UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14F-1

INFORMATION

STATEMENT

PURSUANT

TO SECTION 14(f) OF THE

SECURITIES

EXCHANGE ACT OF 1934

AND

RULE 14F-1 THEREUNDER

NON-INVASIVE

MONITORING SYSTEMS, INC.

(Exact

name of Registrant as specified in its charter)

|

Florida

|

|

000-13176

|

|

59-2007840

|

(State

or other jurisdiction of

incorporation or organization)

|

|

Commission

File

Number

|

|

(I.R.S.

Employer

Identification No.)

|

4400

Biscayne Blvd.,

Miami,

Florida 33137-3212

(Address

of principal executive offices) (Zip code)

(305)

575-4207

Registrant’s

Telephone Number

May

29, 2019

NON-INVASIVE

MONITORING SYSTEMS, INC.

4400 Biscayne Blvd.,

Miami, Florida

INFORMATION

STATEMENT PURSUANT TO SECTION 14(f)

OF

THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, AND RULE 14f-1

PROMULGATED THEREUNDER

NOTICE

OF CHANGE IN MAJORITY OF THE BOARD OF DIRECTORS

May

29, 2019

INTRODUCTION

This

information statement (this “

Information Statement

”) is being furnished to shareholders of record as of May

17, 2019 (the “

Record Date

”) of the outstanding shares of common stock, par value $0.01 per share (the “

Common

Stock

”), of Non-Invasive Monitoring Systems, Inc., a Florida corporation (“

we

”, “

us

”,

“

our

” or the “

Company

”), pursuant to Section 14(f) of the Securities Exchange Act of 1934,

as amended (the “

Exchange Act

”), and Rule 14f-1 promulgated thereunder (“

Rule 14f-1

”). Section

14(f) of the Exchange Act and Rule 14f-1 require the mailing to our shareholders of record of the information set forth in this

Information Statement in connection with an anticipated change in majority control of our Board of Directors (the “

Board

”)

other than at a meeting of our shareholders. Pursuant to Rule 14f-1, such change in majority control of the Board may not occur

earlier than ten days after the later of the date of the filing of this Information Statement with the Securities and Exchange

Commission (the “

SEC

”) and the date on which we mail this Information Statement to holders of record of our

Common Stock as of the Record Date. Accordingly, the change in a majority of our directors in accordance with the Exchange Agreement

and the Exchange (each as defined herein) will not occur until at least 10 days following the mailing of this Information Statement.

This Information Statement will be mailed on or about May 29, 2019 to our shareholders of record on the Record Date.

THIS

INFORMATION STATEMENT IS REQUIRED BY SECTION 14(F) OF THE SECURITIES EXCHANGE ACT AND RULE 14F-1 PROMULGATED THEREUNDER SOLELY

IN CONNECTION WITH THE APPOINTMENT

OF ADAM BERGMAN, ALAN LAIFER, JAMES J. MARTIN AND Matthew

Meehan

TO THE COMPANY’S BOARD OF DIRECTORS.

NO

VOTE OR OTHER ACTION BY OUR SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

PROXIES

ARE NOT BEING SOLICITED, AND YOU ARE REQUESTED NOT TO SEND US A PROXY. YOU SHOULD READ THIS INFORMATION STATEMENT CAREFULLY, BUT

ARE NOT REQUIRED OR REQUESTED TO TAKE ANY ACTION IN CONNECTION WITH THIS INFORMATION STATEMENT.

CHANGE

OF CONTROL

Exchange

Agreement

On

December 3, 2018, as previously reported in our Current Report on Form 8-K filed with the SEC on December 4, 2018, we entered

into an Equity Exchange Agreement (the “

Exchange Agreement

”), with IRA Financial Trust Company, a South Dakota

trust corporation (“

IRA Trust

”), IRA Financial Group LLC, a Florida limited liability company (“

IRA

Financial Group

” and, together with IRA Trust, “

IRA Financial

”), Adam Bergman and Fred Horner (the

“

Equityholders

”). Upon the terms and subject to the conditions contained in the Exchange Agreement, we will

issue to the Equityholders shares of a newly-designated series of our convertible preferred stock, (the “

Exchange Shares

”)

in exchange for 100% of the issued and outstanding equity in IRA Financial (the “

Exchange

”). On April 17, 2019,

we entered into an amendment to the Exchange Agreement, together with IRA Financial and the Equityholders, extending the outside

date for consummation of the Exchange from April 3, 2019 to June 3, 2019. The Exchange Agreement remains unmodified and in effect

in all other respects.

Upon

consummation of the Exchange, the Exchange Shares, on an as-converted basis, will comprise 85% of the issued and outstanding shares

of our Common Stock, on a fully-diluted basis, after giving effect to the conversion or exchange of substantially all of our issued

and outstanding preferred stock (other than the Exchange Shares) and all of our indebtedness, in each case for shares of Common

Stock, together with our consummation of at least $1.25 million in private equity financing, all as contemplated by the terms

of the Exchange Agreement.

Debt

Exchange and Pipe

Additionally,

as previously reported in our Current Report on Form 8-K filed with the SEC on December 28, 2018, in connection with the Exchange

Agreement, on December 21, 2018, we entered into stock purchase agreements with Frost Gamma Investments Trust (“

FGIT

”),

a trust controlled by Dr. Philip Frost, and Jane Hsiao, Ph.D., MBA, the Company’s Chairman and Interim Chief Executive Officer.

Pursuant to the purchase agreements, we issued and sold to FGIT and Dr. Hsiao an aggregate of 8,571,428 shares of Common Stock

(the “

PIPE Shares

”), at a purchase price of $0.07 per share. Each of FGIT and Dr. Hsiao beneficially owned

in excess of 10% of our issued and outstanding shares of Common Stock prior to the issuance of the PIPE Shares and the Debt Exchange

Shares (as defined below).

Also

on December 21, 2018, we entered into a Debt Exchange Agreement (the “

Debt Exchange Agreement

”) with FGIT,

Dr. Hsiao, Hsu Gamma Investments LP (“

Hsu Gamma

”), Marie Wolf and Frost Real Estate Holdings, LLC (collectively,

the “

Creditors

”), pursuant to which we issued to the Creditors or designees thereof an aggregate of 53,321,804

shares of Common Stock (the “

Debt Exchange Shares

”), in exchange for aggregate indebtedness for borrowed money

and unpaid rent, including principal and accrued and unpaid interest thereon, of $3,732,526.17 held by the Creditors, which indebtedness

was cancelled upon issuance of the Debt Exchange Shares. We issued the Debt Exchange Shares at a price of $0.07 per share.

Pursuant

to the Debt Exchange Agreement, we satisfied and discharged all of our obligations under certain previously reported promissory

notes, which are identified in the Debt Exchange Agreement, and that certain Note and Security Agreement, dated as of March 31,

2010, by and among us, FGIT and Hsu Gamma (the “

Credit Agreement

”), and terminated the Credit Agreement, including

all commitments of the lenders to lend thereunder and the lenders’ security interest in all collateral identified therein,

which included substantially all of our personal property.

The

PIPE Shares and the Debt Exchange Shares comprised approximately 43.9% of our issued and outstanding shares of Common Stock immediately

after the issuance thereof, as of the date of such issuance. We issued such shares in connection with, and as contemplated by,

the Exchange Agreement.

Conversion

of Series D Preferred Stock

In

connection with the transactions contemplated by the Exchange Agreement, on February 13, 2019, holders of all of our issued and

outstanding Series D Preferred Stock, par value $1.00 per share, converted their respective shares into an aggregate of 13,910,000

shares of Common Stock.

Redemption

of Series C Preferred Stock

In

connection with the transactions contemplated by the Exchange Agreement, on February 21, 2019, we redeemed all of our issued and

outstanding shares of Series C Preferred Stock, par value $1.00 per share, at a redemption price of $0.40 per share. We effected

this redemption in accordance with the terms of the Series C Preferred Stock set forth in our Articles of Incorporation, as amended.

In total, we redeemed 62,048 shares of Series C Preferred Stock for aggregate consideration of $24,819.20.

Change

in Board of Directors and Executive Officers

Subject

to compliance with Section 14(f) of the Exchange Act and Rule 14f-1, upon consummation of the Exchange, our Board will consist

of five directors, three of whom will be directors designated by IRA Financial, and two of whom will be directors designated by

us.

Effective

as of the consummation of the Exchange (the “

Closing

”), Marvin A. Sackner, M.D. and Subbarao V. Uppaluri, Ph.D.,

will resign from the Board. Morton Robinson, M.D., who had served as a Director since 1989, passed away on May 21, 2019. In addition,

as of the Closing, Jane H. Hsiao, Ph.D., MBA, will resign as our Interim Chief Executive Officer, and James J. Martin will resign

as our Chief Financial Officer.

At

the Closing, in connection with the Exchange, Adam Bergman, Alan Laifer, James J. Martin and Matthew Meehan, will become members

of our Board (the “

Incoming Directors

”), with Adam Bergman to serve as the Chairman of the Board. Adam Bergman,

the Chief Executive Officer of IRA Financial, will become our President and Chief Executive Officer.

Accordingly,

after consummation of the Exchange, our Board will consist of Adam Bergman, Alan Laifer, James J. Martin, Matthew Meehan and Steven

Rubin. Adam Bergman will be our President and Chief Executive Officer with additional executive officers, including a chief financial

officer, to be appointed following consummation of the Exchange in the Board’s discretion.

Lock-Up

and Voting Agreement

In

connection with the Exchange Agreement, the Equityholders and certain of the Company’s current shareholders, who together

hold in excess of 50% of the voting power of the Common Stock, have entered into lock-up and voting agreements (each a “

Lock-up

and Voting Agreement

”), pursuant to which such persons have agreed, subject to certain exceptions, not to sell, transfer

or otherwise convey any of the Company’s securities held by them (collectively, “

Covered Securities

”)

for a certain period following the date on which the Exchange is consummated (the “

Closing Date

”). The Lock-up

and Voting Agreements provide generally that such persons may not sell, transfer or convey any of their respective Covered Securities

during the period of six-months immediately following the Closing Date, following which such persons may sell, transfer or convey

(i) up to 50% of their respective Covered Securities during the period commencing on the six-month anniversary of the Closing

Date and ending on the twelve-month anniversary of the Closing Date and (ii) up to an aggregate of 75% of their respective Covered

Securities during the period commencing on the twelve-month anniversary of the Closing Date and ending on the two-year anniversary

of the Closing Date. The restrictions on transfer contained in the Lock-up and Voting Agreement cease to apply to the Covered

Securities following the second anniversary of the Closing Date;

provided

,

however

, that such restrictions, in the

case of certain Company shareholders, who together currently hold approximately 3.6% of the voting power of the Common Stock (and

which will constitute less than 1.0% of the voting power of the outstanding Common Stock immediately following the consummation

of the Exchange), expire entirely after the six-month anniversary of the Closing Date.

Additionally,

pursuant to the Lock-up and Voting Agreements, each person party thereto has agreed, for the period commencing on the Closing

Date and ending on the six-month anniversary of the Closing Date, to vote all of such person’s Covered Securities in favor

of (i) amending the Company’s articles of incorporation, as currently amended, to change the legal name of the Company and

to provide that the holders of not less than 50% of the Company’s voting power shall be entitled to call a special meeting

of shareholders unless the bylaws establish a lower percentage requirement, (ii) amending the Company’s articles of incorporation,

as currently amended, to increase the authorized shares of Common Stock such that the Exchange Shares shall, upon such amendment’s

effectiveness, convert into Common Stock in accordance with their terms and (iii) any other action requested by the Board as may

be required to consummate the Exchange and the other transactions set forth in the Exchange Agreement.

Effectiveness

of the Lock-up and Voting Agreements is conditioned upon consummation of the Exchange.

VOTING

SECURITIES

Our

authorized capital stock consists of 400,000,000 shares of Common Stock, of which 154,810,655 shares were outstanding as of the

Record Date, and 1,000,000 shares of preferred stock, par value $1.00 per share, of which 100 shares of Series B Preferred Stock

were issued and outstanding as of the Record Date. Each share of Common Stock entitles the holder to one vote on all matters upon

which they are entitled to vote at meetings of shareholders or upon actions taken by written consent pursuant to Florida corporate

law. Holders of Series B Preferred Stock are entitled to vote with the holders of Common Stock as a single class on all matters

upon which they are entitled to vote at meetings of shareholders or upon actions taken by written consent pursuant to Florida

corporate law.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information as of the Record Date concerning the beneficial ownership of our Common Stock by

(i) each person known by us to be the beneficial owner of more than 5% of the outstanding shares of Common Stock, (ii) each of

our current directors, (iii) each of our current executive officers and (iv) all of our current executive officers and directors

as a group. The table does not include information with respect to our Series B Preferred Stock, which constitutes far less than

one percent of the total voting power of the Company’s issued and outstanding voting securities.

Beneficial

ownership is determined in accordance with the rules of the SEC. Except as indicated by footnote and subject to community property

laws where applicable, to our knowledge, the persons named in the table below have sole voting and investment power with respect

to all shares of voting stock shown as beneficially owned by them. In computing the number of shares beneficially owned by a person

and the percentage ownership of that person, shares of common or preferred stock, as applicable, subject to options and warrants,

or underlying other convertible securities, held by such person that are exercisable or convertible as of the Record Date or that

will become exercisable or convertible within 60 days thereafter are deemed outstanding for purposes of such person’s percentage

ownership but not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise

indicated, the mailing address of everyone is c/o Non-Invasive Monitoring Systems, Inc., 4400 Biscayne Blvd., Suite 180, Miami,

Florida 33137. The following information is based upon information provided to us or filed with the SEC by the shareholders.

|

Name

|

|

Number of Shares Beneficially Owned

|

|

|

Percent of Class

(1)

|

|

|

Jane H. Hsiao, Ph.D., Chairman of the Board and Interim CEO

(2)

|

|

|

43,455,734

|

|

|

|

28.1

|

%

|

|

Marvin A. Sackner, M.D., Director

|

|

|

15,000

|

|

|

|

*

|

|

|

Morton Robinson, M.D., Director

(3)

|

|

|

993,491

|

|

|

|

*

|

|

|

Steven D. Rubin, Director

|

|

|

100,000

|

|

|

|

*

|

|

|

Subbarao V. Uppaluri, Ph.D., Director

|

|

|

—

|

|

|

|

*

|

|

|

James J. Martin, Chief Financial Officer

|

|

|

25,000

|

|

|

|

*

|

|

|

All Directors and Executive Officers as a group (6 persons)

|

|

|

44,589,225

|

|

|

|

28.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

5% Holders:

|

|

|

|

|

|

|

|

|

|

Phillip Frost, M.D.

(4)

|

|

|

54,690,325

|

|

|

|

35.3

|

%

|

|

Frost Gamma Investments Trust

|

|

|

54,690,325

|

|

|

|

35.3

|

%

|

|

Hsu Gamma Investments, L.P.

|

|

|

24,553,660

|

|

|

|

15.9

|

%

|

|

*

|

Less

than 1%

|

|

(1)

|

Based

on 154,810,655 shares of Common Stock outstanding as of the Record Date.

|

|

(2)

|

Includes

24,553,660 shares of Common Stock held by Hsu Gamma Investments LP, a Delaware limited partnership (“

Hsu Gamma

”),

of which Dr. Hsiao is the general partner. Also includes 2,150,000 shares of Common Stock held by the Chin Hsiung Hsiao Family

Trust A (the “

Family Trust

”), of which Dr. Hsiao is the trustee and her three children are the sole and

exclusive beneficiaries. Dr. Hsiao disclaims beneficial ownership of the securities held by each of Hsu Gamma and the Family

Trust, except to the extent of her pecuniary interest therein.

|

|

(3)

|

Includes

186,159 shares held jointly with Dr. Robinson’s spouse and 26,250 shares owned by Dr. Robinson’s spouse. Dr. Robinson

passed away on May 21, 2019.

|

|

(4)

|

Includes

54,690,325 shares of Common Stock held by Frost Gamma Investments Trust, of which Dr. Frost is the trustee and Frost Gamma

Limited Partnership is the sole and exclusive beneficiary. Dr. Frost is one of two limited partners of Frost Gamma Limited

Partnership. The general partner of Frost Gamma Limited Partnership is Frost Gamma, Inc. and the sole shareholder of Frost

Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is also the sole shareholder of Frost-Nevada Corporation. Dr. Frost disclaims

beneficial ownership of all securities held by Frost Gamma Investments Trust, except to the extent of his pecuniary interest

therein.

|

DIRECTORS

AND EXECUTIVE OFFICERS

Directors

and Executive Officers (after giving effect to the Exchange)

The

table below sets forth certain information concerning the individuals anticipated to be our executive officers and directors after

giving effect to the Exchange, including their names, ages, anticipated positions with us. Our executive officers are chosen by

our Board and hold their respective offices until their resignation or earlier removal by the Board.

In

accordance with our Bylaws, as amended, incumbent directors are elected to serve until our next annual meeting and until each

director’s successor is duly elected and qualified.

|

Name

(1)

|

|

Age

|

|

Position

|

|

Adam

Bergman

|

|

43

|

|

Director,

Chief Executive Officer and President

|

|

Alan

Laifer

|

|

49

|

|

Director

|

|

James

J. Martin

|

|

52

|

|

Director

|

|

Matthew

Meehan

|

|

42

|

|

Director

|

|

Steven

Rubin

|

|

58

|

|

Director

|

|

(1)

|

Mr.

Bergman will be appointed to serve as Chief Executive Officer and President. Messrs. Bergman, Laifer, Martin and Meehan will

be appointed to serve as directors, to fill the vacancies created by the resignation of four directors. Such appointments

will become effective as of the Closing.

|

Directors

(after giving effect to the Exchange)

The

following information pertains to the anticipated members of our Board effective as of the Closing, their principal occupations

and other public company directorships for at least the last five years and information regarding their specific experiences,

qualifications, attributes and skills.

Adam

Bergman

. Mr. Bergman, 43 years old, founded IRAFG, a self-directed individual retirement account and 401(k) administration,

facilitation and consulting firm, and IRA Trust, a licensed public trust company and retirement account custodian. Mr. Bergman

has been the Chief Executive Officer of IRAFG since its formation in 2010 and the President of IRA Trust since its formation in

2015. Mr. Bergman is recognized in the self-directed retirement industry as a leading industry expert on IRAs and 401(k) plans.

He has published seven books on the topic of retirement plans and taxation, is a frequent contributor to Forbes.com and has been

quoted in over 100 major publications on various self-directed retirement topics. Prior to founding IRAFG and IRA Trust, Mr. Bergman

worked as a tax and ERISA attorney at two large “Wall Street” law firms. Mr. Bergman received his B.A. (with distinction)

from McGill University, his law degree (cum laude) from Syracuse University College of Law, and his Masters of Taxation (LLM)

from New York University School of Law.

Mr.

Bergman’s extensive leadership, business, and legal experience, as well as tremendous knowledge of the self-directed retirement

industry generally, qualify him to be a valuable member of the Board.

Alan

Laifer

. Mr. Laifer, 49 years old, recently served as the CEO of Status Media, a media lab headquartered in New York City.

Prior to that, Mr. Laifer was the founder and CEO of Jolt Media, a company specializing in e-marketing solutions, from 2009 to

2011 until it was sold to Paltalk in 2011. Mr. Laifer also co-founded and served as the CEO for Datran Media (now known as Pulsepoint),

a marketing and advertising services company, from 2001 to 2008. Mr. Laifer currently sits on the Board of Directors for Notion

Digital, a digital products and advertising company.

As

a result of Mr. Laifer’s experiences as a chief executive officer, and his extensive experience in online advertising, social

and mobile marketing, he is expected to provide valuable business, leadership and management advice to the Board in many critical

areas, qualifying him to serve as a member of the Board.

James

J. Martin

.

Mr. Martin, 52 years old, has served as the Chief Financial Officer of NIMS since January 2011, and, from July

2010 through January 2011, he served as the Controller of NIMS. Since February 2017, Mr. Martin has served as the Chief Financial

Officer of Cocrystal Pharma, Inc (NASDAQ: COCP), a clinical stage biotechnology company. From November 2016 to February 2017,

Mr. Martin served as Chief Financial Officer of Motus GI Holdings, Inc. (NASDAQ: MOTS), a medical device company. From September

2014 to November 2016, Mr. Martin has served as Chief Financial Officer of VBI Vaccines Inc. (formerly SciVac Therapeutics, Inc.)

(NASDAQ: VBIV), pharmaceutical development and manufacturing company. From April 2014 to September 2015, Mr. Martin served as

Chief Financial Officer of Vapor Corp, Inc. (NASDAQ: VPCO), a vaporizer retail and wholesale company. From January 2011 to October

2, 2013, Mr. Martin served as Chief Financial Officer of SafeStitch prior to its merger with TransEnterix, Inc. (NYSE: TRXC).

From July 2010 through January 2011, Mr. Martin served as Controller of each of SafeStitch and Aero Pharmaceuticals, Inc. (“Aero”).

Mr. Martin previously has served as Vice President of Finance of Aero, a privately held pharmaceutical distributor.

Mr.

Martin’s financial expertise and extensive experience serving as a chief financial officer of several public companies qualifies

him to serve as a member of the Board.

Matthew

Meehan

. Mr. Meehan, 42 years old, currently serves as the Managing Director for Digital Innovation and Strategic Partnerships

at Kawa Capital Management (“Kawa”), an independent asset management firm. Mr. Meehan has almost two decades of experience

as a tech entrepreneur, portfolio manager, derivatives trader and investment banker. Prior to joining Kawa, from 2015 to 2018,

he was founder and president of Dvdendo Inc., a fintech company that owns a mobile investing app for first-time investors across

the Americas. From 2006 to 2015, Mr. Meehan was a proprietary trader and portfolio manager at several New York-based banks and

hedge funds, including Merrill Lynch, Lehman Brothers, and Covepoint Capital, with experience in Latin American markets and derivative

investments. Mr. Meehan has a bachelor’s degree in economics from Amherst College and an MBA from Columbia Business School.

Mr.

Meehan’s wide-ranging business background, expertise in the fintech industry, and significant experiences as a portfolio

manager and derivatives trader, bring a unique perspective to our Board and qualify him to serve as a member of the Board.

Steven

D. Rubin

. Mr. Rubin, 58 years old, has served as a Director of the Company since October 2008. Mr. Rubin has served as

Executive Vice President – Administration since May 2007 and as a director of the OPKO (NASDAQ: OPKO) since February 2007.

Mr. Rubin currently serves on the board of directors of Red Violet, Inc. (NASDAQ CM:RDVT), a software and services company, Cocrystal

Pharma, Inc. (NASDAQ GM:COCP), a publicly traded biotechnology company developing new treatments for viral diseases, Eloxx Pharmaceuticals,

Inc. (NASDAQ CM:ELOX), a clinical stage biopharmaceutical company dedicated to treating patients suffering from rare and ultra-rare

disease caused by premature termination codon nonsense mutations, Castle Brands, Inc. (NYSE American:ROX), a developer and marketer

of premium brand spirits, Neovasc, Inc. (NASDAQ CM:NVCN), a company that develops and markets medical specialty vascular devices,

and ChromaDex Corp. (NASDAQ CM:CDXC), a science-based, integrated nutraceutical company devoted to improving the way people age.

. Mr. Rubin previously served as a director of VBI Vaccines, Inc. (NASDAQ CM:VBIV), a biopharmaceutical company developing next

generation vaccines, BioCardia, Inc.(OTC US:BCDA), clinical-stage regenerative medicine company developing novel therapeutics

for cardiovascular diseases, Cogint, Inc. (NASDAQ GM:COGT), an information solutions provider focused on the data-fusion market,

prior to the spin-off of its data and analytics operations and assets into Red Violet, Inc., Kidville, Inc. (OTCBB:KVIL), which

operates large, upscale facilities, catering to newborns through five-year-old children and their families and offers a wide range

of developmental classes for newborns to five-year-olds,, Dreams, Inc. (NYSE American:DRJ), a vertically integrated sports licensing

and products company, and Safestitch Medical, Inc. prior to its merger with TransEnterix, Inc. Mr. Rubin also served as the Senior

Vice President, General Counsel and Secretary of IVAX from August 2001 until September 2006.

Mr.

Rubin brings extensive leadership, business, and legal experience, as well as tremendous knowledge of our business and the pharmaceutical

industry generally, to the Board. He has advised pharmaceutical companies in several aspects of business, regulatory, transactional,

and legal affairs for more than 25 years. His experience as a practicing lawyer, general counsel, management executive and board

member to multiple public companies, including several pharmaceutical and life sciences companies, has given him broad understanding

and expertise, particularly relating to strategic planning and acquisitions.

Executive

Officers (After giving effect to the Exchange)

The

following information pertains to our anticipated executive officers effective as of the Closing.

Adam

Bergman

.

Mr. Bergman founded IRAFG and IRA Trust and has been the Chief Executive Officer of IRAFG since 2010 and the

President of IRA Trust since 2015. Mr. Bergman will be appointed to serve as Chief Executive Officer and President of the Company

effective as of the Closing in accordance with the Exchange Agreement. Mr. Bergman’s biographical information is set forth

above under “

—Directors (after giving effect to the Exchange)

”

Directors

and Executive Officers (Prior to giving effect to the Exchange)

The

following information pertains to those current Board members and executive officers who are anticipated to resign upon consummation

of the Exchange. Dr. Morton Robinson, who had served as a Director since 1989, passed away on May 21, 2019.

Jane

H. Hsiao, Ph.D., MBA

.

Dr. Hsiao, 71 years old, has served as a Director and Chairman of the Board of the Company since

October 2008 and as Interim Chief Executive Officer since February 2012. Dr. Hsiao has served as Vice Chairman and Chief Technical

Officer of OPKO Health, Inc. (“

OPKO

”), a specialty healthcare company, since May 2007 and as a director since

February 2007. Dr. Hsiao served as the Vice Chairman – Technical Affairs of IVAX from 1995 to January 2006. Dr. Hsiao served

as Chairman, Chief Executive Officer and President of IVAX Animal Health, IVAX’s veterinary products subsidiary, from 1998

to 2006. Dr. Hsiao is also a director of each of TransEnterix, Inc., a medical device company, Neovasc, Inc., a company developing

and marketing medical specialty vascular devices, and Cocrystal Pharma, Inc., a biotechnology company developing antiviral therapeutics

for human diseases. Dr. Hsiao previously served as a director for Sorrento Therapeutics, Inc., a development stage pharmaceutical

company, PROLOR Biotech, Inc., prior to its acquisition by OPKO in August 2013, and as Chairman of the Board of SafeStitch Medical,

Inc., a medical device company, prior to its merger with TransEnterix, Inc.

Dr.

Hsiao’s background in medical device and pharmaceutical industry, as well as her senior management experience, allow her

to play an integral role in overseeing our product development and regulatory affairs and in navigating the regulatory pathways

for our products and product candidates. In addition, as a result of her role as director and/or chairman of other companies in

the biotechnology and life sciences space, she also has a keen understanding and appreciation of the many regulatory and development

issues confronting pharmaceutical and biotechnology companies.

Steven

D. Rubin

.

Mr. Rubin’s biographical information is set forth above under “—

Directors (after giving

effect to the Exchange)

”.

James

J. Martin

.

Mr. Martin’s biographical information is set forth under “—

Directors (after giving effect

to the Exchange)

”.

Marvin

A. Sackner, M.D.

Dr. Sackner, 86 years old, has served as a Director since he was first elected as our Chairman of the

Board, Chief Executive Officer and Director in November 1989 and served as Chairman of the Board from November 1989 until October

2008. He served as our CEO from 1989 until 2002 and from December 2007 to February 2012. In 1977, Dr. Sackner co-founded Respitrace

Corporation, a predecessor to the Company, and was the Chairman of its board of directors from 1981 until October 1989. Dr. Sackner

served as a director of Continucare Corporation (“Continucare”), a provider of outpatient healthcare services, until

October 2011. From 1974 until October 1991, Dr. Sackner was the Director of Medical Services at Mount Sinai in Miami Beach, Florida.

From 1973 through 1996, he served as Professor of Medicine, University of Miami at Mount Sinai. Since 2004, he has been Voluntary

Professor of Medicine, Leonard Miller Medical School of University of Miami. From 1979 to 1980, Dr. Sackner was the President

of the American Thoracic Society. Dr. Sackner was the Chairman of the Pulmonary Disease Subspecialty Examining Board of the American

Board of Internal Medicine from 1977 to 1980. In 2007, he was awarded an Honorary Doctorate Degree for “outstanding work

in the entire field of pulmonology and sleep disorders,” by the University of Zurich (Switzerland). Dr. Sackner holds more

than 30 U.S. patents and has published four books and more than 200 scientific papers.

Dr.

Sackner’s experience as the Company’s former CEO, as a medical doctor and as the primary inventor of the Company’s

products enables him to provide valuable board leadership and insight into the development of our products.

Subbarao

V. Uppaluri, Ph.D.

Dr. Uppaluri, 69 years old, has served as a Director of the Company since October 2008. Dr. Uppaluri

served as Senior Vice President and Chief Financial Officer of OPKO from May 2007 until July 2012 and as a consultant of OPKO

until February 2014. Dr. Uppaluri is a member of The Frost Group. Dr. Uppaluri served as the Vice President, Strategic Planning

and Treasurer of IVAX from 1997 until December 2006. Before joining IVAX, from 1987 to August 1996, Dr. Uppaluri was Senior Vice

President, Senior Financial Officer and Chief Investment Officer with Intercontinental Bank, a publicly traded commercial bank

in Florida. In addition, he served in various positions, including Senior Vice President, Chief Investment Officer and Controller,

at Peninsula Federal Savings & Loan Association, a publicly traded Florida S&L, from October 1983 to 1987. His prior employment,

during 1974 to 1983, included engineering, marketing and research positions with multinational companies and research institutes

in India and the United States. Dr. Uppaluri previously served on the boards of OPKO, Winston Pharmaceuticals Inc., Ideation Acquisition

Corp., Tiger X Medical, Inc. and Kidville.

Dr.

Uppaluri brings extensive leadership, business, and accounting experience, as well as knowledge of our business and the pharmaceutical

industry generally, to the Board. His experience as the former chief financial officer of OPKO and board member to multiple public

companies, including several pharmaceutical and life sciences companies, has given him broad understanding and expertise, particularly

relating to business, accounting and finance matters.

Involvement

in Legal Proceedings

To

the Company’s knowledge, there are no material proceedings to which any current or incoming director, officer or affiliate

of the Company, any owner of record or beneficially of more than 5% of the Common Stock, or any associate of any such director,

officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries.

Arrangements

for Appointment of Directors and Officers

Pursuant

to the Exchange Agreement, as of the Closing, IRA Financial has the right to appoint three of the five directors of the Company

and has the right to designate all of the executive officers of the Company. For more information see the section of this Information

Statement entitled “

Change of Control—Change in Board of Directors and Executive Officers

.”

Family

Relationships

There

are no family relationships among the members of our Board or our executive officers (including the individuals who are expected

to serve on our Board or as our executive officers after the Exchange).

Composition

of the Board

In

accordance with our Articles of Incorporation, as amended, the Board is elected annually as a single class.

CORPORATE

GOVERNANCE

The

following information describes our current corporate governance arrangements prior to the Exchange. It is anticipated that, after

the consummation of the Exchange, the Board will appoint new directors to the existing committees of the Board and make independence

determinations with respect to the Incoming Directors.

Code

of Ethics

We

have adopted a Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer

and other persons performing similar functions. A copy of our Code of Business Conduct and Ethics is available on our website

at

www.nims-inc.com

. We intend to post amendments to, or waivers from a provision of, our Code of Business Conduct and

Ethics that apply to our principal executive officer, principal financial officer or persons performing similar functions on our

website. Neither our website nor any information contained or linked therein constitutes a part of this Information Statement.

Section

16(a) Beneficial Ownership Reporting Compliance

Under

Section 16(a) of the Exchange Act, our directors, executive officers and persons who own more than ten percent (10%) of our Common

Stock are required to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other

equity securities of the Company. To our knowledge, based solely on a review of copies of such reports furnished to us during

and/or with respect to the year ended July 31, 2018, we are not aware of any late or delinquent filings required under Section

16(a) of the Exchange Act in respect of our Common Stock or other equity securities of the Company.

Board

of Directors and Committees Thereof

Director

Independence

The

Board, in the exercise of its reasonable business judgment, has determined that each of the Company’s directors qualifies

as an independent director pursuant to Nasdaq Stock Market Rule 5605(a)(2) and applicable SEC rules and regulations, with the

exception of Dr. Marvin Sackner, who previously was employed as our Chief Executive Officer, and Dr. Hsiao, who currently serves

as the Company’s interim Chief Executive Officer. Dr. Subbarao V. Uppaluri and Steven D. Rubin comprise our Audit Committee,

and each such person is “independent” for audit committee purposes as defined by the more stringent standard contained

in Nasdaq Stock Market Rule 5605(c)(2).

Board

Committees and Meeting Attendance

The

Board conducts its business through meetings of the full Board and through its Audit and Compensation Committees. We do not have

any other standing committees of the Board. The Board and its committees also act by written consent. During the year ended July

31, 2018, the Board acted via written consent on three occasions. During the year ended July 31, 2018, each of the current directors

attended at least 75% of the aggregate of the Board meetings and the meetings of each committee on which such director served.

We

do not have a policy with respect to Board members’ attendance at annual meetings of shareholders. We did not hold an annual

meeting during the year ended July 31, 2018.

Audit

Committee

We

have a separately-designated standing audit committee, established in accordance with section 3(a)(58)(A) of the Exchange Act.

The Board has adopted a charter that sets forth the responsibilities of the Audit Committee, which is available on our website

located at http://www.nims-inc.com/corporate-gov.aspx. During the year ended July 31, 2018, the Audit Committee met on five occasions.

The

Audit Committee is composed of Dr. Subbarao V. Uppaluri, Chairman, and Steven D. Rubin. Our Board has determined that Dr. Uppaluri

is an audit committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K.

Compensation

Committee

We

have a separately-designated standing compensation committee. The Board has adopted a charter that sets forth the responsibilities

of the Compensation Committee, which is available on our website located at http://www.nims-inc.com/corporate-gov.aspx. During

the year ended July 31, 2018, the Audit Committee did not meet. The Compensation Committee is composed of Dr. Subbarao V. Uppaluri

and Steven D. Rubin. The Board has delegated to the Compensation Committee its responsibilities and authority relating to the

compensation and evaluation of our executive officers, including establishing compensation policies and philosophies for the Company

and its executive officers and reviewing and approving corporate goals and objectives relevant to our Chief Executive Officer’s

compensation, as well as overseeing our incentive compensation plans and equity-based plans. The Compensation Committee has the

power to create subcommittees with such powers as the Compensation Committee may from time to time deem necessary or appropriate.

Nominating

Committee

We

do not have a standing nominating committee or a committee performing similar functions. The entire Board participates in the

consideration of director nominees. The Board Directors believes that a nominating committee separate from the whole Board is

not necessary at this time to ensure that candidates are appropriately evaluated and selected given the size of the Company and

the Board. The Board of Directors also believes that, given the Company’s size and the size of its Board of Directors, an

additional committee would not add to the effectiveness of the evaluation and nomination process. For these reasons, the Board

believes that it is not necessary to appoint a nominating committee. The Board does not have a charter relating to its nominating

functions.

Director

Selection Criteria

The

Board reviews, considers and discusses the appropriate qualifications, skills, and experience expected of individual members and

of the Board with the objective of having a Board with sound judgment and diverse backgrounds and experience to represent stockholder

interests.

The

Board does not specify formal minimum qualifications that must be met by a nominee for director, nor does the Board have a formalized

process for identifying and evaluating nominees for director. Nominees for election to the Board should possess sufficient business

or financial experience and a willingness and ability to devote the time and effort necessary to discharge the responsibilities

of a director. This experience can include, but is not limited to, service on other boards of directors or active involvement

with other boards of directors, experience in the industries in which the Company conducts its business, audit and financial expertise,

medical device experience, operational experience, or a scientific or medical background. Nominees for election to the Board should

not be selected through mechanical application of specified criteria. Rather, the qualifications and strengths of individuals

should be considered in their totality with a view to nominating persons for election to the Board whose backgrounds, integrity,

and personal characteristics indicate that they will make a positive contribution to the Board. Additionally, the Board will consider

such other factors as it deems appropriate.

While

we do not have a formal diversity policy with respect to Board composition, the Board believes it is important for the Board to

have diversity of knowledge base, professional experience and skills, and these qualities are taken into account when considering

director nominees for recommendation to the Board.

Board

Nominations by Security Holders

To

date, no shareholder who is not also a director has presented any candidate for consideration for board membership to the Company.

Therefore, at this time, we do not have a formal policy relating to the consideration of any director candidates recommended by

our shareholders. However, the Board believes its process for evaluation of nominees proposed by shareholders would be no different

from the process of evaluating any other candidate.

The

Board will consider candidates recommended by our shareholders pursuant to written applications submitted to our Corporate Secretary,

which applications should include a short biography of the nominee. There have been no changes to the procedures by which security

holders may recommend nominees to our Board.

Communication

with the Board

Interested

parties who want to communicate with the Board as a whole or any individual Board member should address their communications to

the Board or the individual Board member, as the case may be, and send them to c/o Corporate Secretary, Non-Invasive Monitoring

Systems, Inc., 4400 Biscayne Blvd., Suite 180, Miami, Florida 33137 or call the Corporate Secretary at (305) 575-4207. The Corporate

Secretary will forward all such communications directly to such Board members. Any such communications may be made on an anonymous

and confidential basis.

Board

Leadership Structure

Dr.

Jane Hsiao currently serves both as the Chairman of the Board and as our interim Chief Executive Officer. Given the Company’s

current size, we believe that the same person taking on a dual role appropriately addresses the needs of the Company and its shareholders.

We do not currently have a lead independent director.

Board

Role in Risk Oversight

The

Board’s role in the risk oversight process includes receiving regular reports from our interim Chief Executive Officer and

our Chief Financial Officer on areas of material risk to the Company, including operational, financial, legal and regulatory risks.

In connection with its reviews of the operations of the Company’s business and its corporate functions, the Board considers

and addresses the primary risks associated with these operations and functions. Our full Board regularly engages in discussions

of the most significant risks that the Company is facing and how these risks are being managed. In addition, the Audit Committee

plays a role in overseeing risk management issues that fall within its areas of responsibility, as set forth in the Audit Committee’s

charter.

DIRECTOR

COMPENSATION

For

the year ended July 31, 2018, our directors did not receive any compensation for their service on our Board or any committee thereof.

Our directors do not have any outstanding stock options.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

The

following table summarizes the compensation information for the years ended July 31, 2018 and 2017 for our principal executive

officer and each of the two most highly compensated executive officers receiving compensation in excess of $100,000 in any such

fiscal year. We refer to these persons as our named executive officers.

|

Name

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Option Awards

($)

|

|

|

All Other Compensation

($)

|

|

|

Total

($)

|

|

Jane Hsiao

|

|

|

2018

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Interim Chief Executive Officer (1)

|

|

|

2017

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

(1)

Dr. Hsiao received no salary from the Company and does not have any outstanding stock option awards.

Outstanding

Equity Awards as of July 31, 2018

None

of our named executive officers had any outstanding equity awards as of July 31, 2018.

Risk

Considerations in our Compensation Programs

We

have reviewed our compensation structures and policies as they pertain to risk and have determined that our compensation programs

do not create or encourage the taking of risks that are reasonably likely to have a material adverse effect on the Company.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

The

following information provides certain disclosures regarding related party transactions and director independence matters of the

Company since the beginning of the Company’s last fiscal year.

Our

principal corporate office is located at 4400 Biscayne Blvd., Suite 180, Miami, Florida. We rent this space from Frost Real Estate

Holdings, LLC, a company controlled by Dr. Phillip Frost, who is the beneficial owner of more than 10% of our Common Stock. We

currently lease approximately 1,800 square feet under the lease agreement, which had a five-year term that began on January 1,

2008. The lease required annual rent of approximately $56,000, and increased by approximately 4.5% per year. The lease expired

on December 31, 2012, and we had been renting on a month-to-month basis at approximately $1,250 per month. In February 2016 the

office space rent was reduced to $0 per month.

Dr.

Hsiao, Dr. Frost and directors Steven Rubin and Rao Uppaluri are each stockholders, current or former officers and/or directors

or former directors of TransEnterix, Inc. (formerly SafeStitch Medical, Inc.) (“

TransEnterix

”), a publicly-traded

medical device company. The Company’s Chief Financial Officer also served as the Chief Financial Officer of TransEnterix

until October 2, 2013. The Company’s Chief Financial Officer continued as an employee of TransEnterix until March 3, 2014,

during which he supervised the Miami based accounting staff of TransEnterix under a cost sharing arrangement whereby the total

salaries of the Miami based accounting staff was shared by the Company and TransEnterix. The Chief Financial Officer continues

to serve as the Chief Financial Officer of Cocrystal Pharma, Inc., a clinical stage biotechnology company, and in which Steve

Rubin and Jane Hsiao, serve on the Board. Since December 2009, the Company’s Chief Legal Officer has served under a similar

cost sharing arrangement as the Chief Legal Officer of TransEnterix. The Company recorded additions to selling, general and administrative

costs and expenses to account for the sharing of costs under these arrangements of $5,000 for the years ended July 31, 2018 and

2017, respectively. Aggregate accounts payable to TransEnterix totaled approximately $800 and $800 at July 31, 2018 and 2017,

respectively.

On

March 31, 2010, the Company entered into the Credit Agreement with FGIT, a trust controlled by Dr. Phillip Frost, which beneficially

owns in excess of 10% of the Common Stock, and Hsu Gamma, an entity controlled by the Company’s Chairman and Interim CEO

(together, the “

Lenders

”), pursuant to which the Lenders had provided a revolving credit line in the aggregate

principal amount of up to $1.0 million, which was secured by all of the Company’s personal property. Pursuant to the Debt

Exchange Agreement, we terminated the Credit Facility and the security interests granted thereunder on December 21, 2018. See

“

Change of Control—Debt Exchange and Pipe

”.

Between

September 2011 and November 2018, we issued a series of promissory notes, each bearing interest at an annual rate of 11%, in the

aggregate principal amounts of $575,000, $300,000 and $300,000 to FGIT, Dr. Hsiao and Hsu Gamma, an entity controlled by Dr. Hsiao,

respectively, all of which were set to mature in July 2020.

On

December 21, 2018, we satisfied in full all of our obligations under the foregoing promissory notes pursuant to the Debt Exchange

Agreement. Additionally, on December 21, 2018, we entered into stock purchase agreements with FGIT and Dr. Hsiao, pursuant to

which we issued and sold to FGIT and Dr. Hsiao an aggregate of 8,571,428 shares of Common Stock at a purchase price of $0.07 per

share. See “

Change of Control—Debt Exchange and Pipe

”.

The

Audit Committee of the Board reviews and approves all transactions that are required to be reported under Item 404(a) of Regulation

S-K, including each transaction described above. In order to approve a related party transaction, the Audit Committee requires

that (i) such transactions be fair and reasonable to us at the time it is authorized by the Audit Committee and (ii) such transaction

must be authorized, approved or ratified by the affirmative vote of a majority of the members of the Audit Committee who have

no interest, either directly or indirectly, in any such related party transaction.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet

site that contains reports, proxy and information statements, and other information that we file electronically with the SEC and

which are available at the SEC’s website at http://www.sec.gov.

You

may request a copy of these filings at no cost by writing us at Non-Invasive Monitoring Systems, Inc. Investor Relations, 4400

Biscayne Blvd., Suite 180, Miami, Florida 33137 or telephoning us at (305) 575-4200.

Statements

contained in this Information Statement concerning the provisions of any documents are summaries of those documents, and each

statement is qualified in its entirety by reference to the copy of the applicable document filed with the SEC.

Dated:

May 29, 2019

|

|

Non-Invasive

Monitoring Systems, INC

.

|

|

|

|

|

|

|

By:

|

/s/

James J. Martin

|

|

|

Name:

|

James

J. Martin

|

|

|

Title:

|

Chief

Financial Officer

|

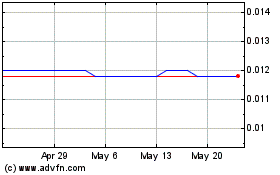

Non Invasive Monitoring ... (PK) (USOTC:NIMU)

Historical Stock Chart

From May 2024 to Jun 2024

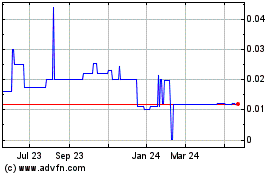

Non Invasive Monitoring ... (PK) (USOTC:NIMU)

Historical Stock Chart

From Jun 2023 to Jun 2024