ArcelorMittal Shrugs Off Trade Worries as 2Q Profits Rise

01 August 2018 - 8:37PM

Dow Jones News

By Nathan Allen

ArcelorMittal (MT.AE) on Wednesday dismissed concerns that

global trade tensions would damage its bottom line and said U.S.

tariffs on steel imports were a net positive for the group as it

reported solid second-quarter earnings.

The U.S. is a key market and a major production hub for the

Luxembourg-listed steelmaker, which has long called for stricter

measures to combat an influx of cheap raw materials and is now

benefiting from a 25% duty imposed on all foreign-produced

steel.

Chief Financial Officer Aditya Mittal said protective measures

were justified given the significant overcapacity in global steel

production and "certain nations unfairly supporting domestic

industries," a thinly veiled reference to China.

Mr. Mittal said the company was already benefiting from the

tariffs, which were introduced in the middle of the quarter, and

that he expects the positive impact to continue through the rest of

the year.

He downplayed the effect of global trade tensions on demand from

the auto industry--a vocal opponent of the tariffs--and said that

most of the group's automotive customers buy steel for vehicles

that will be sold domestically.

"There are negative impacts on exports from Canada, Mexico and

Brazil to the U.S. However, our main concern is the massive

overcapacity that exists in the global steel industry," he said

Earnings before interest, taxes, depreciation and amortization,

or Ebitda, in the Nafta region rose more than 56% to $791 million

in the second quarter, which the company attributed to improved

market demand in the U.S.

The steelmaker posted second-quarter net profit of $1.87

billion, up 40% on year, on sales of $20.00 billion. Overall Ebitda

rose 46% on year to $3.07 billion, comfortably outstripping a

company-compiled consensus of $2.85 billion.

ArcelorMittal doesn't provide quantitative earnings guidance but

the company increased its forecasts for steel consumption in China,

the U.S. and the EU, while slightly trimming expectations for

Brazil.

Chief Executive Lakshmi N. Mittal was fairly bullish in a

statement accompanying Wednesday's results, noting structural

improvements in the global steel industry and within ArcelorMittal.

He said deleveraging remained the priority and the group would

continue to pursue its goal of lowering its net debt to $6

billion.

"We believe improvements in underlying industry fundamentals are

sustainable, although there is still more to be done to thoroughly

address the issue of global overcapacity," he said.

Write to Nathan Allen at nathan.allen@dowjones.com

-0-

(END) Dow Jones Newswires

August 01, 2018 06:22 ET (10:22 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

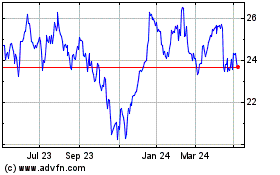

ArcelorMittal (EU:MT)

Historical Stock Chart

From Jun 2024 to Jul 2024

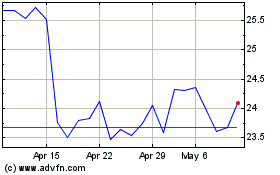

ArcelorMittal (EU:MT)

Historical Stock Chart

From Jul 2023 to Jul 2024