false

0001041859

0001041859

2024-02-15

2024-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

February 15, 2024

| THE CHILDREN’S PLACE, INC. |

| (Exact Name of Registrant as Specified in Charter) |

| |

| Delaware |

| (State or Other Jurisdiction of Incorporation) |

| 0-23071 |

31-1241495 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 500 Plaza Drive, Secaucus, New Jersey |

07094 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| (201) 558-2400 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12-b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange on

which registered |

| Common Stock, $0.10 par value |

PLCE |

NASDAQ Global Select Market |

The

Children’s Place, Inc. (the “Company”) previously announced that it has been seeking to improve its liquidity position

and strengthen its balance sheet to best position the Company for the future and that it has been working with its advisors to identify

potential lenders to obtain new financing necessary to support ongoing operations and to amend certain provisions of its existing Credit

Facility (defined below). As a result, on February 16, 2024, the Company announced its entry into

a non-binding term sheet dated February 15, 2024 with 1903P Loan Agent, LLC (“Gordon Brothers”), as Lender, Administrative

Agent and Collateral Agent, (the “Term Sheet”), for a $130 million term loan (the “Term Loan”). The net proceeds

from the Term Loan, after deducting related fees and expenses, are expected to be used, among other things, to (i) repay the Company’s

existing $50 million term loan under the Company’s Amended and Restated Credit Agreement dated May 9, 2019, as amended, with Wells

Fargo, National Association (“Wells Fargo”), Bank of America, N.A., HSBC Bank (USA), N.A., JPMorgan Chase Bank, N.A., Truist

Bank and PNC Bank, National Association, as lenders and Wells Fargo, as Administrative Agent, Collateral Agent and Swing Line Lender (the

“Credit Facility”) and (ii) reduce a portion of the Company’s accounts payable balances with vendors and other general

corporate purposes.

Consummation of the transactions

contemplated by the Term Sheet is subject to the satisfaction of a number of conditions, including (i) satisfactory completion of customary

due diligence by Gordon Brothers, (ii) negotiation and execution of definitive documentation with Gordon Brothers and the existing lenders

under the Credit Facility, including an amendment to the Credit Facility to permit entry into the Term Loan and otherwise facilitate the

Term Loan transaction, and (iii) entry into an intercreditor agreement between the existing lenders under the Credit Facility and Gordon

Brothers. The Company expects to enter into definitive agreements for the Term Loan as expeditiously as possible during the month of March.

The Company previously announced that it has been working with its financial and legal advisors to consider all strategic alternatives

in the event that the Company is unable to consummate the financing contemplated by the Term Sheet or other financing of a similar nature

in a timely manner. The Company’s work on these alternatives remains in progress.

The Term Loan is expected

to have the following terms:

| · | The Term Loan is expected to (i) mature on November 15, 2026 (the maturity date under the Credit Facility),

(ii) bear interest at the Secured Overnight Financing Rate (“SOFR”) plus 9.00% per annum and (iii) contain customary types

of fees for transactions of this nature, including a closing fee, an agent fee, a monitoring fee and an exit fee (providing for a multiple

on invested capital). |

| · | The Term Loan is expected to be secured by a first-priority security interest in the Company’s intellectual

property and certain other assets (collectively, the “Term Priority Collateral”), and a second-priority security interest

in inventory and certain other working capital assets, securing the Credit Facility on a first-priority basis. In connection with entering

into the Term Loan, the existing lenders under the Credit Facility are expected to be granted a second-priority security interest in the

Term Priority Collateral. |

Mr. Matthews, the Chairman

of the Board of Directors of the Company, also serves as a member of the Board of Directors of Gordon Brothers, a private company.

| Item 9.01 | Financial Statement and Exhibits. |

Forward-Looking Statements

This Current Report on

Form 8-K contains or may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, including but not limited to statements relating to the Term Sheet and expected Term Loan. Forward-looking statements

typically are identified by use of terms such as “may,” “will,” “should,” “plan,” “project,”

“expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are

expressed differently. These forward-looking statements are based upon the Company’s current expectations and assumptions and are

subject to various risks and uncertainties that could cause actual results and performance to differ materially. Some of these risks and

uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including in the “Risk Factors”

section of its annual report on Form 10-K for the fiscal year ended January 28, 2023. Included among the risks and uncertainties that

could cause actual results and performance to differ materially are the risk that the Company will be unsuccessful in gauging fashion

trends and changing consumer preferences, the risks resulting from the highly competitive nature of the Company’s business and its

dependence on consumer spending patterns, which may be affected by changes in economic conditions (including inflation), the risks related

to the COVID-19 pandemic, including the impact of the COVID-19 pandemic on our business or the economy in general, the risk that the Company’s

strategic initiatives to increase sales and margin are delayed or do not result in anticipated improvements, the risk of delays, interruptions,

disruptions and higher costs in the Company’s global supply chain, including resulting from COVID-19 or other disease outbreaks,

foreign sources of supply in less developed countries, more politically unstable countries, or countries where vendors fail to comply

with industry standards or ethical business practices, including the use of forced, indentured or child labor, the risk that the cost

of raw materials or energy prices will increase beyond current expectations or that the Company is unable to offset cost increases through

value engineering or price increases, various types of litigation, including class action litigations brought under consumer protection,

employment, and privacy and information security laws and regulations, the imposition of regulations affecting the importation of foreign-produced

merchandise, including duties and tariffs, the uncertainty of weather patterns, the risk that we may be unable to consummate the Term

Loan as anticipated, or at all, or obtain alternative financing. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they were made. The Company undertakes no obligation to release publicly any revisions to

these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence

of unanticipated events.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 16, 2024 | | |

| | | |

| | THE CHILDREN’S PLACE, INC. |

| | | |

| | By: | /s/ Jane Elfers |

| | Name: Jane Elfers |

| | Title: President and Chief

Executive Officer |

Exhibit 99.1

THE COMPANY ANNOUNCES THAT IT HAS ENTERED INTO

A NON-BINDING TERM SHEET FOR $130 MILLION TERM LOAN

SECAUCUS, N.J., February 16, 2024

—The Children’s Place, Inc. (Nasdaq: PLCE), an omni-channel children’s specialty portfolio of brands with an industry-leading

digital-first model, today announced that it has entered into a non-binding term sheet with 1903P Loan Agent, LLC (“Gordon Brothers”),

as Lender, Administrative Agent and Collateral Agent, (the “Term Sheet”), for a $130 million term loan (the “Term Loan”).

Additional details concerning the

Term Sheet, certain of the expected terms of the Term Loan, and the Company’s ongoing activities concerning strategic alternatives,

may be found in the Form 8-K filed by the Company with the Securities and Exchange Commission on February 16, 2024.

About The Children’s Place

The Children’s Place is an

omni-channel children’s specialty portfolio of brands with an industry-leading digital-first model. Its global retail and wholesale

network includes four digital storefronts, more than 500 stores in North America, wholesale marketplaces and distribution in 16 countries

through six international franchise partners. The Children’s Place is proud to be a women-led Company, including industry-leading

gender diversity in senior management and throughout all levels of its workforce, and of its commitment to sustainable business practices

that benefit its customers, associates, investors, suppliers and the communities it serves. The Children’s Place designs, contracts

to manufacture, and sells fashionable, high-quality apparel, accessories and footwear predominantly at value prices, primarily under its

proprietary brands: “The Children’s Place”, “Gymboree”, “Sugar & Jade”, and “PJ Place”.

For more information, visit: www.childrensplace.com, www.gymboree.com, www.sugarandjade.com and www.pjplace.com, as well as the Company’s

social media channels on Instagram, Facebook, X, formerly known as Twitter, YouTube and Pinterest.

Forward-Looking Statements

This press release contains or

may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of

1995, including but not limited to statements relating to the Term Sheet and expected Term Loan. Forward-looking statements typically

are identified by use of terms such as “may,” “will,” “should,” “plan,” “project,”

“expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are

expressed differently. These forward-looking statements are based upon the Company’s current expectations and assumptions and are

subject to various risks and uncertainties that could cause actual results and performance to differ materially. Some of these risks and

uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including in the “Risk Factors”

section of its annual report on Form 10-K for the fiscal year ended January 28, 2023. Included among the risks and uncertainties that

could cause actual results and performance to differ materially are the risk that the Company will be unsuccessful in gauging fashion

trends and changing consumer preferences, the risks resulting from the highly competitive nature of the Company’s business and its

dependence on consumer spending patterns, which may be affected by changes in economic conditions (including inflation), the risks related

to the COVID-19 pandemic, including the impact of the COVID-19 pandemic on our business or the economy in general, the risk that the Company’s

strategic initiatives to increase sales and margin are delayed or do not result in anticipated improvements, the risk of delays, interruptions,

disruptions and higher costs in the Company’s global supply chain, including resulting from COVID-19 or other disease outbreaks,

foreign sources of supply in less developed countries, more politically unstable countries, or countries where vendors fail to comply

with industry standards or ethical business practices, including the use of forced, indentured or child labor, the risk that the cost

of raw materials or energy prices will increase beyond current expectations or that the Company is unable to offset cost increases through

value engineering or price increases, various types of litigation, including class action litigations brought under consumer protection,

employment, and privacy and information security laws and regulations, the imposition of regulations affecting the importation of foreign-produced

merchandise, including duties and tariffs, the uncertainty of weather patterns, the risk that we may be unable to consummate the Term

Loan as anticipated, or at all, or obtain alternative financing. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they were made. The Company undertakes no obligation to release publicly any revisions to

these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence

of unanticipated events.

Contact: Investor Relations

(201) 558-2400 ext. 14500

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

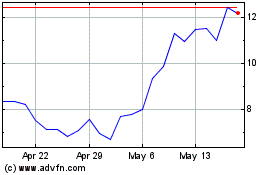

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Apr 2024 to May 2024

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From May 2023 to May 2024