By Suryatapa Bhattacharya, River Davis and Kosaku Narioka

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 18, 2019).

TOKYO -- When U.S.-based hedge-fund partner Robert Hale becomes

an Olympus Corp. director in June, it will mark a milestone in

Japan's opening up to activist investors.

Tokyo market participants say they believe it is the first time

a major Japanese company is bringing a U.S. activist onto its

board. ValueAct Capital, the San Francisco-based hedge fund where

Mr. Hale is a partner, has a 5.5% Olympus stake.

Dozens of other activist campaigns are under way in Japan. One

of Toshiba Corp.'s largest shareholders, New York-based King Street

Capital Management which holds a 5.4% stake, is seeking to replace

a majority of the company's board with its own candidates. Japanese

companies in 46 instances were subjected to activist demands in

2018, more than double the figure two years earlier, according to

data provider Activist Insight.

"Japan is entering a new era of shareholders becoming more vocal

and willing to push out underperforming managements and replace

complacent boards," says Jefferies analyst Zuhair Khan, who has

been following the Japan corporate scene for a quarter-century.

One reason is the gradual impact of changes put forward by Prime

Minister Shinzo Abe's government, which has tried to revitalize the

economy by shaking up corporate management.

A corporate-governance code, first instituted in 2015, was

strengthened last year to call for more women and non-Japanese

executives on company boards. A voluntary code for institutional

investors has compelled many to disclose how they voted at each

company and give reasons for their votes.

And American investors have refined their game from the days

when swashbuckling investors like T. Boone Pickens arrived in Tokyo

with aggressive demands that led Fortress Japan to raise its

drawbridges.

Today's American activists are more likely to quote Mr. Abe and

start off with relatively modest suggestions like adding foreigners

to the board rather than demanding a large special dividend or

corporate breakup. They choose their targets more carefully, often

picking troubled companies like Olympus and Toshiba where the

Japanese management and institutional shareholders are open to

change.

"If you are outside and you're antagonistic, we just don't find

for ValueAct that approach is effective," says Allison Bennington,

a partner at the San Francisco fund.

Japan still has a long way to go before it has diverse boards

and an abundance of well-governed companies. Only 73 of the top 500

companies listed on the Tokyo Stock Exchange have one or more

non-Japanese members on their board, according to Jefferies.

Executive search firm Spencer Stuart says 3% of board members at

Japanese companies are foreigners, compared with 8% in the U.S. and

25% in Germany.

Olympus has faced a long list of scandals in recent years, most

notably a $1.5 billion loss-hiding scheme that was exposed by

former Chief Executive Michael Woodford in 2011.

Even after the company and its former president were found

guilty of violating securities laws in 2013, the problems

continued. In January 2018, one of its in-house lawyers filed a

lawsuit against the company, saying he faced retaliation when

investigating bribery allegations in China. Olympus said it hired

outside law firms to investigate those allegations and they found

no direct evidence of bribery. It declined to comment on the

lawsuit, which is pending.

In December, an Olympus unit agreed to pay $85 million after

pleading guilty to U.S. charges that it failed to report infections

linked to one of its medical devices.

Yasuo Takeuchi, who took over as CEO on April 1, said Olympus's

run-ins with the law were "lucky" because "they forced us to look

at our company's corporate governance."

At their annual meeting in June, shareholders are set to

establish nomination, compensation and audit committees on the

board. They are aimed at better separating the board's oversight

role from management's execution tasks, like at most U.S.

companies. That was a proposal of ValueAct, which won't only get a

partner, Mr. Hale, on the board but also a former ValueAct adviser

and medical-technology executive, Jim Beasley.

"We introduced Olympus to Mr. Beasley," says Ms. Bennington of

ValueAct, adding that the company was open to Western board members

with operational experience.

Olympus gets nearly 80% of its revenue from endoscopes and other

medical technology, yet much of the century-old company's identity

among consumers is tied to its camera business.

Whether to scale back or sell that business, as some analysts

advocate after losses in recent years, is a delicate question that

ValueAct has stayed away from publicly. Olympus replaced the CEO

who had continued pursuing the camera business with Mr. Takeuchi,

who says the company is going to focus on medical devices.

As part of its transition, four new foreign executives joined

the company at its Tokyo headquarters in April, adding to a small

number who entered Olympus earlier.

Caroline West, an American lawyer with decades of experience at

health-care companies like Europe's Shire PLC and Sanofi SA, was

appointed Olympus's global chief compliance officer in 2016. When

taking the job, she says she asked management questions like "am I

just the latest fad or are companies actually making a change?"

Three years later, she thinks it is the latter. Ms. West is

introducing a global hotline for compliance and learning the

consensus-building that is needed at Japanese companies.

"Don't just snap your fingers and expect to change hundreds of

years of history," she says.

Write to Suryatapa Bhattacharya at

Suryatapa.Bhattacharya@wsj.com and Kosaku Narioka at

kosaku.narioka@wsj.com

(END) Dow Jones Newswires

April 18, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

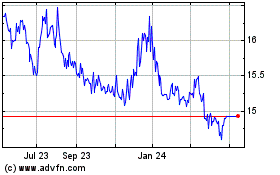

Toshiba (CE) (USOTC:TOSYY)

Historical Stock Chart

From Apr 2024 to May 2024

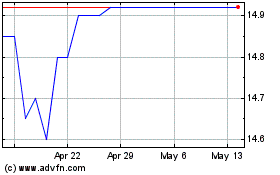

Toshiba (CE) (USOTC:TOSYY)

Historical Stock Chart

From May 2023 to May 2024