Tencent to Borrow up to $4 Billion for Acquisitions

16 May 2016 - 2:20PM

Dow Jones News

Tencent Holdings Ltd. is increasing the amount of its planned

bank loan to as much as $4 billion, people familiar with the matter

said, as the Chinese Internet giant beefs up its war chest for

potential acquisitions.

Tencent was in talks with banks to raise $2 billion in a

syndicated loan, The Wall Street Journal reported last month. But

the loan's syndication has been heavily oversubscribed, and the

company now plans to raise more than $3 billion and up to $4

billion, the people said. The additional funds could help Tencent

finance more acquisitions, the people said.

Tencent, a social-network company that operates the WeChat

smartphone messaging application, and its chief rival, online

shopping company Alibaba Group Holding Ltd., have been raising

billions of dollars in bank loans over the past several months to

finance their expansion through acquisitions in China and abroad.

In November, Tencent secured $1.5 billion in a syndicated loan.

Five banks—Citigroup Inc., Australia & New Zealand Banking

Group, Bank of China, HSBC Holdings PLC and Mizuho Financial Group

Inc.—are underwriting Tencent's latest syndicated loan, according

to the people. The loan is expected to be completed this month, the

people said.

Tencent has been ramping up investments in a wide range of

businesses. It is a major investor, for example, in Chinese

ride-sharing company Didi Chuxing Technology Co., which this month

received a $1 billion investment from Apple Inc. In January,

Tencent and other investors took part in a $3.3 billion funding

round for Meituan-Dianping, China's biggest online provider of

restaurant bookings, movie ticketing and other on-demand

services.

Write to Juro Osawa at juro.osawa@wsj.com

(END) Dow Jones Newswires

May 16, 2016 00:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

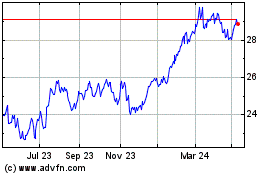

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

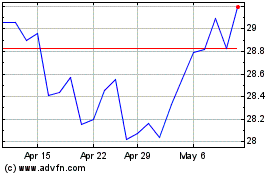

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024