TI Fluid Systems PLC Q1 2022 Trading Update (6798L)

17 May 2022 - 4:00PM

UK Regulatory

TIDMTIFS

RNS Number : 6798L

TI Fluid Systems PLC

17 May 2022

Released: 17 May 2022

TI Fluid Systems plc

Q1 2022 Trading Update

TI Fluid Systems plc, a leading global manufacturer of highly

engineered automotive fluid storage, carrying, delivery and thermal

management systems for light vehicles issues a trading update for

the three months ended 31 March 2022.

Group Results

Group revenue for Q1 was EUR755.0 million, a decrease of 4.1%

versus Q1 2021. Global light vehicle production (GLVP) volumes

decreased 4.5%, reflecting the continued disruptions to the supply

chain, further exacerbated by the Ukraine conflict and Covid-19

related shutdowns in China.

At actual rates, revenue outperformed GLVP by 40 basis points

(bps). On a constant currency basis, revenue declined 7.7% year

over year and underperformed GLVP by 320 bps.

3 months 3 months % Change % Change

ended ended (Actual (Constant Global

EURm Mar 22 Mar 21 currency) Currency) LVP volumes

---------------------------------

Group Revenue 755.0 787.0 -4.1% -7.7% -4.5%

--------- --------- ----------- ----------- -------------

By Region

--------- --------- ----------- ----------- -------------

Europe and Africa 289.9 320.3 -9.5% -9.4% -15.0%

--------- --------- ----------- ----------- -------------

Asia Pacific 257.8 263.6 -2.2% -7.7% 0.2%

--------- --------- ----------- ----------- -------------

North America 196.9 190.2 3.5% -3.6% -1.8%

--------- --------- ----------- ----------- -------------

Latin America 10.4 12.9 -19.3% -26.4% -12.7%

--------- --------- ----------- ----------- -------------

By Segment

--------- --------- ----------- ----------- -------------

Fluid Carrying Systems ("FCS") 427.9 418.8 2.2% -1.9% -4.5%

--------- --------- ----------- ----------- -------------

Fuel Tank and Delivery Systems

("FTDS") 327.1 368.2 -11.2% -14.3% -4.5%

--------- --------- ----------- ----------- -------------

Notes : All production volume outperformance metrics herein are

based on IHS Markit, April 2022, and Company estimates. All revenue

and outperformance at constant currency basis

Revenue by Segment

Supported by strong execution on the Company's electrification

strategy, the FCS division outperformed GLVP by 260 bps primarily

due to the new content thermal revenue.

The FTDS division underperformed GLVP by 980 bps, largely

impacted by the Covid-19 related customer shutdowns in China

(Tianjin) and the anticipated lower year-over-year launch activity

in the quarter.

Revenue by Region

In Europe and Africa, revenue decreased 9.4% year over year and

outperformed GLVP in that region by 560 bps, benefiting from new

thermal HEV and BEV programs. This represented a strong performance

in the region given customer scheduling volatilities resulting from

the Ukraine conflict.

Asia Pacific revenue decreased 7.7% year over year,

underperforming GLVP in that region by 790 bps, reflecting various

disruptions to the supply chain in the region, Covid-19 related

customer shutdowns in China and unfavourable mix.

In North America revenue decreased 3.6% year over year and

underperformed GLVP in that region by 180 bps, mainly due to the

anticipated lower launch activity than prior year.

Electrification

The Group continues to show good progress in the execution of

its electrification strategy and recorded new BEV business bookings

with lifetime revenue of EUR427 million in Q1.

Outlook

We continue to see uncertainty and volatility in the markets due

to continued microchip shortages, the ongoing conflict in Ukraine

and Covid-19 related customer shutdowns in China.

We are making progress with cost recovery from our customers.

However, we expect our H1 2022 margins to be modestly lower than H2

2021 due to disruptions in production, ongoing inflationary

pressures and time lag on recoveries.

Taking the year as a whole, we anticipate annual GLVP volumes to

be below 2021 levels. Provided that commodity prices stabilise and

GLVP volumes and inflationary pressures do not deteriorate

significantly further, consistent with our previous full year

outlook guidance, we would expect to achieve revenue outperformance

and historical cash flow conversion with full year margins slightly

below 2021 levels, thanks to sequential margin expansion in H2 2022

as customer pricing recoveries are realised.

Trading update call

TI Fluid Systems plc is holding a call for analysts and

investors at 09:00am UK time today.

Conference Call Dial-In Details:

UK: +44 (0)330 165 4012

Conference Code: 5754956

The audio recording will be available on www.tifluidsystems.com

later today.

Enquiries

TI Fluid Systems plc

Pilar Riesco

Investor Relations

Tel: +34 607 577 830

FTI Consulting

Richard Mountain

Nick Hasell

Tel: +44 (0) 20 3727 1340

Cautionary Statement

This announcement contains certain forward-looking statements

with respect to the financial condition, results of operations and

business of TI Fluid Systems plc (the "Company"). The words

"believe", "expect", "anticipate", "intend", "estimate",

"forecast", "project", "will", "may", "should" and similar

expressions identify forward-looking statements. Others can be

identified from the context in which they are made. By their

nature, forward-looking statements involve risks and uncertainties,

and such forward-looking statements are made only as of the date of

this announcement. Accordingly, no assurance can be given that the

forward-looking statements will prove to be accurate, and you are

cautioned not to place undue reliance on forward-looking statements

due to the inherent uncertainty therein. Past performance of the

Company cannot be relied on as a guide to future performance.

Nothing in this announcement should be construed as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKABBABKDFPD

(END) Dow Jones Newswires

May 17, 2022 02:00 ET (06:00 GMT)

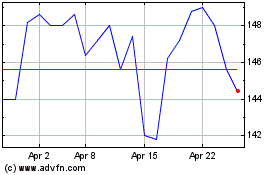

Ti Fluid Systems (LSE:TIFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ti Fluid Systems (LSE:TIFS)

Historical Stock Chart

From Apr 2023 to Apr 2024