TIDMW7L

RNS Number : 5232M

Warpaint London PLC

22 September 2021

22 September 2021

Warpaint London PLC

("Warpaint", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2021

Warpaint London plc (AIM: W7L), the specialist supplier of

colour cosmetics and owner of the W7 and Technic brands is pleased

to announce its unaudited interim results for the six months ended

30 June 2021.

Financial Highlights

-- Strong growth in sales, profitability and cash generation

during the period reflecting the focus on growing sales of

the Group's branded products

-- Group sales increased by 36% to GBP18.4 million in H1 2021

(H1 2020: GBP13.5 million, H1 2019: GBP18.9 million)

-- UK revenue increased by 31% to GBP8.9 million (H1 2020:

GBP6.8 million, 2019: GBP7.8 million)

-- International revenue increased by 41% to GBP9.5 million

(H1 2020: GBP6.7 million, 2019: GBP11.1 million)

-- Gross profit margin of 34.5% (H1 2020: 35.1%, H1 2019: 34.9%),

against the backdrop of supply side price inflation and significant

increases in freight costs

-- Adjusted EBITDA of GBP2.1* million (30 June 2020: GBP0.4*

million, 30 June 2019: GBP2.1* million)

-- Adjusted profit from operations of GBP1.6** million (H1 2020:

GBP0.4** million, H1 2019: GBP1.3** million). Statutory profit

from operations of GBP0.3 million (H1 2020 loss of GBP1.4

million, H1 2019 loss of GBP0.1 million)

-- Cash generated from operating activities of GBP2.8 million

(H1 2020: GBP2.3 million, H1 2019: 1.3 million)

-- Cash of GBP6.7 million at 30 June 2021 (30 June 2020: GBP3.8

million, 30 June 2019 GBP3.7 million)

-- The Company is now debt free with the remaining loans and

HP contracts totaling GBP0.3 million having been repaid in

full in April 2021

-- The board has declared an increased interim dividend of 2.5p

per share (2020 interim dividend 1.5p per share***)

-- The Group's financial performance is expected to continue

to be second half weighted

Comparatives have been included for both the prior year period

and H1 2019, a period not impacted by the Covid-19 pandemic.

* Adjusted for foreign exchange movements, share based payments

and exceptional items.

** Adjusted for exceptional costs of which there were GBP5,000

in the period (H1 2020: GBP0.2 million, H1 2019 nil), GBP1.2

million of amortisation of intangible assets (H1 2020: GBP1.2

million, H1 2019 GBP1.2 million), and share based payments of

GBP0.1 million (H1 2020: GBP0.3 million. H1 2019 GBP0.1 million).

Adjusted numbers are close to the underlying cash flow performance

of the business which is regularly monitored and measured by

management.

*** The 2020 interim dividend declared comprised an interim

dividend of 1.5p per share plus a one off additional 1.3p per share

to reflect that no final dividend was declared for 2019

Operational Highlights

-- Further expansion in the number of Tesco stores stocking the

Group's products and the stocking of additional W7 product

lines. W7 branded products now sold in over 1,300 Tesco stores

in the UK, up from 56 in June 2020

-- Further product expansion in the US with W7 products now being

stocked in over 1,000 Five Below stores

-- As at 30 June 2021 the Group had a significant Christmas order

book for the Group's brands of GBP8.7 million (30 June 2020:

GBP7.7 million), with further Christmas orders taken post

period end and additional white label Christmas orders

-- Online sales continue to accelerate in the UK and the US,

with an increase of 115% in e-commerce sales in H1 2021 compared

to H1 2020

-- The Group's expansion strategy continues with active discussions

being held with additional major retailers in the UK and overseas

Post-Period End Highlights

-- Agreement with Boots to stock a range of approximately 80

W7 products in an initial 84 stores from February 2022

-- Further expansion of online sales presence with the launch

in China of official W7 brand stores owned by the Group on

Taobao Mall (Tmall), the most visited B2C online retail platform

in China and Xiaohongshu (Red), one of China's foremost social

media, fashion and luxury shopping platforms

-- For the eight months to 31 August 2021 the Company had unaudited

sales of GBP27.0 million (8 months to 31 August 2020: GBP22.8

million, 8 months to 31 August 2019: GBP27.7 million)

Commenting, Sam Bazini Chief Executive, said: "Following a

difficult 2020 for everyone, it is pleasing to report a

significantly improved performance from Warpaint in the first half

of 2021. Prior to the impact of Covid-19 the business was trading

well. Despite the continued effect of the pandemic, with lockdowns

in many parts of the world, including the UK, for much of the first

half, we have seen a return to the level of Group sales achieved in

the first half of 2019, a period before the pandemic hit.

"We have seen particularly strong growth in the UK, with sales

increasing beyond the level achieved in the first half of 2019,

aided by the growing sales of our W7 brand through Tesco and of our

Technic and Body Collection brands through wilko . In June 2020 W7

was being sold in 56 Tesco stores, today it is in over 1,300 , with

a further expansion of the W7 range in Tesco planned for later this

year. In addition, W7 products will be launched in Boots early in

2022. There has also been a much improved performance in the US,

strong growth elsewhere internationally and a rapid increase in

online sales.

"Warpaint is a global business with the capacity, expertise and

strategy, coupled with balance sheet strength, to drive future

growth. We are working in partnership with our existing retailers

to grow sales further and are in active discussions with additional

major retailers in the UK and overseas. We have significant

opportunities for further growth and I look forward to the

remainder of the year and into 2022 with confidence."

Investor Webinar

Warpaint's management will be hosting an online presentation and

Q&A session at 5.30 p.m. BST today, Wednesday 22 September

2021. This session is open to all existing and prospective

shareholders. Those who wish to attend should register via the link

below and they will be provided with access details:

https://us02web.zoom.us/webinar/register/WN_lh7Ytv7ASkuDJClO9rrqSQ

Participants will have the opportunity to submit questions

during the session, but questions are welcomed in advance and may

be submitted to: warpaint@investor-focus.co.uk .

Enquiries:

Warpaint London c/o IFC

Sam Bazini - Chief Executive Officer

Eoin Macleod - Managing Director

Neil Rodol - Chief Finance Officer

Singer Capital Markets (Nominated Adviser

& Joint Broker) 020 7496 3000

Shaun Dobson, Tom Salvesen, Jen Boorer,

Alex Bond - Investment Banking

Shore Capital (Joint Broker) 020 7408 4090

Patrick Castle, Daniel Bush - Corporate

Advisory

Fiona Conroy - Corporate Broking

IFC Advisory (Financial PR & IR) 020 3934 6630

Tim Metcalfe

Graham Herring

Florence Chandler

Warpaint London plc

Warpaint sells branded cosmetics under the lead brand names of

W7 and Technic. W7 is sold in the UK primarily to retailers and

internationally to local distributors or retail chains. The Technic

brand is sold in the UK and continental Europe with a significant

focus on the gifting market, principally for high street retailers

and supermarkets. In addition, Warpaint supplies own brand white

label cosmetics produced for several major high street retailers.

The Group also sells cosmetics using its other brand names of

Man'stuff, Body Collection, Very Vegan, and Chit Chat.

Chief Executive's Review

The first half of 2021 was a period of strong growth for the

Group as most of Warpaint's markets emerged from the worst of the

Covid-19 pandemic and certain strategic initiatives started to bear

fruit. However, continuing issues relating to the pandemic were

seen in a number of markets, with lockdowns remaining and a number

of operational challenges being faced, particularly with regard to

supply side price inflation, and freight availability and cost.

Against this background we are very pleased to have achieved

Group sales broadly in line with those of H1 2019, a period not

impacted by the Covid-19 pandemic, with significant growth in the

UK and strong cash generation.

In the first half of 2021 sales of our branded colour cosmetics

accounted for 88% of revenue (H1 2020: 82%) as we continued to

reduce the focus on close-out. Our strategy of producing a wide

range of high quality cosmetics at an affordable price remains our

key focus, growing sales through our existing customers' outlets

and winning new customers with significant sales footprints, both

in the UK and internationally, together with continuing to grow our

online sales.

W7

The Group's lead brand remains W7, with sales in H1 2021

accounting for 57% of total Group revenue (H2 2020: 50%). In the

UK, W7 revenues were up 54% in H1 2021 compared to H1 2020. W7

revenues were also up 34% in the UK in H1 2021 compared to H1 2019,

a period not impacted by the Covid-19 pandemic. The growth in W7 UK

sales has been assisted by the roll out into Tesco, together with a

growth in sales from the Group's other larger customers in the UK.

In June 2020 the Group's W7 products were in 56 Tesco stores, today

they are in over 1,300 across the various store formats, with a

planned further expansion of the W7 full cosmetic displays in

Tesco, together with an increased online presence.

Additionally, we are pleased to announce that we have reached

agreement with Boots to stock a range of approximately 80 W7

products in an initial 84 stores from February 2022.

Internationally W7 sales were up on H1 2020 in all of the

Group's reported regions. In Europe sales increased by 27% compared

to H1 2020, in the US sales increased by 94% compared to H1 2020,

and in the rest of the world sales increased by 124% compared to H1

2020.

Technic

Since the acquisition of Retra Holdings Limited ("Retra") and

its Technic brand in November 2017, we have continued to focus on

improving the sales of all year round cosmetics sold under the

Technic brand, and to ensure the Retra business is profitable

throughout the whole year, not only in the second half when

Christmas gifting is delivered.

Sales of Technic in H1 2021 were 31% of total Group revenue (H1

2020: 30%). In H1 2021, UK revenues of Technic were up 33% on H1

2020, returning to similar a similar level seen in H1 2019, aided

by the growing sales of Technic and Body Collection branded

products in wilko.

Sales increased in Europe by 34% compared to H1 2020 and in the

rest of the world sales also increased by 94% compared to H1 2020.

In the US, sales increased by 2% compared to H1 2020, albeit that

US sales remained small in the context of the Group as a whole.

The Retra business also produces and sells own brand white label

cosmetics for several major high street retailers, with such sales

being 1% of Group revenue (H1 2020: 2%).

Close-out

In line with the strategy to reduce the focus on close-out

sales, particularly in the US, the close-out division was a reduced

proportion of Group sales in the first half of 2021, representing

11% of the overall revenue of the Group (H1 2020: 18%). Whilst not

a core focus, this side of the business continues to provide a

significant and profitable source of intelligence in the colour

cosmetics market and access to new market trends. We will continue

to take advantage of profitable close-out opportunities as they

become available.

e-Commerce

In addition to growing sales through the W7 and Technic brands'

own bespoke e-commerce sites, focus has continued on growing sales

of our brands in the UK and the US on Amazon, which has helped

further accelerate our online sales. In H1 2021 online sales were

GBP0.44 million (H1 2020: GBP0.20 million), an increase of

115%.

Further expansion of the Group's online sales presence has been

implemented post period end with the launch of official W7 brand

stores owned by the Group on Taobao Mall (Tmall), the most visited

B2C online retail platform in China and Xiaohongshu (Red), one of

China's foremost social media, fashion and luxury shopping

platforms.

Brands

As previously announced, in 2020 we undertook a review of all

our brands, removing from sale those small number of brands that

were sub-scale and did not have a compelling market position. This

exercise has enabled the Group to concentrate on its core W7,

Technic, Body Collection, Man'stuff, Chit Chat and Very Vegan

brands during the period with an improved focus. The development of

Body Collection as a key brand continues, with a view to unlocking

the untapped potential it has, given it is currently sold in only

one UK retailer. Discussions are ongoing with further retailers

with a view to them stocking Body Collection and we anticipate

rolling out the brand through additional outlets in due course.

Customers & Geographies

The largest markets for sales of our Group brands are in the UK,

Australia and Europe. In H1 2021 our top ten customers represented

55% of revenues (H1 2020: 50%). Group sales are now made in 45

countries.

UK

Group sales in the UK were up by 31% in H1 2021 compared to H1

2020, led by the growth in sales of our lead brand W7, which

increased by 54%. Group sales in H1 2021 in the UK were also 19%

higher than the level achieved in H1 2019, despite continued

lockdowns in the UK for much of the period.

The top ten UK Group customers accounted for 74% of UK sales in

H1 2021 (H1 2020: 66%). Particularly strong growth was seen during

the first half with B&M Retail (up 34%), The Range (up 270%)

and Tesco (up 353%).

As of 30 June 2021, the Group had an order book for Christmas

gifting for the Group's brands of GBP8.7 million already secured

(30 June 2020: GBP7.7 million), which will be delivered during H2

2021. This will be a significant driver of revenues being weighted

to the second half of the year, with most of it being in the UK. We

have continued to take further significant orders post the period

end as the market continues to recover and customers regain further

confidence.

Europe

Prior to the onset of the Covid-19 pandemic in March 2020,

Continental Europe was for some time an area of excellent growth

for the Group. Following significantly reduced demand caused by

country wide lockdowns in 2020, the gradual opening up in H1 2021

boosted Group sales in Europe by 28% compared to the same period in

2020. Sales for the Group's brands into Europe are mainly to

France, Denmark, Spain and Sweden and during the period strong

growth was seen particularly in sales to customers in

Scandinavia.

US

Sales in US dollars in H1 2021 were up 58% to US$1.7 million (H1

2020: US$1.1 million), aided by the new relationship with store

group Five Below. Following a successful trial with Five Below, W7

products are now being stocked in over 1,000 of their stores in the

US. A good performance was also seen from the Group's other major

customers in the US, including Macys Backstage, Marshalls, and TJ

Maxx.

Additionally, we completed a trial launch of W7 products in 50

Francesca's stores in the US during the first half, where sales

exceeded management expectations. We expect to continue to roll out

product across a significant portion of their 444 store estate

during the remainder of the year.

The focus in the US is to increase the sales of the Group's

brands as the emphasis on close-out in our business reduces. In the

US 79% of sales in H1 2021 were from the sale of the Group's

brands. Additionally, we continue to focus on growing our US online

sales via Amazon FBA.

Rest of the World

Sales in the rest of the world for the Group in the period were

up by 119% to GBP1.7 million, compared to the corresponding period

last year. In Australia, which is a key country for Warpaint in the

rest of the world region, sales increased by 211% in H1 2021 to

GBP1.4 million. Since the easing of the Covid-19 lockdowns in the

rest of the world region we have seen a steady sales recovery for

our brands, though sales in some countries remain constrained and

volatile as further lockdowns are imposed.

Dividend

In accordance with the Group's policy to continue to pay

appropriate dividends, the board is pleased to declare an increased

interim dividend of 2.5p per share (2020 interim dividend 1.5p per

share plus a one off additional 1.3p per share to reflect that no

final dividend was declared for 2019) which will be paid on 26

November 2021 to shareholders on the register at 12 November 2021.

The shares will go ex-dividend on 11 November 2021.

Board and People

The pandemic has dramatically impacted the personal and working

lives of everyone and continues to do so. At Warpaint we quickly

made the required changes to working practices and have continued

to adapt and modify these as appropriate. I am delighted with the

way in which everyone has met these challenges and I would like to

offer my thanks in particular to the Group's employees for their

exceptional efforts.

Post period end we were pleased to announce the appointment of

John Collier as an independent non-executive director of the

Company with effect from 1 September 2021. John is a Canadian

national, based in New York, USA, who has spent nearly 30 years in

the consumer goods industry, primarily at Revlon, the multinational

cosmetics, skin care, fragrance, and personal care company. He

brings with him a wealth of experience in the cosmetics sector that

will be particularly beneficial as we seek to grow our North

American business.

Summary and Outlook

The first half of 2021 has seen a strong performance, with a

significant recovery across the Group, following a difficult 2020

for everyone. Prior to the impact of Covid-19 the business was

trading well. Despite the continued impact of the pandemic, with

lockdowns in many parts of the world, including the UK, for much of

the first half, we have seen a return to the level of Group sales

achieved in the first half of 2019, a period before the pandemic

hit.

We have seen particularly strong growth in the UK, with sales

increasing beyond the level achieved in the first half of 2019,

aided by the growing sales of our W7 brand through Tesco and of our

Technic and Body Collection brands through wilko, with a further

expansion of the W7 range in Tesco planned for later this year.

Additionally, the planned launch of W7 into Boots provides a

further significant opportunity. We have also seen a much improved

performance in the US, strong growth elsewhere internationally and

are seeing a rapid increase in online sales.

Warpaint is a global business with the capacity, expertise and

strategy, coupled with balance sheet strength, to drive future

growth. We are working in partnership with our existing retailers

to grow sales further and are in active discussions with additional

major retailers in the UK and overseas.

I anticipate updating further on our progress later in the year

and with significant opportunities for further growth I look

forward to the future with confidence.

Sam Bazini

Chief Executive Officer

22 September 2021

Chief Financial Officer's Review

In 2020 results were adversely impacted by the Covid-19

pandemic, however the first half of 2021 has seen the Group achieve

results ahead of the first half of 2020 and in line with the first

half of 2019. The Group continues its strategy of building the W7

and Technic brands in the UK and internationally, and we remain

focused on margin, being debt free, generating cash and

safeguarding the business and the jobs of our employees.

Headline results, shown below, represent the performance

comparisons between the consolidated statements of income for the

half years ended 30 June 2021 and 30 June 2020.

Revenue

Total revenue increased by 36% from GBP13.5 million in H1 2020

to GBP18.4 million in H1 2021 (H1 2019: GBP18.9 million).

Company branded sales were GBP16.1 million in the first half of

the year (H1 2020: GBP10.5 million, H1 2019 GBP15.2 million). Our

W7 brand had sales in the first half of the year of GBP10.5 million

(H1 2020: GBP6.6 million, H1 2019: GBP10.3 million). Our Technic

brand contributed sales of GBP5.5 million in the first half of the

year (H1 2020: GBP3.9 million, H1 2019: GBP4.9 million).

The close-out business had sales in the first half of the year

of GBP2.1 million (H1 2020: GBP2.4 million, H1 2019: GBP3.3

million).

Our Retra subsidiary business had sales of retailer own brand

white label cosmetics of GBP0.2 million in the first half of the

year (H1 2020: GBP0.3 million, H1 2019: GBP0.4 million). The white

label business is traditionally cost competitive and Retra chooses

which projects to undertake based on commercial viability, in

particular margin.

In the UK sales increased by 31% to GBP8.9 million (H1 2020:

GBP6.8 million, H1 2019: GBP7.8 million). Internationally, revenue

increased 41% from GBP6.7 million in H1 2020, to GBP9.5 million in

H1 2021 (H1 2019: 11.2 million). In Europe Group sales increased by

28% to GBP6.5 million (H1 2020: GBP5.1 million, H1 2019: GBP7.8

million). In the rest of the world Group sales increased by 116% to

GBP1.7 million (H1 2020: GBP0.8 million, H1 2019: GBP1.2 million).

In the US Group sales increased by 45% to GBP1.2 million (H1 2020:

GBP0.8 million, H1 2019: GBP2.2 million).

Product Gross Margin

Gross margin was 34.5% for the half year compared to 35.1% in H1

2020 (H12019: 34.9%). Since the start of 2021 we have noticed

slight price increases in US dollars coming from our supply base in

China and container freight rates have increased dramatically, both

these cost increases have been partly offset by a weakening dollar

compared to 2020. We also noticed an increase in outbound freight

costs to deliver goods to our European customers. Gross margin has

decreased slightly because of these cost increases.

We remain focused on improving gross margin where possible in

all our businesses and are making good use of our Hong Kong buying

office to ensure this happens. To counter currency pressure, we

continue to move production to new factories of equal quality to

retain or improve margin and have a natural hedge from our US

dollar revenue.

At 31 December 2020 options were in place for the purchase of

US$18 million at US$1.3260/GBP (31 December 2019: US$15 million at

US$1.3142/GBP), this has helped to protect our margin in the

turbulent foreign exchange markets. Since the start of this year we

have purchased more forward options as the dollar continued to

weaken to protect our gross margin through to the end of 2021 and

the start of 2022.

Operating Expenses

Total operating expenses decreased by GBP0.1 million from H1

2020 to H1 2021. Excluding amortisation of intangibles,

depreciation charges, exceptional items, share based payments,

foreign exchange movements, and finance costs operating expenses

decreased by GBP0.1 million from H1 2020 to H1 2021. This decrease

was made up of a reduction in spend on travel, PR and marketing

totalling GBP0.1 million, an increase in wages and salaries of

GBP0.2 million, and a decrease in the provision for bad debts of

GBP0.2 million.

Warpaint remains a business with most operating expenses

relatively fixed and evenly spread across the whole year. We

continue to monitor and examine significant costs to ensure they

are controlled and strive to reduce them. In addition, the

increased scale of the business has given the Group increased

buying power.

Adjusted EBITDA

The board considers Adjusted EBITDA (adjusted for foreign

exchange movements, share based payments and exceptional items) a

key measure of the performance of the Group and one that is more

closely aligned to the success of the business. Adjusted EBITDA for

the half year to 30 June 2021 was GBP2.1 million (30 June 2020:

GBP0.4 million, 30 June 2019: GBP2.1 million).

Profit Before Tax

Group profit before tax for the half year to 30 June 2021 was

GBP0.2 million (H1 2020: GBP1.5 million loss, H1 2019: GBP0.2

million loss). The material changes in profitability between 30

June 2020 and 2021 were:

Effect on

Profit

GBP1.6 million

* Gross margin on increase in sales in H1 2021

GBP0.1 million

* Decrease in operating expenses (see above heading)

(GBP0.5)

* FX gain in H1 2021 GBP0.16 million (H1 2020: GBP0.64 million

million)

GBP0.3 million

* Decrease in the cost of share option schemes

GBP0.2 million

* Decrease in exceptional costs

Exceptional Items

Exceptional costs in H1 2021 included GBP0.005 million of legal

costs (H1 2020 included GBP0.13 million of staff restructuring

costs and GBP0.06 million of legal costs).

Earnings Per Share

The statutory interim basic and diluted profit per share was

0.18p in H1 2021 (1.68p loss in H1 2020, 0.22p loss in H1

2019).

The adjusted interim earnings per share before exceptional items

and amortisation costs was 1.80p in H1 2021 (0.16p in H1 2020,

1.37p in H1 2019).

LTIP, EMI & CSOP Share Options

On 25 May 2021 CSOP share options were granted over a total of

400,000 ordinary shares of 25p each in the Company under the

Warpaint London PLC Company Share Option Plan and the Warpaint

London plc Enterprise Management Incentive Scheme. The options

provide the right to acquire 400,000 ordinary shares at an exercise

price of 122.0p per ordinary share.

The LTIP, EMI & CSOP share options had no dilutive impact on

earnings per share in the period. The share-based payment charge of

the LTIP, EMI and CSOP share options for the half year to 30 June

2021 was GBP0.07 million (H1 2020: GBP0.33 million) and has been

taken to the share option reserve.

Cash Flow and Cash Position

Net cash flow generated from operating activities was GBP2.8

million compared to GBP2.3 million in H1 2020 (GBP1.3 million H1

2019). The Group's cash balance increased by GBP2.9 million to

GBP6.7 million as at 30 June 2021 (30 June 2020: GBP3.8 million, 30

June 2019: GBP3.7 million).

We expect capital expenditure requirements of the Group to

remain low, however as part of our strategy to grow market share in

the UK and US there will be occasions where investment in store

furniture is required to secure that business. In H1 2021, GBP0.1

million (H1 2020: GBP0.5 million, H1 2019: GBP0.2 million) was

spent on store furniture, on new computer software and equipment,

and other general office fixtures and fittings and plant

upgrades.

Balance Sheet

The Group's balance sheet remains in a very healthy position.

Net assets totalled GBP35.3 million at 30 June 2021, with the

majority made up of liquid assets of inventory, trade receivables

and cash. Included in the balance sheet is GBP7.3 million of

goodwill and GBP3.4 million of intangible fixed assets arising from

acquisition accounting.

The balance sheet also includes GBP3.2 million of right-of-use

assets, this is the inclusion of the Group leasehold properties,

now recognised as right-of-use assets as directed by IFRS 16. An

equivalent lease liability is included of GBP3.3 million at the

balance sheet date.

Trade receivables, excluding other receivables, at 30 June 2021

were GBP6.2 million (30 June 2020: GBP5.6 million, 30 June 2019:

GBP7.6 million). Collection times have improved on the prior half

year and H1 2019, allowing for a reduction in the provision for bad

and doubtful debts carried forward to GBP0.06 million/1.0% of gross

trade receivables (30 June 2020: GBP0.26 million/4.4%, 30 June

2019: GBP0.03 million/0.4%).

Inventories at 30 June 2021 were GBP16.7 million (30 June 2020:

GBP18.9 million and 30 June 2019: GBP18.7 million). The fall in

inventory was due to the action taken to reduce inventory across

the Group in response to Covid-19, and our strategy of exiting the

sale of locally sourced close-out brands in the US to focus on our

best-selling brand lines. The provision for old and slow inventory

was GBP0.7 million/4.2% at 30 June 2021 (30 June 2020: GBP0.5

million/2.7%, 30 June 2019: GBP0.2 million/0.9%). The increase in

provision arises from the Group's policy of providing for 50% of

the cost of perishable items that are over two years old. However,

we remain comforted by the fact that, in reality, many such items

are eventually sold in the normal course of business through our

close-out division without a loss to the Group.

Included within borrowings and lease liabilities is an invoice

and stock finance facility used to help fund imports in our gifting

business, and term loans and HP contracts. At 30 June 2021 the

outstanding balance on the invoice and stock finance facility was

GBPnil (30 June 2020: GBP1.0 million, 30 June 2019: GBP1.0

million). At 30 June 2021 the outstanding balance on the term loans

and HP contracts was GBPnil, having been repaid early in full in

April 2021 (30 June 2020: GBP0.4 million, 30 June 2019: GBP0.7

million).

Working capital decreased by GBP2.5 million from 30 June 2020 to

30 June 2021. The main components were a decrease in inventory of

GBP2.2 million, a decrease in trade and other receivables of GBP1.0

million, an increase in cash of GBP2.9 million, and an increase in

trade and other payables of GBP2.2 million.

Foreign Exchange

The Group imports most of its finished goods from China paid for

in US dollars, which are purchased throughout the year at spot as

needed, or by taking forward purchase foreign exchange options when

rates are deemed favourable, and with consideration for the budget

rate set by the board for the year. Similarly, foreign exchange

options are taken to sell forward our expected Euro income in the

year to ensure our sales margin is protected.

We started 2021 with options in place for the purchase of US$18

million at US$1.3260, and the sale of EUR5.1 million @ EUR1.1077 (1

January 2020: US$15 million @ US$1.3142/GBP, and EUR4.4 million @

EUR1.1402/GBP; 1 January 2019: US$nil, and EUR1.1 million @

EUR1.1289/GBP).

We have a natural hedge from sales to the US which are entirely

in US dollars, in H1 2021 these sales were US$1.7 million (H1 2020:

US$1.1 million, H1 2019: US$2.8 million). Together with sourcing

product from new factories where it makes commercial sense to do so

and by buying US dollars when rates are favourable, we are able to

mitigate the effect of a strong US dollar against sterling.

Dividend

The board is pleased to have declared an interim dividend of

2.5p per share which will be paid on 26 November 2021 to

shareholders on the register at 12 November 2021. The shares will

go ex-dividend on 11 November 2021.

Neil Rodol

Chief Financial Officer

22 September 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Unaudited Unaudited Audited

6 Months 6 Months Year ended

ended ended 31 December

Notes 30 June 2021 30 June 2020 2020

GBP'000 GBP'000 GBP'000

----------------- ------------ ------------------------------ ---------------------------- -----------------------

Revenue 18,417 13,531 40,286

Cost of sales (12,064) (8,780) (27,742)

----------------- ------------ ------------------------------ ---------------------------- -----------------------

Gross profit 6,353 4,751 12,544

Administrative

expenses 3 (6,039) (6,120) (13,807)

Other operating

income - - 361

Analysed as:

Adjusted profit

from

operations(1) 1,588 380 2,514

Amortisation (1,204) (1,221) (2,443)

Exceptional

items 3 (5) (193) (317)

Share based

payments (65) (335) (656)

----------------- ------------ ------------------------------ ---------------------------- -----------------------

Profit/(loss)

from operations 314 (1,369) (902)

----------------- ------------

Finance expenses 4 (148) (107) (212)

----------------- ------------ ------------------------------ ---------------------------- -----------------------

Profit/(loss)

before tax 3 166 (1,476) (1,114)

Tax expense 5 (31) 189 111

----------------- ------------ ------------------------------ ---------------------------- -----------------------

Profit/(loss)

for the period

attributable to

equity holders

of the parent

company 135 (1,287) (1,003)

Other

comprehensive

income

(net of tax):

Exchange gain on

translation

of foreign

subsidiary 14 (4) 53

Total

comprehensive

income/(loss)

for the period

attributable

to equity

holders of the

parent company 149 (1,291) (950)

================= ============ ============================== ============================ =======================

Earnings/(loss)

per share

- Basic and

diluted 6 0.18 (1.68) (1.31)

----------------- ------------ ------------------------------ ---------------------------- -----------------------

Note 1 - Adjusted profit from operations is calculated as

earnings before interest, taxation, amortisation, impairment costs,

share based payments and exceptional items.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

As at 30 June As at 30 June As at 31

2021 2020 December

2020

GBP'000 GBP'000 GBP'000

----------------------------- ----------------- ----------------- ------------

ASSETS

Non-current assets

Goodwill 7,274 7,274 7,274

Intangible assets 3,434 5,871 4,651

Property, plant and

equipment 1,198 1,006 1,149

Right-of-use assets 3,205 4,197 3,799

Deferred tax assets 569 396 581

------------------------------ ----------------- ----------------- ------------

15,680 18,744 17,454

Current assets

Inventories 16,687 18,853 14,413

Trade and other receivables 7,898 8,895 9,187

Cash and cash equivalents 6,723 3,819 4,875

Derivative financial

instruments 41 251 40

------------------------------ -----------------

31,349 31,818 28,515

----------------------------- ----------------- ----------------- ------------

Total assets 47,029 50,562 45,969

------------------------------ ----------------- ----------------- ------------

LIABILITIES

Current liabilities

Trade and other payables 7,244 4,957 3,121

Borrowings and lease

liabilities 625 1,989 914

Derivative financial

instruments - - 400

Corporation tax payable 413 255 119

8,282 7,201 4,554

Non-current liabilities

Borrowings and lease

liabilities 2,695 3,409 3,045

Deferred tax liabilities 771 1,095 1,000

------------------------------ -----------------

3,466 4,504 4,045

----------------------------- ----------------- ----------------- ------------

Total liabilities 11,748 11,705 8,599

------------------------------ ----------------- ----------------- ------------

NET ASSETS 35,281 38,857 37,370

============================== ================= ================= ============

EQUITY

Share capital 19,187 19,187 19,187

Share premium 19,359 19,359 19,359

Merger reserve (16,100) (16,100) (16,100)

Foreign exchange reserve 103 32 89

Share option reserve 1,698 1,312 1,633

Retained earnings 11,034 15,067 13,202

------------------------------ ----------------- ----------------- ------------

Total equity attributable

to

shareholders 35,281 38,857 37,370

============================== ================= ================= ============

CONSOLIDATED STATEMENT OF CASH FLOW

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2021 30 June 2020 31 December

Notes 2020

GBP'000 GBP'000 GBP'000

------------------------------------- ------- --------------- --------------- ------------

Profit/(loss) before tax

for the period 166 (1,476) (1,114)

Adjusted by:

Interest paid 4 148 107 212

Depreciation of property,

plant and equipment 683 628 1,252

Amortisation of intangible

assets 1,204 1,221 2,443

Net interest expense

Loss on disposal of property,

plant and equipment and intangible

assets - - 2

Share based payment 65 335 656

Movement in inventories (2,274) (2,659) 3,437

Movement in trade and other

receivables 1,290 3,729 1,781

Movement in trade and other

payables 2,174 1,002 (812)

Movement in derivative financial

instruments (401) (212) 399

Foreign exchange translation

differences 15 (4) 53

------------------------------------- ------- --------------- --------------- ------------

Cash inflow generated from

operations 3,070 2,671 8,309

Income tax paid (310) (333) (853)

Cash flows from operating

activities 2,760 2,338 7,456

Purchase of property, plant

and equipment (122) (462) (869)

Purchase of intangible assets (3) (10) (12)

Sale of property, plant and

equipment proceeds - - 21

------------------------------------- -------

Cash flows used by investing

activities (125) (472) (860)

Principal elements of lease

payments (591) (424) (810)

Repayment of borrowings (48) (45) (90)

Decrease in stock and invoice

finance facilities - (202) (1,191)

Interest paid (148) (107) (212)

Dividends - - (2,149)

------------------------------------- ------- --------------- --------------- ------------

Cash flows used by financing

activities (787) (778) (4,452)

Net change in cash and cash

equivalents 1,848 1,088 2,144

Cash and cash equivalents

at beginning of period 4,875 2,731 2,731

------------------------------------- ------- --------------- --------------- ------------

Cash and cash equivalents

at end of period 6,723 3,819 4,875

===================================== ======= =============== =============== ============

Cash and cash equivalents

consists of:

Cash and cash equivalents 6,723 3,819 4,875

------------------------------------- ------- --------------- --------------- ------------

6,723 3,819 4,875

===================================== ======= =============== =============== ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Foreign Share Retained

capital Premium reserve exchange option earnings Total

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------- -------- --------- -------- --------- -------

As at 1 January 2020 19,187 19,359 (16,100) 36 977 16,354 39,813

On translation of foreign

subsidiary - - - (4) - - (4)

Loss for the period - - - - - (1,287) (1,287)

-------------------------------- -------- -------- -------- --------- -------- --------- -------

Total comprehensive income

for the period - - - (4) - (1,287) (1,291)

-------------------------------- -------- -------- -------- --------- -------- --------- -------

Transactions with owners

Share based payments - - - - 335 - 335

Total transactions with owners - - - - 335 - 335

-------------------------------- -------- -------- -------- --------- -------- --------- -------

As at 30 June 2020 19,187 19,359 (16,100) 32 1,312 15,067 38,857

-------------------------------- -------- -------- -------- --------- -------- --------- -------

As at 1 January 2020 19,187 19,359 (16,100) 36 977 16,354 39,813

On translation of foreign

subsidiary - - - 53 - - 53

Loss for the year - - - - - (1,003) (1,003)

Total comprehensive income

for the year - - - 53 - (1,003) (950)

-------------------------------- -------- -------- -------- --------- -------- --------- -------

Transactions with owners

Share based payments - - - - 656 - 656

Dividends paid - - - - - (2,149) (2,149)

Total transactions with owners - - - - 656 (2,149) (1,493)

-------------------------------- -------- -------- -------- --------- -------- --------- -------

As at 31 December 2020 19,187 19,359 (16,100) 89 1,633 13,202 37,370

-------------------------------- -------- -------- -------- --------- -------- --------- -------

As at 1 January 2021 19,187 19,359 (16,100) 89 1,633 13,202 37,370

On translation of foreign

subsidiary - - - 14 - - 14

Loss for the period - - - - - 135 135

Total comprehensive income

for the period - - - 14 - 135 149

-------------------------------- -------- -------- -------- --------- -------- --------- -------

Transactions with owners

Share based payments - - - - 65 - 65

Dividends paid - - - - - (2,303) (2,303)

Total transactions with owners - - - - 65 (2,303) (2,238)

-------------------------------- -------- -------- -------- --------- -------- --------- -------

As at 30 June 2021 19,187 19,359 (16,100) 103 1,698 11,034 35,281

================================ ======== ======== ======== ========= ======== ========= =======

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation

The accounts have been prepared in accordance with accounting

policies that are consistent with the Group's Annual Report and

Accounts, the Group's Annual Report and Accounts for the year ended

31 December 2020 have been prepared in accordance with

international accounting standards in compliance with the Companies

Act of 2006 and Group's Annual Report and Accounts for the year

ending 31 December 2021 will be prepared in accordance with the UK

adopted international accounting standards.

The comparative financial information for the year ended 31

December 2020 in this interim report does not constitute statutory

accounts for that period under 435 of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2020 have been

delivered to the Registrar of Companies.

The auditors' report on the accounts for 31 December 2020 was

unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

2. Changes in significant accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's

consolidated financial statements as at and for the year ended 31

December 2020.

3. Profit from operations

Profit from operations is arrived at after charging/

(crediting):

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2021 30 June 2020 31 December

2020

GBP'000 GBP'000 GBP'000

------------------------------ ---------------- ---------------- -------------

Depreciation of property,

plant and equipment 344 279 385

Amortisation of right-of-use

assets 339 365 867

Amortisation of intangible

assets 1,204 1,221 2,443

Write down inventories at

net realisable value 167 291 312

Exchange differences (163) (641) 420

Exceptional costs 5 193 317

4. Finance expenses

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2021 30 June 2020 31 December

2020

GBP'000 GBP'000 GBP'000

-------------------------- ---------------- ---------------- -------------

Interest on loans 64 10 18

Lease liability interest 43 87 143

Other interest 41 10 51

-------------------------- ---------------- ---------------- -------------

Finance expenses 148 107 212

========================== ================ ================ =============

5. Tax expenses

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2021 30 June 2020 31 December

2020

GBP'000 GBP'000 GBP'000

------------------------------------ ---------------- ---------------- -------------

Current tax expense

Current income tax charge 248 40 429

Adjustment in respect of - - -

previous periods

------------------------------------ ---------------- ---------------- -------------

40 429

Deferred tax expense

Relating to original and

reversal of temporary differences (217) (229) (544)

------------------------------------ ---------------- ---------------- -------------

Total tax in income statement 31 (189) (111)

==================================== ================ ================ =============

6. Earnings/(loss) per share

(Loss)/profit for the period used in the calculation of the

basic and diluted earnings per share:

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2021 30 June 2020 31 December

2020

GBP'000 GBP'000 GBP'000

----------------------------- ---------------- ---------------- -------------

Profit/(loss) after tax for

the period 135 (1,287) (1,003)

============================= ================ ================ =============

The share options in issue at each period end have not been

included in the computation of diluted earnings per share, as per

IAS 33, the share options are not dilutive as they are not likely

to be exercised given that the exercise price is higher than the

average market price.

The weighted average number of shares for the purposes of

diluted earnings per share reconciles to the weighted average

number of shares used in the calculation of basic earnings per

share as follows:

Unaudited Unaudited Audited

6 Months ended 6 Months ended Year ended

30 June 2021 30 June 2020 31 December

2020

------------------------------- ---------------- ---------------- -------------

Weighted average number of

shares

Weighted number of ordinary

shares for the purpose of

basic earnings per share 76,749,999 76,749,125 76,749,125

Potentially dilutive shares

awarded 251,863 - 67,040

------------------------------- ----------------

Weighted number of ordinary

shares for the purpose of

diluted earnings per share 77,001,862 76,749,125 76,816,165

------------------------------- ---------------- ---------------- -------------

Earnings/(loss) per share

(pence) - Basic and Diluted 0.18 (1.68) (1.31)

=============================== ================ ================ =============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFTARILFIL

(END) Dow Jones Newswires

September 22, 2021 02:00 ET (06:00 GMT)

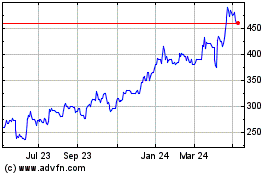

Warpaint London (LSE:W7L)

Historical Stock Chart

From Mar 2024 to Apr 2024

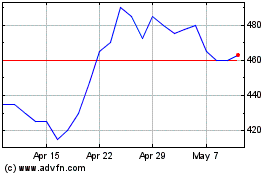

Warpaint London (LSE:W7L)

Historical Stock Chart

From Apr 2023 to Apr 2024