U.S. Existing-Home Sales Rebounded in September

21 October 2016 - 1:50AM

Dow Jones News

WASHINGTON--Home-buying activity picked up in September

following a two-month slide, a rebound that pointed to

stabilization in the U.S. housing market.

Sales of previously owned homes rose 3.2% from August to a

seasonally adjusted annual rate of 5.47 million, the National

Association of Realtors said Thursday. Economists surveyed by The

Wall Street Journal had expected a more modest 0.4% increase to a

sales rate of 5.35 million in September.

Existing-home sales account for the vast majority of U.S.

home-buying activity. After peaking in June at an annual rate of

5.57 million, the strongest monthly sales pace since February 2007,

sales softened in July and August. The August sales pace on

Thursday was revised down to 5.30 million from an earlier estimate

of 5.33 million.

September's sales rebound showed the summer slowdown was a

"moderate decline and not a turning point," said Lawrence Yun, the

NAR's chief economist.

Sales of previously owned homes in September were up 0.6% from a

year earlier.

Inventory remained tight and prices continued to rise. At the

latest sales pace, it would take 4.5 months to exhaust the supply

of previously owned homes on the market, down from 4.8 months in

September 2015. The median price of an existing home sold in

September was $234,200, up 5.6% on the year.

First-time home buyers accounted for 34% of September sales,

according to NAR, up from 31% in August and matching the highest

level since July 2012. At the same time, foreclosures and short

sales are in retreat--just 4% of September purchases were so-called

distressed sales, edging down from 5% the prior month.

News Corp, owner of The Wall Street Journal, also operates

Realtor.com under license from the National Association of

Realtors.

The U.S. housing market's prolonged recovery following the

2007-09 recession was a solid contributor to overall economic

growth in recent years. But a pullback in residential investment

during the second quarter, following eight consecutive quarters of

growth, acted as a drag on the broader economy.

Federal Reserve officials last month judged that "the

sluggishness in the housing sector appeared to have continued into

the third quarter," according to minutes of the Fed's Sept. 20-21

policy meeting that were released last week.

Recent data have suggested weakness in construction of apartment

buildings and other multifamily structures, balanced by rising

investment in single-family housing. Permits issued for buildings

with five or more residential units were down 11.6% in the first

nine months of 2016 versus a year earlier, while permits for new

single-family homes were up 8.1% over the same period, the Commerce

Department said Wednesday.

Sales of newly built single-family homes, which account for a

small slice of the overall market, rose 13.3% in the first eight

months of the year compared with the same period in 2015, according

to the agency.

Borrowing costs remain low for prospective home buyers who

qualify for loans. The average interest rate on a 30-year

fixed-rate mortgage in September was 3.46%, up slightly from 3.44%

the prior two months but well below the September 2015 average of

3.89%, according to Freddie Mac.

Write to Ben Leubsdorf at ben.leubsdorf@wsj.com and Jeffrey

Sparshott at jeffrey.sparshott@wsj.com

(END) Dow Jones Newswires

October 20, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

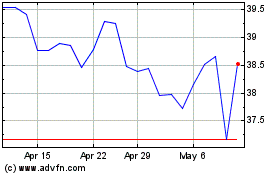

News (ASX:NWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

News (ASX:NWS)

Historical Stock Chart

From Apr 2023 to Apr 2024