TIDMVEL

RNS Number : 5508D

Velocity Composites PLC

30 June 2021

30 June 2021

VELOCITY COMPOSITES PLC

("Velocity", the "Company" and together with its subsidiaries

the "Group")

UNAUDITED HALF YEAR RESULTS

For the six months ended 30 April 2021

Velocity Composites plc (AIM: VEL), the leading supplier of

advanced composite material kits to the Aerospace sector, is

pleased to announce its unaudited half-year results for the six

months ended 30 April 2021 (the "Period" or "H1 FY21").

Financial Highlights:

-- Sales volumes stabilised following impact of Covid-19 on Aerospace

sector, with revenue for six months to 30 April 2021 of GBP4.4m

(H1 FY20: GBP9.5m)

-- Successful drive for technological, operational and cash flow

efficiencies have been successful, with improved gross margin

of 25.1% (H1 FY20: 20.5%)

-- Adjusted EBITDA (1) loss for H1 FY21 of GBP0.6m (H1 FY20:

loss GBP0.3m)

-- Operating loss before tax for H1 FY21 of GBP1.1m (H1 FY20:

loss GBP0.6m)

-- Cash at Bank as at 30 April 2021 of GBP3.5m including GBP0.7m

of EIS funds2 (30 April 2020: GBP2.8m and including GBP1.2m

of EIS funds)

Since the period end Velocity has been successful in partnering

with Close Brothers to secure an additional GBP0.6m net cash

inflow through a Top-up CBILS and asset financing facility

-- Velocity remains on track to move back into positive EBITDA

during H2 2021

(1) Adjusted EBITDA defined as earnings before interest, tax,

depreciation, amortisation, impairment, adjusted for exceptional

administrative costs and share based payments. The business uses

this Alternative Performance Measure to appropriately measure the

underlying business performance, as such it excludes costs

associated with non-core activities.

(2) EIS f unds earmarked for EIS/VCT qualifying expenditure and

is deemed to be 'employed' for those purposes in accordance with

the relevant regulations.

Operating highlights

-- The new Velocity partnership proposition has been utilised by

both existing and prospective new customers, allowing the wider

value of the Velocity service to be highlighted and recognised,

particularly through the disruption of 2020-2021.

-- Developments in the Company's core technology, particularly

around real time supply chain/demand management, material

efficiency and operational performance has driven improved service

offerings to customers and internal margins.

-- Following a period of development with a large, multinational

defence group the Company achieved full approval to supply

structural material kits for the F35 joint strike fighter

programme.

-- Strong pipeline of new business remains notwithstanding

continued disruption for civil aviation customers and restrictions

on the Company's ability to travel to international customer

locations.

Current trading and outlook

Since period end significant progress has been made with three

of the Company's largest customers, with whom contract extensions

entered into during H1 FY21 secured future annual revenues of

GBP8.1m at what are currently suppressed build rates. The Board

remains confident in the long-term prospects of the Company, with

Velocity well placed to capitalise on the underlying recovery of

the Aerospace sector and to benefit from new customer acquisition

as industry priorities refocus on supply chain efficiencies as the

wider industry builds back from the impact of Covid-19. With the

pipeline expected to continue to improve as travel restrictions are

eased, the Board is now cautiously optimistic as to the prospects

for an improved second half performance in FY21 and into FY22.

Enquiries:

Velocity

Jon Bridges, Chief Executive Officer

Andy Beaden, Chairman +44 (0) 1282 577577

Cenkos (Nominated Adviser and Broker) +44 (0)20 7397 8900

Russell Cook +44 (0)20 7397 1977

Ben Jeynes +44 (0)20 7397 1974

About Velocity

Velocity Composites is a manufacturer of composite material kits

for the aerospace industry, delivering engineered kits for its

customers to build component parts. The Company's clients include

multi-national manufacturers of composite parts and assemblies, who

in turn deliver to the world's leading civil and military aircraft

manufacturers. The Airbus A320, A330, A350, A380, Eurofighter

Typhoon, F35 Joint Strike Fighter, Boeing 737, Boeing 787 and V22

Osprey are all constructed using parts manufactured from Velocity's

kits. The Company's business model reduces the operating costs of

preparing composite materials ahead of their usage in the

construction of an aircraft part and as such, its offering is

disposed to being self-financing for aircraft parts' manufacturers.

Velocity Composites also exports to Europe and North America.

Chairman's Statement

Introduction

H1 FY21 ending 30 April 2021 saw significant progress with three

of the Company's largest customers. With these contract renewals

securing future annual revenues of GBP8.1m at currently suppressed

build rates this has helped to secure the long-term prospects of

the Company as well as leaving the Company well placed to

capitalise on the underlying sector recovery.

Although December 2020 saw particularly impacted demand rates

with prolonged customer site closures, this was partially offset by

a successful March 2021. This saw development with a large,

multinational defence group which enabled Velocity to achieve full

approval to supply structural material kits for the F35 fighter and

supports the ongoing strategy of diversification outside of Civil

Aerospace.

The Group's liquidity position has also remained robust over the

period, with the Velocity's cost-base now reduced in line with a

GBP13.5m breakeven business and continued focus on lean stock

management supporting the Company's cash flow.

H1 FY21 Financial Review

Revenue in the period was GBP4.4 m (H1 FY20: GBP9.5m) as the

Company continued to see COVID-19 impacted production rates

suppressing demand from its key customers. In addition, prolonged

customer site closures over the Christmas period particularly

impacted December 2020 performance. The Company, however, increased

its gross margin by 4.6 percentage points to 25.1% (H1 FY20: 20.5%)

as a result of successful efforts from management to further

improve operational efficiencies and the new Velocity partnership

proposition delivering higher value benefit to customers as all

parties worked through the disruption.

Administrative expenses, excluding exceptional items, were

reduced by GBP0.5m to GBP2.1m (H1 FY20: GBP2.6m) as cost

improvements have become realised following the business's

right-sizing drive in H2 FY20, continuing in FY21. This includes

only GBP0.1m of furlough support through the Government furlough

scheme and GBP0.1m hardship grant income from Burnley Local

Authority. No exceptional costs were incurred in the period (H1

FY20: Nil)

Though the adjusted EBITDA loss in the period increased by

GBP0.3m to GBP0.6(H1 FY20: loss of GBP0.3m), as a result of the

continuing suppressed demand levels, this was significantly reduced

from the second half loss of GBP1.9m in 2020 on similar revenue

levels. Loss before tax from continuing operations was GBP1.1m (H1

FY20: loss of GBP0.7m), resulting in an increased loss per share of

3.0p (H1 FY20: loss of 2.0p).

Cash at bank at 30 April 2021 was GBP3.5m, compared to GBP3.3m

at 31 October 2020 driven by focussed cash retention efforts within

the business, particularly through lean stock management. Both

period ends had the same benefit from the GBP2.0mmillion CBILS

facility support. Since the period end, Velocity has been

successful in partnering with the finance provider Close Brothers

to secure additional CBILS and asset finance. This will further

support Velocity's Covid-19 recovery plans with an additional Net

Cash inflow of GBP0.6m and a similar 5 year repayment tenor as the

existing GBP2.0m facility. Cash at bank includes an amount of

GBP0.7m of EIS/VCT funds, which are allocated for investment in new

production facilities in the US, mainland Europe and the UK. In

addition to the CBILS, the Company has access to an Invoice

Discounting Facility, which was undrawn as at 30 April 2021, but

has current capacity of GBP1.6m based on outstanding receivables.

The business remains in a net cash positive position, after

deducting debt drawing.

Risk

In preparing these interim financial statements, the management

is required to make accounting assumptions and estimates. The

assumptions and estimation methods are consistent with those

applied to the Annual Report and financial statements for the year

ended 31 October 2020. With one exception, the principal risks and

uncertainties that may have a material impact on activities and

results of the Group remain materially unchanged from those

described in the Annual Report. The exception is the risk of losing

a key contract, which the Board now deem as a lower risk given the

Company's three largest customers have all signed contract

extensions during H1 FY21 for the next 3 years.

COVID-19 continues to be a risk to the sector that is impacting

demand heavily through greatly reduced civil air travel volumes.

With the Company's cost-base now successfully reset to a GBP13.5m

sales breakeven business and sales levels appearing to have

stabilised during H1 FY21, Velocity is well placed to benefit from

the longer-term market recovery. This is supported by the Company's

robust liquidity position and unique offering to the market. In

addition, management continue to develop opportunities to diversify

into other sectors, such as defence, with progress having been made

in H1 FY21 in supporting F35 production at several customer sites

within the UK.

Outlook

In addition to the recent re-contracting of all major customers

the new business opportunity pipeline for the Company looks strong,

albeit with currently impacted production rates. The disruption in

the industry has led to all customers re-evaluating their own

operational footprint and as such significant changes to their

supply chains have been deferred whilst the full effects of the

pandemic were understood. As air travel resumes it is expected that

build rates for the major aircraft programmes will begin to

recover, firstly on the single aisle platforms (A320, B737),

followed by the twin aisle platforms (A350, B787). With capacity at

customers sites having been cut, the Board believe that the

Company's technology driven enhanced service offering coupled with

the highly operational gearing available for immediate deployment

will open up significant opportunities as the industry increases

its utilisation of outsourcing as part of its recovery. For

example, Airbus recently announced that it had asked suppliers to

prepare for an increase in A350 build rates for 2022 by 20% - from

the current rates of 5 per month to 6. The A350 is a platform

served by Velocity.

As the in-house technology developments drive further

performance gains the Company is also working on additional ways to

partner with customers and deploy its technology and services

directly to customers' sites. This model is currently in final

development and brings significant flexibility to the Company's

proposition by allowing for a tailored approach to the exact

customer requirements, without the need for large scale capital

investments to support single customer locations. Discussions have

begun with target launch customers with an expectation of this

being a major 2022 opportunity for profit and margin expansion.

Despite the continued COVID-19 suppressed demand levels across

the whole industry, the Board is now cautiously optimistic as to

the prospects for an improved second half performance in FY21 and

into FY22. W ith the organisational restructuring process completed

and gross margins improving, the Company's cost-base is now beyond

a target GBP13.5m sales breakeven position. With further new

business wins and cost reduction activities Velocity is well placed

to breakeven in H2 FY21, albeit in challenging and uncertain market

conditions.

Andy Beaden

Non-Executive Chairman

29 June 2021

Condensed consolidated statement of total comprehensive

income

For the six months ended 30 April 2021

Half year Half year Year ended

ended ended

30 April 30 April 31 October

2021 2020 2020

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

--------------------------- --------------------------- --------------------------

Revenue 3 4,439 9,502 13,561

Cost of sales (3,323) (7,558) (11,237)

--------------------------- --------------------------- --------------------------

Gross profit 1,116 1,944 2,324

Administrative

expenses

excluding

exceptional

costs (2,110) (2,589) (5,132)

Exceptional

administrative

expenses - - (341)

Other operating - - -

income

Operating loss (994) (645) (3,149)

------------------------------ ------------------- --------------------------- --------------------------- --------------------------

Operating loss

analysed as:

Adjusted EBITDA (559) (259) (1,925)

Depreciation &

Amortisation (224) (218) (517)

Depreciation on

right to use

assets (151) (108) (246)

Share based

payments (60) (60) (120)

Exceptional

administrative

expenses - - (341)

Finance income

and expense (65) (40) (98)

--------------------------- --------------------------- --------------------------

Loss before tax

from

continuing

operations (1,059) (685) (3,247)

Income tax

income /

(expense) - 67 117

Loss for the

period and

total

comprehensive

loss (1,059) (618) (3,130)

=========================== =========================== ==========================

Losses per

share - Basic

(pence

per share)

from

continuing

operations 4 (3.0p) (2.0p) (8.0p)

=========================== =========================== ==========================

Losses per

share -

Diluted (pence

per share)

from

continuing

operations 4 (3.0p) (2.0p) (8.0p)

=========================== =========================== ==========================

The notes below form part of this interim report.

Condensed consolidated statement of financial position

At 30 April 2021

As at As at As at

30 April 30 April 31 October

2021 2020 2020

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

Non-current

assets

Intangible

assets 123 281 167

Property,

plant and

equipment 1,583 2,733 1,723

Right-of-use

assets 977 380 1,127

--------------------------- --------------------------- --------------------------

Total

non-current

assets 2,683 3,394 3,017

--------------------------- --------------------------- --------------------------

Current

assets

Inventories 769 3,361 1,908

Trade and

other

receivables 2,477 2,924 2,464

Cash and cash

equivalents 3,450 2,841 3,268

--------------------------- --------------------------- --------------------------

Total current

assets 6,696 9,126 7,640

Total assets 9,379 12,520 10,657

--------------------------- --------------------------- --------------------------

Current

liabilities

Loans 300 - 500

Trade and

other

payables 1,444 2,699 1,504

Net

obligations

under

finance

leases 362 436 411

--------------------------- --------------------------- --------------------------

Total current

liabilities 2,106 3,135 2,415

--------------------------- --------------------------- --------------------------

Non-current

liabilities

Loans 1,700 - 1,500

Net

obligations

under lease

liabilities 890 1,252 1,060

--------------------------- --------------------------- --------------------------

Total

non-current

liabilities 2,590 1,252 2,560

Total

liabilities 4,696 4,387 4,975

Net assets 4,683 8,133 5,682

Equity

attributable

to equity

holders

of the

company

Share capital 5 91 90 91

Share premium 9,727 9,727 9,727

Share-based

payments

reserve 550 559 490

Retained

earnings (5,685) (2,243) (4,626)

--------------------------- --------------------------- --------------------------

Total equity 4,683 8,133 5,682

=========================== =========================== ==========================

The notes below form part of this interim report.

The financial statements were approved and authorised for issue

by the Board of Directors on 29 June 2021 and were signed on its

behalf by

Christopher Williams

Company Secretary Co No: 06389233

Condensed consolidated statement of changes in equity

For the six months ended 30 April 2021

Share-based

Share Share Retained payments Total

capital premium earnings Reserve equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ---------------------- ----------------------- -------------------------- ----------------------

As at 31 October 2019 90 9,727 (1,663) 537 8,691

Loss for the period - - (618) - (618)

---------------------- ---------------------- ----------------------- -------------------------- ----------------------

90 9,727 (2,281) 537 8,073

Transactions

with

shareholders:

Share-based payments - - - 60 60

Vesting of share options - - 38 (38) -

---------------------- ---------------------- ----------------------- -------------------------- ----------------------

As at 30 April 2020 90 9,727 (2,243) 559 8,133

Loss for the period - - (2,512) - (2,512)

---------------------- ---------------------- ----------------------- -------------------------- ----------------------

90 9,727 (4,755) 559 5,621

Transactions

with

shareholders:

Share-based payments - - - 60 60

Vesting of share options 1 - 129 (129) 1

---------------------- ---------------------- ----------------------- -------------------------- ----------------------

As at 31 October 2020 91 9,727 (4,626) 490 5,682

Loss for the period - - (1,059) - (1,059)

---------------------- ---------------------- ----------------------- -------------------------- ----------------------

Transactions

with

shareholders:

Share-based payments - - - 60 60

As at 30 April 2021 91 9,727 (5,685) 550 4,683

====================== ====================== ======================= ========================== ======================

The notes below form part of this interim report.

Condensed consolidated statement of cash flows

For the six months ended 30 April 2021

Half year Half year Year ended

ended ended

30 April 30 April 31 October

2021 2020

(unaudited) (unaudited) 2020 (audited)

GBP'000 GBP'000 GBP'000

--------------------------- --------------------------- ------------------------------

Operating activities

Loss for the period (1,059) (618) (3,130)

Taxation - (67) (117)

(Profit)/ Loss on (11) - -

disposal of assets

Finance costs 65 39 98

Amortisation of

intangible assets 44 65 118

Impairment of tangible

asset - - 72

Depreciation of

property, plant and

equipment 180 153 327

Depreciation of right

to use assets 151 108 246

Share-based payments 60 60 120

(570) (260) (2,266)

(Increase)/Decrease in

trade and other

receivables (13) 1,225 1,685

Decrease/(Increase) in

inventories 1,139 (184) 1,269

(Decrease)/Increase in

trade and other

payables (60) (1,331) (1,526)

--------------------------- --------------------------- ------------------------------

Cash generated from

operations 496 (550) (838)

Income taxes received/ - 142 -

(paid)

--------------------------- --------------------------- ------------------------------

Net cash

inflow/(outflow) from

operating

activities 496 (408) (838)

Investing activities

Purchase of property,

plant and equipment (41) (730) (991)

Development

expenditure

capitalised - (28) (39)

Proceeds from disposal

of property,

plant and equipment 10 - 3

Net cash used in

investing activities (31) (758) (1,027)

Financing activities

Loan received - - 2000

Finance lease proceeds - - 211

Finance costs paid (64) (39) (98)

(Decrease)/Increase in - 807 -

invoice discounting

Repayment of finance

lease capital (219) (185) (404)

--------------------------- ---------------------------

Net cash generated

from/ (used in)

financing activities (283) 583 1,709

--------------------------- --------------------------- ------------------------------

Net

increase/(decrease)in

cash and

cash equivalents 182 (583) (156)

Cash and cash

equivalents at

beginning

of period 3,268 3,424 3,424

--------------------------- --------------------------- ------------------------------

Cash and cash

equivalents at end of

period 3,450 2,841 3,268

=========================== =========================== ==============================

Notes to Interim Report

1. General information

Velocity Composites plc (the 'Company') is a public limited

company incorporated and domiciled in England and Wales. The

registered office of the company is AMS Technology Park, Billington

Road, Burnley, Lancashire, BB11 5UB, United Kingdom. The registered

company number is 06389233.

The Company holds shares in a wholly owned subsidiary company,

Velocity Composites Sendirian Berhad, which is domiciled in

Malaysia. During this financial period, the company has provided

engineering services to the Group. The Company also wholly owns

Velocity Composites Aerospace Inc. to prepare for future expansion

in the United States of America. These subsidiaries together with

Velocity Composites plc, now forms the Velocity Composites Group

('the Group').

The Group's principal activity is that of the sale of kits of

composite material and related products to the aerospace

industry.

The condensed consolidated interim financial statements are

unaudited and do not constitute statutory financial statements

within the meaning of Section 435 of the Companies Act 2006. The

review report on these interim financial statements is set out

below. The financial information for the year ended 31 October 2020

has been derived from the published statutory financial statements

for the Company. A copy of the full accounts for that period, on

which the auditor issued an unmodified report that did not contain

statements under Section 498(2) or 498(3) of the Companies Act

2006, has been delivered to the Registrar of Companies.

These interim financial statements will be posted to the

Company's shareholders and are available from the Registered Office

at AMS Technology Park, Billington Road, Burnley, Lancashire, BB11

5UB or from our website at www.velocity-composites.com.

2. Accounting policies

Basis of preparation

These condensed consolidated interim financial statements are

for the six months ended 30 April 2021. This interim financial

report has been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union, and has been prepared using consistent

accounting policies as applied in the Company's full year accounts

to 31 October 2020 and as expected to be applied in the full year

accounts to 31 October 2021. They have therefore been prepared in

compliance with the measurement and recognition criteria of IFRS as

adopted by the European Union.

These financial statements have been prepared on a going concern

basis and using the historical cost convention, as stated in the

accounting policies. These policies have been consistently applied

to all periods presented, unless otherwise stated.

The financial statements are presented in sterling and have been

rounded to the nearest thousand (GBP'000) except where otherwise

indicated.

No new standards have been adopted for the first time in the

current financial year.

Going concern

The current climate continues to present challenges and impact

the business significantly through suppressed sales demand. As a

result, Management have continued the longer-term financial

planning announced in the FY21 Annual Report to ensure liquidity is

robust and any future cash flow requirements are identified as

early as possible. This involves a 24-month rolling period forecast

which is then extended a further 5 years at a high level and

revisited monthly through the Integrated Business Planning process.

The Aerospace sector lends itself to this kind of long-term

planning due to the nature and length of customer programmes,

typically a minimum of 3 years, but often 5 years or more.

This financial forecasting process has helped the Board to

balance the extent of cost reductions required in FY20 to stabilise

the business with the resource requirements needed to support

future growth potential. It has also supported the business case

for the GBP2.0m CBILS facility, as well as the subsequent 5-year

extension of tenor announced at year end. As such, Velocity now has

a cost base beyond a GBP13.5m sales breakeven position and is on

target to breakeven at an adjusted EBITDA level in H2 FY21.

Management continues to utilise this tool routinely to undertake

sensitivity analysis and 'stress testing' as part of Velocity's

ongoing risk management strategy.

With due regard for these latest projections, H1 FY21 has seen

some reassuring progress for Velocity, with sales demand seemingly

stabilised during the half year, three of the Company's largest

customers committed to long-term contract renewals and successful

diversification into the Military sector. Whilst there undoubtedly

remains uncertainty in the Aerospace industry, with available cash

at 30 April 2021 of GBP3.5m, an invoice discounting facility of

GBP1.6m based on debtor levels as yet undrawn and continued support

of our bank and shareholders, it is the opinion of the Board that

the Group is in a robust liquidity position and has adequate

resources to continue to trade as a going concern.

3. Segmental analysis

The Group supplies a single range of kitted products into a

single industry and so has a single segment. Additional information

is given below regarding the revenue receivable based on

geographical location of the customer.

Half year Half year Year ended

ended ended

30 April 30 April 31 October

2021 (unaudited) 2020

(unaudited) 2020

(audited)

GBP'000 GBP'000 GBP'000

-------------------------------- --------------------------- --------------------------

Revenue

United

Kingdom 4,428 8,413 12,337

Rest of

Europe 11 1,066 1,224

Rest of - 23 -

World

4,439 9,502 13,561

================================ =========================== ==========================

Four customers of the Group are responsible for over 90% of the

total revenue in each of the periods presented. The majority of

revenue arises from the sale of goods. Where engineering services

form a part of revenue it is only in support of the development or

sale of the goods.

4. Reconciliation of reported profit

Half year Half year Year ended

ended ended 31 October

30 April 30 April 2020

2021 2020 (audited)

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

---------------------------- ---------------------------- ----------------------------

Loss for the

period (1,059) (618) (3,130)

Weighted Shares Shares Shares

average

number of

shares

---------------------------- ---------------------------- ----------------------------

Weighted

average

number of

shares

in issue 36,265,983 35,943,337 35,995,289

Weighted

average

number of

share

options 2,184,120 2,195,402 2,143,440

---------------------------- ---------------------------- ----------------------------

Weighted

average

number of

shares

(diluted) 38,450,103 38,138,739 38,138,729

============================ ============================ ============================

Share options have not been included in the Diluted calculation

as they would be anti-dilutive with a loss being recognised.

Half year Half year Year ended

ended ended

30 April 30 April 31 October

2021 (unaudited) 2020 (unaudited)

2020

(audited)

GBP GBP GBP

-------------------------------- -------------------------------- --------------------------

Loss

per

share

Basic & (GBP0.03) (GBP0.02) (GBP0.08)

Diluted

5. Share capital of the Company

Number of Share Capital Share Premium

shares

GBP GBP

------------------------- ---------------------------- ----------------------------

Share capital

issued and fully

paid

Ordinary shares

of GBP0.0025

each

as at 1

November 2019, 35,916,179 89,791 9,727,158

Shares issued to

satisfy

exercise

of share

options on 20

February

2020 70,000 175 -

------------------------- ---------------------------- ----------------------------

Ordinary shares

of GBP0.0025

each

as at 30 April

2020 35,986,179 89,966 9,727,158

Shares issued to

satisfy

exercise

of share

options on 15

September

2020 241,200 603 -

------------------------- ---------------------------- ----------------------------

Ordinary shares

of GBP0.0025

each

as at 31

October 2020 36,227,379 90,569 9,727,158

Shares issued to

satisfy

exercise

of share

options on 12

February

2021 38,604 97 -

------------------------- ---------------------------- ----------------------------

Ordinary shares

of GBP0.0025

each

as at 30 April

2021 36,265,983 90,666 9,727,158

========================= ============================ ============================

Ordinary shares carry the right to one vote per share at general

meetings of the Company and the rights to share in any distribution

of profits or returns of capital and to share in any residual

assets available for distribution in the event of a winding up.

6. Capital Commitments

At 30 April 2021 the Group had GBPNIL (2020: GBPNil) of capital

commitments relating to the purchase of leasehold improvements,

plant and machinery and fixture and fittings.

Independent Review Report to the members of Velocity Composites plc .

Introduction

We have reviewed the consolidated, condensed set of financial

statements in the half-yearly financial report of Velocity

Composites PLC (the 'group') for the six months ended 30 April 2021

which comprises consolidated statement of total comprehensive

income, consolidated statement of financial position, consolidated

statement of changes in equity, consolidated statement of cash

flows and the related notes. We have read the other information

contained in the half-yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with International Financial

Reporting Standards as adopted by the European Union. The condensed

set of financial statements included in this half-yearly financial

report has been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting', as adopted

by the European Union.

Our responsibility

Our responsibility is to express a conclusion to the company on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity'. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

The impact of macro-economic uncertainties on our audit

Our review of the condensed set of financial statements in the

half-yearly financial report requires us to obtain an understanding

of all relevant uncertainties, including those arising as a

consequence of the effects of macro-economic uncertainties such as

Covid-19 and Brexit. Such reviews assess and challenge the

reasonableness of estimates made by the directors and the related

disclosures and the appropriateness of the going concern basis of

preparation of the financial statements. All of these depend on

assessments of the future economic environment and the company's

future prospects and performance.

Covid-19 and Brexit are amongst the most significant economic

events currently faced by the UK, and at the date of this report

their effects are subject to unprecedented levels of uncertainty,

with the full range of possible outcomes and their impacts unknown.

We applied a standardised firm-wide approach in response to these

uncertainties when assessing the company's future prospects and

performance. However, no review of interim financial information

should be expected to predict the unknowable factors or all

possible future implications for a company associated with a course

of action such as Brexit.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

April 2019 is not prepared, in all material respects, in accordance

with International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union.

Use of our report

This report is made solely to the company, as a body, in

accordance with International Standard on Review Engagements (UK

and Ireland) 2410, 'Review of Interim Financial Information

performed by the Independent Auditor of the Entity'. Our review

work has been undertaken so that we might state to the company

those matters we are required to state to them in an independent

review report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company as a body, for our review work, for

this report, or for the conclusion we have formed.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

Manchester

29 June 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QKLFLFQLLBBV

(END) Dow Jones Newswires

June 30, 2021 02:00 ET (06:00 GMT)

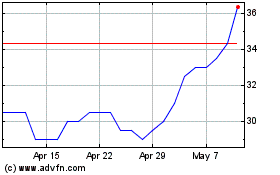

Velocity Composites (LSE:VEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Velocity Composites (LSE:VEL)

Historical Stock Chart

From Apr 2023 to Apr 2024