TIDMTLW TIDMTTM TIDMTTM

RNS Number : 5899S

Tullow Oil PLC

17 November 2021

TULLOW OIL PLC

November trading update

17 NOVEMBER 2021 - Tullow issues the following statement to

provide an update on its ongoing operations and expectations for

the full year. The information contained herein has not been

audited and may be subject to further review and amendment.

Rahul Dhir, Chief Executive Officer, Tullow Oil plc, commented

today:

"We have delivered strong operational performance across both

Jubilee and TEN this year and the Ghana drilling programme

continues to be successful. Our decision to pre-empt Kosmos

Energy's acquisition of Occidental Petroleum's interests in the

Deep Water Tano (DWT) licence underscores our belief in the value

and growth potential of our assets in Ghana. Elsewhere, the process

to find a strategic partner in Kenya is progressing well and we

have had success through selective infrastructure-led exploration

with the Wamba well in Gabon. Finally, I am pleased to have

welcomed Phuthuma Nhleko into the Tullow team as Chairman-designate

and we look forward to working with him over the coming years as we

execute our strategy and reach Net Zero by 2030."

OPERATIONAL UPDATE

Production

-- Group working interest production averaged 59,400 boepd to

end October 2021, in line with expectations.

-- Full year production guidance remains unchanged with a range of 58,000-61,000 boepd.

-- Production guidance for next year will be provided in

Tullow's Trading Statement in January 2022 after work programmes

and budgets are agreed with Joint Venture (JV) Partners across

Tullow's portfolio.

Ghana

-- Ghana drilling campaign on track, with three of the four

wells planned in 2021 now onstream.

-- Significant improvement in operating performance sustained:

combined uptime on both FPSOs is averaging c.97%; gas offtake from

the Government of Ghana is averaging c.110 mmscfd; water injection

rates on Jubilee are in excess of 200 kbwpd.

-- Tullow has exercised its right of pre-emption related to the

sale of Occidental Petroleum's interests in the Jubilee and TEN

fields in Ghana to Kosmos Energy. As a result, Tullow's equity

interests are expected to increase to 38.9% in the Jubilee field

and 54.8% in the TEN fields. Completion of the transaction remains

subject to finalising definitive agreements with Kosmos

Energy/Anadarko WCTP Company and gaining approval from the

Government of Ghana. (See release).

Jubilee

-- Jubilee is currently producing c.28,700 bopd net to Tullow (gross c.81,000 bopd).

-- Two new wells have been brought onstream this year (producer

J56-P in July and water injector J55-WI in September). A third

Jubilee well (producer J57-P) is due onstream in December 2021,

ahead of schedule, and is expected to increase gross production

from the Jubilee field to over 85,000 bopd.

-- The Jubilee FPSO maintenance shutdown originally scheduled

for September 2021 is now forecast to take place in April 2022. The

shift allows the work scope to be optimised and gas enhancement

works previously planned for a 2023 shutdown to be accelerated. An

expected easing in COVID-19 restrictions should support a more

efficient work programme.

TEN

-- TEN is currently producing c.13,200 bopd net to Tullow (gross c.28,000 bopd).

-- A gas injector (Nt06-GI) came onstream in October 2021 and is

providing pressure support to existing Ntomme wells. Nt06-GI also

encountered oil at the base of the well, de-risking the development

potential of areas further to the north of Ntomme.

Non-operated

-- Production guidance for the non-operated portfolio is

c.17,000 bopd net to Tullow for the full year, in line with

expectations.

-- In Gabon, the Simba expansion project has made good progress

with a successful infill well brought onstream in September 2021. A

new 10-inch pipeline, which will allow increased offtake from the

field, is expected to be operational in December 2021.

-- In Côte d'Ivoire, the Espoir field is now back in production

following an extended shutdown. Tullow continues to work with the

Operator (CNR) to help prepare a remediation plan for the FPSO.

Kenya

-- Following the submission of a draft Field Development Plan

(FDP) to the Government over the summer, Tullow and its JV Partners

have been working collaboratively with the Ministry of Petroleum

& Mining to incorporate feedback and plan to submit a final FDP

by the end of 2021 in line with licence commitments.

-- As previously announced, the JV Partners are actively seeking

a strategic partner for the project and constructive discussions

continue with interested parties.

Exploration

-- In Gabon, selective infrastructure-led exploration has led to

the Wamba discovery which is adjacent to the non-operated Tchatamba

South oil field. The discovery has the potential to deliver oil

production from mid-2022, subject to capital allocation and budget

decisions.

-- In the emerging basins of Guyana and Argentina the focus

remains on unlocking value from the substantial prospective

resource base whilst seeking to reduce the Group's capital

exposure.

-- In Guyana, the Kanuku JV Partners plan to drill the

Beebei-Potaro commitment well in mid-2022, targeting in excess of

200 mmbbls gross mean unrisked prospective resources across two

targets.

-- Following the GVN-1 well result, the JV Partners have

notified the Government of Suriname that they have elected not to

enter into the next phase of Block 47, and Tullow will exit this

licence on 31 December 2021. Tullow has also decided to exit Block

54 at year end.

FINANCIAL Update

-- Full year Group capital expenditure is expected to be c.$265

million (previously c.$260 million), adjusted to take account of

revised Kenya expenditure.

-- Full year underlying operating cashflow(1) is expected to be

c.$600 million, and free cash flow is forecast to be c.$100

million, subject to year-end working capital movements, and

excluding any consideration received in respect of Uganda.

-- Tullow is set to receive $75 million from Total following a

Final Investment Decision (FID) for the Lake Albert Development in

Uganda. Whilst Tullow understands that both CNOOC and Total have

now taken FID, it is uncertain whether the final parliamentary

approval will be received before year end. Therefore, this payment

may occur in early 2022.

Hedge portfolio as of 2021 2022 2023 2024

16 November

========================== ======== ======== ======== ========

Hedged volume (bopd) 40,000 39,254 30,588 10,446

========================== ======== ======== ======== ========

Weighted average floor $48/bbl $51/bbl $55/bbl $55/bbl

protected ($/bbl)

========================== ======== ======== ======== ========

Weighted average sold $67/bbl $77/bbl $74/bbl $74/bbl

call

========================== ======== ======== ======== ========

Premium spend per barrel

($/bbl) ($2.6) ($2.0) ($2.0) ($2.0)

========================== ======== ======== ======== ========

BOARD UPDATE

On 25 October, Phuthuma Nhleko joined the Board as a

non-executive Director and Chairman-designate of Tullow. Phuthuma

will take over as Chair of Tullow from Dorothy Thompson, CBE, at

the end of December 2021, at which point Dorothy will retire from

the Board.

---------------------------

CONTACTS

============================================= ===================

Tullow Oil plc Murrays

(London) (Dublin)

(+44 20 3249 9000) (+353 1 498 0300)

George Cazenove (Media) Pat Walsh

Nicola Rogers and Matthew Evans (Investors) Joe Heron

============================================= ===================

Notes to editors

Tullow is an independent oil & gas, exploration and

production group, quoted on the London, Irish and Ghanaian stock

exchanges (symbol: TLW). The Group has interests in over 40

exploration and production licences across 11 countries. In March

2021, Tullow committed to becoming Net Zero on its Scope 1 and 2

emissions by 2030.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc

YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc

LinkedIn: www.linkedin.com/company/Tullow-Oil

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUNVNRAUUAAAA

(END) Dow Jones Newswires

November 17, 2021 02:00 ET (07:00 GMT)

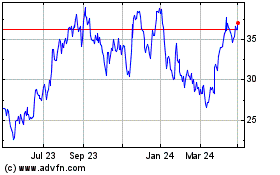

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

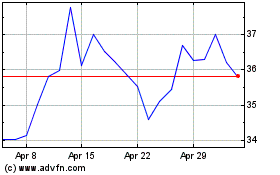

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024