TIDMWSG

RNS Number : 5123I

Westminster Group PLC

13 August 2021

Westminster Group Plc

('Westminster', the 'Group' or the 'Company')

Interim Results for the six months to 30 June 2021

& Investor Presentation

Westminster Group Plc (AIM: WSG), a leading supplier of managed

services and technology-based security solutions, announces its

unaudited interim results for the six months ended 30 June

2021.

Operational Highlights:

-- Secured 20-year managed services contract - 5 airports in the DRC.

-- Secured 10-year managed services contract - port in West Africa.

-- Post-period, secured high profile contract to provide

security services to the Tower of London.

-- 5-year security contract for the Palace of Westminster (UK Parliament) underway.

-- Ghana port operations continue to perform well.

-- West African Airport operations recovering ahead of expectations.

-- Developed new Covid-19 testing programme initiative in partnership with Certific.

-- Aviation training business graded as 'Outstanding in all

Areas' by UK Civil Aviation Authority.

-- Awarded Queen's Award for Enterprise in recognition of

outstanding contribution to International Trade.

Financial Highlights:

-- Group revenues up 16% from H2 2020 to GBP3.5 million (H1

2020: GBP7.0 million, H2 2020: GBP3.0 million).

-- Gross margin increased to 45% (H1 & H2 2020: 40%).

-- Operating Loss of GBP0.93 million (H1 2020: Profit GBP0.48

million, H2 2020 Loss GBP1.22 million).

-- Loss per share of 0.32p (H1 2020: Profit of 0.16p, H2 2020: Loss 0.59p).

-- Administration expenses slightly up at GBP2.5 million (H1

2020: GBP2.3 million, H2 2020: GBP2.4 million) as we increase

selling capacity.

-- GBP2.5m equity raise completed in June 2021 for recently won and future projects.

-- Group debt free, excluding GBP0.05 million of imputed lease

debt (30 June 2020: GBP3.37 million debt, 31 December 2020: GBP0.07

million lease debt).

-- Cash balance as at 30 June 2021: GBP3.1 million (30 June

2020: GBP1.6 million, 31 December 2020: GBP2.1 million).

Commenting on the results and current trading, Peter Fowler,

Chief Executive of Westminster Group, said:

"In our 2020 Annual Report we stated the outlook for 2021 was

looking positive and this remains the case.

"Not only are we seeing recovery and growth in our existing

operations, but we are developing new initiatives and revenue

streams, such as the Covid-19 testing programme, and in recent

weeks and months we have announced several significant new

large-scale, long-term contract wins that will produce a several

million-pound step change in our annual revenues, together all

underpinning confidence in our business model and growth

trajectory.

"Covid-19 has, of course, continued to create challenges during

the first half of 2021 with the global uncertainty causing many

businesses and organisations to be cautious on their spending plans

and with travel restrictions still in place in many parts of the

world, resulting, as previously announced, in further

'right-shifting' of certain expected contracts and revenues.

Because of this our first half year revenues are therefore down on

H1 2020, which had record revenues for the first three months

before the Covid-19 pandemic had any real impact. However, at

GBP3.5m, H1 revenues are 16% ahead of the second half of 2020

(GBP3.0m) demonstrating recovery is underway and we believe that,

providing the expected easing of restrictions and the resultant

recovery continues, together with the recently secured contracts

and our strong pipeline we are on track to deliver a strong

performance for 2021 and we are confident in our future

forecasts.

"In the last few years, we have achieved a lot, despite the

challenges, and it is rewarding to see the quality of our services

and our many achievements being widely recognised. I am extremely

proud therefore, that in April 2021, Westminster was granted the

Queen's Award for Enterprise in recognition of outstanding

achievement in international trade. The award ceremony and

Westminster's open day will now take place at Westminster House on

3 September 2021. Shareholders who would like to attend may

register their interest here www.wg-plc.com/queens-award-2021

."

Investor Presentation

Westminster Group Plc is pleased to announce that Peter Fowler

(CEO) and Mark Hughes (CFO) will provide a live presentation

relating to Westminster Group PLC 2021 Half Year Results via the

Investor Meet Company platform on 17th Aug 2021 at 11:00am BST.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Westminster Group Plc via:

https://www.investormeetcompany.com/westminster-group-plc/register-investor

Westminster Group Plc Media enquiries via Walbrook

PR

Rt. Hon. Sir Tony Baldry - Chairman

Peter Fowler - Chief Executive Officer

Mark Hughes - Chief Financial Officer

Strand Hanson Limited (Financial & Nominated

Adviser)

James Harris 020 7409 3494

Ritchie Balmer

Arden Partners plc (Broker)

Richard Johnson (Corporate)

Tim Dainton/Simon Johnson (Broking) 020 7614 5900

Walbrook (Investor Relations)

Tom Cooper 020 7933 8780

Paul Vann

Nick Rome Westminster@walbrookpr.com

Notes:

Westminster Group plc is a specialist security and services

group operating worldwide via an extensive international network of

agents and offices in over 50 countries.

Westminster's principal activity is the design, supply and

ongoing support of advanced technology security solutions,

encompassing a wide range of surveillance, detection (including

Fever Detection), tracking and interception technologies and the

provision of long-term managed services contracts such as the

management and running of complete security services and solutions

in airports, ports and other such facilities together with the

provision of manpower, consultancy and training services. The

majority of its customer base, by value, comprises governments and

government agencies, non-governmental organisations (NGOs) and

blue-chip commercial organisations.

The Westminster Group Foundation is part of the Group's

Corporate Social Responsibility activities.

www.wg-foundation.org

The Foundation's goal is to support the communities in which the

Group operates by working with local partners and other established

charities to provide goods or services for the relief of poverty

and the advancement of education and healthcare particularly in the

developing world.

The Westminster Group Foundation is a Charitable Incorporated

Organisation, CIO, registered with the Charities Commission number

1158653.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR") WHICH

IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

Chief Executive O cer's Review

Overview

In our 2020 Annual Report we stated the outlook for 2021 was

looking positive and this remains the case.

A key strength of our business is the multiple revenue stream

business model we have developed which provides a degree of

resilience to world events beyond our control and which has proved

invaluable during the Covid-19 crisis.

In this respect, not only are we seeing recovery and growth in

our existing operations, but we are developing new initiatives and

revenue streams, such as the Covid-19 testing programme.

Additionally, in recent weeks and months we have announced several

significant new large-scale, long-term contract wins that will

produce a several million-pound step change in our annual revenues,

thereby underpinning confidence in our business model and growth

trajectory.

Covid-19 has, of course, continued to create challenges during

the first half of 2021 with the global uncertainty causing many

businesses and organisations to be cautious on their spending plans

and with travel restrictions still in place in many parts of the

world, resulting, as previously announced, in further

'right-shifting' of certain expected contracts and revenues.

Because of this our first half year revenues are therefore down on

H1 2020, which had record revenues for the first three months

before the Covid-19 pandemic had any real impact. However, at

GBP3.5m H1 revenues are 16% ahead of the second half 2020 (GBP3.0m)

demonstrating recovery is underway and we believe that, with the

ongoing recovery in our existing business together with the

recently secured contracts, anticipated new contracts and our

strong pipeline and providing the expected easing of restrictions

and delays and the resultant recovery continues, are on track to

meet full year expectations and we are confident in our 2022 and

future forecasts.

In the last few years, we have achieved a lot and it is

rewarding to see the quality of our services and our many

achievements being widely recognised. I am extremely proud that in

April 2021, Westminster was granted the Queen's Award for

Enterprise in recognition of outstanding achievement in

international trade. The award ceremony and Westminster's open day

will now take place at Westminster House on 3 September 2021. In

November 2020 the London Stock Exchange selected Westminster as one

of a 1,000 companies to inspire Britain and in May 2020, and again

in April 2021, the UK Civil Aviation Authority (CAA) graded our

aviation training business as 'Outstanding in all Areas'. These are

all important accolades for our business and a testament to the

skill and hard work of all our people.

Divisional Review

Services Division

Our Services Division has performed well and delivered some

notable achievements in the period.

In our 2020 Annual Report we stated one of our key goals for

2021 was to secure at least one more long-term managed services

contract and in that respect, I am delighted that, with an easing

of restrictions, we have not only been able to secure one, but two,

significant new long-term contract wins.

In December 2020 we announced we were in the advanced stages of

securing a long-term contract for 5 airports in an African country.

We had been pursuing this opportunity since our acquisition of our

French business Euro Ops in 2019 and we expected to secure this

contract in 2020 but due to the various lockdowns and travel

restrictions in place progress was delayed. I was delighted

therefore to be able to announce on 15 June 2021 that we had

secured and signed a 20-year manged services contract to provide

security services to 5 airports in the Democratic Republic of the

Congo ('DRC'), Central Africa. This was a very significant

achievement and not only means we will now have an established

presence in a new region of Africa but also the project offers

substantial growth opportunities. We are excited about this new

contract and looking forward to commencing operations once

formalities are finalised. I am pleased to report we have already

commenced deployment of key personnel for the project, our 100%

subsidiary, Westminster Aviation Security Services RDC, which will

be employing the local personnel and other logistics, has now been

formed, local professional advisors engaged and we are currently

preparing the operational logistics ready for commencement.

In addition, on 16 June 2021, we further announced that we had

signed another long-term managed service contract to provide port

screening services in West Africa for the next 10+ years. We had

been pursuing and developing this opportunity for several years and

it is another important win for the Company that further extends

our global footprint and profile in the port screening sector.

Likewise, personnel deployment and company formation processes are

underway. Our project team is working with the client to prepare

the land for the port screening and inspection areas.

Furthermore, in early July, we announced we had been awarded yet

another high-profile contract to supply security services to help

protect the historic Royal Palace and Fortress of the Tower of

London. Security of such a landmark building, which is open to the

public, is paramount and Westminster has been contracted to provide

inter alia, professional security services to the pedestrian and

vehicular entrances.

These important new contract wins not only demonstrate our

global reach but, as we have stated on a number of occasions, that

large-scale projects such as these do take time to develop and

negotiate and equally demonstrate that we have the skills and

resources required to successfully deliver on such opportunities.

Together these new contracts alone will add, once fully

operational, several million pounds to our annual revenues and

together with our other managed services and recurring revenue

contracts, underpin confidence in our future forecasts and

growth.

In addition to these important new contracts, we are encouraged

in the recovery and growth of our existing operations.

Our West African Airport managed services operation continues to

be ahead of our expectations (currently, in June 2021, it was 70%

of pre-Covid-19 levels) although we do not expect to see a full

recovery to pre-Covid-19 levels until late 2022 although it is

encouraging that this operation is recovering faster than the

average African and European airport traffic and we may see full

recovery earlier than forecast.

Our port managed services operations in Ghana have not been

materially affected by Covid-19 and continue to perform well. With

a 4th berth due to become operational later in 2021, we expect to

see further growth with this important project.

Both our guarding and training businesses were heavily impacted

by Covid-19 lockdowns and travel restrictions, but we are

encouraged by the recovery we are beginning to see in both

businesses, and we expect this to continue as hopefully travel

restrictions ease.

Our guarding business has already secured important new business

and we are pursuing a number of interesting new opportunities which

could see revenues from this business increase dramatically.

We are also pleased to see our training business securing new

contracts from governments and organisations and is now operating

ahead of budget. The global pandemic has demonstrated the

importance of distance and online training and the strategic

decision we took some time ago to invest in building an online

training capability, both in house and through strategic

partnerships, will prove to be very beneficial and we expect this

part of our business to continue to grow.

We continue to develop new opportunities and initiatives such as

our partnership with Certific in their new Covid-19 testing

programme for which Westminster is providing verification services.

This new initiative has delivered six figure revenues in H1 as the

programme began its roll out and, whilst it is uncertain how long

Covid-19 testing will remain a requirement, our expectation is this

will be some time yet. Indeed, there is a likelihood this could be

a requirement for international travel for the foreseeable future

and we therefore are looking at additional opportunities in this

sector and expect revenues from such to continue to grow into 2022

and possibly beyond.

Technology Division

We continue to experience healthy enquiry levels and during H1

2021 have secured orders for our products and services from over 40

countries around the world, although Covid-19 and travel

restrictions have caused some delays in delivery.

The caution on spending by many companies during H2 2020,

continued into H1 2021 and this has meant that purchasing decisions

regarding some of our larger technology project opportunities have

been deferred. We are encouraged however that discussions have now

re-commenced on several of these opportunities and one or more of

these could land at any time.

In this respect, and given budget constraints for many companies

resulting from the global pandemic, we are exploring with debt

funding providers means of moving large scale projects from a

'capital' purchase to a longer term, 5+ years, 'revenue' model

which would also include maintenance and training, along with

value-add services such as Big Data acquisition for applications

such as border crossings. Given that some of these project

opportunities can be multi-million dollars in value we believe this

model brings added value which sets us apart from the competition

and will be attractive to many potential clients; indeed, we are

already in discussions with a few government bodies on this basis.

With large scale projects such as these there is never certainty of

outcome or timing, but we are very optimistic this initiative will

lead to material and additional long-term revenues.

In the UK we are pleased to report that the Palace of

Westminster contract which was secured in 2020 but could not be

started until recently due to Covid-19 restrictions is well

underway and we are already looking at possible extensions to this

project.

As previously advised, we have established Westminster Arabia in

the Kingdom of Saudi Arabia jointly with our partners Hazar

International but have been delayed from finalising licences due to

travel restrictions. I am pleased to report however that with some

easing of restrictions we are preparing to re-enter the Kingdom to

finalise matters which should be completed by Q4 2021. This will be

an important step in enabling us to formally bid on and pursue the

many medium and large-scale opportunities we have been

investigating there.

Financial

Revenues at GBP3.5 million (H1 2020: GBP7.0 million) for the

first half year were 16% ahead of the second half 2020 performance

(H2 2020: GBP3.0 million). H1 2020 benefited from record passenger

numbers in our West African Airport operation in the first quarter.

When Covid-19 hit this, as well as our training and guarding

revenues, it was more than counterbalanced by an increase in fever

detection product sales. However, this trend did not last as travel

restrictions and shutdowns around the world worsened and business

confidence declined, with growing uncertainty leading to companies

conserving resources and reducing spending. H1 2021 represents

recovery as the airport operations increased, to reach in June just

over 70% of a normal year (better than many other airports, latest

global traffic levels are reported as 38% of normal), plus training

and guarding are both once again operational and new contracts are

being secured.

The Group generated a gross profit of GBP1.6 million (H1 2020:

GBP2.8 million, H2 2020: GBP1.2m) which equates to a gross margin

of 45% (H1 & H2 2020: 40%). The percentage increase is due to

the increase in high margin managed services sales in H1 2021.

Administration expenses have increased by 8% (GBP0.2m) from H1

2020 to H1 2021. Almost all of this represents an investment in an

expanded sales team to drive revenues forward in future

periods.

The operating loss was GBP0.93 million (H1 2020: profit of

GBP0.48 million; H2 2020 loss of GBP1.20 million). This is

primarily driven by the drop in sales due to Covid-19 effect offset

by improving gross margin.

Our underlying cash interest cost was zero (H1 2020: GBP0.18

million) The 2020 figure was primarily the interest on the

convertible loan notes which were redeemed in December 2020. There

were no non-cash financing charges arising from the amortisation

and extension of the convertible loan notes (H1 2020: GBP0.06

million). A small amount, GBP2,000 (H1 2020: GBP20,000), was booked

in respect of operating leases in accordance with IFRS16. In total,

the financing costs have been effectively eliminated (H1 2020:

GBP0.24 million).

Earnings per share were a loss of 0.32 pence (H1 2020: a profit

of 0.16 pence, H2 2020: 0.59p loss).

Statement of Financial Position and Cash Flow

The Group ended the period with a GBP3.1 million cash balance

(2020: GBP1.6 million). The net cash outflow from operating

activities was GBP1.3m (H1 2020: inflow of GBP0.7 million). GBP0.1

million cash was used in investing activities (H1 2020: GBP0.2

million) and a movement of GBP2.5 million (before expenses) came

from raising new equity (H1 2020: GBP1.85 million new equity). The

funds raised will be used in the new contracts which are starting

in the second half of 2021, as well as to help secure the Company's

prospective pipeline of future contracts.

At the end of the period, the Group had no borrowings other than

a balance of GBP48,000 arising from the IFRS 16 treatment of

operating leases (2020: GBP3,368,000 of which GBP92,000 was for

operating leases).

Outlook

The business model and opportunities we have been developing

over the years have created a foundation from which we can deliver

significant growth and sustainable revenue streams and build

shareholder value. The recent large-scale long-term contracts we

have secured which will provide an upward step change in revenues,

the recovery and growth in our existing operations and the numerous

new opportunities we are developing underpin our confidence for the

future growth of our business.

Whilst acknowledging that there is still global uncertainty and

delays may still impact the delivery of certain projects in the

short term, providing the expected easing of restrictions and

delays and the resultant recovery continues we are on track to meet

full year expectations. We are however confident in our 2022 and

future forecasts. The Board and I remain committed to delivering on

our significant growth potential.

Peter Fowler,

Group Chief Executive

13 August 2021

Condensed consolidated statement of comprehensive income

(unaudited)

for the six months ended 30 June 2021

Note Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Total (restated) Total

Total

GBP'000 GBP'000 GBP'000

Revenue 5 3,477 6,959 9,945

Cost of sales (1,912) (4,186) (5,974)

Gross profit 1,565 2,773 3,971

Administrative expenses (2,492) (2,297) (4,715)

Operating (loss) / profit 7a (927) 476 (744)

Analysis of operating loss/profit (927) 476 (744)

Add back depreciation and amortisation 117 108 225

----------- ----------- -------------

EBITDA (loss)/profit from underlying

operations 6 (810) 584 (519)

---------------------------------------- ----- ----------- ----------- -------------

Finance Costs 8 (2) (240) (17)

(Loss) / profit before taxation (929) 236 (761)

Taxation 7b - - 31

Total comprehensive income for

the period (929) 236 (730)

Profit / (loss) and total comprehensive income attributable

to:

Owners of the parent (920) 182 (560)

Non-controlling interest (9) 54 (170)

Profit / (loss) and total comprehensive

income (929) 236 (730)

----------------------------------------------- ----------- ----------- -------------

Earnings per share (pence) 7c (0.32p) 0.16p (0.45p)

The 2020 half year results have been restated to remove an

exceptional item not recognised in the 2020 audited results. In H1

2020 an exceptional item was recorded to reflect the effect of

Covid-19. This was reviewed at the full year and following guidance

from the Finance Reporting Council, it was decided that this should

not have been recorded as an exceptional item.

Condensed consolidated balance sheet (unaudited)

as at 30 June 2021

As at As at As at 31

30 June 30 June December

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

Goodwill 613 616 614

Other intangible assets 151 205 187

Property, plant and equipment 1,882 1,947 1,901

Deferred Tax 956 907 956

Total Non-Current Assets 3,602 3,675 3,658

--------- -------------------- ------------------

Inventories 585 444 773

Trade and other receivables 2,328 3,767 2,438

Cash and cash equivalents 3,054 1,582 2,143

Total Current Assets 5,967 5,793 5,354

--------- -------------------- ------------------

Non-current receivable 484 - 484

Total Assets 10,053 9,468 9,496

========= ==================== ==================

Called up share capital 9 16,322 16,040 16,278

Share premium account 16,346 9,579 14,069

Merger relief reserve 300 300 300

Share based payment reserve 1,050 1,318 1,050

Equity Reserve on Convertible - 398 -

Loan Note

Revaluation reserve 139 133 139

Retained earnings (25,162) (23,662) (24,242)

--------- -------------------- ------------------

Equity attributable to

Owners of the parent 8,995 4,106 7,594

Non-controlling interest (544) (310) (535)

Total Shareholders' Equity 8,451 3,796 7,059

--------- -------------------- ------------------

Non-current borrowings 10 16 231 29

Total Non-Current Liabilities 16 231 29

--------- -------------------- ------------------

Current borrowing 10 32 3,137 38

Contractual liabilities 97 58 100

Trade and other payables 1,457 2,246 2,270

Total Current Liabilities 1,586 5,441 2,408

--------- -------------------- ------------------

Total Liabilities 1,602 5,672 2,437

Total Liabilities and Shareholders'

Equity 10,053 9,468 9,469

========= ==================== ==================

Condensed consolidated statement of changes in equity

(unaudited)

for the six months ended 30 June 2021

Called Share Merger Share Revaluation Retained Total Non-controlling Total

up premium relief based reserve earnings interest share-holders'

share account reserve payment equity

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1(st)

January

2021 16,278 14,069 300 1,050 139 (24,242) 7,594 (535) 7,059

Loss for the

period - - - - - (920) (920) (9) (929)

Total

comprehensive

income for

the period - - - - - (920) (920) (9) (929)

-------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

Transactions with owners

in their capacity as

owners:

Issue of new

shares 44 2,456 - - - - 2,500 - 2,500

Costs of new

share

issues - (179) - - - - (179) - (179)

44 2,277 - - - - 2,321 - 2,321

--------------- -------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

As at 30th

June

2021 16,322 16,346 300 1,050 139 (25,162) 8,995 (544) 8,451

--------------- -------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

for the six months ended 30 June 2020

Called Share Merger Share Equity Revaluation Retained Total Non-controlling Total

up share premium relief based reserve reserve earnings interest share-holders'

capital account reserve payment on CLN equity

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1(st)

January

2020 14,540 9,577 300 1,166 423 133 (23,844) 2,295 (365) 1,930

Profit for the

period - - - - - - 182 182 54 236

Total

comprehensive

income for

the period - - - - - - 182 182 54 236

------------------- ------------- -------------- ------------- ---------------- ------------------- ------------- ---------- ---------------- ---------------

Transactions with owners in their capacity

as owners:

Issue of new

shares 1,500 350 - - - - - 1,850 - 1,850

Costs of new

share issues - (348) - - - - - (348) - (348)

CLN Movements - - - - (25) - - (25) - (25)

Issue of new

warrant - - - 152 - - - 152 - 152

Other

movements in

equity - - - - - - - - 1 1

1,500 2 - 152 (25) - - 1,629 1 1,630

--------------- ------------------- ------------- -------------- ------------- ---------------- ------------------- ------------- ---------- ---------------- ---------------

As at 30th

June 2020 16,040 9,579 300 1,318 398 133 (23,662) 4,106 (310) 3,796

--------------- ------------------- ------------- -------------- ------------- ---------------- ------------------- ------------- ---------- ---------------- ---------------

for the twelve months ended 31 December 2020

Called Share Merger Share Equity Revaluation Retained Total Non-controlling Total

up premium relief based reserve reserve earnings interest share-holders'

share account reserve payment on CLN equity

capital reserve

--------------- -------- -------- -------- -------- -------- ------------ --------- ------ ---------------- ---------------

AS AT 1

JANUARY

2020 as

previously

stated 14,540 9,577 300 1,166 423 133 (23,844) 2,295 (365) 1,930

Prior year

adjustment - - - (188) - - 147 (41) - (41)

---------

AS AT 1

JANUARY

2020 Restated 14,540 9,577 300 978 423 133 (23,697) 2,254 (365) 1,889

--------------- -------- -------- -------- -------- -------- ------------ --------- ------ ---------------- ---------------

Shares issued

for

cash 1,525 5,225 - - - - - 6,750 - 6,750

Cost of share

issues - (733) - - - - - (733) - (733)

Share based

payment

charge - - - 87 - - - 87 - 87

Lapse of share

options - - - (15) - - - (15) - (15)

Exercise of

warrants

and share

options 213 - - - - - - 213 - 213

Revaluation of

freehold

property - - - - - 6 - 6 - 6

Other

movements

in equity - - - - - - 15 15 - 15

CLN Movement - - - - (423) - - (423) - (423)

TRANSACTIONS

WITH

OWNERS 1,738 4,492 - 72 (423) 6 15 5,900 - 5,900

--------------- -------- -------- -------- -------- -------- ------------ --------- ------ ---------------- ---------------

Total

comprehensive

expense for

the

year - - - - - - (560) (560) (170) (730)

AS AT 31

DECEMBER

2020 16,278 14,069 300 1,050 - 139 (24,242) 7,594 (535) 7,059

--------------- -------- -------- -------- -------- -------- ------------ --------- ------ ---------------- ---------------

Consolidated Cash Flow Statement (unaudited)

for the six months ended 30 June 2021

Six months Six months Year ended

ended ended 30 31 December

30 June June 2020 2020

2021

Total Total Total

Note GBP'000 GBP'000 GBP'000

(Loss) / Profit after taxation (929) 236 (730)

Tax - - (31)

------------------- ----------- -------------

Loss before taxation (929) 236 (761)

Non-cash adjustments 8 122 43 (59)

Net changes in working capital 8 (517) 457 (1,033)

------------------- ----------- -------------

Cash inflow/(outflow) from operating

activities (1,324) 736 (1,853)

------------------- ----------- -------------

Investing activities

Purchase of property, plant and equipment (65) (84) (111)

Purchase of intangible assets - (103) (121)

------------------- ----------- -------------

Cash outflow from investing activities (65) (187) (232)

------------------- ----------- -------------

Financing activities

Gross proceeds from the issue of ordinary

shares and exercise of warrants 2,500 1,850 6,963

Equity placing and sharing agreement - (1,750)

loan -

Costs of share issues (179) (348) (733)

Mezzanine Loan - 1,500 -

Repayment of CLN in cash - (508) (2,222)

Reduction in finance lease debt (19) (66) (69)

Finance cost on lease liabilities 8 (2) (20) (5)

Interest paid 8 - (182) (262)

Other loan repayments, including interest - - (1)

------------------- ----------- -------------

Cash inflow from financing activities 2,300 476 3,671

------------------- ----------- -------------

Change in cash and cash equivalents

in the period 911 1,025 1,586

Cash and cash equivalents at the beginning

of the period 2,143 557 557

Cash and cash equivalents at the end

of the period 3,054 1,582 2,143

------------------- ----------- -------------

Notes to the unaudited financial statements

for the six months ended 30 June 2021

1. General information and nature of operations

This condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2021 has been prepared in

accordance with Accounting Standard IAS 34 Interim Financial

Reporting.

These unaudited interim financial statements were approved by

the board on 12 August 2021. The 31 December 2020 numbers are

extracted from the Group's audited accounts.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31

December 2020 and any public announcements made by Westminster

Group Plc during the interim reporting

period.

Westminster Group Plc (the "Company") was incorporated on 7

April 2000 and is domiciled and incorporated in the United Kingdom

and quoted on AIM. The Group's financial statements for the

six-month period ended 30 June 2021 consolidate the individual

financial information of the Company and its subsidiaries. The

Group designs, supplies and provides advanced technology security

solutions and services to governmental and non-governmental

organisations on a global basis.

The Group does not show any distinct seasonality.

2. Significant changes in the current reporting period

The result reflected a continuing return towards normal from the

damage inflicted by the Covid-19 pandemic.

However, the most significant move forward for the group has

already been mentioned in the Chief Executive O cer's Review above.

That is the signing of two new managed services contracts.

Whilst uncertainty still exists around the world, particularly

in terms of travel, we remain positive about our prospects for H2

and the full year.

3. Basis of preparation

This condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2021 has been prepared in

accordance with Accounting Standard IAS 34 Interim Financial

Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2020 and any public announcements made by

Westminster Group Plc during the interim reporting period.

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting period

and the adoption of new and amended standards as set out below.

These consolidated interim financial statements for the six

months ended 30 June 2021 have neither been audited nor formally

reviewed by the Group's auditors. The financial information for the

year ended 31 December 2020 set out in this interim report does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006 but is derived from those accounts. The

statutory financial statements for the year ended 31 December 2020

have been reported on by the Company's auditors and delivered to

the Registrar of Companies. A copy is available at

https://www.wsg-corporate.com/investor-relations/publications/

.

3(a) New and amended standards adopted by the Group

There are no new or amended standards relevant to the group

which became applicable for the current reporting period. However,

the group has adopted early the following amended Standards:

-- IAS 16 - Property, Plant and Equipment

-- IAS 37 - Provisions, Contingent Liabilities and Contingent Assets

The Group did not have to change its accounting policies or make

retrospective adjustments as a result of adopting these

standards.

3(b) Impact of standards issued but not yet applied by the entity

The Group does not expect to be significantly impacted by the

adoption of standards issued but not yet applied.

4. Going concern

The directors have considered the impact of Covid-19 and the way

the Group has traded positively through the crisis although at a

lower level. The equity capital raises in December 2020 and June

2021 have ensured that the group has sufficient funds to perform

its obligations under recently signed contracts. At the time of

approving this interim report, and in view of the foregoing, the

directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. Thus, they continue to adopt the going concern basis of

accounting in preparing the financial statements.

5. Segment reporting

Operating segments

The Board considers the Group on a Business Unit basis. Reports

by Business Unit are used by the chief decision-makers in the

Group. The Business Units operating during the period are the main

operating work streams, Services and Technology (products and

solutions).

30 June

6 Months to 2021

Services Technology Group Group Total

and Central

---------------------- --------------------- -------------------- ----------------- ---------------------

GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------------------- -------------------- ----------------- ---------------------

6 MONTHS TO JUNE 2021

Supply of products 10 678 - 688

Supply and

installation

contracts - 329 - 329

Maintenance and

services 2,209 153 - 2,362

Training courses 51 47 - 98

Revenue 2,270 1,207 - 3,477

--------------------- -------------------- -----------------

Segmental underlying

EBITDA 966 1,060 (2,836) (810)

Depreciation &

amortisation (54) (4) (59) (117)

Segment operating

result 912 1,056 (2,895) (927)

Finance cost - - (2) (2)

---------------------- --------------------- -------------------- ----------------- ---------------------

Profit/ (loss) before

tax 912 1,056 (2,897) (929)

Income tax charge - - - -

Profit/(loss) for the

financial

year 912 1,056 (2,897) (929)

--------------------- -------------------- -----------------

Segment assets 3,912 1,136 5,005 10,053

---------------------- --------------------- -------------------- ----------------- ---------------------

Segment liabilities 716 474 412 1,602

---------------------- --------------------- -------------------- ----------------- ---------------------

Capital expenditure 20 - 45 65

---------------------- --------------------- -------------------- ----------------- ---------------------

30 JUNE

6 Months to 2020 (restated)

Services Technology Group Group Total

and Central

--------------------- --------------------- -------------------- ----------------- -------------------

GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------------------- -------------------- -----------------

6 MONTHS TO JUNE

2020

Supply of products 22 3,360 - 3,382

Supply and

installation

contracts - 1,184 - 1,184

Maintenance and

services 2,146 167 - 2,313

Training courses 80 - - 80

----------------------

Revenue 2,248 4,711 - 6,959

---------------------- --------------------- -------------------- -----------------

Segmental underlying

EBITDA 657 1,060 (1,133) 584

Depreciation &

amortisation (54) (4) (50) (108)

Segment operating

result 603 1,056 (1,183) 476

Finance cost - - (240) (240)

---------------------- --------------------- -------------------- ----------------- -------------------

Profit/ (loss) before

tax 603 1,056 (1,423) 236

Income tax charge - - - -

Profit/(loss) for the

financial

year 603 1,056 (1,423) 236

--------------------- -------------------- -----------------

Segment assets 4,234 1,724 3,550 9,508

---------------------- --------------------- -------------------- -----------------

Segment liabilities 2,584 692 2,311 5,587

---------------------- --------------------- -------------------- -----------------

Capital expenditure 28 9 150 187

---------------------- --------------------- -------------------- -----------------

Marketing segments

Our extensive portfolio of products and services are categorised

in three key focus sectors - Land, Sea and Air. We are starting to

report on these sectors.

Six months Six months Twelve months

ended 30 June ended 30 June ended 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------- -------------------

Land 1,069 3,654 3,939

Sea 1,175 1,985 3,842

Air 1,233 1,320 2,164

--------------- -------------------

Total revenue 3,477 6,959 9,945

--------------- --------------- -------------------

Geographical areas

The Group's international business is conducted on a global

scale, with agents present in all major continents. The following

table provides an analysis of the Group's sales by geographical

market, irrespective of the origin of the goods/services.

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

--------------- -------------

United Kingdom and

Europe 805 1,458 2,056

Africa 1,934 1,930 4,172

Middle East 51 582 508

Rest of the World 687 2,989 3,209

Total revenue 3,477 6,959 9,945

--------------------

6. Reconciliation of adjusted EBITDA

A reconciliation of adjusted EBITDA to operating profit before

income tax is provided as follows:

Six months Six months Year ended

ended ended 30 31 December

30 June June 2020 2020

2021

(restated)

GBP'000 GBP'000 GBP'000

(Loss) / Profit from Operations (927) 476 (744)

Depreciation, amortisation and impairment

charges 117 108 225

----------- ------------

Reported EBITDA (810) 584 (519)

Share based expense - - -

Exceptional Items - - -

Adjusted EBTIDA (loss) / profit (810) 584 (519)

-------------------------------------------------

Adjusted EBITDA is an alternative reporting measure. For further

details refer to the 31 December 2020 accounts.

The 2020 half year results have been restated to remove

exceptional items not recognised in the 2020 audited results.

7. Income statement information

a. Significant Items

Profit for the half year to 30 June 2021 includes no items that

are unusual because of their nature, size or incidence: In 2020,

there was a Solutions delivery of one of the two advanced container

screening solutions to an Asian port with a sales value of

GBP1.2m.

b. Income Tax

Income tax expense is recognised based on management's estimate.

The Group has significant tax losses in the UK brought forward from

prior years and does not expect to have to provide any material

amount for tax.

Deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. The Group's

projections show the expectation of future profits, hence in 2018 a

deferred tax asset was recognised. Reviews were performed in 2019,

2020 and again this year, considering Covid-19, which has confirmed

those expectations. The recent award of the managed services

contracts has underpinned this.

c. Earnings per share

Earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period. For

diluted earnings per share the weighted average number of ordinary

shares in issue is adjusted to assume conversion of all dilutive

potential ordinary shares. Only those outstanding options that have

an exercise price below the average market share price in the

period have been included. For each period, the issue of additional

shares on exercise of outstanding share options would decrease the

basic loss per share and therefore there is no dilutive effect.

The weighted average number of ordinary shares is calculated as

follows:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

'000 '000 '000

Number of issued ordinary shares at the

start of period 286,528 145,403 145,403

Effect of shares issued during the period 841 6,186 17,245

----------- ----------- -------------

Weighted average basic and diluted number

of shares for period 287,369 151,589 162,648

=========== =========== =============

GBP'000 GBP'000 GBP'000

Loss and total comprehensive expense (929) 236 (730)

p p p

Earnings per share (0.32)p 0.16p (0.45)p

8. Cash flow adjustments and changes in working capital

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Total Total Total

GBP'000 GBP'000 GBP'000

Adjustment for non-cash items

Depreciation, amortisation and impairment

of non-financial assets 117 108 225

Finance costs 2 240 (17)

Revaluation of fixed assets - - (6)

(Profit) / loss on disposal of non-financial

assets 3 - 33

IFRS 16 interest adjustment (1) (4) -

Non-cash accounting for CLN - (199) (119)

(Increase)/decrease in deferred tax asset - - (49)

FX effect on goodwill 1 (2) -

Conversion of CLN - (100) (213)

Share-based payment expenses - - 87

Total adjustments 122 43 (59)

====================== ====================== =============

Net changes in working capital:

Decrease / (increase) in inventories 188 (397) (726)

Decrease in trade and other receivables 110 549 128

Increase in long term receivables - - (484)

(Decrease) / increase in contract liabilities (3) (15) 27

(Decrease) / increase in trade and other

payables (812) 150 (148)

Decrease in assets of disposal group classified

as held for sale - 170 170

Total changes in working capital (517) 457 (1,033)

====================== ====================== =============

9. Called up share capital

Ordinary Share Capital 6 months to 6 months to 30th Year to 31st

30th June 2021 June 2020 December 2020

Number GBP'000 Number GBP'000 Number GBP'000

------------------------------ ------------ -------- ------------ -------- ------------ ---------

At the beginning of

the period 286,527,511 287 145,402,511 14,540 145,402,511 14,540

Arising on exercise

of share options and

warrants - - 1,000,000 100 2,125,000 213

Issued under the RiverFort

EPSA - - 14,000,000 1,400 14,000,000 1,400

Share capital reorganisation

to create deferred shares - - - - - (15,991)

Other issue for cash 43,859,649 44 - - 125,000,000 125

At the end of the period 330,387,160 331 160,402,511 16,040 286,527,511 287

------------------------------ ------------ -------- ------------ -------- ------------ ---------

Deferred share capital 6 months to 30th 6 months to 30th Year to 31st December

June 2020 June 2019 2020

Number GBP'000 Number GBP'000 Number GBP'000

------------------------------ ------------ -------- -------- --------- -------------- --------

At 1 January 161,527,511 15,991 - - - -

Share capital reorganisation

to create deferred shares - - - - 161,527,511 15,991

At the end of the period 161,527,511 15,991 - - 161,527,511 15,991

------------------------------ ------------ -------- -------- --------- -------------- --------

Total Share Capital 6 months to 30th 6 months to 30th Year to 31st December

June 2021 June 2020 2020

Number GBP'000 Number GBP'000 Number GBP'000

Ordinary Share Capital 330,387,160 331 160,402,511 16,040 286,527,511 287

Deferred share capital 161,527,511 15,991 - - 161,527,511 15,991

491,914,671 16,322 160,402,511 16,040 448,055,022 16,278

======================== ============ ======== ============ ======== ============== ========

10. Borrowings

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Current

borrowings (due

< 1 year)

Mezzanine Loan - 1,500 -

Convertible - 1,593 -

loan note

Lease Debt 32 44 38

Total current

borrowings 32 3,137 38

Non-current

borrowings

(due > 1 year)

Convertible - - -

loan note

Convertible - 183 -

Unsecured loan

note

Lease Debt 16 48 29

Total

non-current

borrowings 16 231 29

Total

borrowings 48 3,368 67

================================ ================================ ================================

11. Contingencies

The RiverFort EPSA was described in the 2020 accounts. In

summary, the company issued 14m ordinary shares and received a

GBP1.5m mezzanine loan. At the same time under the EPSA the company

issued 14m shares and booked a sundry debt of GBP1.75m. The loan

was to be repaid and the sundry debt settled by selling down the

shares. The mezzanine loan was fully repaid in December 2020. As at

the 31 December 2020 there remained shares still to be sold by

RiverFort and a residual sundry debt for those shares. Because of

the low share price caused primarily by the market reaction to

Covid-19, had the remaining shares been sold at the 30 June 2021

there would have been a loss of GBP885,000 (31 Dec 2020:

GBP936,000) on this debt. However, the shares do not have to be

fully sold until at least 31 December 2021 and there is reason to

believe that it will be at a price higher than the 30 June 2021

price level and enough to recoup the losses.

12. Events after the Reporting Period

There were no material events which occurred after the period

end.

13. Copies of interim financial statements

A copy of these interim financial statements is available on the

Company's website, www.wsg-corporate.com and from the Company

Secretary at the company's registered office, Westminster House,

Blacklocks Hill, Banbury, Oxfordshire, OX17 2BS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDISBBDGBD

(END) Dow Jones Newswires

August 13, 2021 02:00 ET (06:00 GMT)

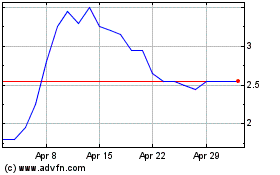

Westminster (LSE:WSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Westminster (LSE:WSG)

Historical Stock Chart

From Apr 2023 to Apr 2024