AK Steel to Increase Prices on Steel Products -- Update

05 March 2016 - 6:26AM

Dow Jones News

By Joshua Jamerson and John W. Miller

AK Steel Holding Corp. Friday became the latest steelmaker to

raise prices, a sign that steel markets in the U.S. are starting to

improve.

AK Steel said it would increase base prices for its carbon

flat-rolled steel products by a minimum $30 a metric ton, a move

similar to increases announced to customers by other big

steelmakers, including Nucor Corp., U.S. Steel Corp. and

ArcelorMittal.

After falling more than 35% in 2015, prices in the U.S. are on

their way up. The benchmark hot-rolled coil index has risen 10.4%

to $402 a ton from $364 on Dec. 2.

Investors are noticing. AK Steel's stock price rose 8.5% to

$3.91 in afternoon trading in New York.

"There's strength in construction, appliance and automotive

markets," said John Packard of Steel Market Update. "Imports have

fallen, and service center inventories have been dropping, which

means service centers need to go out and buy more steel."

One area that isn't improving, Mr. Packard added, is the oil and

gas industries, traditionally heavy consumers of steel that have

slumped along with the fall in energy prices.

Imports of steel into the U.S. during December were 2.6 million

tons, down 26% from 3.5 million tons during the same month in

2014.

U.S. construction firms in February added 19,000 workers,

according to the Associated General Contractors of America.

Construction employment now totals 6.6 million, the most since

December 2008.

Lower prices have driven down steel imports, but they also are

falling because of pressure from U.S. trade officials. On Tuesday,

the Commerce Department announced preliminary new import tariffs on

cold-rolled steel from seven countries, including China. The U.S.

is looking at imposing duties in a handful of other steel

categories, following complaints by AK Steel and other big

steelmakers that China, Brazil, Russia and other countries are

illegally dumping, or selling below cost, steel in the U.S.

Steelmakers in the U.S. need all the help they can get after

going through one of the roughest cycles in recent memory. AK

Steel's shipments fell to 1.66 million tons in the fourth quarter,

down 17% from 2.01 million tons in the year-earlier period.

AK Steel said the decline was due to its decision to focus on

sales of higher-margin products and reduce sales to the carbon

steel spot market. Overall sales declined 23% to $1.54 billion in

the quarter as the average selling price per ton dropped 5.3% to

$929.

The company is expected to report its next set of quarterly

results in April.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and John W.

Miller at john.miller@wsj.com

(END) Dow Jones Newswires

March 04, 2016 14:11 ET (19:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

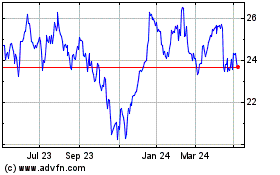

ArcelorMittal (EU:MT)

Historical Stock Chart

From Aug 2024 to Sep 2024

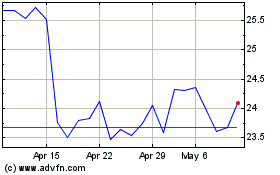

ArcelorMittal (EU:MT)

Historical Stock Chart

From Sep 2023 to Sep 2024