TIDMWOSG

RNS Number : 2988H

Watches of Switzerland Group PLC

02 August 2021

02 August 2021

Watches of Switzerland Group PLC (the "Company")

Annual Report and Accounts 2021

In compliance with Listing Rule 9.6.1, the Company announces

that the following documents have today been submitted to the UK

Financial Conduct Authority, and will shortly be available for

inspection via the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

-- Annual Report and Accounts 2021; and

-- Notice of Annual General Meeting of the Company, to be held

at 36 North Row, London W1K 6DH at 2pm on 2(nd) September 2021

In accordance with DTR 6.3.5(3) the Annual Report and Accounts

2021 and the Notice of Annual General Meeting are accessible on the

Group's website: thewosgroupplc.com/governance /

A condensed set of Watches of Switzerland Group PLC financial

statements and information on important events that have occurred

during the year and their impact on the financial statements were

included in the Company's FY 21 results announcement on 8(th) July

2021. That information together with the information set out below

which is extracted from the Annual Report and Accounts 2021

constitute the requirements of DTR 6.3.5 which is to be

communicated via an RNS in unedited full text. This announcement is

not a substitute for reading the full Annual Report and Accounts

2021. Page and note references in the text below refer to page

numbers in the Annual Report and Accounts 2021. To view the FY 21

results announcement visit the Company website:

thewosgroupplc.com/governance /

For further information, please contact:

Laura Battley

Company Secretary and General Counsel

+44 (0)20 7317 4604

companysecretariat@thewosgroup.com

Additional Information

Principal risks and uncertainties

Below are descriptions of our principal risks and uncertainties

and explanations of how we manage or mitigate the risk. It is

recognised that the Group is exposed to risks wider than those

listed. However, we have disclosed those we believe are likely to

have the greatest impact on our business at this moment in

time.

Principal risk description How we manage or mitigate the risk

Business strategy execution and

development:

The Board reviews business strategy

If the Board adopts the wrong strategy on a regular basis to determine

or does not implement its strategy how sales and profit can be maximised,

effectively, the business may suffer. and business operations be made

more efficient

The Group's growth strategy exposes

it to risks and the Group may encounter The Board has significant relevant

setbacks in its ongoing expansion experience, including in the retail

in the UK and the US. and luxury markets

The Group's significant investments The CEO provides updates to the

in its store portfolio, IT systems, Board on key development opportunities

colleagues and marketing may be and initiatives

unsuccessful in growing the Group's

business as planned. Expansion of the property portfolio

or potential acquisitions must

The Group may make acquisitions meet strict payback criteria. Return

or other investments that prove on investment of marketing and

unsuccessful or divert its resources. other investment activity is monitored

Successful growth through future closely

acquisitions is dependent upon

the Group's ability to identify Key management information is provided

suitable acquisition targets, conduct to the Board on a regular basis

appropriate due diligence, negotiate to help inform strategic decision

transactions on favourable terms, making

complete such transactions and

successfully integrate the acquired The Group adapted its strategy

businesses. to take advantage of online trading

and remote clienteling activities

The Group may fail to respond to to maximise sales throughout lockdown

the pressures of an increasingly periods and post re-opening

changing retail environment effectively

and rapidly, including from the The Group has diversified its operations

impact of COVID-19. The re-evaluation through the expansion of mono-brand

of priorities and their delivery, boutiques and ecommerce platforms.

including the consideration of Having entered the US market in

initiatives to respond to permanent 2017 there is international market

changes in customer behaviours diversification reducing reliance

or to change working practices, on one territory

is paramount in the current environment

---------------------------------------------------

Key suppliers and supply chain:

The manufacture of key luxury watch The Group fosters strong relationships

brands is highly concentrated among with suppliers, many of which have

a limited number of brand owners been held for a significant length

and the production of luxury watches of time

is limited by the small number

of master watchmakers and the availability Supplier distribution contracts

of artisanal skills. are monitored to ensure ongoing

compliance with contractual obligations

Owners of luxury watch brands control

distribution through strict, selective The Group works collaboratively

distribution agreements. Consequently, with suppliers to identify product

the relationship with owners of trends and forward demand

luxury watch brands is crucial

to the Group's success. Continued focus on providing exceptional

customer experience, representing

Some of the Group's distribution the brands in the best possible

agreements with luxury watch brands way

provide owners of such brands with

a right to terminate the agreement In-depth training for store colleagues

in the event of a change of control is provided, including specific

and/or management of the Group. training provided by the brand

owners themselves

The Group is subject to the risk

that owners of luxury watch brands

may decide to terminate these contracts

or otherwise not to renew them

upon expiry, or to reduce the number

of agencies they grant to the Group.

The Group's distribution agreements

with suppliers do not guarantee

a steady supply of merchandise.

The Group's business model may

also come under significant pressure

should the owners of luxury watch

brands choose to distribute their

own watches, increasingly or entirely

by-passing third party retailers

such as the Group.

As a result of COVID-19, supplier

manufacturing operations could

be forced to close, impacting operational

activities, customer experience

and business strategy.

Customer Experience and Market

Risk

The Group provides the ultimate

An inability to maintain a consistent luxury environment for its customers

high-quality experience for the to feel welcome, appreciated and

Group's customers across the sales supported

channels, particularly within the

store network, and during the COVID-19 Initiatives launched in response

pandemic, could adversely affect to the COVID-19 lockdown to continue

business. making product available safely

to customers

The Group faces competition and

any failure by the Group to compete Exceptional training is provided

effectively could result in a loss for our store colleagues, and other

of market share or the ability customer facing colleagues, to

to retain supplier agencies. The allow them to provide the best

Group also competes with the grey customer service, along with in-depth

market, where unauthorised dealers product knowledge

may be offering significant discounts.

The CRM database allows the Group

Long term consumer attitudes to to engage with the customer from

diamonds, gold and other precious a potential to a loyal customer

metals and gemstones could be affected

by a variety of issues, including The Group continues to invest in

concern over the source of raw and develop its product offering

materials, the impact of mining to improve the value offered to

and refining of minerals on the consumers, retailers and manufacturers

environment, labour conditions

in the supply chain, and the availability Competitor activity is monitored

and perception of substitute products, in detail, enabling strategic decision

such as cubic zirconia and laboratory-created making on key market positions

diamonds. Equally, longer term

consumer attitudes to more technologically The diversification of the Group

advanced watches, such as "smart through mono-brand boutiques and

watches" could reduce consumer significant online presence together

demand for luxury watches with the Group's scale and technological

capabilities are competitive advantages

for the Group

Colleague talent and capability:

The Group depends on the services The Trading Board considers the

of key personnel to manage its development of Senior Management

business, and the departure of to ensure there are opportunities

such personnel or the failure to for career development, promotion

recruit and retain suitable personnel and appropriate succession

could adversely affect the Group's

business. The Nomination Committee considers

Customer experience is an essential the succession planning for the

element in the success of the Group's Board

business, where many customers

prefer a more personal face-to-face The Group's award winning 'VibE'

experience and have established recognition programme is in place

personal relationships with the to incentivise and motivate all

Group's sales colleagues. An inability colleagues

to recruit, train, motivate and

retain suitably qualified colleagues, A wide range of training and development

especially with specialised knowledge programmes are available to colleagues,

of luxury watches, would have a including the Group's own Academy

material impact on the Group.

A group-wide engagement survey

provides an insight into what colleagues

feel would make the Group an even

better place to work

The Group continually reviews the

remuneration and benefits packages

for all colleagues to make sure

they are appropriately rewarded

for the substantial contribution

they make to the Group's growth

and success. These benefits and

the value they bring to colleagues

are continually communicated to

ensure they are taking advantage

of them

A focused project group has been

established, with an objective

to monitor and reduce retail labour

turnover, particularly in the first

year of employment

The Group is initiating a shift

from part time to full time contracts

for retail colleagues

A talent bank has been established,

which provides a pipeline for management

and high potential hires

Succession planning for key management,

below Executive level, has been

presented to the Nomination Committee

Business interruption and IT infrastructure:

Adverse weather conditions, pandemics, The Group has a framework of operational

travel disruption, natural disasters, procedures and business continuity

terrorism, acts of war or other plans that are regularly reviewed,

external events could adversely updated and tested

affect consumer discretionary spending

or cause a disruption to the Group's The multi-channel model allows

operations. customers to purchase online from

the safety and comfort of their

The inability of the Group to be homes

able to operate stores or a significant

reduction in available colleagues Robust security arrangements are

to operate the business, such as in place across our store network

during the COVID-19 pandemic, would to protect people and products

significantly impact the operations in the case of security incidents

of the business.

A comprehensive insurance programme

The Group offers flexible delivery is in place to offset the financial

options (home delivery or click consequences of insured events

and collect in store) and its online

operations rely on third party Business critical systems are based

carriers and transportation providers. on established, industry leading

The Group's shipments are subject package solutions

to various risks, including labour

strikes and adverse weather. A detailed IT development and security

roadmap is in place aligned to

The Group may experience significant our strategy

theft of products from its stores,

distribution centres or during Reliable and reputable third party

the transportation of goods. If logistic partners have been engaged

a hold-up, burglary or other theft to ensure the secure transportation

incident takes a violent turn, of goods

the Group may also suffer reputational

damage and our customers may become The Group put in place action plans

less inclined to visit our stores. to effectively deal with the COVID-19

pandemic impact on business operations

Disruptions to, or failures in,

the Group's IT infrastructure and

networks, or those of third parties,

could disrupt the Group's operations,

especially during periods of increased

reliance on these systems such

as those experienced during the

COVID-19 lockdowns.

The Group relies on IT networks

and systems, some of which are

managed by third parties, to process,

encrypt, transmit and store electronic

information, and to manage or support

a variety of business processes

and activities, including sales,

supply chain, merchandise distribution,

customer invoicing and collection

of payments.

---------------------------------------------- -------------------------------------------

Data protection and cyber security:

The increasing sophistication and Significant investment in systems

frequency of cyber-attacks, coupled development and security programmes

with data protection laws, highlight

the escalating information security Systems vulnerability and penetration

risk facing all businesses. testing is carried out regularly

As the Group operates in both the The Data Protection Committee meets

US and UK markets, the regulatory at least six times a year to review

environment surrounding these areas related processes and emerging

is considered more complex. risks

Security breaches and failures

in the Group's IT infrastructure GDPR policies, procedures and training

and networks, or those of third in place

parties, could compromise sensitive

and confidential information and Strict access rights are in place

affect the Group's reputation. to limit access to data and reports

to limited people

Theft or loss of Company or customer

data or potential damage to any Regular communication with colleagues

systems from viruses, ransomware on the risk of "phishing" emails

or other malware could result in and alerts of identified examples

fines and reputational damage to

the business that could negatively Security Information and Event

impact on our sales. Management (SEIM) tools are being

introduced across the Group's technology

Potential additional COVID-19 related estate

security risks in relation to increased

working from home arrangements, VPN security controls have been

an increase in phishing campaigns, enhanced in light of the increased

and increased reliance on third requirement for use through working

parties supporting critical support from home arrangements

services.

Enhanced password security measures

have been introduced to decrease

the likelihood of a breach

Regulatory and compliance:

Fines, litigation, and reputational The Group actively monitors both

damage could arise if the Group regulatory developments in the

fails to comply with legislative UK and US and compliance with existing

or regulatory requirements including, obligations

but not limited to, consumer law,

health and safety, employment law, Clear policies and procedures are

data protection, in place, including, but not limited

anti-bribery and corruption, competition to, anti-bribery and corruption,

law, anti-money laundering and whistleblowing, and data protection

supply chain regulations.

As the Group continues to expand Mandatory induction briefings and

in the US, there is a risk the training for all staff on regulation

business lacks the detailed knowledge and compliance

of US laws and regulations resulting

in a breach, significant fine and Experienced in-house legal team

reputational impact. with external expertise sought

There is a risk that the Group as needed

could fail to adequately look after

the health and wellbeing of its The established culture and values

colleagues and customers, especially foster open, honest communication

considering the challenges faced

by COVID-19, with potential breaches Operational activities have been

of health and safety laws and regulations. amended, and continue to be updated,

to comply with guidance provided

by the Government to prioritise

the safety of colleagues and customers

Regulatory compliance reviews form

part of the rolling internal audit

plan

Economic and political:

The Group's business is geographically Regular monitoring of economic

concentrated in the UK and US. and political events

Any sustained stagnation or deterioration

in the luxury watch or jewellery Focus on customer service to attract

markets or decline in consumer and retain customers

spending in the UK or US could

have a material adverse impact Detailed sales data is analysed

on the Group's business. to anticipate future trends and

demand, taking into consideration

The Group or its suppliers may the current economic environment

not be able to anticipate, identify

and respond to changing consumer Through the expansion into the

preferences in a timely manner, US, the Group is not wholly dependent

and the Group may not manage its on the economic or political environment

inventory in line with customer in one single market

demand.

Ongoing legal, political and economic

uncertainty in the UK, US and international

markets could give rise to significant

currency fluctuations, interest

rate increases, adverse taxation

arrangements or affect current

trading and supply arrangements.

--------------------------------------------

Brand and reputational damage:

The Watches of Switzerland Group's The Group has a clear and open

trading brands and its corporate culture with a focus on trust and

brand are an important asset, and transparency

failure to protect the Group's

reputation and brand could lead Training and monitoring of adherence

to a loss of trust and confidence. by colleagues to Group policies

This could result in a decline and procedures

in the customer base, affect the

ability to recruit and retain the Good customer experience is a key

best people, and damage our reputation priority of the Group

with our suppliers.

The Group undertakes regular customer

engagement to understand and adapt

the product, offer and store environment

The use of bold, impactful, digital-led

marketing, along with an in-depth

knowledge of products, makes the

Group an authority in the markets

it serves

--------------------------------------------

Financial and treasury:

The Group's ability to meet its The Group's debt position, available

financial obligations and to support funding and cash flow projections

the operations and expansion of are regularly monitored

the business is dependent on having

sufficient funding over the short, Current lending facilities are

medium and long term. The Group in place until April 2023 and June

is reliant on the availability 2024. On 18 June 2020, the covenant

of adequate financing from banks requirements on the UK facilities

and capital markets to meet its were amended to reflect a liquidity

liquidity needs. headroom requirement, rather than

financial ratios, for the October

The Group's level of indebtedness 2020 and April 2021 covenant tests

could adversely affect its ability

to react to changes in the business

and may limit the commercial and

financial flexibility to operate

the business.

The Group is exposed to foreign

exchange risk and profits may be

adversely impacted by unforeseen

movements in foreign exchange rates.

Significantly reduced trading over

an extended period, due to the

COVID-19 pandemic, could impact

the business's ability to operate

within committed credit facilities.

This has been considered as part

of the Group's going concern assessment

on page 114

---------------------------------------------- --------------------------------------------

Further information on the financial risks we face and how they

are managed is provided on pages 102 to 113.

Directors' Responsibility Statement

The Directors are responsible for preparing the Annual Report

and Accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial

statements for each financial year that give a true and fair view

of the state of affairs of the Group and the Company as at the end

of the financial year, and of the profit or loss of the Group for

the financial year.

Under that law the Directors have elected to prepare the Group

Financial Statements in accordance with International Financial

Reporting Standards (IFRSs) in conformity with the requirements of

the Companies Act 2006 and have elected to prepare the Company's

financial statements in accordance with United Kingdom Generally

Accepted Accounting Practice, including FRS 102 (The Financial

Reporting Standard applicable in the United Kingdom and the

Republic of Ireland) and the Companies Act 2006. Under the

Financial Conduct Authority's Disclosure Guidance and Transparency

Rules, Group Financial Statements are required to be prepared in

accordance with IFRSs adapted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union.

Under company law, the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and the Company and of

the profit or loss of the Group for that period. In preparing the

Annual Report and Accounts, the Directors are required to:

- Select suitable accounting policies in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors (or

in respect of the parent company Financial Statements, Section 10

of FRS 102) and then apply them consistently;

- Make judgements and accounting estimates that are reasonable

and prudent;

- Present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

- Provide additional disclosures when compliance with the

specific requirements in IFRSs (or in respect of the parent company

financial statements, FRS 102) is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the Group's financial position and financial

performance;

- For the Group Financial Statements, state whether

International Financial Reporting Standards in conformity with the

requirements of the Companies Act 2006 and IFRSs adapted pursuant

to Regulation (EC) No 1606/2002 as it applies in the European Union

have been followed, subject to any material departures disclosed

and explained in the Financial Statements;

- For the Parent Company Financial Statements, state whether

applicable UK accounting standards, FRS 102, have been followed,

subject to any material departures disclosed and explained in the

Parent Company financial statements;

- Prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's and the

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Company and the Group and enable

them to ensure that the financial statements comply with the

Companies Act 2006 and, as regards the Group Financial Statements,

Article 4 of the IAS Regulation. They are also responsible for

safeguarding the assets of the Company and the Group and hence for

taking reasonable steps for the prevention and detection of fraud

and other irregularities. Under applicable law and regulations, the

Directors are also responsible for preparing a Strategic report,

Directors' report, Directors' Remuneration report and Corporate

Governance statement that comply with that law and those

regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website.

Each of the Directors, whose names and functions are listed on

pages 128 to 129 confirms that, to the best of their knowledge:

- that the Group Financial Statements, which have been prepared

in accordance with International Financial Reporting Standards in

conformity with the requirements of the Companies Act 2006 and

IFRSs adopted pursuant to Regulation (EC) 1606/2002 as it applies

in the European Union, give a true and fair view of the assets,

liabilities, financial position and profit of the Group;

- that the Annual Report and Accounts 2021, including the

Strategic Report, includes a fair review of the development and

performance of the business and the position of the Company and

undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face; and

- that they consider the Annual Report and Accounts 2021, taken

as a whole, is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Company's

position, performance, business model and strategy

The Directors of Watches of Switzerland Group PLC are listed in

the Group's Annual Report and Accounts 2021 and on the Group's

website: thewosgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSSMFLEEFSEEA

(END) Dow Jones Newswires

August 02, 2021 10:31 ET (14:31 GMT)

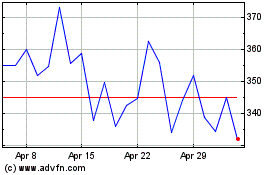

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Apr 2023 to Apr 2024