SolGold Gets Favorable Cash Investment Proposal from Maxit Capital

22 September 2016 - 7:43PM

Dow Jones News

LONDON--SolGold PLC (SOLG.LN) said Thursday it has received a

more favorable cash investment proposal from Maxit Capital LP.

Late last month the Brisbane, Australia based, copper gold

exploration and development company SolGold proposed to raise $10.7

million via a share subscription agreement with gold miner Newcrest

International and its parent, Newcrest Mining Ltd. (NCM.AU). The

company said Newcrest will subscribe 135.7 million shares at 8

cents per share.

Earlier this month SolGold recommended that shareholders approve

the issue of shares to Newcrest, subject always to no competing

proposal being received and recommended by the SolGold board.

SolGold said Thursday it has received a proposal from Maxit

Capital LP offering to arrange a cash investment into SolGold at a

price of 16 cents per share. The raising is proposed to be for $20

million.

As part of the competing proposal received, Maxit has advised

that Newcrest may participate in the further raising by advising

before close of business on Sept. 23, their participation to the

extent of subscribing to 10% of the expanded issued capital of

SolGold also at 16 cents for $22.863 million.

Maxit and its clients would in that case subscribe for $10.137

million at 16 cents per share, resulting in a total raising of $33

million, SolGold said Thursday.

SolGold said it will advise the market of developments and

recommends that shareholders wait for further advice ahead of

lodging any proxy votes for the general meeting to be convened on

Oct. 13.

Shares at 0910 GMT up 2.8% at 14 pence, valuing the company at

GBP166.6 million.

-Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

September 22, 2016 05:28 ET (09:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

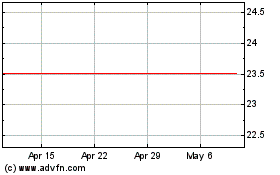

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

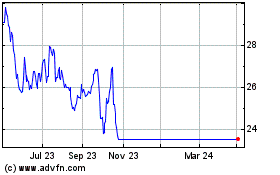

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Apr 2023 to Apr 2024