TIDMWOSG

RNS Number : 9337N

Watches of Switzerland Group PLC

04 February 2021

Watches of Switzerland Group PLC

Q3 FY21 Trading

for the 13 weeks (Q3) and 39 weeks (9M) to 24 January 2021

Continued strong growth in the US and robust UK ecommerce

performance

Full year guidance maintained despite UK store closures

Watches of Switzerland Group PLC ("the Group") today provides

the following update relating to the 13 and the 39 weeks ending 24

January 2021.

Q3 trading remained strong despite extended period of UK store

closures due to COVID-19

-- Group revenue GBP272.6 million, +6.6% in constant currency,

+5.7% in reported terms vs last year

o Leading multi-channel business model advanced, with

significant further development of the mono-brand network,

ecommerce, customer relationship management ("CRM") and

clienteling, digital marketing

o Luxury watch sales continue to drive performance and in the

first nine months of FY21 represent 86% of Group revenue (9M FY20:

84%), with no disruption to supply experienced

o Higher conversion continues to more than offset lower traffic

across both the UK and US

-- UK revenue GBP186.1 million, +1.5% vs last year

o Domestic sales remain strong and continue to offset lower

tourist and airport business (6.6% of Group revenue (Q3 FY20:

22.2%)

o Very strong ecommerce sales +121.1% vs last year, with newly

launched luxury concierge and collect service delivering robust

initial results and helping to offset the impact of store

closures

o UK stores traded 37% of potential trading hours reflecting

eight weeks of national lockdown

o No disruption to supply experienced from Brexit during the

initial transition period

-- US revenue GBP86.5 million, +19.2% in constant currency,

+16.0% in reported terms vs last year

o Successful launch of mono-brand network with the opening of

eight boutiques (two OMEGA, three TAG Heuer, three Breitling),

despite pandemic-related challenges

o Mayors stores in Florida and Georgia and Watches of

Switzerland stores in New York continue to see strong momentum

whilst trends in Las Vegas stores moderated, due to lower domestic

tourism

o CRM and clientelling continue to play an important role in

driving business performance

o Ecommerce delivering according to plan following recent

launch

Outlook

-- The Group maintains its guidance for FY21 despite UK market

conditions having worsened since announcing H1 FY21 results on 17

December 2020, with the national lockdown introduced in England on

26 December 2020

-- The Group has assumed a continued high level of uncertainty

in the UK where stores are not expected to reopen until late March

2021 at the earliest; no impact is assumed from any lockdown on US

retail activities and on production in Switzerland

-- Continued development of the mono-brand channel with five new boutiques to open in the UK:

o Two mono-brand boutiques in Cardiff are expected to open

immediately following the current lockdown (TAG Heuer,

Breitling)

o Three mono-brand boutiques (OMEGA, TAG Heuer, Breitling) are

planned to open in Plymouth (Summer 2021)

Brian Duffy, Chief Executive Officer, said:

"We delivered another strong performance, driven by continued

strong growth in the US and a surge in UK online sales, which

mitigated the significant headwinds, the extended period of store

closures and the continued very low level of international business

in the UK.

We continue to provide an exceptional customer service during

these unusual circumstances, making further enhancements to our

customer relationship management, ecommerce and clienteling

capabilities through the introduction of our luxury concierge and

collect service and the launch of our new virtual boutique. Our

performance is underpinned by the strengths of our leading

multi-channel business model and the uniquely attractive qualities

of the luxury watch category, where demand continues to outpace

supply. The experience of prior lockdowns in the UK has given our

teams the tools to optimise commercial opportunities through online

and clienteling, whilst in the US we are driving fantastic

conversion levels with continued subdued traffic.

Tax-free shopping for tourists in the UK was removed from 1

January 2021. We continue to support all efforts to have the UK

Government review and change this policy.

Through maintaining consistent investment and adapting with

agility to changing conditions, we have shown our strategy is

working well, with initial findings suggesting we have gained

further market share in luxury watches in the UK over the last

year.

With a strong plan for continued investment and future growth,

we are well positioned to further enhance our leading position in

the UK and become a leader in the US luxury watch market."

Q3 FY21 and 9M FY21 Revenue Performance by Geography

Q3 9M

---------------

13 weeks 13 weeks Constant 39 weeks 39 weeks Constant

(GBPm) to to YoY currency to to YoY currency

24 Jan 26 Jan variance YoY variance 24 Jan 26 Jan variance YoY variance

2021 2020 % % 2021 2020 % %

--------- --------- ---------- ---------------- --------- --------- ---------- ---------------

UK 186.1 183.3 1.5% 1.5% 480.2 500.9 (4.1)% (4.1)%

--------- --------- ---------- ---------------- --------- --------- ---------- ---------------

US 86.5 74.6 16.0% 19.2% 206.6 185.7 11.3% 14.3%

--------- --------- ---------- ---------------- --------- --------- ---------- ---------------

Group Revenue 272.6 257.9 5.7% 6.6% 686.8 686.6 0.0% 0.9%

--------- --------- ---------- ---------------- --------- --------- ---------- ---------------

Q3 FY21 Revenue Performance by Category

Q3 9M

------------------

13 weeks 13 weeks 39 weeks 39 weeks

to to YoY to to YoY

(GBPm) 24 Jan 26 Jan variance 24 Jan 26 Jan variance

2021 2020 % 2021 2020 %

--------- --------- ---------- --------- --------- ----------

Luxury watches 231.3 209.8 10.2% 593.4 575.3 3.1%

--------- --------- ---------- --------- --------- ----------

Luxury jewellery 22.2 27.8 (20.1)% 48.5 59.3 (18.2)%

--------- --------- ---------- --------- --------- ----------

Other 19.1 20.3 (5.9)% 44.9 52.0 (13.7)%

--------- --------- ---------- --------- --------- ----------

Group Revenue 272.6 257.9 5.7% 686.8 686.6 0.0%

--------- --------- ---------- --------- --------- ----------

Q3 FY21 % Total Potential Traded Hours

Q3

-------

UK 37%

-----

US 78%

-----

Group 50%

-----

Conference call

A webcast conference call for analysts and investors will be

held at 9.00am (UK time) today. To join the call, please use the

following details:

Dial-in: +44 20 3936 2999

Conference access code: 127487

Contacts

The Watches of Switzerland Group

Anders Romberg, CFO +44 (0) 116 2817 401

Allegra Perry, Investor Relations +44 7767 100603

investor.relations@thewosgroup.com

Headland

Lucy Legh / Rob Walker +44 (0) 20 3805 4822

wos@headlandconsultancy.com

About the Watches of Switzerland Group

The Watches of Switzerland Group is the UK's largest luxury

watch retailer, operating in both the UK and US, comprising four

prestigious brands; Watches of Switzerland (UK and US), Mappin

& Webb (UK), Goldsmiths (UK) and Mayors (US), with

complementary jewellery offering.

As at 24 January 2021, the Watches of Switzerland Group has 146

core stores across the UK and US (which includes 35 dedicated

mono-brand stores in these two markets in partnership with Rolex,

TAG Heuer, OMEGA, Breitling, Audemars Piguet, Tudor and FOPE) and

has a leading presence in Heathrow Airport with representation in

Terminals 2, 3, 4 and 5 as well as five transactional websites.

The Watches of Switzerland Group is proud to be the UK's largest

retailer for Rolex, Cartier, OMEGA, TAG Heuer and Breitling

watches.

Mappin & Webb holds Royal warrants as goldsmiths,

silversmiths and jeweller to Her Majesty The Queen and silversmiths

to His Royal Highness The Prince of Wales. The Mappin & Webb

master jeweller has been Crown Jeweller, custodian of the Crown

Jewels of Her Majesty The Queen since 2012.

https://www.thewosgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBCGDDLGGDGBX

(END) Dow Jones Newswires

February 04, 2021 02:00 ET (07:00 GMT)

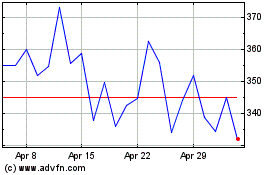

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Apr 2023 to Apr 2024