CSL Catches Cold from Flu Vaccines Deal with Novartis -- Market Talk

16 October 2015 - 10:37AM

Dow Jones News

23:08 GMT [Dow Jones] CSL (CSL.AU), Australia's largest

pharmaceuticals group, is nursing a cold from the flu-vaccines

business it bought from Novartis in a deal that completed in

August. CSL signaled a US$130 million underlying net loss on the

business in FY16, contributing to Goldman Sachs lowering its

FY16-FY18 EPS forecasts by 1%-6%. Still, the broker retains a buy

call on the stock. "We believe investors will likely regards FY17

metrics as a better reflection of the company's underlying earnings

(whereas FY16 incorporates flu losses ahead of the restructuring

program)," analyst Ian Abbott says. CSL last traded at A$88.99.

(david.winning@wsj.com; @dwinningWSJ)

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 15, 2015 19:22 ET (23:22 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

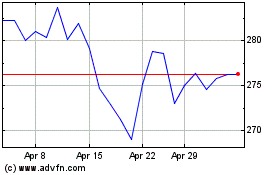

CSL (ASX:CSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSL (ASX:CSL)

Historical Stock Chart

From Apr 2023 to Apr 2024