ArcelorMittal Buys Back 62% Of $500 Million, 6.5% Notes Due 2014

17 July 2013 - 1:31AM

Dow Jones News

By Alex MacDonald

LONDON--ArcelorMittal (MT) has bought back around 62% of $500

million in bonds falling due in 2014, part of a plan to reduce its

debt.

The Luxembourg-based steelmaker said investors holding $310.68

million of outstanding notes with a 6.5% coupon took advantage of

an early-bird offer that expired on June 28. The steelmaker paid

those investors $326.99 million on July 1 to buy back their notes,

a figure that includes bonuses for the quick response.

ArcelorMittal bought back another $0.819 million worth of notes

for $0.823 million before the offer expired July 15.

That leaves ArcelorMittal, the world's largest steelmaker, with

only $188.5 million to pay back.

-Write to Alex MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

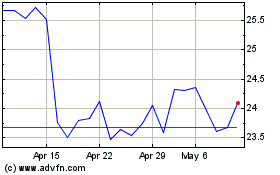

ArcelorMittal (EU:MT)

Historical Stock Chart

From Jun 2024 to Jul 2024

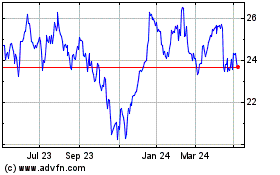

ArcelorMittal (EU:MT)

Historical Stock Chart

From Jul 2023 to Jul 2024