TIDMVAST

Vast Resources PLC

05 November 2021

Vast Resources plc / Ticker: VAST / Index: AIM / Sector:

Mining

5 November 2021

Vast Resources plc

("Vast" or the "Company")

Q&A

Vast Resources plc, the AIM-listed mining company, is pleased to

provide the market with answers to a number of questions submitted

by shareholders during recent weeks. The answers to these questions

are intended to provide further clarity over and above the

information issued in the recent annual report and announcement of

25 October 2021 regarding the Company Update. The Board and

management would like to note that some questions have been omitted

from this document due to regulatory or commercial sensitivity

restrictions.

General

1. Is Vast being set up to be taken over privately by another

company or any Vast employees? The actions of the board and the

share price decline has prompted some shareholders question whether

this is the ultimate aim.

No, this is certainly not the case. The Vast board, management

team and advisory teams are all unified in their objective to

continue to advance the Company's operations and communicate this

to the market to achieve the appropriate value uplift on the equity

market.

2. Will Vast be providing a separate RNS on production figures

from the six months to October 2021 by the end of November

2021?

Production figures were provided up to the third week of October

2021. The Company will provide production and sales figures for the

whole of October, November, and December by the end of January and

quarterly thereafter as per the RNS made on 25(th) October 2021

3. Can Vast confirm that the AGM will be held in a reasonable

timeframe, given that Andrew Prelea and Craig Harvey have both

exceeded the period for their approved directorships?

The duration of the directorships has not been exceeded; Craig

Harvey was reappointed last year, and Andrew Prelea is eligible for

re-election at the next AGM as is Roy Tucker. The Company will be

issuing a notice of the next AGM during the current month.

4. Can you advise if Andrew Prelea and other board members will

extend their no selling duration by another 12 months, given the

performance this year?

Please refer to the announcement of 28 October 2021 relating to

the extension of the directors' lock-up period.

5. Will the SARs recipients consider exercising once the Annual

Report is issued to demonstrate faith in the plans and their

achievement, rather than waiting to make a cashless guaranteed

profit transaction?

The SARs awarded to date are not exercisable given the strike

price for all awards is significantly greater than the current

share price. The Directors have also purchased shares and are

themselves in a loss-making scenario based on the current share

price. The Board of Directors are unified in the goal of restoring

fair value to the share price.

6. Will directors consider a pay freeze or at least a pay cut,

to show solidarity with the current long-term shareholders who are

tens of thousands of pounds down on their investment?

All Vast directors have opted to defer their remuneration over

recent months and as a Board, they prioritise cashflows to the

asset and supporting personnel before compensating Directors.

7. Are there any outstanding court cases involving Vast in any jurisdiction?

There are some outstanding court cases in Romania however these

are not deemed to pose a risk to the Company's operations. For more

information, please refer to the Company's audited accounts dated

28 October 2021 ( see note 25).

8. Vast's reputation in the market has been eroded - how can the

Company look to attract institutional investors when retail

investors are panicked, and volume and the price are at an all-time

low?

We intend to demonstrate a continued consistent improvement in

our production profile at Baita Plai and rationalise the financing

structures in place to support long term share price performance.

Baita Plai is an exceptional asset and whilst it has taken longer

to move into profitability than originally conceived, the Company

has overcome challenges, as outlined in the recent RNS, and has

translated limited capital expenditure (by usual mining industry

standards), into enormous potential value. The fact that the value

is not reflected in the share price today, does not take away the

fundamental potential value of the asset which should become more

evident to the Market as the asset progresses towards production

capacity.

The additional pipeline interests within Vast's portfolio,

particularly Manaila which the Company believes could be brought

back into production with modest capital outlay, are not recognised

in today's share price today.

9. How is the Company addressing recent allegations?

As stated in the RNS of 25 October 2021 we have instituted an

enquiry into a breach of confidential information by an external

counterparty who was under strict confidentiality agreements with

the Company. The internal enquiry remains ongoing, and the

counterparty has been notified of his breach by the Company's

lawyers. The result of the enquiry will be announced when

available.

Financing & Atlas

10. Could you update shareholders on Vast's financing strategy

in respect to Baita Plai, Manaila and Botswana? Shareholders have

concerns about Vast's risk management and ability to get

traditional funding, and instead relying on placings and the

dilution of shareholders.

a. Can you name who the finance companies are, and/or whether

they are classified as 'Tier One' banking institutions offering a

proper finance set up instead of what we currently have in place

with Atlas?

The Company cannot name the funders due to commercial NDAs. It

should be noted that Romania is a relatively new jurisdiction for

foreign direct investment in the mining sector and it currently has

no real peer comparisons which has created additional hurdles for

the board and management to overcome when negotiating with

traditional lenders. However, as Baita Plai ramps up and

demonstrates a consistent production profile, the financing process

is expected to ameliorate.

b. Considering a tier one bank wouldn't lend to Vast until a

corporate restructuring had been undertaken, why should these

banking institutions agree to lend now as this restructuring has

not been done?

The Tier 1 bank we were in discussions with last year has

different criteria from the current lenders we are negotiating

with, and we do not believe that structure and geographic spread of

portfolio will influence the decision making of these lenders.

Baita Plai

11. Supply issues are currently a problem worldwide. With

shipping costs having escalated and drivers in short supply. How is

this being addressed? Does Vast pay the shipping costs or does

Mercuria? Is the Company shipping monthly or has this moved to

bi-monthly or quarterly to save money? Is this affecting the

cashflow of the business?

The shipments are being carefully managed however shipping is

ultimately in the hands of the off-taker, with Vast supplying

concentrate according to the off-takers shipping schedules. The

shipments vary from month to month however both Vast and the

off-taker are working on a pre-booking arrangement to mitigate

delays and optimise shipments.

12. When can shareholders expect the following:

a. The arrival on site and installation of the new jumbo drilling rig?

Vast has been advised that it will be delivered before the end

of December 2021, however the Vast team have forward planned to

ensure that it doesn't need to be in place until January to provide

an additional buffer.

b. The installation of the XRT at Baita Plai?

This has been scheduled to be operational in the latter part of

H1 2022 to accommodate the additional infrastructure required and

to synchronise with the increased volumes contemplated at that

time.

13. The friable issue at Baita Plai was discovered in late

August so why wasn't the market advised immediately, like the

broken bridge and the lack of production in H2 FY21, these were all

materially impactful price issues that should have been

communicated to the market much sooner.

As regards the friable area, this was initially encountered in

late August. The tonnage to plant in August still exceeded that of

July. The Company, without hesitation, initiated an audit of the

situation and prepared a strategy to work around the area. The

market was immediately updated with the conclusions being reached

once the audit process had been concluded.

Zimbabwe & Botswana

14. What is causing the delay in Zimbabwe? Shareholders were

advised that the Company were simply awaiting a signature, but this

does not seem to be the case. At what point does Vast concede

defeat on this? At what point does Vast's business in Zimbabwe have

too much of a detrimental impact on the business as a whole - such

as the inability to get finance?

Due to the various political and legal sensitivities, the Board

cannot publicly comment on this however every action taken by the

Company has been documented and verified to the full satisfaction

of the various regulatory bodies involved. Although the continued

delays are unquestionably frustrating, the Company, as per various

announcements, remains hopeful of a positive outcome and believes

the continued tenacity of the Vast team will ultimately reward

shareholders.

15. Further, regarding Zimbabwe, and settlement of historical

claims, can you confirm that this would be in Vast's favour and, if

so, are the sums involved something that would change the Company's

ability to refinance? Does the Board expect a conclusion within a

year?

The settlement is mutually beneficial to all Parties involved

and the Board are in constant dialogue with the relevant

authorities but cannot disclose at this point the status. The

Company is hopeful of a conclusion but is not in control of timing

or the outcome and it is premature to speculate as to what that

might be.

16. What is the status of finance re Botswana (and is it

reasonable to expect success on financing given the ability to

finance other assets?). If external finance cannot be secured, how

will the Board proceed?

The Board has been clear that Ghaghoo will be financed through

third-party, non-equity linked, financing and external finance in

the form of a bank guarantee is a condition precedent for the

completion of the acquisition.

**ENDS**

For further information, visit www.vastplc.com or please

contact:

Vast Resources plc www.vastplc.com

Andrew Prelea (CEO) +44 (0) 20 7846 0974

Andrew Hall (CCO)

St Brides Partners Limited www.stbridespartners.co.uk

Susie Geliher +44 (0) 20 7236 1177

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM listed mining company

with mines and projects in Romania and Zimbabwe.

In Romania, the Company is focused on the rapid advancement of

high-quality projects by recommencing production at previously

producing mines.

The Company's Romanian portfolio includes 100% interest in the

producing Baita Plai Polymetallic Mine, located in the Apuseni

Mountains, Transylvania, an area which hosts Romania's largest

polymetallic mines. The mine has a JORC compliant Reserve &

Resource Report which underpins the initial mine production life of

approximately 3-4 years with an in-situ total mineral resource of

15,695 tonnes copper equivalent with a further 1.8M-3M tonnes

exploration target. The Company is now working on confirming an

enlarged exploration target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic Mine in Romania,

which was commissioned in 2015, currently on care and maintenance.

The Company has been granted the Manaila Carlibaba Extended

Exploitation Licence that will allow the Company to re-examine the

exploitation of the mineral resources within the larger Manaila

Carlibaba licence area.

In Zimbabwe, the Company is focused on the commencement of the

joint venture mining agreement on the Community Diamond Concession,

Chiadzwa, in the Marange Diamond Fields.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAFFFILLELSIIL

(END) Dow Jones Newswires

November 05, 2021 03:00 ET (07:00 GMT)

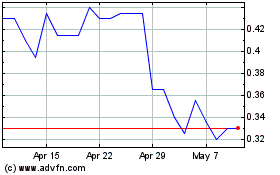

Vast Resources (LSE:VAST)

Historical Stock Chart

From Mar 2024 to Apr 2024

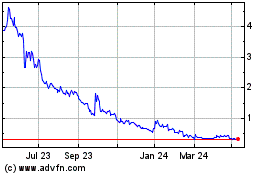

Vast Resources (LSE:VAST)

Historical Stock Chart

From Apr 2023 to Apr 2024