Steelmaker ArcelorMittal Gains From Tariffs as Prices Rise

01 August 2018 - 10:08PM

Dow Jones News

By Nathan Allen

Luxembourg-listed ArcelorMittal signaled Wednesday it would be

one of the winners from U.S. tariffs on steel and aluminum imports

that have been an earnings headwinds for many American and foreign

manufacturers.

The steelmaker posted a 40% rise in second-quarter net profit to

$1.87 billion on sales of $20 billion Wednesday.

U.S. steel and aluminum prices are up around 33% and 11% this

year, which has proved a boon for ArcelorMittal.

"We have a strong U.S. exposure [and] clearly we are a net

beneficiary of the trade actions," Chief Financial Officer Aditya

Mittal said Wednesday.

The Trump administration levied 25% tariffs on global steel

imports and 10% on aluminum in March in a bid to protect U.S.

suppliers. That has raised production costs for manufacturers from

cars to tools. Consumers are starting to pay more for products

ranging from sodas to snowmobiles.

Mr. Mittal said he expected the positive impact from tariffs for

ArcelorMittal to continue through the rest of the year.

Second-quarter operating earnings in the U.S., Canada, and Mexico

jumped 56% compared with the previous year, largely because of the

business in the U.S., the company said.

Mr. Mittal said protective measures were justified given the

significant overcapacity in global steel production and unfair

state aid granted to producers in "certain countries"--a thinly

veiled reference to China.

Nucor Corp., the largest U.S.-based steelmaker, said in July it

had also benefited from rising commodity prices. The company's

average sale price per ton in its second quarter rose 17% from a

year earlier as the company ramped up production.

In contrast, Alcoa Corp., which produces only about 14% of its

aluminum in the U.S., said in July its earnings had been dented by

tariffs. The cost to the company from levies on imports, primarily

from Canada, will be around $12 million to $14 million a month.

President Trump and European Union Commission President

Jean-Claude Juncker said last week they would try to resolve their

differences over the U.S. and aluminum tariffs.

ArcelorMittal said global demand for its product remained

buoyant and increased its forecast for steel consumption in the

U.S., China and the EU in 2018.

(END) Dow Jones Newswires

August 01, 2018 07:53 ET (11:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

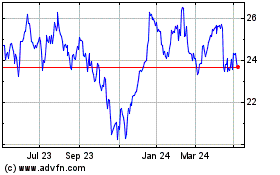

ArcelorMittal (EU:MT)

Historical Stock Chart

From Jun 2024 to Jul 2024

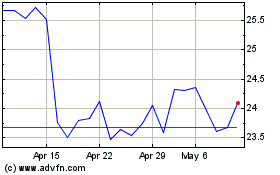

ArcelorMittal (EU:MT)

Historical Stock Chart

From Jul 2023 to Jul 2024