Wynnstay Group PLC Trading Update (3325T)

24 November 2021 - 5:59PM

UK Regulatory

TIDMWYN

RNS Number : 3325T

Wynnstay Group PLC

24 November 2021

24 November 2021

AIM: WYN

WYNNSTAY GROUP PLC

("Wynnstay" or "the Group")

TRADING UPDATE

The Board of Wynnstay, the agricultural supplies group, is

pleased to provide the following update on trading for the

financial year ended 31 October 2021.

Trading Update

Trading since June, when the Group reported interim results, and

in particular in the key trading month of October, has been strong

across all core activities. Certain areas have outperformed the

Board's expectations especially fertilizer blending activities,

which experienced certain one-off benefits, and joint venture

activities. As a result, the Board now expects that underlying

Group pre-tax profit* for FY 2021 will be significantly ahead of

current market forecasts.

The second half performance has been supported by strong

farmgate prices across almost all categories, which has continued

to buoy farmer confidence and farm re-investment. After last year's

historically poor harvest, tonnages and yields have reverted to

more normalised levels, benefiting the Group's arable activities in

the important final quarter of the financial year, and grain prices

remain strong. The Specialist Agricultural Merchanting Division

experienced strong demand from farmer customers across all major

categories.

The inflationary and supply chain challenges being experienced

across the wider economy, including energy, distribution, fuel and

labour costs, are being managed, and to date Wynnstay has avoided

any significant disruption to its business. The Board expects to be

able to continue to manage these operational and cost challenges

effectively, although some imported product lines have experienced

delays and this may continue.

The Board believes that the short and medium term outlook for

agriculture and farm commodities in the UK remains positive. As the

agricultural sector adapts to the Agricultural Act 2020 and a

greater focus on environmental priorities, the Group remains very

well-positioned to support farmers and to increase its market

share.

*underlying Group pre-tax profit excludes non-recurring items,

share based remuneration payments and adds back the Group's share

of tax incurred by joint ventures.

Enquiries:

Wynnstay Group plc Gareth Davies, Chief T: 01691 827

Executive 142

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178

Mahoney 6378

Shore Capital (Nomad Stephane Auton / Patrick T: 020 7408

and Broker) Castle / 4090

John More

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKNBQOBDDODB

(END) Dow Jones Newswires

November 24, 2021 01:59 ET (06:59 GMT)

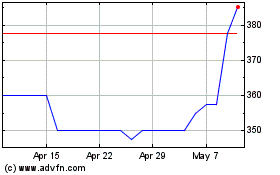

Wynnstay (LSE:WYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

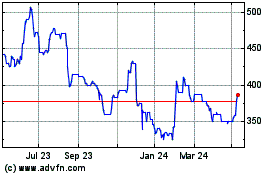

Wynnstay (LSE:WYN)

Historical Stock Chart

From Apr 2023 to Apr 2024