TIDMUVEL

RNS Number : 0382X

UniVision Engineering Ltd

30 December 2021

30 December 2021

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 (as in force in the

United Kingdom pursuant to the European Union (Withdrawal) Act

2018). Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

UniVision Engineering Limited

("UniVision" or the "Company" or the "Group")

Interim Results

For the Six Months Ended 30 September 2021

UniVision (AIM: UVEL), the Hong Kong based Group whose principal

activities are the supply, design, installation and maintenance of

closed-circuit television and surveillance systems, and the sale of

security related products, is pleased to announce its unaudited

interim results for the six months ended 30 September 2021.

For further information visit www.uvel.com or contact:

UniVision Engineering Limited Tel: +852 2389 3256

Stephen Koo, Chairman www.uvel.com

Danny Kwok Fai Yip, Finance Director

Nicholas Lyth, Non-Executive Director Tel: +44 (0)7769 906686

Ivor Shrago, Non-Executive Director Tel: +44 (0) 7900251

925

SPARK Advisory Partners Limited Tel: +44 (0)20 3368 3551

(Nominated Adviser)

Mark Brady / Neil Baldwin www.sparkadvisorypartners.com

SI Capital Limited Tel: +44 (0)1483 413500

(Broker) www.sicapital.co.uk

Nick Emerson

CHAIRMAN'S STATEMENT

INTRODUCTION

Though the Company is not engaged in an industry seriously

affected by COVID-19, the pandemic together with other factors

described below have caused delays to projects and held up billing

to customers and respective certifications. The Board remains

cautious about the Group's business in the second half of the

financial year.

THE MAJOR CONTRACT WITH MTRC

The major contract with Mass Transit Railway Corporation

("MTRC") was awarded May 2017 and had an initial value of

HK$389.4m. Under the contract, the Group provides replacement work

on Closed-Circuit Television (CCTV) systems and installs a unified

IP-based, digital CCTV system for numerous railway lines in Hong

Kong. With further agreed orders of HK$100.2m since May 2017, the

total value of the Major Contract is now HK $ 489.7m. Following the

additional orders and supplementary agreements added, the Board

anticipates that the expected date for completion of contract works

is July 2024.

The contract was in the installation stage during the current

financial period. Due to the persistence of the pandemic project

progress has been affected. During the period under review, one

major sub-contractor who performed the installation works for a

railway line, has been in dispute with the Company over the value

of certain work. The Company believes the sub-contractor has

under-performed tasks, which has caused delays.

Since the key network equipment for the contract has now

changed, the Company is required to purchase a large amount of new

equipment from a separate supplier. Cash resources are required to

purchase the new equipment, it also requires time and manpower to

check with MTRC for matching, replacement and compatibility with

the existing equipment. To cope with this challenge, the Company

has deployed resources for the outstanding work.

The Company has sourced additional subcontractors to perform the

installation works in place of the original installer. The

installation work was relatively more labour intensive than

originally anticipated. For cost effectiveness, the Company has

agreed with MTRC that it can use its resources for the low margin

installation works. Nevertheless, the Company also intends to

organise its own workforce to perform the project.

As stated above, the dispute with the one major subcontractor

and its unsatisfactory performance has affected the progress of

installation works. Further, the change of key network equipment

caused additional delays. These factors adversely affected the

process of certification and has led to slow billing to MTRC. This

is the primary reason for the significant increase in Contract

Assets.

The Company has invoiced, in total, HK$184.5m to MTRC up to 30

September 2021. This leaves a further value of HK$305.2m over the

remaining years of the contract, assuming no further additions to

the work. The gross valuation of certified works on the Major

Contract was HK$212m up to 30 June 2021.

The Hongkong and Shanghai Banking Corporation ("HSBC"), the

Group's major bank, has provided a trade finance facility and an

invoice discounting/factoring facility. These facilities are

crucial to provide additional working capital for delivery of the

Major Contract and other sizeable projects. The Board closely

monitors the Company's status of working capital.

FINANCIAL REVIEW

The profit attributable to the equity holders of the Company is

approximately GBP0.14m (H1 2020: GBP0.39m). In the six months

period under review, revenue for the Group increased by 34% to

HK$53.5m (H1 2020: HK$39.9m). The increase in revenue was mainly

contributed from construction contract income which increased of

HK$21.6m to HK$50.5m (H1 2020: $28.9m).

The increase was largely due to numerous jobs completing and

associated project income being realised during the reporting

period and the installation works carried out for the Major

Contract.

Income from the maintenance business fell 68% to HK$2.9m (H1

2020: $8.9m) since the Company ceased to provide maintenance

services for the network of CCTV and public address systems on

seven railway lines in Hong Kong to MTRC from April 2021. Due to

expected timely disputes with MTRC on the final account of last

maintenance contract ended 31 December 2020 and the three months'

extended contract ended 31 March 2021, an impairment loss for

provision for unbilled receivable was made. Total amount of HK$6.8m

as presented in the Statement of Comprehensive Income as other

loss.

Gross profit margin in the construction business rose from 23%

to 30.5%. This was mainly due to numerous jobs completed and

recognised project income during the reporting period.

The change of key network equipment for the Major Contract,

together with the disputes with a subcontractor for installation

works have caused delays in the process of the project and led to

slow billing to MTRC for certification. These are the key reasons

for significant increase of HK$40.6m on Contract Assets to

HK$107.8m (H1 2020: HK$67.2m).

Administration expenses for the period decreased by 7% to

HK$7.6m (H1 2020: HK$8.2m). This was mainly caused by effective

cost control on rental expenses and repairs and maintenance

expenses.

To manage the execution of the Major Contract, the Company has

employed professional and technical staff, including a number of

system design and networks engineers. The number of staff was 76 as

at 30 September 2021 (H1 2020: 78).

Finance costs increased to HK$827k (2020: HK$378k) as a result

of increased adoption of trade finance and creation of new term

loans. During the reporting period, the Company raised new term

loans from HSBC with amount HK$23.9m of which HK$10m is for

financing the deposit placed for a life insurance policy as

additional security for the banking facility. The Company is

required to pay the principal and interest monthly. The interest

payable for trade finance and factoring were charged at the bank's

Hong Kong Dollars Best Lending Rate, currently 5% per annum.

The profit attributable to the equity holders of the Company for

the period is HK$1.5m (2020 underlying profit: HK$1.8m). Profit

before interest and income tax from operations during the period

was HK$2.3m (H1 2020: HK$4.2m).

During the period under review, the relative strength of HK$ at

the period-end has led to a 2.1% appreciation in the GBP reporting

amount in the Statement of Financial Position. It is also the

reason for the significant gain of GBP181k (H1 2020: loss GBP329k)

on exchange differences arising on the translation. All figures in

GBP in the Financial Statements have therefore needed to be

adjusted for comparative purposes. The financial data is also

presented in HK$ to provide a comparison with the comparative

figures in 2020 that were unaffected by exchange rate

fluctuations.

BUSINESS REVIEW

Markets

The CCTV surveillance market is growing rapidly with increasing

demand for digital and intelligent video products. The Company

anticipates more business opportunities in government

infrastructure and public security projects. There is also

increasing demand for wireless system such as 5G network for video

surveillance to enhance public safety and security.

The Board believes that the Major Contract should allow

UniVision to market its brand to the customers of similar systems

outside Hong Kong. The Group is now exploring the opportunity of

developing the overseas market by tendering prospective

projects.

The Company now actively participates in other market segments,

such as provision of UPS (Uninterrupted Power Supply), to

strengthen business growth in the Group.

Business

Under the Major Contract, the Company is a network service

provider in the application of CCTV systems. By acquiring skills

and training in networking and wireless technology area and

software skills for video analytics and facial recognition

applications to customisation and localisation for our clients.

The Company keeps moving forward in the CCTV segment and

gradually towards the safe city concept by introducing video-based

analytics to big data AI processing. The Board always explores and

seeks to capture the business opportunity in other business,

particularly in the Electrical and Mechanical ("E&M')

business.

Customers

MTR Corporation is the Company's largest customer in this

financial period with the implementation of the Major Contract. The

Company is on the list of Approved Specialist Contractors for

Public Works under the category "Video Electronics Installation".

As such, Electrical and Mechanical Services Department ("EMSD"),

Hong Kong Police Force ("HKPF") and Correctional Services

Department ("CSD") of the Hong Kong Government also provided

another source for business income.

In particular, with our successful deployment of Video Analytic

System for the first Smart Prison in Hong Kong, the Company would

anticipate more business opportunities with "CSD" in other

potential projects.

PROSPECTS

The Government has announced new infrastructure projects

including the new railway lines and urban development in northern

territories. Those projects will include large scale CCTV systems

for safety protection. With our technical expertise and project

experience in the security industry, the Company has a competitive

advantage to tender these potential projects.

Finally, on behalf of the Board, I would like to thank our

customers, suppliers, sub-contractors, bankers and shareholders for

their continued support of UniVision. I would also like to express

my gratitude to the management team and all staff for their

continued support, contribution and dedication to the Group.

MR. STEPHEN SIN MO KOO

EXECUTIVE CHAIRMAN

29 December 2021

UniVision Engineering Limited

Statements of Comprehensive Income (Unaudited)

For the six months ended 30 September 2021

For the six months ended 30 September

2021 2020 2021 2020

HK$'000 HK$'000 GBP'000 GBP'000

Revenue 53,551 39,944 4,979 4,061

Cost of sales (36,956) (29,668) (3,436) (3,016)

---------- ---------- --------- --------

Gross profit 16,595 10,276 1,543 1,045

Other income 251 2,225 23 226

Other gains and losses, net (6,825) - (634) -

Selling and distribution expenses (19) (21) (2) (2)

Administrative expenses (7,645) (8,222) (711) (837)

Finance costs (827) (378) (77) (38)

---------- ---------- --------- --------

Profit before income tax 1,530 3,880 142 394

Income tax - - - -

---------- ---------- --------- --------

Profit for the period 1,530 3,880 142 394

========== ========== ========= ========

Other comprehensive income/(loss):

Exchange differences arising on translation

of foreign operations - - 181 (329)

Total comprehensive income for the period 1,530 3,880 323 65

========== ========== ========= ========

Profit attributable to:

Equity shareholders of the Company 1,530 3,880 142 394

---------- ---------- --------- --------

1,530 3,880 142 394

========== ========== ========= ========

Total comprehensive income attributable

Equity shareholders of the Company 1,530 3,880 323 65

1,530 3,880 323 65

========== ========== ========= ========

Earnings per share - Basic and Diluted HK Cents HK Cents Pence Pence

Basic 0.3987 1.0112 0.0371 0.1028

Diluted 0.3987 1.0112 0.0371 0.1028

UniVision Engineering Limited

Statements of Financial Position (Unaudited)

As at 30 September 2021

For the six months ended 30 September

2021 2020 2021 2020

HK$'000 HK$'000 GBP'000 GBP'000

ASSETS

Non-current assets

Plant and equipment 1,169 1,253 112 126

Right-of use assets 3,711 1,003 355 100

Deposit paid for life insurance policy 19,422 9,171 1,857 919

Amounts due from related companies 30,205 30,385 2,888 3,046

Prepayments 420 626 40 63

Total non-current assets 54,927 42,438 5,252 4,254

Current assets

Inventories 33,956 10,911 3,247 1,094

Trade and other receivables 14,225 19,832 1,360 1,988

Contract assets 107,851 67,181 10,313 6,735

Restricted bank deposits 170 - 16 -

Cash and bank balances (4,253) 2,967 (406) 297

Total current assets 151,949 100,891 14,530 10,114

Total assets 206,876 143,329 19,782 14,368

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 65,897 34,045 6,299 3,413

Bank loans 28,556 6,552 2,731 657

Contract liabilities 16,738 12,122 1,600 1,215

Lease liabilities 3,564 922 341 92

Total current liabilities 114,755 53,641 10,971 5,377

Non-current liability

Lease liabilities 200 140 19 14

Amount due to a related company 4,200 4,200 402 421

Total non-current liabilities 4,400 4,340 421 435

Total liabilities 119,155 57,981 11,392 5,812

2021 2020 2021 2020

HK$'000 HK$'000 GBP'000 GBP'000

Capital and reserves

Share capital 55,034 55,034 3,890 3,890

Reserves 32,687 30,314 4,500 4,666

Total equity 87,721 85,348 8,390 8,556

Total liabilities and equity 206,876 143,329 19,782 14,368

UniVision Engineering Limited

Statements of Changes in Equity (Unaudited)

in GBP '000

Special Special

capital capital

Share Retained Reserve Reserve Translation Total

capital earnings "A" "B" reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 Apr 2020 3,891 2,451 156 143 2,065 8,706

Profit for the year - 563 - - - 563

Other comprehensive income

Exchange difference arising

on translation of financial

statements - - - - (901) (901)

-------- --------- -------- -------- ----------- -------

Total comprehensive income - 563 - - (901) (338)

Dividend paid - (208) - - - (208)

--------- -------

Balance at 31 Mar 2021 3,891 2,806 156 143 1,164 8,160

======== ========= ======== ======== =========== =======

Profit for the six months

ended 30 Sep 2021 - 142 - - - 142

Other comprehensive income

Exchange difference arising

on translation of foreign

operations - - - - 181 181

-------- --------- -------- -------- ----------- -------

Total comprehensive income - 142 - - 181 323

Dividend declared - (93) - - - (93)

-------- --------- -------- -------- ----------- -------

Balance at 30 Sep 2021 3,891 2,855 156 143 1,345 8,390

======== ========= ======== ======== =========== =======

UniVision Engineering Limited

Statements of Changes in Equity (Un-audited)

in HK$'000

Special Special

capital capital

Share Retained Reserve Reserve

capital earnings "A" "B" Total equity

HK$'000 HK$'000 HK$'000 HK$'000 HK$'000

Balance at 1 April 2020 55,034 24,356 2,181 2,007 83,578

Profit for the year - 5,720 - - 5,720

-------- --------- -------- -------- ------------

Total comprehensive income - 5,720 - - 5,720

Dividend paid - (2,110) - - (2,110)

-------- --------- -------- -------- ------------

Balance at 31 Mar 2021 55,034 27,966 2,181 2,007 87,188

Profit for the six months ended

30 Sep 2021 - 1,530 - - 1,530

-------- --------- -------- -------- ------------

Total comprehensive income - 1,530 - - 1,530

Dividend declared - (997) - - (997)

--------- ------------

Balance at 30 Sep 2021 55,034 28,499 2,181 2,007 87,721

======== ========= ======== ======== ============

UniVision Engineering Limited

Statements of Cash Flows (Un-audited)

For the six months ended 30 September 2021

For the six months ended 30

September

2021 2020 2021 2020

HK$'000 HK$'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVITIES

Profit before income tax 1,530 3,880 142 394

Adjustments for:

Interest income (249) (1) (23) -

Depreciation of plant and equipment 284 288 26 29

Depreciation of right-of use assets 719 1,059 67 108

Interest expense on bills payable and

factoring 464 255 43 26

Interest expense on bank borrowings 297 81 28 8

Interest on lease liabilities 67 42 6 4

Impairment loss recognised on other receivables 6,819 - 634 -

-------- ------- ------- -------

Operating cash flows before working capital

changes 9,931 5,604 923 569

Changes in operating assets and liabilities:

Inventories (17,030) (982) (1,583) (59)

Other deposit received 1,000 - 93 -

Trade and other receivables 928 2,260 86 315

Contract assets (24,493) (7,246) (2,277) (492)

Amount due from related companies 1,323 (70) 91 (7)

Contract liabilities (62) (516) (6) (101)

Trade and other payables 10,442 (3,665) 971 (486)

-------- ------- ------- -------

Net cash used in operating activities (17,961) (4,615) (1,702) (261)

-------- ------- ------- -------

CASH FLOWS FROM INVESTING ACTIVITIES

Interest received 249 1 23 -

Purchase of plant and equipment (395) (244) (37) (20)

Decrease in pledged deposits - 2,890 - 301

Deposit placed for a life insurance policy (10,206) (130) (949) (13)

Net cash (used in)/generated from investing

activities (10,352) 2,517 (963) 268

-------- ------- ------- -------

CASH FLOWS FROM FINANCING ACTIVITIES

Interest expense on bills payable and

factoring (464) (255) (43) (26)

Interest expense on bank borrowings (297) (81) (28) (8)

New bank loans raised 23,912 - 2,224 -

Repayment of bank loans (1,355) - (126) -

Capital element of lease liabilities

paid (707) (1,077) (66) (109)

Interest element of lease liabilities

paid (67) (42) (6) (4)

Net cash generated from/(used in) financing

activities 21,022 (1,455) 1,955 (147)

-------- ------- ------- -------

NET DECREASE IN CASH AND CASH EQUIVALENTS (7,291) (3,553) (710) (140)

EFFECT OF FOREIGN EXCHANGES RATE CHANGES, NET - - 19 (242)

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 3,038 6,520 284 679

CASH AND CASH EQUIVALENTS AT END OF PERIOD (4,253) 2,967 (407) 297

Notes to the Interim financial statements for the six months

ended 30 September 2021

1. Basis of preparation

The unaudited interim financial statements for the six months

ended 30 September 2021 have been prepared in accordance with

International Financial Reporting Standards ("IFRSs") using the

policies consistent with those applied to the annual financial

statements for the year ended 31 March 2021 , except for the

adoption of the new and revised IFRSs (which include all IFRSs,

International Accounting Standards ("IASs") and Interpretations)

that are initially adopted for the current period financial

statements. The interim financial statements, together with the

comparative information contained in this report for the six months

ended 30 September 2020, do not constitute the statutory accounts

of the Company.

2. Earnings per share

The calculation of basic earnings per ordinary share is based on

the profit attributable to equity holders of the Group for the six

months ended 30 September 2021 of HK$1.5m (H1 2020: HK$3.8m), and

the weighted average of 383,677,323 (H1 2020: 383,677,323) ordinary

shares in issue during the period.

There were no potential dilutive instruments at either financial

period end.

3. Interim report

Copies of the interim report will be available for inspection at

the registered office of the Company, Unit 201, 2/F., Sunbeam

Centre, 27 Shing Yip Street, Kwun Tong, Hong Kong and available on

the Company's website ( www.uvel.com ) in accordance with Rule 26

of the AIM Rules for Companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKKBDOBDKOBN

(END) Dow Jones Newswires

December 30, 2021 02:20 ET (07:20 GMT)

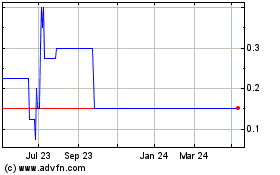

Univision Engineering (LSE:UVEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

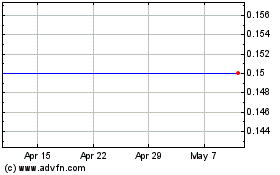

Univision Engineering (LSE:UVEL)

Historical Stock Chart

From Apr 2023 to Apr 2024