TIDMWOSG

RNS Number : 7204R

Watches of Switzerland Group PLC

09 November 2021

Watches of Switzerland Group PLC

Q2 FY22 Trading

for the 13 weeks (Q2 FY22) and 26 weeks (H1 FY22) to 31 October

2021

Better than anticipated first half performance leads to upgrade

in full year outlook

US expansion strategy advanced with acquisitions of five stores

agreed

Watches of Switzerland Group PLC ("the Group") today provides

the following update relating to the 13 and 26 weeks ending 31

October 2021.

Strong performance achieved in H1 FY22, driven by broad-based

and margin-enhancing growth in the UK and the US against both last

year and two years ago

-- Group revenue GBP586.2 million (H1 FY21: GBP414.3 million)

+44.6% vs H1 FY21 and +40.8% vs H1 FY20 (both in constant

currency)

o Continued strong demand environment for luxury watches and

jewellery, with growth in the period led by a significant increase

in volumes of non-supply constrained brands

o Group ecommerce sales +28.7% on last year, despite stores

having been fully opened in H1 FY22

-- Robust UK performance continues to be generated by a thriving

domestic clientele, with revenue GBP418.6 million +42.3% vs H1

FY21

o Revenue +31.8% vs H1 FY20 when 33.6% of Group sales were

generated by tourists and airports vs negligible tourist and much

reduced airport business in H1 FY22

-- Strong momentum in the US with revenue GBP167.6 million,

+50.2% vs H1 FY21 and +66.7% vs H1 FY20 (both in constant

currency)

-- Net cash [1] of GBP30.0 million as at 31 October 2021 (net

debt as at 25 October 2020: GBP(22.7) million)

-- Following a strong sales performance with a margin-accretive

product mix and further operating leverage, H1 FY22 Adjusted EBITDA

[2] is expected to be GBP81.0 million to GBP83.0 million (H1 FY21:

GBP52.2 million)

-- As a result of first half performance and acquisition

agreements, guidance for the full year has been raised

US expansion strategy further advanced with agreements to

purchase five stores in four new states [3]

-- Combined annual revenue of approximately $100.0 million;

future profitability expected to be in line with the Group's US

average

-- Stores located in Plano (Dallas), Texas; Vail and Aspen,

Colorado; Greenwich, Connecticut; and Minneapolis, Minnesota

-- These acquisitions will bring the US store network to 22

multi-brand and 14 mono-brand boutiques to reach a total

representation of 36 stores in 12 states

Good trading performance in Q2 FY22 against a strong prior year

comparable and achieved whilst rebuilding stock on Rolex

-- Group revenue GBP288.7 million (Q2 FY21: GBP262.7 million),

+11.8% in constant currency, +9.9% in reported terms vs Q2 FY21 and

+36.2% in constant currency vs Q2 FY20

-- Following a period of destocking during Q1 FY22, the Group

actively re-built store stock for Rolex in the US and the UK to

reach an appropriate level of brand representation

-- UK revenue of GBP196.9 million, +6.0% vs Q2 FY21 and +21.1%

vs Q2 FY20, driven by other luxury watches and jewellery

-- Strong momentum continues in the US, with revenue of GBP91.8

million, +25.9% vs Q2 FY21 and +79.6% vs Q2 FY20 (both in constant

currency)

-- Continued investment in the Group's store estates in the US and the UK:

o Opening of enhanced Rolex dedicated space within Mayors

Aventura, Phase I of the store's refurbishment plan

o Introduction of first Goldsmiths Luxury concept in two stores

(Canterbury and Reading)

o Refurbishment of a further five stores in the UK

o Opening of three mono-brand boutiques in Plymouth

Outlook

-- The Group has continued to generate strong growth and make

further progress on its strategic objectives during the year, with

investments yielding positive results and newly announced

acquisitions contributing towards Long Range Plan goals

-- As a result, the Group today upgrades its guidance for the full year

-- Our guidance reflects visibility of supply of key brands. The

Group does not expect the return of tourism and airport business to

pre-pandemic levels during the year

-- The Group's guidance for FY22 on a 52-week, pre-IFRS 16 basis, is as follows:

o Revenue: GBP1.15 billion to GBP1.20 billion (previous guidance

GBP1.05 billion to GBP1.10 billion)

o EBITDA and Adjusted EBITDA margin %: +1.0% to +1.5% vs last

year (previous guidance flat to +0.5% vs last year)

o Depreciation, amortisation, impairment and profit/loss on

disposal of fixed assets: GBP30.0 million to GBP32.0 million (no

change vs previous guidance)

o Total finance costs: GBP4.0 million to GBP4.5 million (no

change vs previous guidance)

o Underlying tax rate: 21.0% to 22.5% (no change vs previous

guidance)

o Capex: GBP45.0 million to GBP50.0 million (previously GBP40.0

million to GBP45.0 million)

o Net debt: GBP10.0 million to GBP20.0 million (previously

GBP20.0 million to GBP30.0 million)

o Average USD/GBP full year rate of $1.40 (no change vs previous

guidance)

-- H1 FY22 Results will be published on 9 December 2021

Brian Duffy, Chief Executive Officer, said:

"We are very pleased with our first half performance. Over the

last two years, we have demonstrated the versatility of our

multi-channel model with a more than doubling of sales to domestic

clients and within this half year, a significant change in brand

mix.

"We have enjoyed re-connecting with customers in our stores

whilst further elevating the experience by retaining several

initiatives and enhancements introduced during the COVID-19

pandemic. We have further expanded the Luxury Watch and Jewellery

Virtual boutique in the UK, continued to grow the "By Personal

Appointment" business which now accounts for approximately 40.0% of

UK sales and continued to enhance CRM, clienteling and digital

marketing initiatives. Our teams have been fantastic in embracing

all modes of customer engagement, driving growth across all

channels throughout this period.

"We continue to build on a growing foundation in the US, further

strengthening our position through the agreement to purchase five

stores in four new states.

"The strength of our performance, both in our well-established

UK business and in our growing US business, coupled with our

confidence in the luxury watch and jewellery categories has led us

to upgrade our guidance for the full year. We are well stocked for

the holiday period and look forward to providing an exceptional

shopping experience for our customers. I would also like to take

this opportunity to thank my colleagues for their dedication and

enthusiasm and to welcome our new colleagues to the business."

H1 FY22 Revenue Performance by Geography

H1 FY22 H1 FY21 H1 FY22 vs H1 H1 FY22 vs H1

FY21 FY20

---------------

26 weeks 26 weeks Constant 2-year

(GBPm) to to currency 2-year constant

31 Oct 25 Oct Reported YoY % Reported currency

2021 2020 YoY % YoY % YoY %

--------- --------- --------- ------------- ---------- -------------

UK 418.6 294.2 42.3% 42.3% 31.8% 31.8%

--------- --------- --------- ------------- ---------- -------------

US 167.6 120.1 39.5% 50.2% 50.9% 66.7%

--------- --------- --------- ------------- ---------- -------------

Group Revenue 586.2 414.3 41.5% 44.6% 36.7% 40.8%

--------- --------- --------- ------------- ---------- -------------

Q2 FY22 Revenue Performance by Geography

Q2 FY22 Q2 FY21 Q2 FY22 vs Q2 Q2 FY22 vs Q2

FY21 FY20

---------------

13 weeks 13 weeks 2-year

to to Constant 2-year constant

(GBPm) 31 Oct 25 Oct Reported currency Reported currency

2021 2020 YoY % YoY % YoY % YoY %

--------- --------- --------- ------------- ---------- ----------

UK 196.9 185.9 6.0% 6.0% 21.1% 21.1%

--------- --------- --------- ------------- ---------- ----------

US 91.8 76.8 19.5% 25.9% 62.0% 79.6%

--------- --------- --------- ------------- ---------- ----------

Group Revenue 288.7 262.7 9.9% 11.8% 31.6% 36.2%

--------- --------- --------- ------------- ---------- ----------

Q2 and H1 FY22 Revenue Performance by Category

Q2 H1

------------------

13 weeks 13 weeks 26 weeks 26 weeks

to to to to

(GBPm) 31 Oct 25 Oct Reported 31 Oct 25 Oct Reported

2021 2020 YoY % 2021 2020 YoY %

--------- --------- --------- --------- --------- ---------

Luxury watches 249.6 230.5 8.2% 508.8 362.1 40.5%

--------- --------- --------- --------- --------- ---------

Luxury jewellery 20.7 16.4 25.4% 40.8 26.3 53.3%

--------- --------- --------- --------- --------- ---------

Other 18.4 15.8 18.3% 36.6 25.9 43.2%

--------- --------- --------- --------- --------- ---------

Group Revenue 288.7 262.7 9.9% 586.2 414.3 41.5%

--------- --------- --------- --------- --------- ---------

Conference call

A webcast conference call for analysts and investors will be

held at 9.00am (UK time) today. To join the call, please use the

following details:

Dial-in (UK): 0800 279 7209

Dial-in (all other locations): +44 (0)330 336 9411

Conference access code: 3277581

Contacts

The Watches of Switzerland Group

Anders Romberg, CFO +44 (0) 116 2817 401

Allegra Perry, Investor Relations

+44 (0) 20 7317 4600

Caroline Browne, Group Finance Director +44 (0) 116 2817 420

investor.relations@thewosgroup.com

Headland

Lucy Legh / Rob Walker +44 (0) 20 3805 4822

wos@headlandconsultancy.com

About the Watches of Switzerland Group

The Watches of Switzerland Group is the UK's largest luxury

watch retailer, operating in both the UK and US, comprising four

prestigious brands; Watches of Switzerland (UK and US), Mappin

& Webb (UK), Goldsmiths (UK) and Mayors (US), with

complementary jewellery offering.

As at 31 October 2021, the Watches of Switzerland Group has 158

stores across the UK and US including 46 dedicated mono-brand

stores in these two markets in partnership with Rolex, TAG Heuer,

OMEGA, Breitling, Audemars Piguet, Tudor and FOPE) and has a

leading presence in Heathrow Airport with representation in

Terminals 2, 3, 4 and 5 as well as six transactional websites.

The Watches of Switzerland Group is proud to be the UK's largest

retailer for Rolex, Cartier, OMEGA, TAG Heuer and Breitling

watches.

Mappin & Webb holds Royal warrants as goldsmiths,

silversmiths and jeweller to Her Majesty The Queen and silversmiths

to His Royal Highness The Prince of Wales. The Mappin & Webb

master jeweller has been Crown Jeweller, custodian of the Crown

Jewels of Her Majesty The Queen since 2012.

https://www.thewosgroupplc.com

Disclaimer

This trading statement does not constitute an invitation to

underwrite, subscribe for, or otherwise acquire or dispose of any

Watches of Switzerland Group PLC shares or other securities nor

should it form the basis of or be relied on in connection with any

contract or commitment whatsoever. It does not constitute a

recommendation regarding any securities. Past performance,

including the price at which the Company's securities have been

bought or sold in the past, is no guide to future performance and

persons needing advice should consult an independent financial

adviser.

Certain statements in this trading statement constitute

forward-looking statements. Any statement in this document that is

not a statement of historical fact including, without limitation,

those regarding the Company's future plans and expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, among

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this statement. As a result you are cautioned not to place

reliance on such forward-looking statements. Nothing in this

statement should be construed as a profit forecast.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain. The person responsible for making this

announcement is Anders Romberg, Chief Financial Officer.

[1] Net cash/(net debt) is total borrowings (excluding

capitalised transaction costs) less cash and cash equivalents.

Excludes lease liabilities under IFRS 16.

[2] Unaudited adjusted EBITDA is EBITDA before exceptional items shown on a pre-IFRS 16 basis.

[3] Two stores completed at the end of Q2 FY22 with minimal

impact to the Group's H1 FY22 performance; the remaining three

stores are expected to complete before the end of Q3 FY22.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFSIFAAEFSELF

(END) Dow Jones Newswires

November 09, 2021 02:00 ET (07:00 GMT)

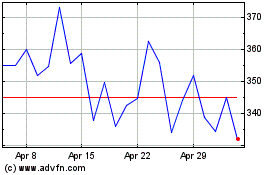

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Apr 2023 to Apr 2024