OSI Systems, Inc. (NASDAQ:OSIS), a vertically integrated provider

of specialized electronics products for critical applications in

the Security and Healthcare industries, today announced its

financial results for its first quarter ended September 30, 2008.

The Company reported revenues of $148.2 million for the first

quarter of fiscal 2009, an increase of 13% from the $131.0 million

reported for the first quarter of fiscal 2008. Net income for the

first quarter of fiscal 2009 was $0.1 million, or $0.01 per diluted

share, compared to a net loss of $(2.1) million, or $(0.12) per

diluted share for the first quarter of fiscal 2008. The results for

the first quarter ended September 30, 2008 and the prior comparable

period of fiscal 2008 included non-recurring restructuring charges

of $0.8 million compared to $0.1 million for the comparable period

of fiscal 2008. Excluding the impact of the aforementioned

non-recurring charges, net income for the first quarter of fiscal

2009 would have been approximately $0.7 million or $0.04 per

diluted share compared to a net loss of $(2.0) million or $(0.12)

per diluted share for the first quarter of fiscal 2008. These

non-GAAP figures are provided to allow for the comparison of

underlying earnings, net of non-recurring charges, providing

insight into the on-going operations of the Company. The Company�s

backlog as of September 30, 2008, was approximately $231 million,

compared to $212 million as of June 30, 2008. For the comparable

period, the backlog for the Company�s Security division increased

by $26 million to $141 million. For the first quarter of fiscal

2009, the Company generated cash flow from operations of $14.7

million and capital expenditures were $2.2 million, as compared to

cash flow from operations using $3.6 million and capital

expenditures of $2.6 million during the first quarter of fiscal

2008. Deepak Chopra, OSI Systems� Chairman and CEO, stated,

�Revenue growth for the first quarter was driven primarily by

strong performances in our Security and Optoelectronics divisions

which grew 20% and 23% respectively. For the quarter our Security

division achieved record bookings of approximately $94 million

improving our backlog to near record levels. Mr. Chopra continued,

�For the quarter, sales in our Healthcare division declined 3% when

compared to the first quarter of the prior fiscal year. The decline

was a direct result of the tightening credit markets within North

America causing customers to delay planned orders. Internationally,

however, our Healthcare division sales remain strong. We continue

to be diligent in monitoring the market conditions within North

America as it relates to our Healthcare division and have begun to

implement proactive measures to address our overall cost structure.

Mr. Chopra concluded, �Within our Security division we have made

significant announcements of late. Firstly, we were awarded a $3

million contract for air cargo inspection systems. This was the

first contract award we have received related to the U.S.

government mandate for 100% inspection of all air cargo by August

2010. Additionally, today we announced receipt of an approximate $6

million development and delivery contract from the TSA for our next

generation high-speed CT system for checked baggage screening.�

Company Outlook � Guidance for Fiscal 2009 Due to significant

levels of economic uncertainty within the credit markets in North

America, the Company is unable to provide guidance for fiscal 2009

and as such has withdrawn its previously published guidance for

fiscal 2009. Alan Edrick, Executive Vice President and CFO, stated,

�We remain confident in our long run business fundamentals. While

our healthcare division has been impacted by economic conditions in

the Unites States and the challenging credit markets, we are moving

quickly to address our overall cost structure. Overall

our�liquidity position�remains strong and in the first quarter we

generated $12.5 million of free cash flow, a record for the

Company.� Conference Call Information OSI Systems, Inc. will host a

conference call and simultaneous webcast over the Internet

beginning at 9:00 a.m. PT (12:00 p.m. ET) today to discuss its

financial and business results for the first quarter of fiscal

2009. The conference call will contain forward looking information.

To listen, please log on to www.fulldisclosure.com or the investor

relations section of the OSI Systems website

(http://investors.osi-systems.com/index.cfm). A replay of the

webcast will be available shortly after the conclusion of the

conference call until November 13, 2008. The replay can either be

accessed through the Company�s website or via telephonic replay by

calling 1-888-286-8010 and entering the conference call

identification number �40344917� when prompted for the replay code.

About OSI Systems, Inc. OSI Systems, Inc. is a vertically

integrated designer and manufacturer of specialized electronic

systems and components for critical applications�in�the homeland

security, healthcare, defense and aerospace industries. We

combine�more than 30 years of�electronics engineering and

manufacturing experience with�offices and production facilities in

more than a dozen countries to�implement a strategy of expansion

into selective end product markets.�For more information on OSI

Systems Inc. or any of its subsidiary companies, visit

www.osi-systems.com. News Filter: OSIS-G This press release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Such statements

include information regarding the Company�s expectations, goals or

intentions about the future, including the Company�s predictions

about the effects of steps being taken to improve profitability as

well as the Company�s guidance regarding future revenues and future

earnings. The actual results may differ materially from those

described in or implied by any forward-looking statement. In

particular, there can be no assurance that the Company will achieve

profitability or that future revenue or earnings predictions will

ultimately prove accurate. Other important factors are set forth in

our Securities and Exchange Commission filings. All forward-looking

statements speak only as of the date made, and we undertake no

obligation to update these forward-looking statements. OSI SYSTEMS,

INC. AND SUBSIDIARIES � CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except per share data) (Unaudited) � Three Months Ended

September 30, � 2007 � � � 2008 � Revenue $ 131,013 $ 148,161 Cost

of goods sold � 86,903 � � 98,526 � Gross profit 44,110 49,635 �

Operating expenses: Selling, general and administrative 36,211

37,571 Research and development 9,729 10,213 Impairment,

restructuring, and other charges � 85 � � 801 � Total operating

expenses � 46,025 � � 48,585 � � Income (loss) from operations

(1,915 ) 1,050 � Interest expense, net (1,089 ) (895 ) Income

(loss) before provision for income taxes and minority interest

(3,004 ) 155 � Provision (benefit) for income taxes (1,055 ) 53

Minority interest of net earnings (losses) of consolidated

subsidiaries (118 ) 30 � � Net income (loss) � (2,067 ) � 132 � �

Diluted income (loss) per share $ (0.12 ) $ 0.01 � � Weighted

average shares outstanding � diluted � 17,171 � � 18,166 �

CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited) � � June 30,

September 30, � 2008 � 2008 Assets Cash and cash equivalents $

18,232 $ 21,048 Accounts receivable, net 156,781 137,116

Inventories 144,807 148,599 Other current assets � 36,635 � 42,030

Total current assets 356,455 348,793 Non-current assets � 151,186 �

149,455 Total $ 507,641 $ 498,248 � Liabilities and Stockholders'

Equity Bank lines of credit $ 18,657 $ 9,000 Current portion of

long-term debt 6,593 7,094 Accounts payable and accrued expenses

89,594 82,373 Other current liabilities � 46,653 � 58,156 Total

current liabilities 161,497 156,623 Long-term debt 49,091 46,541

Other long-term liabilities � 17,804 � 19,095 Total liabilities

228,392 222,259 Minority interest 1,228 1,198 Shareholders' equity

� 278,021 � 274,791 Total liabilities and stockholders� equity $

507,641 $ 498,248 SEGMENT INFORMATION (in thousands) (unaudited) �

Three Months Ended September 30, � 2007 � � � 2008 � Revenues � by

Segment Group: Security Group $ 48,805 $ 58,685 Healthcare Group

56,598 54,827 Optoelectronics and Manufacturing Group including

intersegment revenues 36,372 44,882 Intersegment revenues

elimination � (10,762 ) � (10,233 ) Total � 131,013 � � 148,161 � -

- Operating income (loss) � by Segment Group: Security Group $ (696

) $ 3,048 Healthcare Group 1,051 (1,824 ) Optoelectronics and

Manufacturing Group 1,339 3,863 Corporate (3,479 ) (4,215 )

Eliminations � (130 ) � 178 � Total $ (1,915 ) $ 1,050 �

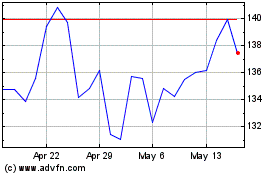

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

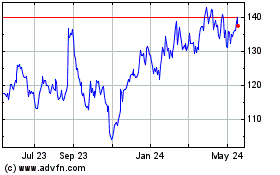

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024