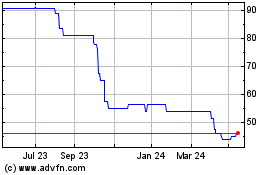

TIDMMCON

RNS Number : 6410S

Mincon Group Plc

13 March 2023

Mincon Group plc

("Mincon" or the "Group")

2022 Full Year Financial Results

Mincon Group plc (Euronext: MIO AIM:MCON), the Irish engineering

group specialising in the design, manufacture, sale and servicing

of rock drilling tools and associated products, announces its

results for the year ended 31 December 2022.

Change

2022 2021 in period

---------------------------- -------- ------- -----------

Product revenue: EUR'000 EUR'000

Sale of Mincon product 141,830 118,802 +19%

Sale of third-party product 28,178 25,560 +10%

Total revenue 170,008 144,362 +18%

-----------

Gross profit 54,070 48,763 +11%

---------------------------- -------- ------- -----------

EBITDA 27,531 25,212 +9%

---------------------------- -------- ------- -----------

Operating profit 19,749 18,107 +9%

---------------------------- -------- ------- -----------

Profit for the period 14,704 14,600 +1%

---------------------------- -------- ------- -----------

Financial Highlights

-- 2022 Group revenue of EUR170 million, representing 18% growth over 2021:

o Revenue across each of our three industries grew in 2022:

-- The stand out performance was in construction with revenue

growth of 45%

-- Mining, our largest industry, had revenue growth of 6%

-- Waterwell/geothermal revenue grew by 7%

o The vast majority of growth was organic, with the 2022

acquisition in the USA contributing 0.5% to our revenue growth for

the year

-- Gross profit grew by 11% in 2022 to EUR54.1 million, with

gross margin for the year of 31.8% (2021:33.8%):

-- Price increases implemented in H2 2022 offset the

well-reported manufacturing cost inflation experienced in H1

2022

-- 2022 gross margin is inclusive of significant Greenhammer and

Subsea project costs absorbed during H2 2022

-- EBITDA of EUR27.5 million in 2022, an increase of 9% over 2021

-- Final dividend of 1.05c per ordinary share recommended,

taking the total dividend for 2022 to 2.10c per ordinary share

(2021: 2.10c per ordinary share)

Operational and Business Development Highlights

-- Navigated the difficult environment in H1 2022 arising from

raw materials and freight availability pressures and maintained our

excellent customer service levels, conserving or growing market

share in our key markets. These pressures started to ease in H2

2022 and as a result we have started to normalise our shipping

arrangements and working capital position

-- Signing of the first commercial contract for the Greenhammer

system with a blue-chip mining contractor operating on a major gold

mine in Western Australia

-- Significant milestones achieved with our Subsea project and

the large diameter drilling system in Malaysia

-- The Group's order books are strong, and the opportunity for

our large R&D projects is ever more evident with critical work

continuing in 2023

Chief Executive's Review:

"Despite what was another challenging year characterised by

volatility and uncertainty in the global markets in which we

operate, I am pleased to report that Mincon delivered further

growth in revenue and profitability in 2022.

Revenues

We achieved revenue growth across all our industries and

finished the year ahead of 2021 by approximately 18%, driven by

continued organic growth.

Our construction segment delivered strong growth levels with

revenues up 45% on 2021 to EUR61.8 million as a result of a

particularly strong performance in North America where our direct

to market approach for mid-to-large projects delivered some

excellent contract wins.

Revenue in our mining business was up 6% in the year to EUR81.4

million, mostly through organic growth. Again, North America was

the standout here, while we also managed to grow our revenues in

Africa as COVID-19 restrictions eased there at the beginning of

2022. Conversely, our mining business in the EME and APAC regions

was more challenged during the period reflecting suspension of

trading with Russian customers, decisions by some customers to

reduce carried inventory and the effects of site access

restrictions in Australia.

Finally, our Waterwell / Geothermal segment achieved 7% revenue

growth in 2022 to EUR26.7 million, again primarily due to strong

performance in North America where our direct sales approach to

smaller contractors proved effective. Revenue in the EME region was

broadly flat in the year but we managed to protect our market share

in Geothermal consumables.

Profitability

2022 was characterised by heavy cost inflation globally, with

the biggest effect being felt in Europe, largely due to the war in

Ukraine. We continued to navigate poor freight conditions which

hampered our ability to provide the excellent service-levels our

customers expect, as well as requiring working capital investment

due to the higher levels of inventory required to manage extended

shipping transit times.

We introduced price increases in Q2 2022, and those were

implemented in Q3 2022. These largely offset the cost increases in

our manufacturing during the second half of 2022, however during

that period we significantly increased our development spend

through our Greenhammer and Subsea projects, as we continue to

invest strategically in long-term growth projects.

Freight conditions did start to improve toward the end of the

year, and this has encouraged us to look critically at our

inventory levels across the group. This will be a strong focus for

the year ahead and we have started a group wide project to unwind

our working capital position by reducing our inventory to better

match prevailing conditions.

As well as this we have largely succeeded in reducing our lead

times from key factories such as Shannon which has given the

breathing space to carefully plan our production based on forecasts

and to reduce our reliance on more expensive air freight

requirements which arose from time to time during 2022 to ensure

product delivery to key customers.

Our strong regional management structure continued to work well

throughout the year as it had previously demonstrated during the

COVID crisis. The last business area to open for travel was Western

Australia in March 2022. This opening up has meant that we have

been able to return to on-the-ground business development to

rebuild our revenues in the region.

Product Development

A significant part of rebuilding our revenues in the Australian

market will be through our Greenhammer project. As previously

announced in September 2022, we were pleased to announce the

signing of the first commercial contract for the Greenhammer system

with a blue-chip mining contractor operating on a major gold mine

in Western Australia, an important milestone after many years of

development work and a step toward revenue generation from this

project.

We have been on site with the system drilling blastholes with

our Mincon owned test rig. The Greenhammer system has performed to

expectations when operating. However, it has been challenging to

consistently deliver drilled metres due to reliability issues

encountered with the drill rig. As a result, we had to carry out an

extensive rebuild on the rig which we are confident will reliably

support the system. While this delay has been frustrating in the

short term, we remain confident in the long-term success of this

project and believe that the system will be transformational for

Mincon and the hard rock surface mining industry.

We believe that the successful roll out of this innovative

drilling system will require that we closely collaborate with rig

manufacturers to ensure the system is properly supported on a

reliable drill rig platform. With that in mind we have engaged in

discussions with rig manufacturers with a view to developing

mutually beneficial working relationships.

We have made significant progress on our subsea project with a

number of significant milestones achieved on the road to completing

our project objectives for the Disruptive Technology Innovation

Funded (DTIF) collaboration. The objective of the project is to

deliver a load tested anchor solution for the offshore wind turbine

industry. We remain confident that we will achieve the project

objectives and in so doing, we can commence the commercialisation

of this exciting opportunity in collaboration with our project

partner, Subsea Micropiles Limited.

We have successfully drilled test holes with our full-size

prototype water powered hammer system. This was test drilled in a

quarry close to our manufacturing plant in Shannon using an

excavator mounted drilling rig which was designed and manufactured

in our plant in Benton. This drill rig is one of three units that

will ultimately be assembled in our Shannon plant, to complete the

subsea drilling rig. The assembly work will commence in the first

half of 2023 with a view to being offshore for testing toward the

end of this year. There is a significant interest in our solution

from offshore developers and we have engaged with a top-class

multifunctional team to develop the full commercial solution which

will include expertise and delivery in areas such as large-scale

fabrication, subsea electronics, grouting, mooring lines and vessel

services including subsea remote operating vehicles.

Our engineering focus continues to be on more efficient drilling

systems, and we have made progress in 2022 on continuous

improvement initiatives for some of our current products which will

serve us well for the year ahead. We also finally got onsite in

Malaysia, after COVID-19 restrictions were lifted, to see our large

diameter drilling system drilling 1750 mm diameter holes. We were

very happy with the performance of the system and believe that

there is a great future for this concept within our product

offering for the large diameter construction piling industry.

Sustainability

In August 2022 we published our first sustainability report

which outlined our commitment to report on carbon emissions across

the group as well as targets to reduce them. Within the report, we

outlined the measures and initiatives to meet the company's

sustainability goals by 2040 and our intermediate goals by 2030. An

Environment and Sustainability sub-committee of the Board, led by

Dr. Pirita Mikkanen who joined the Board as a non-executive

director in 2022, was formed to ensure that our sustainability

goals are met, and appropriate new targets set. Key initial targets

for Mincon include a 50% reduction in manufacturing CO2 emissions

by 2030, to achieve net zero carbon emissions by 2040 and to have

100% of Mincon manufacturing sites using a mix of fossil-fuel free

energy sources by 2040. We look forward to reporting on the

progress we are making on meeting our targets during our ongoing

sustainability journey. Our next sustainability report is due to be

published in line with our interim results in August 2023.

Concluding comments

It is pleasing to be able to report on a further year of revenue

and profit growth for Mincon in 2022, during what proved to be a

challenging environment and, I am particularly encouraged with the

resilience displayed by the Company in meeting and overcoming the

challenges presented by inflation, the global supply chain and

residual market access restrictions due to COVID. Whilst these

challenges delayed our ambitions to fully realise the opportunities

and deliver on the growth platform we have created, we remain

confident that we will deliver in the year ahead as well as make

significant progress on our ambitious product development

projects.

These ambitious projects challenge us, but they are essential to

underpin our future, maintain our competitive advantages and to

drive our profitability and return on capital employed. It also

ensures our sustainability as we develop and attract future

engineering leaders within the Group.

I am very pleased and appreciative of the efforts and

perseverance of our global teams across engineering, manufacturing,

and customer service, in delivering these results for last year. I

would also like to acknowledge the continued support of our board

and investors and look forward to the challenges and opportunities

in the year ahead."

13 March 2023

For further information, please contact:

Mincon Group plc Tel: +353 (61) 361 099

Joe Purcell CEO

Mark McNamara CFO

Davy Corporate Finance

(Nominated Adviser, Euronext Growth Listing Sponsor and Joint

Broker) Tel: +353 (1) 679 6363

Anthony Farrell

Daragh O'Reilly

Shore Capital (Joint Broker) Tel: +44 (0) 20 7408 4090

Malachy McEntyre

Mark Percy

Daniel Bush .

Consolidated Income Statement for the year ended 31 December

2022

2022 2021

Notes EUR'000 EUR'000

----------------------------------- ------- ---------- ----------

Continuing operations

Revenue 4 170,008 144,362

Cost of sales 6 (115,938) (95,599)

---------- ----------

Gross profit 54,070 48,763

Operating costs 6 (34,321) (30,656)

---------- ----------

Operating profit 19,749 18,107

Finance costs 7 (1,479) (927)

Finance income 26 20

Foreign exchange gain 469 630

Movement on deferred consideration 22 (31) (2)

Profit before tax 18,734 17,828

-----------------------------------

Income tax expense 11 (4,030) (3,228)

----------------------------------- ------- ---------- ----------

Profit for the period 14,704 14,600

----------------------------------- ------- ---------- ----------

Earnings per Ordinary Share

Basic earnings per share, 20 6.92 6.87

Diluted earnings per share, 20 6.85 6.69

----------------------------------- ------- ---------- ----------

The accompanying notes are an integral part of these financial

statements.

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2022

2022 2021

EUR'000 EUR'000

--------------------------------------------------- -------- --------

Profit for the year 14,704 14,600

Other comprehensive loss:

Items that are or may be reclassified subsequently

to profit or loss:

Foreign currency translation - foreign operations (418) 2,865

Other comprehensive (loss)/income for the year (418) 2,865

--------------------------------------------------- -------- --------

Total comprehensive income for the year 14,286 17,465

--------------------------------------------------- -------- --------

The accompanying notes are an integral part of these financial

statements.

Consolidated Statement of Financial Position as at 31 December

2022

2022 2021

Notes EUR'000 EUR'000

------------------------------------- ----- ------------------ -----------------

Non-Current Assets

Intangible assets and goodwill 12 40,109 40,157

Property, plant and equipment 13 53,004 50,660

Deferred tax asset 11 1,994 1,075

Total Non-Current Assets 95,107 91,892

-------------------------------------- ----- ------------------ -----------------

Current Assets

Inventory and capital equipment 14 76,911 63,050

Trade and other receivables 15a 23,872 25,110

Prepayments and other current assets 15b 12,727 8,822

Current tax asset 361 521

Cash and cash equivalents 22 15,939 19,049

Total Current Assets 129,810 116,552

-------------------------------------- ----- ------------------ -----------------

Total Assets 224,917 208,444

-------------------------------------- ----- ------------------ -----------------

Equity

Ordinary share capital 19 2,125 2,125

Share premium 67,647 67,647

Undenominated capital 39 39

Merger reserve (17,393) (17,393)

Share based payment reserve 2,505 2,695

Foreign currency translation reserve (5,586) (5,168)

Retained earnings 104,449 94,207

-------------------------------------- ----- ------------------ -----------------

Total Equity 153,786 144,152

-------------------------------------- ----- ------------------ -----------------

Non-Current Liabilities

Loans and borrowings 18 26,971 23,265

Deferred tax liability 11 2,046 1,622

Deferred consideration 22 1,705 4,224

Other liabilities 833 852

Total Non-Current Liabilities 31,555 29,963

-------------------------------------- ----- ------------------ -----------------

Current Liabilities

Loans and borrowings 18 14,973 11,205

Trade and other payables 16 14,420 15,683

Accrued and other liabilities 16 8,699 6,027

Current tax liability 1,484 1,414

Total Current Liabilities 39,576 34,329

-------------------------------------- ----- ------------------ -----------------

Total Liabilities 71,131 64,292

-------------------------------------- ----- ------------------ -----------------

Total Equity and Liabilities 224,917 208,444

-------------------------------------- ----- ------------------ -----------------

The accompanying notes are an integral part of these financial

statements.

On behalf of the Board:

Hugh McCullough Joseph Purcell

Chairman Chief Executive Officer

Consolidated Statement of Cash Flows for the year ended 31

December 2022

2022 2021

Notes EUR'000 EUR'000

------------------------------------------------- ------ ------------------- -----------------

Operating activities:

Profit for the period 14,704 14,600

Adjustments to reconcile profit to net cash

provided by operating activities:

Depreciation 13 7,782 7,105

Amortisation of intellectual property 12 190 105

Amortisation of product development 12 121 -

Movement on deferred consideration 31 2

Finance cost 1,479 927

Finance income (26) (20)

Loss/(Gain) on sale of property, plant and

equipment 32 (177)

Income tax expense 4,030 3,228

Other non-cash movements (458) (633)

------------------------------------------------- ------ ------------------- -----------------

27,885 25,137

Changes in trade and other receivables 1,354 (2,695)

Changes in prepayments and other assets (3,848) (4,502)

Changes in inventory (13,463) (7,468)

Changes in trade and other payables 1,632 5,240

Cash provided by operations 13,560 15,712

Interest received 26 20

Interest paid (1,479) (927)

Income taxes paid (4,042) (3,627)

------------------------------------------------- ------ ------------------- -----------------

Net cash provided by operating activities 8,065 11,178

------------------------------------------------- ------ ------------------- -----------------

Investing activities

Purchase of property, plant and equipment (7,309) (7,567)

Proceeds from the sale of property, plant

and equipment 996 543

Investment in intangible assets (286) (1,139)

Proceeds from the issuance of share capital - 8

Acquisitions of subsidiary, net of cash acquired (1,014) (681)

Investment in acquired intangible assets (147) (275)

Payment of deferred consideration (2,628) (2,082)

Proceeds from the sale of subsidiaries - 111

Net cash used in investing activities (10,388) (11,082)

------------------------------------------------- ------ ------------------- -----------------

Financing activities

Dividends paid (4,462) (6,693)

Repayment of borrowings 18 (4,107) (3,262)

Repayment of lease liabilities 18 (3,993) (3,590)

Drawdown of loans 18 11,478 15,236

Purchase of NCI - -

Net cash provided by/(used in) financing

activities (1,084) 1,691

------------------------------------------------- ------ ------------------- -----------------

Effect of foreign exchange rate changes on

cash 297 217

------------------------------------------------- ------ ------------------- -----------------

Net increase in cash and cash equivalents (3,110) 2,004

------------------------------------------------- ------ ------------------- -----------------

Cash and cash equivalents at the beginning

of the year 19,049 17,045

------------------------------------------------- ------ ------------------- -----------------

Cash and cash equivalents at the end of the

year 15,939 19,049

------------------------------------------------- ------ ------------------- -----------------

The accompanying notes are an integral part of these financial

statements

1. Description of business

The consolidated financial statements of Mincon Group plc (also

referred to as "Mincon" or "the Group") comprises the Company and

its subsidiaries (together referred to as "the Group"). The

companies registered address is Smithstown Industrial Estate,

Smithstown, Shannon, Co. Clare, Ireland.

The Group is an Irish engineering Group, specialising in the

design, manufacturing, sale and servicing of rock drilling tools

and associated products. Mincon Group Plc is domiciled in Shannon,

Ireland.

On 26 November 2013, Mincon Group plc was admitted to trading on

the Euronext Growth and the Alternative Investment Market (AIM) of

the London Stock Exchange.

2. Basis of preparation

These consolidated financial statements have been prepared in

accordance with the International Financial Reporting Standards as

adopted by the European Union (EU IFRS), which comprise standards

and interpretations approved by the International Accounting

Standards Board (IASB), and endorsed by the EU.

The Group's financial statements consolidate those of the parent

company and all of its subsidiaries as of 31 December 2022. All

subsidiaries have a reporting date of 31 December.

The accounting policies set out in note 3 have been applied

consistently in preparing the Group and Company financial

statements for the years ended 31 December 2022 and 31 December

2021.

The Group and Company financial statements are presented in

euro, which is the functional currency of the Company and also the

presentation currency for the Group's financial reporting. Unless

otherwise indicated, the amounts are presented in thousands of

euro. These financial statements are prepared on the historical

cost basis.

The preparation of the consolidated financial statements in

conformity with IFRS requires management to make judgements,

estimates and assumptions that affect the application of policies

and reported amounts of assets and liabilities, income and

expenses. The judgements, estimates and associated assumptions are

based on historical experience and various other factors that are

believed to be reasonable under the circumstances. Actual results

could differ materially from these estimates. The areas involving a

high degree of judgement and the areas where estimates and

assumptions are critical to the consolidated financial statements

are discussed in note 3.

The directors believe that the Group has adequate resources to

continue in operational existence for the foreseeable future and

that it is appropriate to continue to prepare our consolidated

financial statements on a going concern basis.

3. Significant accounting principles, accounting estimates and

judgements

The accounting principles as set out in the following paragraphs have,

unless otherwise stated, been consistently applied to all periods

presented in the consolidated financial statements and for all entities

included in the consolidated financial statements.

The following new and amended standards are not expected to have a

significant impact on the Group's consolidated financial statements:

New Standards adopted as at 1 January 2022

-- IFRS 3 References to the Conceptual Framework

-- IAS 16 Proceeds before Intended Use

-- IAS 37 Onerous Contracts - Cost of Fulfilling a Contract

-- IFRS 1, IFRS 9, IFRS 16, IAS 41 Annual Improvements to IFRS Standards

2018-2020 Cycle

Standards, amendments and Interpretations to existing Standards that

are not yet effective

-- IIAS 1 Classification of Liabilities as Current or Non-current

-- IAS 1 Disclosure of Accounting Policies (Amendments to IAS 1 and

IFRS Practice Statement 2)

-- IAS 12 Deferred Tax related to Assets and Liabilities arising from

a Single Transaction

(Amendments to IAS 12)

-- IAS 1 Disclosure of Accounting Policies

-- IAS 8 Definition of Accounting Estimates

3. Significant accounting principles, accounting estimates and judgements

(continued)

Segment Reporting

An operating segment is a component of the Group that engages in busi-ness

activities from which it may earn revenue and incur expenses, and

for which discrete financial information is available. The operating

result of the operating segment is reviewed regularly by the Board

of Directors, the chief operating decision maker, to make deci-sions

about allocation of resources and also to assess performance.

Results are reported in a manner consistent with the internal reporting

provided to the chief operating decision maker (CODM). Our CODM has

been identified as the Board of Directors.

The Group has determined that it has one reportable segment (see Note

5). The Group is managed as a single business unit that sells drilling

equipment, primarily manufactured by Mincon manufacturing sites.

Revenue Recognition

The Group is involved in the sale and servicing of rock drilling tools

and associated products. Revenue from the sale of these goods and

services to customers is measured at the fair value of the consideration

received or receivable (excluding sales taxes). The Group recognises

revenue when it transfers control of goods to a customer or has completed

a service over a set period (typically one month) for a customer.

The following provides information about the nature and timing of

the satisfaction of performance obligations in contracts with customers,

including significant payment terms, and the related revenue recognition

policies.

Customers obtain control of products when one of the following conditions

are satisfied:

1. The goods have been picked up by the customer from Mincon's premises.

2. When goods have been shipped by Mincon, the goods are delivered

to the customer and have been accepted at their premises, or;

3. The customer accepts responsibility of the goods during transit

that is in line with international commercial terms.

Where the Group provides a service to a customer, who also purchases

Mincon manufactured product from the Group, the revenue associated

with this service is separately identified in a set period (typically

one month) and is recognised in the Groups revenue as it occurs.

Invoices are generated when the above conditions are satisfied. Invoices

are payable within the timeframe as set in agreement with the customer

at the point of placing the order of the product or service. Discounts

are provided from time-to-time to customers.

Customers may be permitted to return goods where issues are identified

with regard to quality of the product. Returned goods are exchanged

only for new goods or a credit note. No cash refunds are offered.

Where the customer is permitted to return an item, revenue is recognised

to the extent that it is highly probable that a significant reversal

in the amount of cumulative revenue recognised will not occur. Therefore,

the amount of revenue recognised is adjusted for expected returns,

which are estimated based on the historical data for specific types

of products. In these circumstances, a refund liability and a right

to recover returned goods asset are recognised.

The Group has elected to apply IFRS 15 Practical expedient, the Group

need not adjust the promised amount of consideration for the effects

of a significant financing component if the entity expects, at contract

inception, that the period between when the Group transfers a promised

good or service to a customer and when the customer pays for that

good or service will be one year or less.

Government Grants

Amounts recognised in the profit and loss account are presented under

the heading Operating Costs on a systematic basis in the periods in

which the expenses are recognised, unless the conditions for receiving

the grant are met after the related expenses have been recognised.

In this case, the grant is recognised when it is receivable. Current

government grants have no conditions attached.

3. Significant accounting principles, accounting estimates and

judgements (continued)

Earnings per share

Basic earnings per share is calculated based on the profit for the

year attributable to owners of the Company and the basic weighted

average number of shares outstanding. Diluted earnings per share

is calculated based on the profit for the year attributable to owners

of the Company and the diluted weighted average number of shares

outstanding.

Taxation

Current tax comprises the expected tax payable or receivable on

the taxable income or loss for the year and any adjustment to the

tax payable or receivable in respect of previous years. The amount

of current tax payable or receivable is the best estimate of the

tax amount expected to be paid or received that reflects

uncertainty related to income taxes, if any. It is measured using

tax rates enacted or substantively enacted at the reporting date.

Current tax also includes any tax arising from dividends.

Current tax assets and liabilities are offset only if certain

criteria are met.

Deferred tax

Deferred tax is recognised in respect of temporary differences

between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for taxation

purposes. Deferred tax is not recognised for:

-- not a business combination and that affects neither

accounting nor taxable profit or loss;

-- temporary differences related to investments in subsidiaries,

associates and joint arrangements to the extent that the Group is

able to control the timing of the reversal of the temporary

differences and it is probable that they will not reverse in the

foreseeable future; and

-- taxable temporary differences arising on the initial recognition of goodwill.

Deferred tax assets are recognised for unused tax losses, unused

tax credits and deductible temporary differences to the extent that

it is probable that future taxable profits will be available

against which they can be used. Future taxable profits are

determined based on the reversal of relevant taxable temporary

differences. If the amount of taxable temporary differences is

insufficient to recognise a deferred tax asset in full, then future

taxable profits, adjusted for reversals of existing temporary

differences, are considered, based on the business plans for

individual subsidiaries in the Group. Deferred tax assets are

reviewed at each reporting date and are reduced to the extent that

it is no longer probable that the related tax benefit will be

realised; such reductions are reversed when the probability of

future taxable profits improves.

Unrecognised deferred tax assets are reassessed at each

reporting date and recognised to the extent that it has become

probable that future taxable profits will be available against

which they can be used.

Deferred tax is measured at the tax rates that are expected to

be applied to temporary differences when they reverse, using tax

rates enacted or substantively enacted at the reporting date.

The measurement of deferred tax reflects the tax consequences

that would follow from the manner in which the Group expects, at

the reporting date, to recover or settle the carrying amount of its

assets and liabilities.

Deferred tax assets and liabilities are offset only if certain

criteria are met.

Leases

At inception of a contract, the Group assesses whether a

contract is, or contains, a lease. A contract is, or contains, a

lease if the contract conveys the right to control the use of an

identified asset for a period of time in exchange for

consideration. To assess whether a contract conveys the right to

control the use of an identified asset, the Group uses the

definition of a lease in IFRS 16.

(i) As a lessee

At commencement or on modification of a contract that contains a

lease component, the Group allocates the consideration in the

contract to each lease component on the basis of its relative

stand-alone prices

The Group recognises a right-of-use asset and a lease liability

at the lease commencement date. The right-of-use asset is initially

measured at cost, which comprises the initial amount of the lease

liability adjusted for any lease payments made at or before the

commencement date, plus any initial direct costs incurred and

an

3. Significant accounting principles, accounting estimates and

judgements (continued)

Leases (continued)

estimate of costs to dismantle and remove the underlying asset

or to restore the underlying asset or the site on which it is

located, less any lease incentives received.

The right-of-use asset is subsequently depreciated using the

straight-line method from the commencement date to the end of the

lease term, unless the lease transfers ownership of the underlying

asset to the Group by the end of the lease term or the cost of the

right-of-use asset reflects that the Group will exercise a purchase

option. In that case the right-of-use asset will be depreciated

over the useful life of the underlying asset, which is determined

on the same basis as those of property and equipment. In addition,

the right-of-use asset is periodically reduced by impairment

losses, if any, and adjusted for certain remeasurements of the

lease liability.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted using the interest rate implicit in the lease or, if

that rate cannot be readily determined, the Group's incremental

borrowing rate.

The Group determines its incremental borrowing rate by obtaining

interest rates from various external financing sources.

The lease liability is measured at amortised cost using the

effective interest method. It is remeasured when there is a change

in future lease payments arising from a change in an index or rate,

if there is a change in the Group's estimate of the amount expected

to be payable under a residual value guarantee, if the Group

changes its assessment of whether it will exercise a purchase,

extension or termination option or if there is a revised

in-substance fixed lease payment.

When the lease liability is remeasured in this way, a

corresponding adjustment is made to the carrying amount of the

right-of-use asset, or is recorded in profit or loss if the

carrying amount of the right-of-use asset has been reduced to

zero.

(ii) As a lessor

At inception or on modification of a contract that contains a

lease component, the Group allocates the consideration in the

contract to each lease component on the basis of their relative

stand-alone prices.

When the Group acts as a lessor, it determines at lease

inception whether each lease is a finance lease or an operating

lease.

When the Group is an intermediate lessor, it accounts for its

interests in the head lease and the sub-lease separately. It

assesses the lease classification of a sub-lease with reference to

the right-of-use asset arising from the head lease, not with

reference to the underlying asset.

Short term leases and leases of low-value assets

The Group has elected not to recognise right-of-use assets and

lease liabilities for leases of low-value assets and short-term

leases, including IT equipment. The Group recognises the lease

payments associated with these leases as an expense on a

straight-line basis over the lease term.

Inventories and capital equipment

Inventories and capital equipment (rigs) are valued at the lower

of cost or net realisable value. Net realisable value is the

estimated selling price in the ordinary course of business less the

estimated costs of completion and selling expenses. The cost of

inventories is based on the first-in, first-out principle and

includes the costs of acquiring inventories and bringing them to

their existing location and condition. Inventories manufactured by

the Group and work in progress include an appropriate share of

production overheads based on normal operating capacity.

Inventories are reported net of deductions for obsolescence.

Intangible Assets and Goodwill

Goodwill

The Group accounts for acquisitions using the purchase

accounting method as outlined in IFRS 3 Business Combinations.

Goodwill is not amortised and is tested annually.

Intangible assets

Expenditure on research activities is recognised in profit or

loss as incurred.

3. Significant accounting principles, accounting estimates and

judgements (continued)

Intangible Assets and Goodwill (continued)

Development expenditure is capitalised only if the Group can

demonstrate if the expenditure can be measured reliably, the

product or process is technically and commercially feasible, future

economic benefits are probable and the Group intends to and has

sufficient resources to complete development and to use or sell the

asset. Otherwise, it is recognised in the profit or loss as

incurred. Subsequent to initial recognition, development

expenditure is measured at cost less accumulated amortisation and

any accumulated impairment losses.

Acquired IP which has been obtained at a cost that can be

measured reliably, and that meets the definition and recognition

criteria of IAS38, will be accounted for as an intangible

asset.

Recognising an internally developed intangible assets post the

development phase once the company has assessed the development

phase is complete and the asset is ready for use. Internally

generated assets have an infinite life. They will be amortised over

a fifteen-year period on a straight line basis. Currently there is

fourteen years and nine months remaining on the amortisation.

Foreign Currency

Foreign currency transactions

Transactions in foreign currencies (those which are denominated

in a currency other than the functional currency) are translated at

the foreign exchange rate ruling at the date of the transaction.

Monetary assets and liabilities denominated in foreign currencies

are translated using the foreign exchange rate at the statement of

financial position date. Exchange gains and losses related to trade

receivables and payables, other financial assets and payables, and

other operating receivables and payables are separately presented

on the face of the income statement.

Exchange rate differences on translation to functional currency

are reported in profit or loss, except when reported in other

comprehensive income for the translation of intra-group receivables

from, or liabilities to, a foreign operation that in substance is

part of the net investment in the foreign operation.

Exchange rates for major currencies used in the various

reporting periods are shown in note 22.

Translation of accounts of foreign entities

The assets and liabilities of foreign entities, including

goodwill and fair value adjustments arising on consolidation, are

translated to euro at the exchange rates ruling at the reporting

date. Revenues, expenses, gains, and losses are translated at

average exchange rates, when these approximate the exchange rate

for the respective transaction. Foreign exchange differences

arising on translation of foreign entities are recognised in other

comprehensive income and are accumulated in a separate component of

equity as a translation reserve. On divestment of foreign entities,

the accumulated exchange differences, are recycled through profit

or loss, increasing or decreasing the profit or loss on

divestments.

Business combinations and consolidation

The consolidated financial statements include the financial

statements of the Group and all companies in which Mincon Group

plc, directly or indirectly, has control. The Group controls an

entity when it is exposed to, or has rights to, variable returns

from its involvement with the entity and has the ability to affect

those returns through its power over the entity. The financial

statements of subsidiaries are included in the consolidated

financial statements from the date on which control commences until

the date on which control ceases.

The consolidated financial statements have been prepared in

accordance with the acquisition method.

According to this method, business combinations are seen as if

the Group directly acquires the assets and assumes the liabilities

of the entity acquired. At the acquisition date, i.e., the date on

which control is obtained, each identifiable asset acquired, and

liability assumed is recognised at its acquisition-date fair

value.

Consideration transferred is measured at its fair value. It

includes the sum of the acquisition date fair values of the assets

transferred, liabilities incurred to the previous owners of the

acquiree, and equity interests issued by the Group. Deferred

consideration is initially measured at its acquisition-date fair

value. Any subsequent change in such fair value is recognised in

profit or loss, unless the deferred consideration is classified as

equity. In that case, there is no remeasurement and the subsequent

settlement is accounted for within equity. Deferred consideration

arises in the current year where part payment for an acquisition is

deferred to the following year or years.

3. Significant accounting principles, accounting estimates and

judgements (continued)

Business combinations and consolidation (continued)

Transaction costs that the Group incurs in connection with a

business combination, such as legal fees, due diligence fees, and

other professional and consulting fees are expensed as

incurred.

Goodwill is measured as the excess of the fair value of the

consideration transferred, the amount of any non-controlling

interest in the acquiree, and the fair value of the Group's

previously held equity interest in the acquiree (if any) over the

net of acquisition-date fair values of the identifiable assets

acquired and liabilities assumed. Goodwill is not amortised but

tested for impairment at least annually.

Non-controlling interest is initially measured either at fair

value or at the non-controlling interest's proportionate share of

the fair value of the acquiree's identifiable net assets. This

means that goodwill is either recorded in "full" (on the total

acquired net assets) or in "part" (only on the Group's share of net

assets). The choice of measurement basis is made on an

acquisition-by-acquisition basis.

Earnings from the acquirees are reported in the consolidated

income statement from the date of control.

Intra-group balances and transactions such as income, expenses

and dividends are eliminated in preparing the consolidated

financial statements. Profits and losses resulting from intra-group

transactions that are recognised in assets, such as inventory, are

eliminated in full, but losses are only eliminated to the extent

that there is no evidence of impairment.

Property, plant and equipment

Items of property, plant and equipment are carried at cost less

accumulated depreciation and impairment losses. Cost of an item of

property, plant and equipment comprises the purchase price, import

duties, and any cost directly attributable to bringing the asset to

its location and condition for use. The Group capitalises costs on

initial recognition and on replacement of significant parts of

property, plant and equipment, if it is probable that the future

economic benefits embodied will flow to the Group and the cost can

be measured reliably. All other costs are recognised as an expense

in profit or loss when incurred.

Depreciation

Depreciation is calculated based on cost using the straight-line

method over the estimated useful life of the asset. The following

useful lives are used for depreciation:

Years

Buildings 20-30

Plant and equipment 3-10

The depreciation methods, useful lives and residual values are

reassessed annually. Land is not depreciated.

Right of use assets are depreciated using the straight-line

method over the estimated useful life of the asset being the

remaining duration of the lease from inception date of the asset.

The depreciation methods, useful lives and residual values are

reassessed annually.

Financial Assets and Liabilities

Classification and initial measurement of financial assets

financial liabilities.

Financial assets and liabilities are recognised at fair value

when the Group becomes a party to the contractual provisions of the

instrument. Purchases and sales of financial assets are accounted

for at trade date, which is the day when the Group contractually

commits to acquire or dispose of the assets. Trade receivables are

recognised once the responsibility associated with control of the

product has transferred to the customer. Liabilities are recognised

when the other party has performed and there is a contractual

obligation to pay. A financial asset and a financial liability are

offset, and the net amount presented in the statement of financial

position when there is a legally enforceable right to set off the

recognised amounts and there is an intention to either settle on a

net basis or to realise the asset and settle the liability

simultaneously.

The classification is determined by both:

-- the entity's business model for managing the financial asset,

and

-- the contractual cash flow characteristics of the financial

asset.

3. Significant accounting principles, accounting estimates and

judgements (continued)

Financial Assets and Liabilities ( continued)

Subsequent measurement of financial assets and financial

liabilities

Financial assets at amortised cost

Financial assets are measured at amortised cost if the assets

meet the following conditions (and are not designated as

FVTPL):

-- they are held within a business model whose objective is to

hold the financial assets and collect its contractual cash flows,

and

-- the contractual terms of the financial assets give rise to

cash flows that are solely payments of principal and interest on

the principal amount outstanding.

After initial recognition, these are measured at amortised cost

using the effective interest method. Discounting is omitted where

the effect of discounting is immaterial.

Financial liabilities at amortised cost

Subsequently, financial liabilities are measured at amortised

cost using the effective interest method.

Derecognition (fully or partially) of a financial asset occurs

when the rights to receive cash flows from the financial

instruments expire or are transferred and substantially all of the

risks and rewards of ownership have been removed from the Group.

Financial assets are assessed at each reporting date. The Group

derecognises (fully or partially) a financial liability when the

obligation specified in the contract is discharged or otherwise

expires.

Impairment of financial assets

Financial assets are assessed from initial recognition and at

each reporting date to determine whether there is a requirement for

impairment. Financial assets require there expected lifetime losses

to be recognised from initial recognition.

IFRS 9's impairment requirements use forward-looking information

to recognise expected credit losses - the 'expected credit loss

(ECL) model'. Instruments within the scope of the requirements

included loans and other debt-type financial assets measured at

amortised cost, trade and other receivables.

The Group considers a broader range of information when

assessing credit risk and measuring expected credit losses,

including past events, current conditions, reasonable and

supportable forecasts that affect the expected collectability of

the future cash flows of the instrument.

In applying this forward-looking approach, a distinction is made

between:

-- financial instruments that have not deteriorated

significantly in credit quality since initial recognition or that

have low credit risk ('Stage 1') and

-- financial instruments that have deteriorated significantly in

credit quality since initial recognition and whose credit risk is

not low ('Stage 2').

'Stage 3' would cover financial assets that have objective

evidence of impairment at the reporting date.

'12-month expected credit losses' are recognised for the first

category (ie Stage 1) while 'lifetime expected credit losses' are

recognised for the second category (ie Stage 2).

Measurement of the expected credit losses is determined by a

probability-weighted estimate of credit losses over the expected

life of the financial instrument.

Trade and other receivables

The Group makes use of a simplified approach in accounting for

trade and other receivables and records the loss allowance as

lifetime expected credit losses. These are the expected shortfalls

in contractual cash flows, considering the potential for default at

any point during the life of the financial instrument. In

calculating, the Group uses its historical experience, external

indicators and forward-looking information to calculate the

expected credit losses using a provision matrix.

The Group assesses impairment of trade and other receivables on

a collective basis as they possess shared credit risk

characteristics they have been grouped based on the days past

due.

3. Significant accounting principles, accounting estimates and

judgements (continued)

Financial Assets and Liabilities ( continued)

Borrowing costs

All borrowing costs are expensed in accordance with the

effective interest rate method.

Equity

Shares are classified as equity. Incremental costs directly

attributable to the issue of ordinary shares and share options are

recognised as a deduction from equity, net of any tax effect.

Financial instruments carried at fair value: Deferred

consideration

Fair value is calculated based on the present value of future

principal and interest cash flows, discounted at the market rate of

interest at the reporting date. These are set amounts detailed in

each contract.

Finance income and expenses

Finance income and expense are included in profit or loss using

the effective interest method.

Contingent liabilities

A contingent liability is a possible obligation or a present

obligation that arises from past events that is not reported as a

liability or provision, as it is not probable that an outflow of

resources will be required to settle the obligation or that a

sufficiently reliable calculation of the amount cannot be made.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits with maturities of three months or less..

Provisions

A provision is recognised in the statement of financial position

when the Group has a legal or constructive obligation as a result

of a past event, it is probable that an outflow of economic

benefits will be required to settle the obligation, and the outflow

can be estimated reliably. The amount recognised as a provision is

the best estimate of the expenditure required to settle the present

obligation at the reporting date. If the effect of the time value

of money is material, the provision is determined by discounting

the expected future cash flows at a pre-tax rate that reflects the

current market assessments of the time value of money and, where

appropriate, the risks specific to the liability.

A provision for restructuring is recognised when the Group has

approved a detailed and formal restructuring plan and the

restructuring has either commenced or been announced publicly.

Future operating losses are not provided for.

Defined contribution plans

A defined contribution retirement benefit plan is a

post-employment benefit plan under which the Group pays fixed

contributions into a separate entity and will have no legal or

constructive obligation to pay further amounts. Obligations for

contributions to defined contribution retirement benefit plans are

recognised as an employee benefit expense in profit or loss when

employees provide services entitling them to the contributions.

Share-based payment transactions

The Group operates a long-term incentive plan which allows the

Company to grant Restricted Share Awards ("RSAs") to executive

directors and senior management. All schemes are equity settled

arrangements under IFRS 2 Share-based Payment.

The grant-date fair value of share-based payment awards granted

to employees is recognised as an employee expense, with a

corresponding increase in equity, over the period that the

employees become unconditionally entitled to the awards. The amount

recognised as an expense is adjusted to reflect the number of

awards for which the related service and non-market performance

conditions are expected to be met, such that the amount ultimately

recognised as an expense is based on the number of awards that meet

the related service and non-market performance conditions at the

vesting date. It is reversed only where entitlements do not vest

because all

non-market performance conditions have not been met or where an

employee in receipt of share entitlements leaves the Group before

the end of the vesting period and forfeits those options in

consequence.

3. Significant accounting principles, accounting estimates and

judgements (continued)

Critical accounting estimates and judgements

The preparation of financial statements requires management's

judgement and the use of estimates and assumptions that affect the

amounts reported in the consolidated financial statements and

accompanying notes. These estimates and associated assumptions are

based on historical experience and various other factors that are

believed to be reasonable under the prevailing circumstances.

Actual results may differ from those estimates. The estimates and

assumptions are reviewed on an ongoing basis. Revisions to the

accounting estimates are recognised in the period in which they are

revised and in any future periods affected.

Following are the estimates and judgements which, in the opinion

of management, are significant to the underlying amounts included

in the financial reports and for which there is a significant risk

that future events or new information could entail a change in

those estimates or judgements.

Deferred consideration

The deferred consideration payable represents management's best

estimate of the fair value of the amounts that will be payable,

discounted as appropriate using a market interest rate. The fair

value was estimated by assigning probabilities, based on

management's current expectations, to the potential pay-out

scenarios. The fair value of deferred consideration is primarily

dependent on the future performance of the acquired businesses

against predetermined targets and on management's current

expectations thereof.

Climate-related matters

Consistent with the prior year, as at 31 December 2022, the

Group has not identified significant risks induced by climate

changes that could negatively and materially affect the estimates

and judgements currently used in the Group's financial statements.

Management continuously assesses the impact of climate-related

matters.

Goodwill

The initial recognition of goodwill represents management' best

estimate of the fair value of the acquired entities value less the

identified assets acquired.

During the annual impairment assessment over goodwill,

management calculate the recoverable value of the group using their

best estimate of the discounted future cash flows of the group. The

fair values were estimated using management's current and future

projections of the Mincon Group's performance as well as

appropriate data inputs and assumptions.

Useful life and residual values of Intangible Assets

Distinguishing the research and development phase, determining

the useful life, and deciding whether the recognition requirements

for the capitalisation of development costs of new projects are met

all require judgement. These judgements are based on historical

experience and various other factors that are believed to be

reasonable under the prevailing circumstances.

After capitalisation, management monitors whether the

recognition requirements continue to be met and whether there are

any indicators that capitalised costs may be impaired.

Trade and other receivables

Trade and other receivables are included in current assets,

except for those with maturities more than 12 months after the

reporting date, which are classified as non-current assets. The

Group estimates the risk that receivables will not be paid and

provides for doubtful debts in line with IFRS 9.

The Group applies the simplified approach to providing for

expected credit losses (ECL) permitted by IFRS 9 Financial

Instruments, which requires expected lifetime losses to be

recognised from initial recognition of the receivables and

considered at each reporting date. Loss rates are calculated using

a "roll rate" method based on the probability of a receivable

progressing through successive chains of non-payment to

write-off.

Trade receivables are written off when there is no reasonable

expectation of recovery, such as a debtor failing to engage in a

repayment plan with the company. Where recoveries are made, these

are recognised in the Consolidated Income Statement.

4. Revenue

In the following table, revenue is disaggregated between Mincon

manufactured product and product that is purchased outside the

Group and resold through Mincon distribution channels.

2022 2021

EUR'000 EUR'000

---------------------------- ------- -------

Product revenue:

Sale of Mincon product 141,830 118,802

Sale of third party product 28,178 25,560

Total revenue 170,008 144,362

---------------------------- ------- -------

The Group's revenue disaggregated by primary geographical

markets are disclosed in Note 5.

5. Operating Segment

The CODM assesses operating segment performance based on

operating profit. Segment revenue for the year ended 31 December

2021 of EUR170 million (2020: EUR144.4 million) is wholly derived

from sales to external customers.

Entity-wide disclosures

The business is managed on a worldwide basis but operates

manufacturing facilities and sales offices in Ireland, UK, Sweden,

Finland, South Africa, Western Australia, the United States and

Canada and sales offices in ten other locations including Eastern

Australia, South Africa, France, Spain, Namibia, Sweden, Chile and

Peru. In presenting information on geography, revenue is based on

the geographical location of customers and non-current assets based

on the location of these assets.

Revenue by region (by location of customers):

2022 2021

EUR'000 EUR'000

----------------------------------------- ------- -------

Region:

I reland 2,974 1,859

Americas 69,752 45,908

Australasia 16,882 17,327

Europe, Middle East, Africa 80,400 79,268

Total revenue from continuing operations 170,008 144,362

----------------------------------------- ------- -------

During 2022, Mincon had sales in the USA of EUR42.4 million

(2020: EUR24.4 million), this contributed to more than 10% of the

entire Group's sales for 2022.

2022 2021

EUR'000 EUR'000

Region:

Americas 17,752 14,682

Australasia 12,252 11,838

Europe, Middle East, Africa 63,109 64,297

Total non-current assets(1) 93,113 90,817

------------------------------------------------------ ------- -------

(1) Non-current assets exclude deferred tax assets.

During 2022, Mincon held non-current assets (excluding deferred

tax assets) in Ireland of EUR17.6 million (2021: EUR18.3 million),

in the USA of EUR12.5 million (2021: EUR10.7 million) these

separately contributed to more than 10% of the entire Group's

non-current assets (excluding deferred tax assets) for 2022.

5. Operating Segment (continued)

2022 2021

EUR'000 EUR'000

Region:

Americas 6,839 4,577

Australasia 2,555 2,290

Europe, Middle East, Africa 20,115 21,474

Total non-current liabilities(1) 29,509 28,341

--------------------------------------------------- ------- -------

(1) Non-current liabilities exclude deferred tax

liabilities.

During 2022, Mincon held non-current liabilities (excluding

deferred tax liabilities) in Ireland of EUR13.5 million (2021:

EUR11.6 million), this contributed to more than 10% of the entire

Group's non-current liabilities (excluding deferred tax

liabilities) for 2022.

6. Cost of Sales and operating expenses

Included within cost of sales and operating costs were the

following major components:

Cost of sales

2022 2021

EUR'000 EUR'000

------------------------------------ ------- -------

Raw materials 45,523 37,081

Third party product purchases 21,838 19,275

Employee costs 23,093 19,764

Depreciation (note 13) 5,194 4,801

In bound costs on purchases 4,759 3,772

Energy costs 3,116 2,188

Maintenance of machinery 2,120 1,711

Subcontracting 7,139 5,463

Amortisation of product development 121 -

Other 3,035 1,544

Total cost of sales 115,938 95,599

------------------------------------ ------- -------

The Group invested approximately EUR4.4 million on research and

development projects in 2022 (2021: EUR3.9 million). EUR4.1 million

of this has been expensed in the period (2021: EUR2.8 million),

with the balance of EUR285,000 of development costs capitalised

(2021: EUR1.1 million) (note 12).

Operating costs

2022 2021

EUR'000 EUR'000

----------------------------------------------- ------- -------

Employee costs (including director emoluments) 20,370 18,615

Depreciation (note 13) 2,588 2,304

Amortisation of acquired IP 190 105

Travel 1,927 1,238

Professional costs 2,637 2,589

Administration 2,997 2,841

Marketing 706 694

Legal cost 846 629

Other 2,060 1,641

Total other operating costs 34,321 30,656

----------------------------------------------- ------- -------

The Group recognised EUR119,000 in Government Grants in 2021

(2021: EUR450,000). These grants differ in structure from country

to country, they primarily relate to personnel costs.

7. Finance costs

2022 2021

EUR'000 EUR'000

--------------------------------- ------- -------

Interest on lease liabilities 609 684

Interest on loans and borrowings 870 243

--------------------------------- ------- -------

Finance costs 1,479 927

--------------------------------- ------- -------

8. Employee information

2022 2021

EUR'000 EUR'000

--------------------------------------------------------- -------- -------

Wages and salaries - excluding directors 36,085 31,830

Wages, salaries, fees and retirement benefit - directors

(note 10) 868 797

Social security costs 4,428 3,357

Retirement benefit costs of defined contribution

plans 2,272 1,959

Share based payment expense (note 21) (190) 436

Total employee costs 43,463 38,379

--------------------------------------------------------- -------- -------

In addition to the above employee costs, the Group capitalised payroll

costs of EUR151,000 in 2022 (2021: EUR700,000) in relation to development.

At 31 December 2022, there was EUR234,000 (2020: EUR256,000) accrued

for and not in paid pension contributions.

The average number of employees was as follows:

2022 2021

Number Number

------------------------------------------------------------ --------- -------

Sales and distribution 133 136

General and administration 75 75

Manufacturing, service and development 417 383

------------------------------------------------------------ --------- -------

Average number of persons employed 625 594

------------------------------------------------------------ --------- -------

Retirement benefit and Other Employee Benefit Plans

The Group operates various defined contribution retirement

benefit plans. During the year ended 31 December 2022, the Group

recorded EUR2.3 million (2021: EUR2 million) of expense in

connection with these plans.

9. Acquisitions & Disposals

2022 Acquisition

In January 2022, Mincon acquired 100% shareholding in Spartan

Drilling Tools, a manufacturer of drill pipe and related products

based in the USA for a consideration of EUR1,014,000. Spartan

Drilling Tools was acquired to manufacture drill pipe closer to the

end user in the America's region.

A. Consideration transferred

The following table summarises the acquisition date fair value

of each major class of consideration transferred.

Spartan Total

Drilling

Tools

EUR'000 EUR'000

--------------------------------- ---------- --------

Deferred consideration 1,014 1,014

Total consideration transferred 1,014 1,014

----------------------------------- ---------- --------

9. Acquisitions & Disposals (continued)

B. Identifiable assets acquired and liabilities assumed

The following table summarises the recognised amounts of assets

and liabilities assumed at the date of acquisition.

Total

EUR'000

----------------------------------------------- -------------

Property, plant and equipment 480

Right of use assets 455

Inventories 369

Trade receivables 133

Other assets 63

Trade and other payables (83)

Right of use liabilities (455)

Other accruals and liabilities (109)

Fair value of identifiable net assets acquired 853

----------------------------------------------- -------------

Measurement of fair values

The valuation techniques used for measuring the fair value of

material assets acquired were as follows.

Assets acquired Valuation Technique

Property, plant Market comparison technique and cost technique: The valuation

and equipment model considers quoted market prices for similar items

when they are available, and depreciated replacement cost

when appropriate. Depreciated replacement cost reflects

adjustments for physical deterioration as well as functional

and economic obsolescence.

Inventories Market comparison technique: The fair value is determined

based on the estimated selling price in the ordinary course

of business less the estimated costs of completion and

sale, and a reasonable profit margin based on the effort

required to complete and sell the inventories.

----------- ------------------------------------------------------------

Assets acquired Valuation Technique

----------------- --------------------------------------------------------------

Trade receivables All receivable balances were assessed and all are collectable.

Trade and other All were accessed and deemed payable to credible suppliers

payables

--------------- -----------------------------------------------------------

Other current All were accessed for recoverability and all is recoverable

assets

Other accruals All were assessed for credibility and deemed payable

and liabilities

---------------- ----------------------------------------------------

The loss from the acquisition of Spartan Drilling Tools has been

consolidated into the Mincon Group 2022 profit for the reporting

period.

Goodwill

Goodwill of EUR 161,000 is primarily due to growth expectations,

expected future profitability and expected cost synergies.

Goodwill arising from the acquisition has been recognised as

follows.

Spartan Total

Drilling 2022

Tools EUR'000

EUR'000

--------------------------------------- ---------- ---------

Consideration transferred 1,014 1,014

Fair value of identifiable net assets (853) (853)

--------------------------------------- ---------- ---------

Goodwill 161 161

--------------------------------------- ---------- ---------

2021 Acquisition

In June 2021, Mincon acquired the business of Campbell's Welding

& Fabrication, for a consideration of EUR421,000. This was made

up of a cash consideration of EUR84,000 and deferred consideration

of EUR337,000. Mincon acquired Campbell's Welding & Fabrication

to bring in-house their knowhow and processes.

9. Acquisitions & Disposals (continued)

2021 Acquisition

In June 2021, Mincon acquired 100% shareholding in Attakroc, a

Canadian-based mining and construction product distributor, for a

consideration of EUR1.8 million. The Group acquired Attakroc to

bring in-house their vast experience in selling and servicing the

mining and construction industries in western Canada. Attakroc

brings their knowledge of the local market conditions and give

Mincon a distinctive advantage in this region. The transaction

included a cash consideration of EUR600,000 and deferred

consideration of EUR1.2 million.

A. Consideration transferred

The following table summarises the acquisition date fair value

of each major class of consideration transferred.

Campbell

Welding

& Fabrication Attakroc Total

EUR'000 EUR'000 EUR'000

--------------------------------- --------------- --------- --------

Cash 84 597 681

Deferred consideration 337 1,227 1,564

Total consideration transferred 421 1,824 2,245

----------------------------------- --------------- --------- --------

B. Identifiable assets acquired and liabilities assumed

The following table summarises the recognised amounts of assets

and liabilities assumed at the date of acquisition.

Total

EUR'000

----------------------------------------------- ---------------

Property, plant and equipment 176

Right of use assets 39

Inventories 958

Trade receivables 1,174

Other assets 15

Trade and other payables (699)

Right of use liabilities (39)

Other accruals and liabilities (615)

Fair value of identifiable net assets acquired 1,009

----------------------------------------------- ---------------

Measurement of fair values

The valuation techniques used for measuring the fair value of

material assets acquired were as follows.

Assets acquired Valuation Technique

Property, plant Market comparison technique and cost technique: The valuation

and equipment model considers quoted market prices for similar items

when they are available, and depreciated replacement cost

when appropriate. Depreciated replacement cost reflects

adjustments for physical deterioration as well as functional

and economic obsolescence.

Inventories Market comparison technique: The fair value is determined

based on the estimated selling price in the ordinary course

of business less the estimated costs of completion and

sale, and a reasonable profit margin based on the effort

required to complete and sell the inventories.

----------- ------------------------------------------------------------

Goodwill

Goodwill arising from the acquisition has been recognised as

follows.

Attakroc Total

EUR'000 2022

EUR'000

--------------------------------------- --------- ---------

Consideration transferred 1,824 1,824

Fair value of identifiable net assets (1,009) (1,009)

--------------------------------------- --------- ---------

Goodwill 815 815

--------------------------------------- --------- ---------

10. Statutory and other required disclosures

Operating profit is stated after charging the following

amounts: 2022 2021

EUR'000 EUR'000

-------------------------------------------------------- ---------------- ---------------

Directors' remuneration

Fees 210 220

Wages and salaries 599 522

Retirement benefit contributions 59 55

-------------------------------------------------------- ---------------- ---------------

Total directors' remuneration 868 797

-------------------------------------------------------- ---------------- ---------------

2022 2021

Auditor's remuneration EUR'000 EUR'000

----------------------------------------------------- -------- --------

Auditor's remuneration - Fees payable to lead audit

firm

Audit of the Group financial statements 180 205

Audit of the Company financial statements 10 15

Other assurance services 13 20

203 240

----------------------------------------------------- -------- --------

Auditor's remuneration - Fees payable to other firms

in lead audit firm's network

Audit services 35 149

Other assurance services - 3

Tax advisory services 2 -

Total auditor's remuneration 37 152

----------------------------------------------------- -------- --------

11. Income tax

Tax recognised in income statement:

2022 2021

Current tax expense EUR'000 EUR'000

-------------------------------------------------- ------- --------

Current year 4,409 3,427

Adjustment for prior years 172 (7)

-------------------------------------------------- ------- --------

Total current tax expense 4,581 3,420

-------------------------------------------------- ------- --------

Deferred tax expense

Origination and reversal of temporary differences (551) (192)

-------------------------------------------------- ------- --------

Total deferred tax expense (551) (192)

Total income tax expense 4,030 3,228

-------------------------------------------------- ------- --------