0001013488

False

0001013488

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 27, 2024

BJ'S

RESTAURANTS, INC.

(Exact name of registrant as specified in its charter)

| California |

0-21423 |

33-0485615 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 7755

Center Avenue, Suite 300 |

|

| Huntington

Beach, California |

92647 |

| (Address of principal executive offices) |

(Zip Code) |

(714)

500-2400

(Registrant's telephone number, including area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common Stock, No Par

Value |

|

BJRI |

|

NASDAQ

Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On February 28, 2024, BJ’s Restaurants, Inc., a California corporation

(the “Company”), announced its entry into a cooperation agreement (the “Cooperation Agreement”)

with Fund 1 Investments, LLC (with its affiliates, “Fund”). The Company and Fund are each herein referred to as a “party”

and collectively, the “parties.”

Pursuant to the Cooperation Agreement, the board of directors (the “Board”)

of the Company (i) increased the size of the Board to twelve (12) directors and appointed C. Bradford Richmond (the “New Director”)

to serve on the Board with a term expiring at the 2024 annual meeting of shareholders (the “2024 Annual Meeting”),

and (ii) agreed to nominate, support and recommend the New Director for election at the 2024 Annual Meeting.

The Cooperation Agreement further provides, among other things, that:

| |

· |

the Board will form, as promptly as practicable, a Shareholder Value Initiatives Committee of the Board, which shall be responsible for

reviewing opportunities to enhance shareholder value, and appoint the New Director to such committee, along with three additional members

to be selected by the Board; |

| |

· |

until the Termination Date (as defined below) and as long as Fund’s aggregate net long ownership remains at or above the lesser

of (i) 1,161,849 shares of common stock (subject to adjustment for stock splits, reclassifications, combinations and recapitalizations)

and (ii) five (5%) of the outstanding shares of the Company’s common stock, no par value (the “Common Stock”),

in the event that the New Director ceases to be a director of the Company for any reason, the Company and Fund will cooperate in good

faith to select, and the Company will appoint, as promptly as practicable, a Qualified Candidate mutually agreeable to the Company and

Fund, to serve as a director of the Company for the remainder of the New Director’s term. A Qualified Candidate means an individual

who (i) qualifies as an “independent director” under the applicable rules of the U.S. Securities and Exchange Commission,

the rules of any stock exchange on which the Company is traded and the applicable governance policies of the Company, (ii) is not a current

or former principal, Affiliate or controlled Associate of Fund (as defined in the Cooperation Agreement), (iii) serves on no more than

a total of three other public company boards of directors, and (iv) meets all other qualifications required for service as a director

set forth in the Company’s Amended and Restated Articles of Incorporation or the Amended and Restated Bylaws, committee charters,

corporate governance principles, and any similar documents applicable to directors; |

| |

· |

Fund will be subject to customary standstill restrictions, including, among others, with respect to the acquisition of beneficial ownership

of or otherwise having economic exposure up to a maximum ownership cap of fifteen percent (15%) of the shares of Common Stock in the aggregate,

proxy solicitation and related matters, extraordinary transactions and other changes, each of the foregoing subject to certain exceptions; |

| |

· |

until the Termination Date, Fund will vote all shares of Common Stock beneficially owned by it in accordance with the Board’s recommendations

with respect to (i) the election, removal and/or replacement of directors of the Company and (ii) any other proposal submitted to shareholders,

subject to certain exceptions relating to extraordinary transactions and recommendations made by Institutional Shareholder Services, Inc.

or Glass Lewis & Co., LLC; |

| |

· |

each party agrees not to disparage or sue the other party, subject to certain exceptions; |

| |

· |

unless otherwise mutually agreed to in writing by each party, the Cooperation Agreement will remain in effect until the date that is the

earlier of (i) one (1) year from the date of the Cooperation Agreement and (ii) thirty (30) days prior to the deadline for delivery of

notice under the Company’s Amended and Restated Bylaws for the nomination of director candidates for election to the Board at the

2025 annual meeting of shareholders (the “Termination Date”); and |

| |

· |

the Company will reimburse certain of Fund’s out-of-pocket fees and expenses, provided that such reimbursement will not exceed $75,000

in the aggregate. |

The foregoing description does not purport to be complete and is qualified

in its entirety by reference to the Cooperation Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein

by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(d) On February 27, 2024, the Board increased the

size of the Board to twelve (12) directors and appointed C. Bradford Richmond to the Board with a term expiring at the 2024 Annual Meeting.

C. Bradford Richmond, 65, brings to the Board extensive capital allocation and restaurant operations

experience. Mr. Bradford is a Certified Public Accountant with over 40 years of experience in the restaurant industry, contributing to

the operations and strategic planning of restaurant chains.

From 2006 to 2015, Mr. Richmond served as Chief Financial Officer of Darden Restaurants, Inc.

(NYSE: DRI) (“Darden”), a restaurant company featuring a portfolio of differentiated brands that include Olive Garden, LongHorn

Steakhouse, Yard House, Ruth’s Chris Steak House, Cheddar’s Scratch Kitchen, The Capital Grille, Seasons 52, Eddie V’s

and Bahama Breeze. From 2005 to 2006, Mr. Richmond served as Corporate Controller of Darden. Mr. Richmond previously held executive-level

finance and strategic planning roles at Red Lobster and Olive Garden. He also served as a senior auditor at Price Waterhouse & Cooper.

Mr. Richmond currently serves on the boards of Coast Entertainment Holdings Limited (ASX: CEH)

and Qualfon, Inc.

Except for the arrangements disclosed herein, there is no arrangement or understanding between

the Company and Mr. Richmond pursuant to which he was appointed to the Board, and there have been no related party transactions between

the Company and Mr. Richmond that would be reportable under Item 404(a) of Regulation S-K. Mr. Richmond will receive compensation consistent

with the Company’s compensation program for non-employee directors, as described in the Company’s latest proxy statement,

filed with the U.S. Securities and Exchange Commission on April 28, 2023.

The disclosure set forth in Item 1.01 above is hereby incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

A copy of the press release announcing the Company’s entry into the

Cooperation Agreement is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BJ'S RESTAURANTS, INC. |

| |

(Registrant) |

| |

|

| |

|

|

| Date: February 28, 2024 |

By: |

/s/ GREGORY S. LEVIN |

| |

|

Gregory S. Levin |

| |

|

Chief Executive Officer, President and Director |

| |

|

|

Exhibit 10.1

EXECUTION VERSION

COOPERATION AGREEMENT

This COOPERATION AGREEMENT (this “Agreement”)

is made and entered into as of February 27, 2024, by and between BJ’s Restaurants, Inc. (the “Company”), on the

one hand, and Fund 1 Investments, LLC (collectively with its Affiliates, the “Fund”), on the other hand. The Company

and Fund are each herein referred to as a “party” and collectively, the “parties.” Capitalized terms

used herein and not otherwise defined have the meanings ascribed to them in Section 14 below.

WHEREAS, on January 18, 2024, Fund filed a Schedule

13D with the Securities and Exchange Commission disclosing its intent to engage in discussions with the Board of Directors (the “Board”)

and management of the Company regarding the composition of the Board and opportunities to enhance shareholder value, which was amended

on February 21, 2024; and

WHEREAS, the Company and Fund have determined

to come to an agreement with respect to the composition of the Board and certain other matters, as provided in this Agreement.

NOW THEREFORE, in consideration of the foregoing

premises and the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties, intending to be legally bound hereby, agree as follows:

1.

Board Composition and Related Matters.

(a)

Simultaneously with the execution of this Agreement, the Board shall take all necessary actions to increase the size of the Board

to twelve (12) directors and appoint C. Bradford Richmond (the “New Director”) to the Board as a director with a term

expiring at the 2024 annual meeting of shareholders (the “2024 Annual Meeting”) or until his earlier death, disability,

resignation, disqualification, or removal. At the 2024 Annual Meeting, the Board shall nominate the New Director for election and shall

recommend, support, and solicit proxies for the election of the New Director in a manner no less rigorous and favorable than the manner

in which the Company recommends, supports, and solicits proxies for the election of its other nominees.

(b)

The size of the Board shall be no more than twelve (12) directors until the 2024 Annual Meeting, and no more than eleven (11) directors

from the completion of the 2024 Annual Meeting until the Termination Date (as defined below).

(c)

As promptly as practicable (and in any event within three (3) Business Days) following the execution of this Agreement, the Board

shall take all necessary actions to form a Shareholder Value Initiatives Committee of the Board (the “Committee”),

and to appoint the New Director and three additional members, to be selected by the Board subject to its sole discretion, to the Committee.

The Committee shall be responsible for reviewing opportunities to enhance shareholder value, and shall present formal recommendations

to the Board for review and approval. Upon Fund’s request, the Committee shall use its reasonable efforts to meet with Fund at least

once prior to June 30, 2024, so Fund has a reasonable opportunity to share its views with the Committee with respect to opportunities

to enhance shareholder value.

(d)

Until the Termination Date and as long as Fund’s Net Long Position remains at or above the lesser of (x) 1,161,849 shares

of Common Stock (subject to adjustment for stock splits, reclassifications, combinations, and recapitalizations) and (y) five percent

(5%) of the outstanding shares of the Common Stock:

(i)

If the New Director (or any Replacement Director (as defined below)) is unable or unwilling to serve as a director and ceases to

be a director, resigns as a director, is removed as a director, or for any other reason fails to serve as a director, the Company and

Fund shall cooperate in good faith to select, and the Company shall appoint, as promptly as practicable, a Qualified Candidate mutually

agreeable to the Company and Fund (any such replacement director, once appointed to the Board, the “Replacement Director”),

to serve as a director of the Company for the remainder of the New Director’s term. A Replacement Director who is appointed to the

Board shall be considered a New Director for purposes of this Agreement. As used in this Agreement, “Qualified Candidate”

means an individual who (1) qualifies as an “independent director” under the applicable rules of the U.S. Securities and Exchange

Commission, the rules of any stock exchange on which the Company is traded and the applicable governance policies of the Company, (2)

is not a current or former principal, Affiliate or controlled Associate of Fund, (3) serves on no more than a total of three (3) other

public company boards of directors, and (4) meets all other qualifications required for service as a director set forth in the Company’s

Amended and Restated Articles of Incorporation (as may be amended from time to time, the “Charter”) or the Amended

and Restated Bylaws (as may be amended from time to time, the “Bylaws”), committee charters, corporate governance principles,

and any similar documents applicable to directors (collectively, the “Governance Documents”).

(ii)

If the New Director is no longer serving as a member of the Committee for any reason, Fund shall be entitled to recommend to the

Board another member of the Board (including a Replacement Director) to serve as a member of the Committee (such replacement, a “Replacement

Member”). Any candidate for Replacement Member shall be subject to the reasonable approval of the Board, which approval shall

occur as soon as practicable following Fund proposing a member and shall not be unreasonably withheld, conditioned or delayed, and such

Replacement Member shall be appointed to the Committee within five (5) Business Days after the Board has approved of such candidate. In

the event the Board determines in good faith not to approve and appoint to the Board any Replacement Member proposed by Fund, Fund shall

have the right to propose an additional Replacement Member in accordance with this paragraph until a Replacement Member is appointed to

the Committee.

(e)

Additional committee appointments for the New Director, if any, shall be determined by the Board in good faith, in accordance with

the Board’s customary governance processes, and the Board shall give the New Director the same due consideration for committee membership

as any other independent director with similar expertise and qualifications.

(f)

The Company agrees that the New Director shall receive (i) the same benefits of director and officer insurance as all other non-management

directors on the Board, (ii) the same compensation for his service as a director as the compensation received by other non-management

directors on the Board, and (iii) such other benefits on the same basis as all other non-management directors on the Board.

(g)

Fund acknowledges and agrees that the New Director shall be governed by (i) all applicable laws and regulations, and (ii) all of

the same policies, processes, procedures, codes, rules, standards and guidelines (including, in each case, as related to confidentiality,

insider trading and conflicts of interest) applicable to members of the Board.

(h)

Fund acknowledges and agrees that: (i) consistent with his fiduciary duties as a director of the Company, the New Director shall

consider in good faith, to the same extent as any other director of the Company, recusal from any Board or committee meeting in the event

there is any other actual or potential conflict of interest; and (ii) the Board may restrict the New Director’s access to information

of the Company to the same extent it would for any other director of the Company, in accordance with applicable law.

2.

Voting Commitment. Until the Termination Date, Fund shall, and shall cause its Representatives to, (a) appear in person

or by proxy at each of the Company’s shareholder meetings (a “Shareholder Meeting”) and (b) vote, or deliver

consents or consent revocations with respect to, all shares of Common Stock beneficially owned by Fund in accordance with the Board’s

recommendations with respect to all proposals submitted to shareholders at such Shareholder Meeting, in each case as the Board’s

recommendation is set forth in the definitive proxy statement, consent solicitation statement, or revocation solicitation statement filed

by the Company in respect of such Shareholder Meeting. Notwithstanding the foregoing, (i) in the event that Institutional Shareholder

Services Inc. (“ISS”) or Glass Lewis & Co., LLC (“Glass Lewis”) issue voting recommendations

that differ from the Board’s recommendation with respect to any proposals (other than a proposal with respect to director elections

or removal), Fund shall be permitted to vote, or deliver consents or consent revocations with respect to any shares beneficially owned

by Fund in accordance with such ISS or Glass Lewis recommendation and (ii) Fund shall be permitted to vote in its sole discretion on any

proposal with respect to any Extraordinary Transaction. Fund shall use commercially reasonable efforts (including by calling back loaned

out shares) to ensure that Fund has voting power for each share beneficially owned by it on the record date for each Shareholder Meeting.

3.

Standstill. Prior to the Termination Date, except as otherwise provided in this Agreement, without the prior written

consent of the Board, Fund shall not, and shall cause its Affiliates not to, directly or indirectly:

(a)

acquire, offer or seek to acquire, agree to acquire, or acquire rights to acquire (except by way of stock dividends or other distributions

or offerings made available to holders of voting securities of the Company generally on a pro rata basis or pursuant to an Extraordinary

Transaction approved by the Board), whether by purchase, tender or exchange offer, through the acquisition of control of another person,

by joining a group, through swap or hedging transactions or otherwise, any voting securities of the Company (other than through any index

fund, exchange traded fund, benchmark fund or broad-based basket of securities) or any voting rights decoupled from the underlying voting

securities that would result in Fund and its Affiliates having beneficial ownership of, in the aggregate, more than fifteen percent (15%)

of the shares of Common Stock outstanding at such time, or otherwise having economic exposure equal to, in the aggregate, more than fifteen

percent (15%) of the shares of Common Stock outstanding at such time (collectively, the “Maximum Ownership Cap”);

(b)

sell, assign, or otherwise transfer or dispose of shares of Common Stock, or any rights decoupled from such shares, beneficially

owned by them, other than in open market sale transactions where the identity of the purchaser is not known or in underwritten widely-dispersed

public offerings, to any Third Party that, to Fund’s knowledge (after reasonable due inquiry in connection with a private, non-open

market transaction), would result in such Third Party, together with its Affiliates and Associates, beneficially owning, in the aggregate,

more than four and nine-tenths percent (4.9%) of the shares of Common Stock outstanding at such time or would increase the beneficial

ownership of any Third Party who, together with its Affiliates and Associates, has a beneficial or other ownership interest of, in the

aggregate, more than four and nine-tenths percent (4.9%) of the shares of Common Stock outstanding at such time;

(c)

(i) nominate, recommend for nomination or give notice of an intent to nominate or recommend for nomination a person for election

at any Shareholder Meeting at which the Company’s directors are to be elected; (ii)

knowingly initiate, encourage or participate in any solicitation of proxies, consents or consent revocations in respect of any election

contest or removal contest with respect to the Company’s directors; (iii)

submit, initiate, make or be a proponent of any shareholder proposal for consideration at, or bring any other business before, any Shareholder

Meeting; (iv) knowingly initiate, encourage or participate in any solicitation

of proxies, consents or consent revocations in respect of any shareholder proposal for consideration at, or other business brought before,

any Shareholder Meeting; or (v) knowingly initiate, encourage or participate

in any “withhold” or similar campaign with respect to any proposal for consideration at, or other business brought before,

any Shareholder Meeting; or (vi) call or seek to call, or request the call of, or

initiate a consent solicitation or consent revocation solicitation with respect to, alone or in concert with others, any Shareholder Meeting,

whether or not such a Shareholder Meeting is permitted by the Charter or the Bylaws, including any “town hall” meeting;

(d)

form, join or in any way participate in or with any group or agreement of any kind with respect to any voting securities of the

Company, other than any such group or agreement that is with an Affiliate of Fund and such Affiliate agrees to be bound by the terms and

conditions of this Agreement as if it were a party hereto and such group or agreement would not result in Fund exceeding the Maximum Ownership

Cap;

(e)

deposit any voting securities of the Company in any voting trust or subject any Company voting securities to any arrangement or

agreement with respect to the voting thereof, other than any such voting trust, arrangement, or agreement that is with an Affiliate of

Fund and such Affiliate agrees to be bound by the terms and conditions of this Agreement as if it were a party hereto and such voting

trust, arrangement, or agreement would not result in Fund exceeding the Maximum Ownership Cap;

(f)

seek publicly, alone or in concert with others, to amend any provision of the Governance Documents;

(g)

demand an inspection of the Company’s books and records;

(h)

make any public proposal with respect to: (A) any change in the composition, number or term of directors serving on the Board or

the filling of any vacancies on the Board, (B) any change in the capitalization, dividend policy, or share repurchase programs or practices

of the Company, (C) any other change in the Company’s management, governance, corporate structure or policies, (D) causing a class

of securities of the Company to be delisted from, or to cease to be authorized to be quoted on, any securities exchange or (E) causing

a class of equity securities of the Company to become eligible for termination of registration pursuant to Section 12(g)(4) of the

Exchange Act (as defined below);

(i)

offer or propose to effect any (i) material acquisition of any assets or businesses

of the Company or any of its subsidiaries; (ii) tender offer or exchange offer, merger,

acquisition, share exchange or other business combination, or Extraordinary Transaction, involving the Company and any of the voting securities

or any of the material assets or businesses of the Company or any of its subsidiaries; or (iii)

recapitalization, restructuring, liquidation, dissolution or other material transaction with respect to the Company or any of its subsidiaries

or any material portion of its or their businesses, in each case of clauses (i)-(iii) which would reasonably be expected to require public

announcement or disclosure of such offer or proposal;

(j)

enter into any negotiations, agreements, or understandings with any Third Party, or knowingly advise, assist, encourage or seek

to persuade any Third Party to, take any action that is prohibited under this Section 3;

(k)

publicly make or in any way advance publicly any request or proposal that the Company or the Board amend, modify, or waive any

provision of this Agreement; or

(l)

take any action challenging the validity or enforceability of this Section 3 or this Agreement unless the Company is challenging

the validity or enforceability of this Agreement.

Notwithstanding anything to the contrary in this Agreement, nothing in

this Agreement, including the restrictions in this Section 3, shall prohibit or restrict Fund from (i) making

any true and correct statement to the extent required by applicable legal process, subpoena or legal requirement from any governmental

authority with competent jurisdiction over Fund so long as such request did not arise as a result of any action by Fund; (ii) communicating

privately with any director or executive officer of the Company, or members of the investor relations team made available for communications

involving broad-based groups of investors (including through participation in investor meetings and/or conferences), on any matter so

long as such communications would not reasonably be expected to require public disclosure obligations for any party; (iii) making any

public or private statement or announcement with respect to any Extraordinary Transaction that is publicly announced by the Company,

(iv) tendering shares, receiving payment for shares or otherwise participating in

any transaction approved by the Board on the same basis as the other shareholders of the Company; or (v) making

or sending private communications to investors or prospective investors in Fund, provided that such statements or communications (1)

are based on publicly available information; (2) are not reasonably expected to be publicly disclosed and are understood by all parties

to be confidential communications; and (3) are not intended to be circumventing the restrictions in Section 3 and 4 hereof.

4.

Mutual Non-Disparagement. Until the Termination Date, without the prior written consent of the other party, neither

party shall, nor shall it permit any of its Representatives to, make any public statement, including by filing or furnishing any document

to the SEC, or by press release or other public statement to a member of the press or media, in a manner that disparages, defames, slanders

or impugns the other party, its subsidiaries, its business, or its current or former directors (in their capacity as such), officers,

or employees. A statement or announcement shall only be deemed to be made by the Company if made by a member of the Board or senior management

team or other designated representative of the Company, in each case authorized to make such statement or announcement on behalf of the

Company. A statement or announcement shall only be deemed to be made by Fund if made by a manager, director, general partner, member of

the senior management team or other designated representative of Fund, in each case authorized to make such statement or announcement

on behalf of Fund. The restrictions in this Section 4 shall not (a) apply to (i) any compelled testimony or production of information,

whether by legal process, subpoena, or as part of a response to a request for information from any governmental or regulatory authority

with jurisdiction over the party from whom information is sought, in each case to the extent required, (ii) any disclosure that such party

reasonably believes, after consultation with outside counsel, to be legally required by applicable law, rules or regulations, or (iii)

any private communications between or among the parties and their respective Representatives; (b) prohibit either party from reporting

what it reasonably believes, after consultation with outside counsel, to be violations of federal law or regulation to any governmental

authority pursuant to Section 21F of the Exchange Act or Rule 21F promulgated thereunder; or (c) prohibit any private communications

among the principals, officers, managers, and employees of Fund.

5.

No Litigation. Prior to the Termination Date, each party hereby covenants and agrees that it shall not, and shall not

permit any of its Representatives to, directly or indirectly, alone or in concert with others, encourage, pursue, or knowingly assist

any other person to threaten or initiate any lawsuit, claim, or proceeding before any court (each, a “Legal Proceeding”)

against the other party or any of its Representatives based on information known or unknown as of the date of this Agreement, except for

(a) any Legal Proceeding initiated primarily to remedy a breach of or to enforce this Agreement, (b) counterclaims with respect to any

proceeding initiated by or on behalf of one party or its Affiliates against the other party or its Affiliates or (c) any Legal Proceeding

with respect to claims of fraud in connection with, arising out of or related to this Agreement; provided, however, that

the foregoing shall not prevent any party or any of its Representatives from responding to oral questions, interrogatories, requests for

information or documents, subpoenas, civil investigative demands or similar processes (each, a “Legal Requirement”)

in connection with any Legal Proceeding if such Legal Proceeding has not been initiated by, on behalf of, or at the suggestion of such

party or any of its Representatives; provided, further, that in the event any party or any of its Representatives receives

such Legal Requirement, such party shall give prompt written notice of such Legal Requirement to the other party (except where such notice

would be legally prohibited or not practicable). Each party represents and warrants that neither it nor any assignee has filed any Legal

Proceeding against the other party.

6.

Public Statements; SEC Filings.

(a)

Not later than February 28, 2024, the Company shall issue a mutually agreeable press release (the “Press Release”)

announcing this Agreement in the form attached hereto as Exhibit A. Prior to the issuance of the Press Release, neither the

Company nor Fund shall issue any press release or public announcement regarding this Agreement or take any action that would require public

disclosure thereof without the prior written consent of the other party.

(b)

Not later than February 28, 2024, the Company shall file with the SEC a Current Report on Form 8-K setting forth a brief description

of the terms of this Agreement and appending this Agreement as an exhibit thereto (the “Form 8-K”). The Company shall

provide Fund and its Representatives with a reasonable opportunity to review and comment on the Form 8-K prior to it being filed with

the SEC and consider in good faith any comments of Fund and its Representatives.

(c)

Within two (2) Business Days following the date of this Agreement, Fund shall file with the SEC an amendment to its Schedule 13D

setting forth a brief description of the terms of this Agreement and appending this Agreement as an exhibit thereto (the “Schedule

13D Amendment”). The Schedule 13D Amendment shall be consistent with the terms of this Agreement and the Press Release. Fund

shall provide the Company and its Representatives with a reasonable opportunity to review and comment on the Schedule 13D Amendment prior

to it being filed with the SEC and consider in good faith any comments of the Company and its Representatives.

(d)

Prior to the Termination Date, neither party shall issue any press release or other public statement (including in any filing under

the Exchange Act) about the subject matter of this Agreement that is inconsistent with or contrary to the Press Release, the Form 8-K

and the Schedule 13D Amendment, except as required by law, Legal Requirement or applicable stock exchange listing rules or with the prior

written consent of the other party and otherwise in accordance with this Agreement.

7.

Affiliates and Associates. Each party shall instruct its Affiliates and Associates to comply with the terms of this

Agreement applicable to such persons, and shall be responsible for any breach of this Agreement by any such Affiliate or Associate. A

breach of this Agreement by an Affiliate or Associate of a party, if such Affiliate or Associate is not a party to this Agreement, shall

be deemed to occur if such Affiliate or Associate engages in conduct that would constitute a breach of this Agreement if such Affiliate

or Associate was a party to this Agreement.

8.

Representations and Warranties.

(a)

Fund represents and warrants that it has full power and authority to execute, deliver and carry out the terms and provisions of

this Agreement and to consummate the transactions contemplated hereby, and that this Agreement has been duly and validly executed and

delivered by it, constitutes a valid and binding obligation and agreement of it and is enforceable against it in accordance with its terms,

except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or

similar laws generally affecting the rights of creditors and subject to general equity principles. Fund represents that (i) the execution

of this Agreement, the consummation of any of the transactions contemplated hereby, and the fulfillment of the terms hereof, in each case

in accordance with the terms hereof, will not conflict with, or result in a breach or violation of the organizational documents of it

as currently in effect and (ii) the execution, delivery and performance of this Agreement by it does not and will not (A) violate

or conflict with any law, rule, regulation, order, judgment or decree applicable to it or (B) result in any breach or violation of

or constitute a default under or pursuant to (or an event which with notice or lapse of time or both could constitute such a breach, violation

or default), or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation

of, any organizational document, agreement, contract, commitment, understanding or arrangement to which it is a party or by which it is

bound. Fund represents and warrants that, as of the date of this Agreement, Fund beneficially owns 2,568,476 shares of Common Stock and

has voting authority over all such shares.

(b)

The Company hereby represents and warrants that it has the power and authority to execute, deliver and carry out the terms and

provisions of this Agreement and to consummate the transactions contemplated hereby, and that this Agreement has been duly and validly

authorized, executed and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company and is enforceable

against the Company in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance or similar laws generally affecting the rights of creditors and subject to general equity principles.

The Company represents and warrants that (i) the execution of this Agreement, the consummation of any of the transactions contemplated

hereby, and the fulfillment of the terms hereof, in each case in accordance with the terms hereof, will not conflict with, or result in

a breach or violation of the organizational documents of the Company as currently in effect and (ii) the execution, delivery and performance

of this Agreement by the Company does not and will not (A) violate or conflict with any law, rule, regulation, order, judgment or decree

applicable to the Company or (B) result in any breach or violation of or constitute a default under or pursuant to (or an event which

with notice or lapse of time or both could constitute such a breach, violation or default), or result in the loss of a material benefit

under, or give any right of termination, amendment, acceleration or cancellation of, any organizational document, agreement, contract,

commitment, understanding or arrangement to which the Company is a party or by which it is bound.

9.

Termination.

(a)

Unless otherwise mutually agreed to in writing by each party, this Agreement shall remain in effect until the date that is the

earlier of (i) one (1) year from the date of this Agreement and (ii) thirty (30) days prior to the deadline for delivery of notice under

the Bylaws for the nomination of director candidates for election to the Board at the 2025 annual meeting of shareholders (the “Termination

Date”).

(b)

Notwithstanding anything to the contrary in this Agreement:

(i)

the obligations of Fund pursuant to Sections 3 (Standstill), 4 (Mutual Non-Disparagement) and 6 (Public Statement; SEC Filings)

shall terminate in the event that the Company materially breaches its obligations pursuant to 4 (Mutual Non-Disparagement) or 6 (Public

Statement; SEC Filings) and such breach (if capable of being cured) has not been cured within fifteen (15) days following written notice

of such breach; provided, however, that any termination in respect of a breach of Section 4 (Mutual Non-Disparagement)

shall require a determination of a court of competent jurisdiction that the Company has materially breached Section 4 (Mutual Non-Disparagement);

and

(ii)

the obligations of the Company pursuant to Sections 4 (Mutual Non-Disparagement) and 6 (Public Statement; SEC Filings) shall

terminate in the event that Fund materially breaches its obligations in Sections 3 (Standstill), 4 (Mutual Non-Disparagement) and

6 (Public Statement; SEC Filings) and such breach (if capable of being cured) has not been cured within fifteen (15) days following written

notice of such breach; provided, however, that any termination in respect of a breach of Section 4 (Mutual Non-Disparagement)

shall require a determination of a court of competent jurisdiction that Fund has materially breached Section 4 (Mutual Non-Disparagement).

(c)

If this Agreement is terminated in accordance with this Section 9, this Agreement shall forthwith become null and void, but

no termination shall relieve either party from liability for any breach of this Agreement prior to such termination. Notwithstanding the

foregoing, Sections 11 (Notices), 12 (Governing Law; Jurisdiction; Jury Waiver), 13 (Specific Performance) and 15 (Miscellaneous)

shall survive the termination of this Agreement.

10.

Expenses. The Company shall reimburse Fund for documented out-of-pocket costs, fees and expenses (including attorneys’

fees and other legal expenses) incurred by Fund in connection with its engagement with the Company, the negotiation and execution of this

Agreement and related matters; provided, however, that such reimbursement shall not exceed $75,000 in the aggregate.

11.

Notices. All notices, demands and other communications to be given or delivered under or by reason of the provisions

of this Agreement shall be in writing and shall be deemed to have been given (a) when delivered by hand, with written confirmation of

receipt; (b) upon sending, if sent by electronic mail to the electronic mail addresses below, with confirmation of receipt from the receiving

party by electronic mail; (c) one (1) Business Day after being sent by a nationally recognized overnight carrier to the addresses set

forth below; or (d) when actually delivered if sent by any other method that results in delivery, with written confirmation of receipt:

| If to the Company: |

|

with mandatory copies (which shall not constitute notice) to: |

| |

|

|

| BJ’s Restaurants, Inc. |

|

Sidley Austin LLP |

| 7755 Center Avenue, Suite 300 |

|

787 Seventh Avenue |

| Huntington Beach, California 92647 |

|

New York, NY 10019 |

| Attn: Kendra D. Miller, Executive Vice |

|

Attn: |

Kai H. Liekefett |

| President, General Counsel and Corporate |

|

|

Leonard Wood |

| Secretary |

|

Email: |

kliekefett@sidley.com |

| Email: kmiller@bjsrestaurants.com |

|

|

lwood@sidley.com |

| |

|

|

|

| |

|

|

|

| If to Fund: |

|

with mandatory copies (which shall not constitute notice) to: |

| |

|

|

|

| |

|

|

|

| Fund 1 Investments, LLC |

|

Olshan Frome Wolosky LLP |

| 100 Carr 115, Unit 1900 |

|

1325 Avenue of the Americas |

| Rincon, Puerto Rico 00677 |

|

New York, NY 10019 |

| Attn: Jonathan Lennon |

|

Attn: |

Kenneth S. Mantel |

| Email: jonathan.lennon@plpfunds.com |

|

Email: |

KMantel@olshanlaw.com |

12.

Governing Law; Jurisdiction; Jury Waiver. This Agreement, and any disputes arising out of or related to this Agreement

(whether for breach of contract, tortious conduct or otherwise), shall be governed by, and construed in accordance with, the laws of the

State of Delaware, without giving effect to its conflict of laws principles. The parties agree that exclusive jurisdiction and venue for

any Legal Proceeding arising out of or related to this Agreement shall exclusively lie in the Court of Chancery of the State of Delaware

or, if the Court of Chancery does not have subject matter jurisdiction, the Superior Court of the State of Delaware or, if jurisdiction

is vested exclusively in the Federal courts of the United States, the Federal courts of the United States sitting in the State of Delaware,

and any appellate court from any such state or Federal court. Each party waives any objection it may now or hereafter have to the laying

of venue of any such Legal Proceeding, and irrevocably submits to personal jurisdiction in any such court in any such Legal Proceeding

and hereby further irrevocably and unconditionally waives and agrees not to plead or claim in any court that any such Legal Proceeding

brought in any such court has been brought in any inconvenient forum. Each party consents to accept service of process in any such Legal

Proceeding by service of a copy thereof upon either its registered agent in the State of Delaware or the Secretary of State of the State

of Delaware, with a copy delivered to it by certified or registered mail, postage prepaid, return receipt requested, addressed to it at

the address set forth in Section 11. Nothing contained herein shall be deemed to affect the right of any party to serve process in

any manner permitted by law. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT

OF OR RELATED TO THIS AGREEMENT.

13.

Specific Performance. Each party to this Agreement acknowledges and agrees that the other party would be irreparably

injured by an actual breach of this Agreement by the first-mentioned party or its Representatives and that monetary remedies would be

inadequate to protect either party against any actual or threatened breach or continuation of any breach of this Agreement. Without prejudice

to any other rights and remedies otherwise available to the parties under this Agreement, each party shall be entitled to equitable relief

by way of injunction or otherwise and specific performance of the provisions hereof upon satisfying the requirements to obtain such relief,

without the necessity of posting a bond or other security, if the other party or any of its Representatives breaches or threatens to breach

any provision of this Agreement. Such remedy shall not be deemed to be the exclusive remedy for a breach of this Agreement but shall be

in addition to all other remedies available at law or equity to the non-breaching party.

14.

Certain Definitions and Interpretations. As used in this Agreement: (a) the

terms “Affiliate” and “Associate” (and any plurals thereof) have the meanings ascribed to such terms

under Rule 12b-2 promulgated by the SEC under the Exchange Act and shall include persons or entities that after the date hereof become

Affiliates or Associates of any applicable person or entity referred to in this Agreement; provided, however, that the term “Associate”

shall refer only to Associates controlled by the Company or Fund, as applicable; provided, further, that Fund shall not

be an Affiliate or Associate of the Company, and the Company shall not be an Affiliate or Associate of Fund; provided, further,

that with respect to Fund, the term Affiliate shall not include any portfolio company of Fund; (b) the

terms “beneficial ownership,” “group,” “person,” “proxy” and

“solicitation” (and any plurals thereof) have the meanings ascribed to such terms under the Exchange Act and the rules

and regulations promulgated thereunder; provided, that the meaning of “solicitation” shall be without regard to the

exclusions set forth in Rules 14a-1(l)(2)(iv) and 14a-2(b)(2) under the Exchange Act; (c) the

term “Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in the State

of California are authorized or obligated to be closed by applicable law; (d) the

term “Common Stock” means the common stock, no par value per share, of the Company; (e)

the term “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated

thereunder; (f) the term “Extraordinary Transaction” means

any tender offer, exchange offer, merger, consolidation, acquisition, business combination, sale of all or substantially all of the Company’s

assets, recapitalization, restructuring, or other similar corporate transaction involving the Company and a third party, in each case,

that results in a change in control of the Company; (g) the term “Net Long

Position” means such shares of Common Stock beneficially owned, directly or indirectly, that constitute such person’s

net long position as defined in Rule 14e-4 under the Exchange Act mutatis mutandis; provided, that “Net Long Position”

shall not include any shares as to which such person does not have the right to vote or direct the vote other than as a result of being

in a margin account, or as to which such person has entered into a derivative or other agreement, arrangement or understanding that hedges

or transfers, in whole or in part, directly or indirectly, any of the economic consequences of ownership of such shares; and the terms

“person” or “persons,” for purposes of the meaning of the term “Net Long Position,” shall mean any

individual, corporation (including not-for-profit), general or limited partnership, limited liability or unlimited liability company,

joint venture, estate, trust, associate, organization or other entity of any kind or nature; (h) the

term “Representatives” means (i) a person’s Affiliates and Associates and (ii) its and their respective

directors, officers, employees, partners, members, managers, consultants, legal or other advisors, agents and other representatives, in

each case, only to the extent such persons are acting in a capacity on behalf of, in concert with, or at the direction of such person

or its Affiliates or Associates; (i) the term “SEC” means

the U.S. Securities and Exchange Commission; (j) the term “Shareholder

Meeting” means each annual or special meeting of shareholders of the Company, or any action by written consent of the Company’s

shareholders in lieu thereof, and any adjournment, postponement, rescheduling or continuation thereof; and (k) the

term “Third Party” refers to any person that is not a party, a member of the Board, a director or officer of the Company,

or legal counsel to either party. In this Agreement, unless a clear contrary intention appears, (i)

the word “including” (in its various forms) means “including, without limitation;” (ii)

the words “hereunder,” “hereof,” “hereto” and words of similar import are references in this Agreement

as a whole and not to any particular provision of this Agreement; (iii) the

word “or” is not exclusive; (iv) references to “Sections”

in this Agreement are references to Sections of this Agreement unless otherwise indicated; and (v) whenever

the context requires, the masculine gender shall include the feminine and neuter genders.

15.

Miscellaneous.

(a)

This Agreement, including all exhibits hereto, contains the entire agreement between the parties and supersedes all other prior

agreements and understandings, both written and oral, between the parties with respect to the subject matter hereof.

(b)

This Agreement is solely for the benefit of the parties and is not enforceable by any other persons.

(c)

This Agreement shall not be assignable by operation of law or otherwise by a party without the consent of the other party. Any

purported assignment without such consent is void ab initio. Subject to the foregoing sentence, this Agreement shall be binding

upon, inure to the benefit of, and be enforceable by and against the permitted successors and assigns of each party.

(d)

Neither the failure nor any delay by a party in exercising any right, power or privilege under this Agreement shall operate as

a waiver thereof, nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any

right, power, or privilege hereunder.

(e)

If any term, provision, covenant, or restriction of this Agreement is held by a court of competent jurisdiction to be invalid,

void, or unenforceable, the remainder of the terms, provisions, covenants, and restrictions of this Agreement shall remain in full force

and effect and shall in no way be affected, impaired, or invalidated. It is hereby stipulated and declared to be the intention of the

parties that the parties would have executed the remaining terms, provisions, covenants, and restrictions without including any of such

which may be hereafter declared invalid, void, or unenforceable. In addition, the parties agree to use their reasonable best efforts to

agree upon and substitute a valid and enforceable term, provision, covenant, or restriction for any of such that is held invalid, void,

or unenforceable by a court of competent jurisdiction.

(f)

Any amendment or modification of the terms and conditions set forth herein or any waiver of such terms and conditions must be agreed

to in a writing signed by each party.

(g)

This Agreement may be executed in one (1) or more textually identical counterparts, each of which shall be deemed an original,

but all of which together shall constitute one and the same agreement. Signatures to this Agreement transmitted by facsimile transmission,

by electronic mail in “portable document format” (“.pdf”) form, or by any other electronic means intended to preserve

the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of the paper document bearing

the original signature.

(h)

Each party acknowledges that it has been represented by counsel of its choice throughout all negotiations that have preceded the

execution of this Agreement, and that it has executed this Agreement with the advice of such counsel.

(i)

The headings set forth in this Agreement are for convenience of reference purposes only and will not affect or be deemed to affect

in any way the meaning or interpretation of this Agreement or any term or provision of this Agreement.

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the parties has executed

this Agreement, or caused the same to be executed by its duly authorized representative, as of the date first above written.

| |

THE COMPANY: |

| |

|

|

| |

|

|

| |

BJ’S RESTAURANTS, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Gerald W. Deitchle |

| |

|

|

| |

Name: Gerald W. Deitchle |

| |

Title: Chairman of the Board |

| |

FUND: |

| |

|

|

| |

|

|

| |

FUND 1 INVESTMENTS, LLC |

| |

|

|

| |

|

|

| |

By: |

/s/ Jonathan Lennon |

| |

|

|

| |

Name: Jonathan Lennon |

| |

Title: Managing Member |

Signature Page to Cooperation Agreement

Exhibit A

Form of Press Release

BJ’s Restaurants, Inc. Appoints New Independent Director Brad

Richmond

Announces Cooperation Agreement with Fund 1 Investments

Board to Form a Shareholder Value Initiatives Committee to Provide Analysis

and Recommendations to Board

HUNTINGTON BEACH, Calif. -- (February 28, 2024) -- BJ’s Restaurants,

Inc. (“BJ’s” or the “Company”) (Nasdaq: BJRI) today announced that it has appointed C. Bradford (Brad) Richmond

to its Board of Directors (the “Board”), effective immediately. In conjunction with Mr. Richmond’s appointment, the

Company entered into a cooperation agreement (the “Cooperation Agreement”) with Fund 1 Investments, LLC, one of the company’s

shareholders (collectively with its affiliates, “Fund 1”).

Mr. Richmond served as Chief Financial Officer of Darden Restaurants Inc.

from 2006 to 2015, where he also served as Corporate Controller from 2005 to 2006. He previously held executive-level finance and strategic

planning roles at Red Lobster and Olive Garden. Mr. Richmond also serves on the boards of directors of Coast Entertainment Holdings, a

specialty operator of theme parks, tourist attractions, and other leisure facilities, and Qualfon, a global provider of call centers,

back office services, and business process outsourcing services. He is experienced in multiple areas relevant to the Company’s business,

including capital allocation, restaurant operations, and strategic planning.

“We are pleased to welcome Brad, an accomplished public company executive,

to the Board,” said Gerald (“Jerry”) W. Deitchle, Chairman of the Board. “His addition reflects our commitment

to ensuring the Board has the right mix of skills and experiences.”

In connection with entering into the Cooperation Agreement, the Board also

will form a Shareholder Value Initiatives Committee that will make recommendations to the full Board with respect to the Board’s

continued efforts to maximize value for shareholders.

Peter (“Pete”) A. Bassi, the Company’s Lead Independent

Director, said, “We look forward to working with Brad, who we believe will provide important insight to the Board.”

“We are pleased to have reached an agreement with the Board on the

appointment of Brad, a highly qualified independent director, and the formation of the Shareholder Value Initiatives Committee" said

Jonathan Lennon, the Managing Member of Fund 1. “We believe that BJ’s is well positioned to navigate a dynamic market environment,

and we are confident that Brad can help the company drive shareholder value.”

Fund 1 has agreed to a customary standstill, voting commitment, and related

provisions in connection with the Cooperation Agreement. A copy of the Cooperation Agreement will be included as an exhibit to the company’s

current report on Form 8-K, which will be filed with the U.S. Securities and Exchange Commission (the “SEC”).

Sidley Austin LLP and Elkins Kalt Weintraub Reuben Gartside LLP are serving

as legal counsel to the Company. Olshan Frome Wolosky LLP and Kleinberg, Kaplan, Wolff & Cohen, P.C. are serving as legal counsel

to Fund 1.

About BJ’s Restaurants, Inc.

BJ’s Restaurants, Inc. is a national brand with brewhouse roots where

Craft Matters®. BJ’s broad menu has something for everyone: slow-roasted entrees, like prime rib, BJ’s EnLIGHTened Entrees®

including Cherry Chipotle Glazed Salmon, signature deep-dish pizza and the often imitated, but never replicated world-famous Pizookie®

dessert. A winner of the 2023 Vibe Vista Award in the Best Spirits Program category and the most decorated restaurant-brewery in the country,

BJ’s has been a pioneer in the craft brewing world since 1996 and takes pride in serving BJ’s award-winning proprietary handcrafted

beers, brewed at its brewing operations in four states and by independent third-party craft brewers. The BJ’s experience offers

high-quality ingredients, bold flavors, moderate prices, sincere service, and a cool, contemporary atmosphere. Founded in 1978, BJ’s

owns and operates over 200 casual dining restaurants in 30 states. All restaurants offer dine-in, take-out, delivery and large party catering.

For more BJ’s information, visit http://www.bjsrestaurants.com.

Forward Looking Statements

Statements used in this news release relating to future plans, or events,

are forward-looking statements subject to certain risks and uncertainties.&NegativeTh Additional information concerning

these and other risks and uncertainties is contained in the Company’s filings with the SEC, including the Annual Report on Form

10-K, and other periodic reports filed with the SEC. The Company has no obligation to publicly update or revise any of the forward-looking

statements in this news release.

Investor Relations Contact

For further information, please contact Tom Houdek of BJ’s Restaurants,

Inc. at (714) 500-2400.

EXHIBIT 99.1

BJ’s Restaurants, Inc. Appoints New Independent Director Brad Richmond

Announces Cooperation Agreement with Fund 1 Investments

Board to Form a Shareholder Value Initiatives Committee to Provide Analysis and Recommendations to Board

HUNTINGTON BEACH, Calif., Feb. 28, 2024 (GLOBE NEWSWIRE) -- BJ’s Restaurants, Inc. (“BJ’s” or the “Company”) (Nasdaq: BJRI) today announced that it has appointed C. Bradford (Brad) Richmond to its Board of Directors (the “Board”), effective immediately. In conjunction with Mr. Richmond’s appointment, the Company entered into a cooperation agreement (the “Cooperation Agreement”) with Fund 1 Investments, LLC, one of the company’s shareholders (collectively with its affiliates, “Fund 1”).

Mr. Richmond served as Chief Financial Officer of Darden Restaurants Inc. from 2006 to 2015, where he also served as Corporate Controller from 2005 to 2006. He previously held executive-level finance and strategic planning roles at Red Lobster and Olive Garden. Mr. Richmond also serves on the boards of directors of Coast Entertainment Holdings, a specialty operator of theme parks, tourist attractions, and other leisure facilities, and Qualfon, a global provider of call centers, back office services, and business process outsourcing services. He is experienced in multiple areas relevant to the Company’s business, including capital allocation, restaurant operations, and strategic planning.

“We are pleased to welcome Brad, an accomplished public company executive, to the Board,” said Gerald (“Jerry”) W. Deitchle, Chairman of the Board. “His addition reflects our commitment to ensuring the Board has the right mix of skills and experiences.”

In connection with entering into the Cooperation Agreement, the Board also will form a Shareholder Value Initiatives Committee that will make recommendations to the full Board with respect to the Board’s continued efforts to maximize value for shareholders.

Peter (“Pete”) A. Bassi, the Company’s Lead Independent Director, said, “We look forward to working with Brad, who we believe will provide important insight to the Board.”

“We are pleased to have reached an agreement with the Board on the appointment of Brad, a highly qualified independent director, and the formation of the Shareholder Value Initiatives Committee" said Jonathan Lennon, the Managing Member of Fund 1. “We believe that BJ’s is well positioned to navigate a dynamic market environment, and we are confident that Brad can help the company drive shareholder value.”

Fund 1 has agreed to a customary standstill, voting commitment, and related provisions in connection with the Cooperation Agreement. A copy of the Cooperation Agreement will be included as an exhibit to the company’s current report on Form 8-K, which will be filed with the U.S. Securities and Exchange Commission (the “SEC”).

Sidley Austin LLP and Elkins Kalt Weintraub Reuben Gartside LLP are serving as legal counsel to the Company. Olshan Frome Wolosky LLP and Kleinberg, Kaplan, Wolff & Cohen, P.C. are serving as legal counsel to Fund 1.

About BJ’s Restaurants, Inc.

BJ’s Restaurants, Inc. is a national brand with brewhouse roots where Craft Matters®. BJ’s broad menu has something for everyone: slow-roasted entrees, like prime rib, BJ’s EnLIGHTened Entrees® including Cherry Chipotle Glazed Salmon, signature deep-dish pizza and the often imitated, but never replicated world-famous Pizookie® dessert. A winner of the 2023 Vibe Vista Award in the Best Spirits Program category and the most decorated restaurant-brewery in the country, BJ’s has been a pioneer in the craft brewing world since 1996 and takes pride in serving BJ’s award-winning proprietary handcrafted beers, brewed at its brewing operations in four states and by independent third-party craft brewers. The BJ’s experience offers high-quality ingredients, bold flavors, moderate prices, sincere service, and a cool, contemporary atmosphere. Founded in 1978, BJ’s owns and operates over 200 casual dining restaurants in 30 states. All restaurants offer dine-in, take-out, delivery and large party catering. For more BJ’s information, visit http://www.bjsrestaurants.com.

Forward Looking Statements

Statements used in this news release relating to future plans, or events, are forward-looking statements subject to certain risks and uncertainties. Additional information concerning these and other risks and uncertainties is contained in the Company’s filings with the SEC, including the Annual Report on Form 10-K, and other periodic reports filed with the SEC. The Company has no obligation to publicly update or revise any of the forward-looking statements in this news release.

Investor Relations Contact

For further information, please contact Tom Houdek of BJ’s Restaurants, Inc. at (714) 500-2400.

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

0-21423

|

| Entity Registrant Name |

BJ'S

RESTAURANTS, INC.

|

| Entity Central Index Key |

0001013488

|

| Entity Tax Identification Number |

33-0485615

|

| Entity Incorporation, State or Country Code |

CA

|

| Entity Address, Address Line One |

7755

Center Avenue, Suite 300

|

| Entity Address, City or Town |

Huntington

Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92647

|

| City Area Code |

714

|

| Local Phone Number |

500-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, No Par

Value

|

| Trading Symbol |

BJRI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

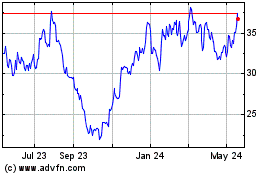

BJs Restaurants (NASDAQ:BJRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

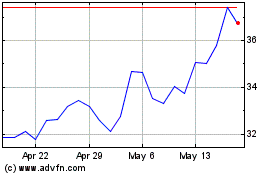

BJs Restaurants (NASDAQ:BJRI)

Historical Stock Chart

From Apr 2023 to Apr 2024