resource on the portion of the historic Kapunda copper mine and the

Alford West copper project, both situated in South Australia, and

both considered amenable to recovery by way of ISR.(2)(3)

Thor holds 100% interest in two private companies with mineral

claims in the US states of Colorado and Utah with historical

high-grade uranium and vanadium drilling and production

results.

Thor holds 100% of the advanced Molyhil tungsten project,

including measured, indicated and inferred resources , in the

Northern Territory of Australia, which was awarded Major Project

Status by the Northern Territory government in July 2020.

Adjacent to Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including Inferred

resource estimates for the Bonya copper deposit, and the White

Violet and Samarkand tungsten deposits.

Thor holds 100% of the Pilot Mountain tungsten project in

Nevada, USA which is subject to a sale option agreement.(6)

Notes

(1)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210127-maiden-copper.gold-estimate-alford-east-sa.pdf

(2)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20172018/20180222-clarification-kapunda-copper-resource-estimate.pdf

(3)

www.thormining.com/sites/thormining/media/aim-report/20190815-initial-copper-resource-estimate---moonta-project---rns---london-stock-exchange.pdf

(4)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210408-molyhil-mineral-resource-estimate-updated.pdf

(5)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210901-pilot-mountain-project-us1.8m-sale-option.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISFFFIVIALLVIL

(END) Dow Jones Newswires

November 01, 2021 03:00 ET (07:00 GMT)

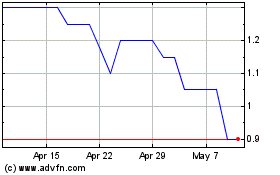

Thor Energy (LSE:THR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Thor Energy (LSE:THR)

Historical Stock Chart

From Apr 2023 to Apr 2024