Australia's ACCC: Maintains Opposition To NAB's Bid For AXA Asia Pacific

09 September 2010 - 10:16AM

Dow Jones News

Australia's competition regulator continued its opposition to

National Australia Bank Ltd.'s (NAB.AU) proposed A$13.3 billion bid

for wealth management firm rival AXA Asia Pacific Holdings Ltd.

(AXA.AU) Thursday, dealing a heavy blow to the bank's plans to

become the country's largest wealth manager.

The Australian Competition and Consumer Commission's Deputy

Chairman Peter Kell said in a statement that undertakings proposed

by the bank to sell AXA APH's new online investment platform North

to IOOF Holdings Ltd. (IFL.AU) "do not provide sufficient certainty

that the ACCC's competition concerns will be addressed".

"The undertakings as proposed place a heavy reliance upon IOOF

having sufficient distribution capability to provide an effective

competitive constraint upon existing key players in the foreseeable

future," said Kell.

The regulator said the proposed undertakings also rely on third

parties completing certain actions, and involve complex and

long-term behavioural obligations that present risks, creating

uncertainty that IOOF could become an effective competitor to the

combined NAB-AXA.

-By Bill Lindsay, Dow Jones Newswires; 61-2-8272-4694;

bill.lindsay@dowjones.com

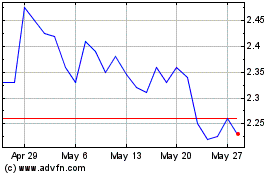

Insignia Financial (ASX:IFL)

Historical Stock Chart

From May 2024 to Jun 2024

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Insignia Financial Ltd (Australian Stock Exchange): 0 recent articles

More Ioof Holdings News Articles