WOOD GROUP (JOHN) PLC - Director/PDMR Shareholding

11 June 2022 - 12:29AM

PR Newswire (US)

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

ROBIN

WATSON |

| 2 |

Reason for the notification |

| a) |

Position/status |

CHIEF

EXECUTIVE |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

263,611

SHARES OPTIONS

LAPSED

– 197,709

DIVIDEND SHARE OPTIONS

ACCRUED

– 4,290

100% OF THE TOTAL ADJUSTED AWARD NOTED BELOW IS DEFERRED FOR TWO

YEARS AND SHALL VEST ON 10 MARCH 2024.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE DEFERRED AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

70,192 |

|

|

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

70,192 - adjusted awarded

£NIL |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

OUTSIDE A TRADING

VENUE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

DAVID

KEMP |

| 2 |

Reason for the notification |

| a) |

Position/status |

CHIEF

FINANCIAL OFFICER |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

146,084

SHARES OPTIONS

LAPSED

– 109,563

DIVIDEND SHARE OPTIONS

ACCRUED

– 2,377

100% OF THE TOTAL ADJUSTED AWARD NOTED BELOW IS DEFERRED FOR TWO

YEARS AND SHALL VEST ON 10 MARCH 2024. DIVIDENDS WILL

CONTINUE TO ACCRUE ON THE DEFERRED AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

38,898 |

|

|

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

38,898 - adjusted awarded

£NIL |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

OUTSIDE A TRADING

VENUE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

STEPHANIE

COX |

| 2 |

Reason for the notification |

| a) |

Position/status |

EXECUTIVE

PRESIDENT - OPERATIONS |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

125,051

SHARES OPTIONS

LAPSED

– 93,789

DIVIDEND SHARE OPTIONS

ACCRUED

– 2,035

80% OF THE TOTAL ADJUSTED AWARD NOTED BELOW VESTS IMMEDIATELY

AND THE SHARES EXERCISED AND RETAINED NET OF ASSOCIATED TAX

LIABILITY. THE REMAINING 20% OF THE ADJUSTED AWARD IS

DEFERRED FOR TWO YEARS.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE 20% DEFERRED

AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

33,297 adjusted

award |

| £2.29 |

7,914 shares

sold |

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

33,297 adjusted awarded

7,914 shares

sold at £2.29 |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

AWARD

- OUTSIDE A TRADING VENUE

SALE - LONDON STOCK

EXCHANGE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

MICHAEL

COLLINS |

| 2 |

Reason for the notification |

| a) |

Position/status |

EXECUTIVE

PRESIDENT - PROJECTS |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

46,131

SHARES OPTIONS

LAPSED

– 34,599

DIVIDEND SHARE OPTIONS

ACCRUED

– 750

80% OF THE TOTAL ADJUSTED AWARD NOTED BELOW VESTS IMMEDIATELY

AND THE SHARES EXERCISED AND RETAINED NET OF ASSOCIATED TAX

LIABILITY. THE REMAINING 20% OF THE ADJUSTED AWARD IS

DEFERRED FOR TWO YEARS.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE 20% DEFERRED

AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

12,282 adjusted

award |

| £2.29 |

4,850

shares sold |

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

12,282 adjusted awarded

4,850 shares sold at

£2.29 |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

AWARD

- OUTSIDE A TRADING VENUE

SALE - LONDON STOCK

EXCHANGE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

LESLEY

BIRSE |

| 2 |

Reason for the notification |

| a) |

Position/status |

EXECUTIVE

PRESIDENT - PEOPLE & ORGANISATION |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

26,361

SHARES OPTIONS

LAPSED

– 19,771

DIVIDEND SHARE OPTIONS

ACCRUED

– 429

80% OF THE TOTAL ADJUSTED AWARD NOTED BELOW VESTS IMMEDIATELY

AND THE SHARES EXERCISED AND RETAINED NET OF ASSOCIATED TAX

LIABILITY. THE REMAINING 20% OF THE ADJUSTED AWARD IS

DEFERRED FOR TWO YEARS.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE 20% DEFERRED

AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

7,019 adjusted award |

| £2.29 |

2,771 shares sold |

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

7,019 adjusted awarded

2,771 shares sold at £2.29 |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

AWARD

- OUTSIDE A TRADING VENUE

SALE - LONDON STOCK

EXCHANGE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

JOSEPH

SCZURKO |

| 2 |

Reason for the notification |

| a) |

Position/status |

EXECUTIVE

PRESIDENT - ENVIRONMENT & INFRASTRUCTURE

CONSULTING |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

68,993

SHARES OPTIONS

LAPSED

– 51,745

DIVIDEND SHARE OPTIONS

ACCRUED

– 1,122

80% OF THE TOTAL ADJUSTED AWARD NOTED BELOW VESTS IMMEDIATELY

AND THE SHARES EXERCISED AND RETAINED NET OF ASSOCIATED TAX

LIABILITY. THE REMAINING 20% OF THE ADJUSTED AWARD IS

DEFERRED FOR TWO YEARS.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE 20% DEFERRED

AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

18,370 adjusted

award |

| £2.29 |

4,367 shares

sold |

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

18,370 adjusted awarded

4,367 shares sold at

£2.29 |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

AWARD

- OUTSIDE A TRADING VENUE

SALE - LONDON STOCK

EXCHANGE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

NINA

SCHOFIELD |

| 2 |

Reason for the notification |

| a) |

Position/status |

EXECUTIVE PRESIDENT

- HSSES |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

73,305

SHARES OPTIONS

LAPSED

– 54,979

DIVIDEND SHARE OPTIONS

ACCRUED

– 1,192

80% OF THE TOTAL ADJUSTED AWARD NOTED BELOW VESTS IMMEDIATELY

AND THE SHARES EXERCISED AND RETAINED NET OF ASSOCIATED TAX

LIABILITY. THE REMAINING 20% OF THE ADJUSTED AWARD IS

DEFERRED FOR TWO YEARS.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE 20% DEFERRED

AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

19,518 adjusted

award |

| £2.29 |

4,640

shares sold |

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

19,518 adjusted awarded

4,640 shares sold at

£2.29 |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

AWARD

- OUTSIDE A TRADING VENUE

SALE - LONDON STOCK

EXCHANGE |

JOHN WOOD GROUP PLC

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

| 1 |

Details of the person discharging

managerial responsibilities / person

closely associated |

| a) |

Name |

MARTIN

MCINTYRE |

| 2 |

Reason for the notification |

| a) |

Position/status |

GENERAL COUNSEL AND

COMPANY SECRETARY |

| b) |

Initial

notification/Amendment |

INITIAL

NOTIFICATION |

| 3 |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

| a) |

Name |

JOHN WOOD GROUP

PLC |

| b) |

LEI |

549300PLYY6I10B6S323 |

| 4 |

Details of the transaction(s): section to be

repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv)

each place where transactions have been conducted |

| a) |

Description of the financial instrument, type of instrument

Identification code |

ORDINARY SHARES OF 4 2/7 PENCE EACH

GB00B5N0P849 |

| b) |

Nature of the

transaction |

ADJUSTMENT OF AWARDS FOR PERFORMANCE AND ACCRUAL OF HISTORIC

DIVIDENDS UNDER THE JOHN WOOD GROUP PLC LONG-TERM PLAN (“LTP”) IN

RESPECT OF THE 2019-2021 PERFORMANCE PERIOD.

ORIGINAL NO OF SHARE OPTIONS AWARDED –

49,971

SHARES OPTIONS

LAPSED

– 37,479

DIVIDEND SHARE OPTIONS

ACCRUED

– 813

80% OF THE TOTAL ADJUSTED AWARD NOTED BELOW VESTS IMMEDIATELY

AND THE SHARES EXERCISED AND RETAINED NET OF ASSOCIATED TAX

LIABILITY. THE REMAINING 20% OF THE ADJUSTED AWARD IS

DEFERRED FOR TWO YEARS.

DIVIDENDS WILL CONTINUE TO ACCRUE ON THE 20% DEFERRED

AWARD |

| c) |

Price(s) and

volume(s) |

| Price(s) |

Volume(s) |

| £NIL |

13,305 adjusted

award |

| £2.29 |

5,253 shares sold |

|

| d) |

Aggregated

information |

|

|

-

Aggregated volume

-

Price |

13,305 adjusted awarded

5,253 shares sold at

£2.29 |

| e) |

Date of the

transaction |

2022-06-09 |

| f) |

Place of the

transaction |

AWARD

- OUTSIDE A TRADING VENUE

SALE - LONDON STOCK

EXCHANGE |

Copyright e 10 PR Newswire

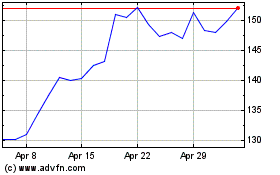

Wood Group (john) (LSE:WG.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wood Group (john) (LSE:WG.)

Historical Stock Chart

From Apr 2023 to Apr 2024