TIDMWOSG

RNS Number : 2224B

Watches of Switzerland Group PLC

10 February 2022

Watches of Switzerland Group PLC

Q3 FY22 Trading

for the 13 weeks (Q3 FY22) and 39 weeks (9M FY22) to 30 January

2022

Strong Q3 FY22 trading, outlook now expected to be towards the

top end of guidance

Entrance into the European market securing six mono-brand

boutiques

Watches of Switzerland Group PLC ('the Group') today provides

the following trading update for the 13 and 39 weeks ending 30

January 2022.

-- Q3 FY22 Group revenue GBP348.1 million (Q3 FY21: GBP272.6

million), +27.9% vs Q3 FY21 and +36.5% vs Q3 FY20 (both in constant

currency). YTD Group revenue GBP934.3 million +38.0% vs FY21 and

+39.2% vs FY20 (both in constant currency)

o Q3 FY22 luxury watches +21.0% on last year. Demand for luxury

watches continues to be very strong in both the UK and the US

consistently exceeding supply

o Sales of "Super High Demand" (Rolex, Patek Philippe and

Audemars Piguet) watches reflected the timing of intake in the

quarter. Full year intake continues to be in line with our

expectations

o Growth in other luxury watches (i.e. excluding Rolex, Patek

Philippe and Audemars Piguet) was +111.9% on last year

o Q3 FY22 luxury jewellery +88.4% on last year reflecting a

strong market, continued improvement in ranging and the incremental

growth from the Betteridge acquisition and the opening of our first

Bvlgari boutique

o Q3 FY22 Group ecommerce sales -1.1% on last year when UK

stores were open for four weeks out of thirteen due to COVID-19

lockdowns (+123.1% vs Q3 FY20)

o Group's strategy to expand in Europe progressed, securing six

mono-brand boutiques in Sweden, Denmark and Republic of Ireland.

These boutiques will open in H1 FY23

o Previously committed donation of GBP3.0 million paid to The

Watches of Switzerland Foundation of which GBP1.5 million was

accrued in FY21 and GBP1.5 million in H1 FY22

o The Group granted a free gift of 50 shares to all colleagues

and launched employee share save schemes in the UK and the US to

further incentivise colleagues

-- Q3 FY22 US revenue GBP124.6 million (Q3 FY21: GBP86.5

million), +44.6% vs Q3 FY21 and +72.3% vs Q3 FY20 (both in constant

currency)

o Luxury watch growth of +32.4% on last year, with 214.3% growth

in other luxury watch brands (i.e. excluding Rolex, Patek Philippe

and Audemars Piguet)

o Exceptional luxury jewellery growth of +172.6% on last year,

benefiting from the Betteridge acquisition on 1 December 2021 and

the opening of our first Bvlgari boutique, adjacent to the

refurbished Mayors Aventura, Florida

o Store network further enhanced with:

-- Refurbished Rolex boutique in Wynn Resort, Las Vegas

-- Further progress on our Mayors refurbishment programme with

the reopening of Mayors Millenia, Florida

-- Expansion of the mono-brand boutique channel with the opening

of Breitling Short Hills, New Jersey and Tudor Millenia,

Florida

-- Q3 FY22 UK revenue GBP223.5 million (Q3 FY21: GBP186.1

million), +20.1% vs Q3 FY21 and +22.0% vs Q3 FY20

o UK performance continues to be driven by a thriving domestic

clientele

o Sales driven through our omni-channel approach supported by

increased digital marketing

o Luxury watches +15.2% on last year, with +77.9% growth in

other luxury watch brands (i.e. excluding Rolex, Patek Philippe and

Audemars Piguet)

o Luxury jewellery +55.7% on last year reflecting continued

market demand and continued improvement in ranging

o Continued investment in store network:

-- Roll out of the Goldsmiths Luxury concept to a further five

stores

-- Mono-brand boutique network enhanced with three further TAG

Heuer boutiques (Guildford, Brighton and Southampton) and

refurbishment of Breitling Trafford

-- Refurbishment of Mappin & Webb Regent Street

Outlook

-- Reflecting strong trading in Q3 FY22, margin accretive sales

growth of other luxury watch brands and price increases implemented

by certain brands, the Group now expects full year revenue and

profit to be towards the top end of the upgraded guidance announced

at 9 November 2021. Other guidance remains unchanged

-- Our guidance reflects that we do not expect any significant

change in market conditions in the balance of the fiscal year

-- The Group has an exciting pipeline of confirmed store

projects for the remainder of the fiscal year:

o Mayors Boca Raton, Florida refurbishment

o Opening of new flagship store in Kenwood Towne Center,

Cincinnati, Ohio

o Three new mono-brand boutiques in the UK

-- Furthermore, the Group has committed to the following projects in FY23:

o New flagship store in American Dream, New Jersey

o Watches of Switzerland store in Battersea, London

o Continued roll out of UK Goldsmiths Luxury elevated store

formats

o Further elevation of the Mayors network in Florida

o Expansion of the mono-brand footprint in the UK and US

o Entry into the European market through the opening of six

mono-brand stores in Sweden, Denmark and Republic of Ireland

Brian Duffy, Chief Executive Officer, said:

"I am pleased to report continued strong momentum for our Group

following a successful Christmas trading period. We have delivered

impressive growth in both luxury watches and luxury jewellery in

both the UK and US markets demonstrating the value of our portfolio

of world leading partner brands.

"I am also pleased to report a strong sales performance of the

five stores acquired in the year and a great contribution from our

new colleagues.

"We have announced today our entry into the European market with

mono-brand boutiques agreed in Sweden, Denmark and Republic of

Ireland providing our Group with further geographic diversification

in line with our Long Range Plan.

"Having received its GBP3.0 million donation in the period, The

Watches of Switzerland Foundation has now begun putting the

proceeds towards providing essential support in the communities

where we live and work in the UK and in the US.

"Furthermore, in recognition of our colleagues' hard work and to

ensure they have the opportunity to share in the success we deliver

as a business, we are pleased to have provided all our colleagues

with a gift of 50 free shares and access to employee share save

schemes in the UK and US.

"Strong trading to date, revised pricing by certain brands and

visibility of supply for calendar 2022 all support our expectation

to perform towards the top end of our full year guidance. Demand in

our category continues to outstrip supply and we remain confident

in the future of our business and achieving the goals laid out in

our Long Range Plan."

Q3 FY22 Revenue performance by geography

Q3 FY22 Q3 FY21 Q3 FY22 vs Q3 Q3 FY22 vs Q3

FY21 FY20

----------------

13 weeks 13 weeks 2-year

to to Constant 2-year constant

30 Jan 24 Jan Reported currency reported currency

(GBPmillion) 2022 2021 YoY % YoY % YoY % YoY %

--------- --------- --------- ------------- ---------- ----------

UK 223.5 186.1 +20.1% +20.1% +22.0% +22.0%

--------- --------- --------- ------------- ---------- ----------

US 124.6 86.5 +44.0% +44.6% +67.0% +72.3%

--------- --------- --------- ------------- ---------- ----------

Group Revenue 348.1 272.6 +27.7% +27.9% +35.0% +36.5%

--------- --------- --------- ------------- ---------- ----------

Q3 FY22 and 9M FY22 Revenue performance by category

(reported)

Q3 9M

------------------

13 weeks 13 weeks 39 weeks 39 weeks

to to to to

(GBPmillion) 30 Jan 24 Jan 30 Jan 24 Jan

2022 2021 YoY % 2022 2021 YoY %

--------- --------- ------- --------- --------- -------

Luxury watches 279.8 231.3 +21.0% 788.7 593.4 +32.9%

--------- --------- ------- --------- --------- -------

Luxury jewellery 41.8 22.2 +88.4% 82.5 48.5 +70.2%

--------- --------- ------- --------- --------- -------

Other 26.5 19.1 +38.6% 63.1 44.9 +40.4%

--------- --------- ------- --------- --------- -------

Group Revenue 348.1 272.6 +27.7% 934.3 686.8 +36.0%

--------- --------- ------- --------- --------- -------

YTD FY22 Revenue performance by geography

9M FY22 9M FY21 9M FY22 vs 9M 9M FY22 vs 9M

FY21 FY20

----------------

39 weeks 39 weeks 2-year

to to Constant 2-year constant

30 Jan 24 Jan Reported currency reported currency

(GBPmillion) 2022 2021 YoY % YoY % YoY % YoY %

--------- --------- --------- ----------- ---------- -----------

UK 642.2 480.2 +33.7% +33.7% +28.2% +28.2%

--------- --------- --------- ----------- ---------- -----------

US 292.1 206.6 +41.4% +47.8% +57.4% +69.0%

--------- --------- --------- ----------- ---------- -----------

Group Revenue 934.3 686.8 +36.0% +38.0% +36.1% +39.2%

--------- --------- --------- ----------- ---------- -----------

Q3 FY22 Results Conference call

A conference call for analysts and investors will be held at

9.00am (UK time) today. To access the webcast, please use the

following details:

Conference call: United Kingdom (Local): 020 3936 2999

All other locations: +44 20 3936 2999

Participant access code: 866937

Contacts

The Watches of Switzerland Group

Bill Floydd, Chief Financial Officer +44 (0) 207 317 4600

Caroline Browne, Group Finance Director +44 (0) 116 2817 420

investor.relations@thewosgroup.com

Headland

Lucy Legh / Rob Walker / Joanna Clark

+44 (0) 20 3805 4822

wos@headlandconsultancy.com

About the Watches of Switzerland Group

The Watches of Switzerland Group is the UK's largest luxury

watch retailer, operating in both the UK and US, comprising five

prestigious brands; Watches of Switzerland (UK and US), Mappin

& Webb (UK), Goldsmiths (UK), Mayors (US) and Betteridge (US),

with a complementary jewellery offering.

As at 30 January 2022, the Watches of Switzerland Group has 171

stores across the UK and US including 51 dedicated mono-brand

boutiques in partnership with Rolex, TAG Heuer, Breitling, OMEGA,

Tudor, Audemars Piguet, Grand Seiko, Bvlgari and FOPE and has a

leading presence in Heathrow Airport with representation in

Terminals 2, 3, 4 and 5 as well as seven retail websites.

The Watches of Switzerland Group is proud to be the UK's largest

retailer for Rolex, Cartier, OMEGA, TAG Heuer and Breitling

watches.

Mappin & Webb holds Royal warrants as goldsmiths,

silversmiths and jeweller to Her Majesty The Queen and silversmiths

to His Royal Highness The Prince of Wales. The Mappin & Webb

master jeweller has been Crown Jeweller, custodian of the Crown

Jewels of Her Majesty The Queen since 2012.

https://www.thewosgroupplc.com

Cautionary note regarding forward-looking statements

This announcement has been prepared by Watches of Switzerland

Group PLC (the 'Company'). It includes statements that are, or may

be deemed to be, "forward-looking statements". These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "believes",

"estimates", "anticipates", "expects", "intends", "plans", "goal",

"target", "aim", "may", "will", "would", "could" or "should" or, in

each case, their negative or other variations or comparable

terminology. They appear in a number of places throughout this

announcement and the information incorporated by reference into

this announcement and may include statements regarding the

intentions, beliefs or current expectations of the Company

Directors or the Group concerning, amongst other things: (i) future

capital expenditures, expenses, revenues, earnings, synergies,

economic performance, indebtedness, financial condition, dividend

policy and future prospects; (ii) business and management

strategies, the expansion and growth of the Group's business

operations; and (iii) the effects of government regulation and

industry changes on the business of the Company or the Group.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future and may be

beyond the Company's ability to control or predict. Forward-looking

statements are not guarantees of future performance. The Group's

actual results of operations, financial condition, liquidity, and

the development of the industry in which it operates may differ

materially from the impression created by the forward-looking

statements contained in this announcement and/or the information

incorporated by reference into this presentation.

Any forward-looking statements made by or on behalf of the

Company or the Group speak only as of the date they are made and

are based upon the knowledge and information available to the

Directors on the date of this announcement, and are subject to

risks relating to future events, other risks, uncertainties and

assumptions relating to the Company's operations and growth

strategy, and a number of factors that could cause actual results

and developments to differ materially from those expressed or

implied by the forward-looking statements. Undue reliance should

not be placed on any forward-looking statements.

Before making any investment decision in relation to the Company

you should specifically consider the factors identified in this

document, in addition to the risk factors that may affect the

Company or the Group's operations which are described in the Annual

Report and Accounts 2021 in Risk Management and Principal Risks and

Uncertainties.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKKLFBLLLXBBE

(END) Dow Jones Newswires

February 10, 2022 01:59 ET (06:59 GMT)

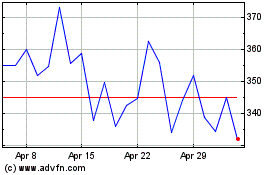

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Watches Of Switzerland (LSE:WOSG)

Historical Stock Chart

From Apr 2023 to Apr 2024