NZ Dollar Plunges As RBNZ's Wheeler Talks Down Currency

24 July 2014 - 2:26PM

RTTF1

The New Zealand dollar tumbled against the other major

currencies in Asian deals on Thursday, as Reserve Bank of New

Zealand governor Graeme Wheeler warned that the level of the

domestic currency cannot be justified and "there is potential for a

significant fall." The central bank decided to raise the cash rate

as expected, while signaling that it plans to pause its tightening

cycle.

The RBNZ hiked its official cash rate by 25 basis points to 3.50

percent from 3.25 percent. The decision was in line with

expectations, and it marked the fourth straight meeting in which

the RBNZ has hiked the OCR.

Wheeler noted that New Zealand's export prices for dairy and

timber have fallen over recent months, which "would reduce primary

sector incomes over the coming year". "With the exchange rate yet

to adjust to weakening commodity prices, the level of the New

Zealand dollar is unjustified and unsustainable and there is

potential for a significant fall," he added.

The economy seems to be adjusting with recent monetary policy

tightening cycle, Wheeler told. Regarding future course of monetary

policy, Wheeler noted that "it would be wise that there now be a

period of assessment before interest rates adjust further towards a

more-neutral level."

In economic news, New Zealand's trade surplus came in at NZ$247

million in June following the downwardly revised surplus of NZ$270

million in May, data from the Statistics New Zealand showed.

Exports were up NZ$4.20 billion in June, while imports added

NZ$3.95 billion.

The New Zealand dollar depreciated to 0.8592 against the

greenback, a level not seen since June 12, and was lower by 1.2

percent from an early high of 0.8699. Continuation of downtrend may

take the kiwi to a support around the 0.85 zone. The pair was worth

0.8698 at yesterday's close.

The kiwi fell by 1.1 percent to hit a 6-week low of 87.25

against the yen, off a high of 88.26 hit at the commencement of

today's trading. The next possible downside target for the kiwi is

seen around the 86.00 mark.

Data from Ministry of Finance showed that Japan posted a

merchandise trade deficit of 822.2 billion yen in June. That missed

forecasts for a shortfall of 642.9 billion yen following the 910.8

billion yen deficit in May.

Reversing from an early high of 1.5459 against the euro, the

kiwi declined to a 4-week low of 1.5661 during Asian deals. The

kiwi is poised to test support around the 1.575 region.

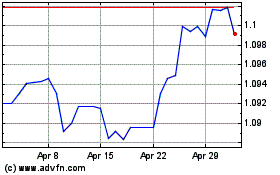

The kiwi came off from early high of 1.0852 against the aussie

and fell by 1.2 percent to a new 6-week low of 1.0997. The kiwi is

likely to challenge support around the 1.10 level. The pair was

valued at 1.0856 when it closed deals yesterday.

Looking ahead, PMIs from major European economies are due in the

European session.

The U.S. weekly jobless claims for the week ended July 19, new

home sales data for June and Markit's preliminary manufacturing PMI

for July are to be released in the New York session.

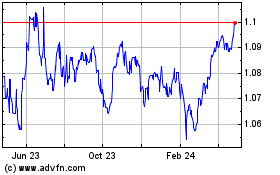

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024