OSI Systems, Inc. (NASDAQ:OSIS) today announced financial results

for its fourth quarter and fiscal year ended June 30, 2006. The

Company reported revenues of $125.6 million for the fourth quarter

of fiscal 2006, an increase of 25% from the $100.7 million reported

for the fourth quarter of fiscal 2005. Net income for the fourth

quarter of fiscal 2006 was $0.7 million, or $0.04 per diluted

share, compared to a net loss of $3.2 million, or ($0.20) per

diluted share, for the fourth quarter of fiscal 2005. The fourth

quarter of fiscal 2006 results included stock-based compensation

expenses of $1.3 million, or $0.06 per diluted share, due to the

adoption of FAS 123R on July 1, 2005. Results for the fourth

quarter of fiscal 2005 did not include stock-based compensation

expenses. For the fiscal year ended June 30, 2006, revenues

increased by $67.6 million, or 18%, to $452.7 million, from $385.0

million for fiscal 2005. For fiscal 2006, the Company reported a

net loss of $2.4 million, or $(0.17) per diluted share, including

stock-based compensation expenses of $5.4 million, or $0.25 per

diluted share. In fiscal 2005 the net loss was $2.4 million, or

$(0.15) per share, which did not include stock-based compensation

expenses. Deepak Chopra, Chairman and CEO, stated, "We are pleased

with the results for the fourth quarter, a period in which

operating income improved by $13 million, excluding stock-based

compensation expenses, when compared to the fourth quarter of

fiscal 2005. We expect to continue this momentum for fiscal 2007

while continuing to work diligently on improving our profitability.

At year end, the Company's backlog is at an all time high of

approximately $147 million, led by the strong bookings in the

Security division." Mr. Chopra continued, "Each of our three

business divisions grew in fiscal 2006. The Security division

continued to make positive strides in its development programs,

while simultaneously growing revenues by 10% and operating income

by $4.8 million over the prior year. We expect that the Security

division will see continued growth in fiscal 2007, led by the

improvement in the cargo and vehicle inspection market and the

introduction of its first product in the international Hold Baggage

Screening market. Our Healthcare division's fiscal 2006 revenues

increased 13% and operating income increased by 75% from the prior

year. The Healthcare division is poised for continued success in

fiscal 2007, strengthened by the recent acquisition of Del Mar

Reynolds. The Optoelectronics and Manufacturing division had an

outstanding year, increasing external revenues by 47% and operating

income by 102% from the prior year and is well positioned for

continued strong results in fiscal 2007." Segment Information

Security Division The Security division recorded revenues of $41.3

million for the fourth quarter of fiscal 2006, an increase of 28%

from $32.2 million reported for the fourth quarter of fiscal 2005.

Income from operations for the fourth quarter of fiscal 2006 was

$2.0 million, compared to a loss from operations of $2.4 million

for the fourth quarter of fiscal 2005. The fiscal 2006 fourth

quarter results included stock-based compensation expenses of $0.2

million, whereas no such expense was included in the fourth quarter

of fiscal 2005. For the fiscal year ended June 30, 2006, revenues

increased by $11.9 million, or 10%, to $135.1 million, from $123.2

million for fiscal 2005. For fiscal 2006, the Security division

reported a loss from operations of $0.6 million, compared to a loss

from operations of $5.4 million for fiscal 2005. Fiscal 2006

results include stock-based compensation expenses of $0.9 million,

whereas no such expense was included in fiscal 2005. Healthcare

Division The Healthcare division reported revenues of $58.8 million

for the fourth quarter of fiscal 2006, an increase of 15% from

$51.1 million reported for the fourth quarter of fiscal 2005.

Income from operations for the fourth quarter of fiscal 2006 was

$6.5 million, compared to $2.4 million for the fourth quarter of

fiscal 2005. The fourth quarter results included stock-based

compensation expenses of $0.5 million, whereas no such expense was

included in the fourth quarter of fiscal 2005. For the fiscal year

ended June 30, 2006, revenues increased by $24.9 million, or 13%,

to $220.6 million, from $195.7 million for fiscal 2005. For fiscal

2006, income from operations increased by $6.3 million, or 75%, to

$14.7 million, from $8.4 million for fiscal 2005. Fiscal 2006

results include stock-based compensation expenses of $1.6 million,

whereas no such expense was included in fiscal 2005.

Optoelectronics and Manufacturing Division The Optoelectronics and

Manufacturing division generated external revenues of $25.4 million

for the fourth quarter of fiscal 2006, an increase of 46% from

$17.4 million reported for the fourth quarter of fiscal 2005.

Income from operations for the fourth quarter of fiscal 2006 was

$5.1 million, compared to $0.5 million for the fourth quarter of

fiscal 2005. The fourth quarter results included stock-based

compensation expenses of $0.1 million, whereas no such expense was

included in the fourth quarter of fiscal 2005. For the fiscal year

ended June 30, 2006, external revenues increased by $30.9 million,

or 47%, to $97.0 million from $66.1 million for fiscal 2005. For

fiscal 2006, income from operations increased by $6.3 million, to

$12.5 million, from $6.2 million for fiscal 2005. Fiscal 2006

results include stock-based compensation expenses of $0.5 million,

whereas no such expense was included in fiscal 2005. Higher

intercompany sales to the Security and Healthcare divisions in

fiscal 2006 compared to fiscal 2005 positively impacted operating

income for the Optoelectronics and Manufacturing division. However,

these sales are eliminated in consolidation. Forward-Looking

Guidance for the Year Ending June 30, 2007 The Company has not

previously issued guidance for fiscal 2007. The Company provides

the following guidance for fiscal 2007: Fiscal 2007 -- Net sales of

$535-$545 million, or year-over-year growth of 18-20%. The Company

expects to report earnings per share of $0.35 to $0.45 for fiscal

2007 as compared to a loss per share of $(0.14) in fiscal 2006.

Fiscal 2007 -- First Quarter -- Net sales of $112-$116 million, or

year-over-year growth of 10-14%. The Company expects the loss per

share to be reduced from the ($0.26) per share loss reported in the

first quarter of 2005. The first quarter, historically the softest

quarter in the Company's fiscal year, is impacted primarily by the

seasonality factors within the Healthcare division. The Company has

not yet established the final allocation of the purchase price

associated with the Del Mar Reynolds acquisition, including the

allocation of in-process research and development and intangibles,

which could affect the above results guidance. Conference Call

Information OSI Systems, Inc. will host a conference call and

simultaneous webcast today over the Internet beginning at 9:00 am

PT (12:00 pm ET) to discuss these results. To listen, please log on

www.fulldisclosure.com or www.osi-systems.com and follow the link

that will be posted on the front page. A replay of the webcast will

be available shortly after the presentation and will be archived on

www.osi-systems.com. A telephonic replay of the call will also be

available from 1:00 pm PT on September 13th until September 26th.

The replay may be accessed by calling 888-286-8010 and entering the

conference call identification number "35075047" when prompted for

the replay code. About OSI Systems, Inc. OSI Systems, Inc. is a

Hawthorne-based diversified global developer, manufacturer and

seller of security and inspection systems, medical monitoring and

anesthesia delivery products, and optoelectronic-based components,

as well as a provider of engineering and manufacturing services.

The Company has more than 30 years of experience in electronics

engineering and manufacturing and maintains offices and production

facilities located in more than a dozen countries. OSI Systems,

Inc. implements a strategy of expansion by leveraging its

electronics and contract manufacturing capabilities into selective

end product markets through organic growth and acquisitions. For

more information on OSI Systems, Inc. or any of its subsidiary

companies, visit www.osi-systems.com. This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Such statements

include information regarding the Company's expectations, goals or

intentions about the future, including the Company's predictions

about upcoming improvements in the market for products that screen

cargo, the introduction by the Company's Security division of its

first product that screens hold (checked) baggage, the effect of

the Healthcare division's recent acquisition of Del Mar Reynolds,

future results of the Optoelectronics and Manufacturing division,

and the Company's guidance fiscal year 2007. The actual results may

differ materially from those described in or implied by any

forward-looking statement. In particular, there can be no assurance

that expected improvements in markets, introductions of new

products, effects of acquisitions or other expectations, such as

those concerning future revenues and operating income, will

ultimately materialize. Other important factors are set forth in

our Securities and Exchange Commission filings. All forward-looking

statements speak only as of the date made, and we undertake no

obligation to update these forward-looking statements. -0- *T OSI

SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except share and per share amounts) Three

months ended Year ended June 30, June 30, -------------------------

------------------------- 2006 2005 2006 2005 -----------

----------- ----------- ----------- Revenues $ 125,586 $ 100,713 $

452,686 $ 385,041 Cost of goods sold 74,090 62,507 276,025 243,415

----------- ----------- ----------- ----------- Gross profit 51,496

38,206 176,661 141,626 ----------- ----------- -----------

----------- Operating expenses: Selling, general and administrative

37,693 35,692 138,428 116,245 Research and development 9,557 9,495

35,839 30,537 Restructuring charges - 800 - Management retention

bonus - 438 623 1,824 ----------- ----------- -----------

----------- Total operating expenses 47,250 45,625 175,690 148,606

----------- ----------- ----------- ----------- Income (loss) from

operations 4,246 (7,419) 971 (6,980) Interest income 87 38 267 196

Interest expense (372) (561) (1,558) (807) Impairment of equity

investments - - - (182) Gain on sale of marketable securities - -

349 - Other income 475 - 475 - ----------- ----------- -----------

----------- Income (loss) before provision for income taxes and

minority interest 4,436 (7,942) 504 (7,773) Provision (benefit) for

income taxes 2,905 (4,707) 1,090 (5,309) Minority interest (796) -

(1,772) 69 ----------- ----------- ----------- ----------- Net

income (loss) $ 735 $ (3,235) $ (2,358) $ (2,395) ===========

=========== =========== =========== Diluted earnings (loss) per

share $ 0.04 $ (0.20) $ (0.17) $ (0.15) =========== ===========

=========== =========== Weighted average shares outstanding --

diluted 16,736,545 16,245,131 16,516,652 16,222,998 ===========

=========== =========== =========== Condensed Consolidated Balance

Sheets (in thousands) June 30, 2006 2005 ---------------

-------------- ASSETS Cash and cash equivalents $ 13,799 $ 14,623

Accounts receivable, net 119,419 89,227 Inventories 120,604 107,441

Other current assets 29,902 26,382 --------------- --------------

Total current assets 283,724 237,673 Non-current assets 119,774

109,447 --------------- -------------- Total $ 403,498 $ 347,120

=============== ============== LIABILITIES AND SHAREHOLDERS' EQUITY

Bank lines of credit $ 10,857 $ 15,752 Current portion of long-term

debt 1,251 499 Accounts payable and accrued expenses 68,526 54,504

Other current liabilities 40,934 36,543 ---------------

-------------- Total current liabilities 121,568 107,298 Long-term

debt 5,483 4,852 Other long-term liabilities 17,769 11,343

--------------- -------------- Total liabilities 144,820 123,493

Minority interest 9,731 - Shareholders' equity 248,947 223,627

--------------- -------------- Total $ 403,498 $ 347,120

=============== ============== Segment Information (in thousands)

Three months ended Twelve months ended June 30, June 30,

------------------- ------------------ 2006 2005 2006 2005 --------

-------- -------- -------- Revenues - by Segment Group: Security

Group $ 41,302 $ 32,180 $135,089 $123,197 Healthcare Group 58,825

51,101 220,624 195,698 Optoelectronics and Manufacturing Group,

including intersegment revenues 37,277 20,885 125,870 84,558

Intersegment revenues elimination (11,818) (3,453) (28,897)

(18,412) -------- -------- -------- -------- Total $125,586

$100,713 $452,686 $385,041 -------- -------- -------- --------

Operating income (loss) -- by segment group: Security Group $ 1,974

$ (2,405) $ (640) $ (5,438) Healthcare Group 6,501 2,423 14,660

8,394 Optoelectronics and Manufacturing Group 5,114 515 12,505

6,159 Corporate (8,784) (7,735) (24,786) (15,420) Eliminations

(559) (217) (768) (675) -------- -------- -------- -------- Total $

4,246 $ (7,419) $ 971 $ (6,980) -------- -------- -------- --------

*T

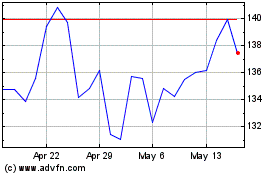

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

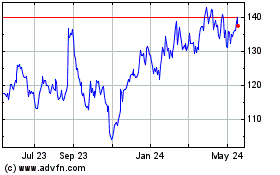

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024