MARKET COMMENT: S&P/ASX 200 May Rise After BHP Output Report

17 July 2013 - 10:28AM

Dow Jones News

2357 GMT [Dow Jones] Australia's S&P/ASX 200 may rise

Wednesday, after BHP (BHP.AU) delivered a strong 4Q production

report featuring record iron-ore production that beat market

expectations. BHP's ADRs rose to A$33.87 vs Tuesday's local close

at A$33.43. Rio Tinto (RIO.AU) may also outperform after its

London-listed shares rose 2.7% following the 2Q production report

released yesterday. Higher commodity prices should also help the

miners, with spot iron ore up 1.7% and LME copper up 1.2% as the

U.S. dollar declined before Fed Chairman Ben Bernanke's

Congressional testimony later Wednesday. U.S. CPI, industrial

production and housing market data exceeded expectations, as did

results from Goldman Sachs. But the S&P 500 slipped 0.4%,

breaking an 8-day winning streak. Goldman Sachs' result could rub

off on Macquarie Group shares today. Insurance Australia (IAG.AU)

will also be in focus after raising its insurance margin guidance.

The S&P/ASX 200 still faces strong technical resistance at

5014.0, although tentative support has emerged near 4960. Index

last 4986.0. (david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

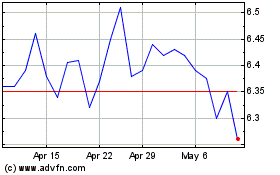

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Apr 2024 to May 2024

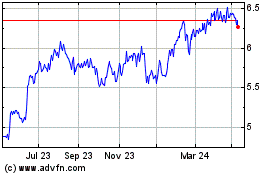

Insurance Australia (ASX:IAG)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Insurance Australia Group Limited (Australian Stock Exchange): 0 recent articles

More Insurance Australia News Articles