OSI Systems, Inc. (NASDAQ: OSIS) today announced financial

results for its fourth quarter and fiscal year ended June 30,

2009.

Deepak Chopra, OSI Systems Chairman and CEO, stated, “The

challenges of the global economy significantly impacted our sales

throughout fiscal 2009. However, we have viewed this economic

slowdown as an opportunity to adjust our cost structure to better

position ourselves for improved profitability and cash flow going

forward, while continuing to aggressively invest in product

development. As a result, despite economic pressure on our top

line, these significant reductions to our cost structure, coupled

with ongoing efficiency projects, resulted in strong earnings

growth and record free cash flow during fiscal 2009.”

The Company reported revenues of $139.1 million for the fourth

quarter of fiscal 2009, a decrease of 19% from the $171.2 million

reported for the fourth quarter of fiscal 2008. Without the adverse

impact of foreign exchange for the three months ended June 30,

2009, revenues would have decreased approximately 16%. Net income

for the fourth quarter of fiscal 2009 was $4.3 million, or $0.24

per diluted share, compared to net income of $5.5 million, or $0.31

per diluted share for the fourth quarter of fiscal 2008. Excluding

the impact of restructuring and other nonrecurring charges, net

income for the fourth quarter of fiscal 2009 would have been

approximately $5.1 million or $0.29 per diluted share compared to

net income of $6.5 million or $0.36 per diluted share for the

fourth quarter of fiscal 2008.

For the fiscal year ended June 30, 2009, the Company reported

revenues of $590.4 million, a decrease of 5% from the $623.1

million reported for fiscal 2008. Without the adverse impact of

foreign exchange for the twelve months ended June 30, 2009,

revenues would have decreased approximately 3%. Net income for

fiscal 2009 was $11.2 million, or $0.63 per diluted share, compared

to net income of $13.9 million, or $0.78 per diluted share in

fiscal 2008. During fiscal 2008, the Company was favorably impacted

by a one-time $4.3 million tax benefit in connection with a

transaction. Excluding the impact of restructuring and other

nonrecurring charges and this one-time tax benefit, net income for

fiscal 2009 would have been approximately $16.0 million, or $0.91

per diluted share compared to net income of $13.1 million or $0.74

per diluted share for the comparable period of fiscal 2008.

Discussion of adjustments to arrive at non-GAAP figures for the

three and twelve months ended June 30, 2009 is provided to allow

for the comparison of underlying earnings, net of restructuring and

other charges, and the one-time tax benefit, thus providing

additional insight into the on-going operations of the Company. For

the three months and fiscal year ended June 30, 2009 the Company

incurred restructuring and other charges of $1.1 million and $7.1

million, respectively, compared to $1.3 million and $4.7 million

for the comparable periods of fiscal 2008.

During fiscal 2009, the Company generated operating cash flow of

$44.5 million as compared to using $0.7 million during fiscal 2008.

Capital expenditures were $10.9 million and $12.1 million for

fiscal 2009 and 2008, respectively. Additionally, during fiscal

2009, the Company repurchased 620,000 shares of its common stock

for approximately $7.4 million.

Mr. Chopra continued, “Our Security Division had a very strong

fiscal 2009 as operating profits soared 167% from $5.4 million in

fiscal 2008 to $14.3 million in the current year. The improvement

in operating income was a result of increased sales coupled with

the realization of the operating efficiencies that we have been

working hard to achieve over the past two years. Sales in our

Security Division, excluding the adverse impact of foreign

exchange, improved by 11% compared to fiscal 2008. Our fiscal 2010

outlook is very positive as we have a robust pipeline both

domestically and internationally and we expect to see double digit

sales growth in our Security Division.”

Mr. Chopra concluded, “The business climate for our Healthcare

division continues to be challenging as fiscal 2009 sales,

excluding the adverse impact of foreign exchange, were off

approximately 14% from fiscal 2008. We continue to monitor market

conditions and believe that these issues are timing related as we

have not lost any significant sales opportunities. We expect that

the proactive measures we initiated throughout fiscal 2009 to

address our cost structure have positioned us for operating margin

expansion as Healthcare sales improve in fiscal 2010.”

As of June 30, 2009, the Company had a backlog of $203 million

compared to $212 million as of June 30, 2008.

Company Outlook – Guidance for Fiscal 2010

Subject to the risk factors referenced in the Safe Harbor

section of this press release, the Company announces that, for

fiscal 2010, it anticipates 15% - 30% growth in earnings per

diluted share to $1.05 to $1.18, excluding the impact of

impairment, restructuring and other non-recurring charges.

Alan Edrick, OSI Systems Executive Vice President and Chief

Financial Officer, said, “Our performance in fiscal 2009 marked the

continuation of a significant financial turnaround that has

emphasized earnings and cash flow. We will continue our ongoing

operational improvement initiatives, which we believe will result

in significant leverage to our bottom line. Our focus on generating

free cash flow was evident throughout the year and we anticipate

continued strength in fiscal 2010.”

Conference Call Information

OSI Systems, Inc. will host a conference call and simultaneous

webcast over the Internet beginning at 9:00 am PDT (12:00 pm EDT)

today to discuss its financial results and its business outlook.

This conference call will contain forward looking information. To

listen to the call, please log on to www.fulldisclosure.com or

www.osi-systems.com and follow the link that will be posted on the

front page. A replay of the webcast will be available shortly after

the conclusion of the conference call until September 10, 2009. The

replay can either be accessed through the Company’s website,

www.osi-systems.com, or via telephonic replay by calling

1-888-286-8010 and entering the conference call identification

number ‘29816963’ when prompted for the replay code.

About OSI Systems, Inc.

OSI Systems, Inc. is a Hawthorne, California based diversified

global developer, manufacturer and seller of security and

inspection systems, medical monitoring and anesthesia products, and

optoelectronic devices and value-added subsystems. The Company has

more than 30 years of experience in electronics engineering and

manufacturing and maintains offices and production facilities

located in more than a dozen countries. OSI Systems implements a

strategy of expansion by leveraging its electronics and contract

manufacturing capabilities into selective end product markets

through organic growth and acquisitions. For more information on

OSI Systems, Inc. or any of its subsidiary companies, visit

www.osi-systems.com. News Filter: OSIS-G

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include information regarding the

Company’s expectations, goals or intentions about the future,

including, the Company’s earnings per share guidance for fiscal

2010 as well as its plans to achieve improved profitability and

cash flow. The actual results may differ materially from those

described in or implied by any forward-looking statement. In

particular, there can be no assurance that the Company will

continue to realize the benefit of operating efficiencies achieved

by its Security Division over the last two year or that the

business climate for its Healthcare division will improve in the

near future. Other important factors are set forth in the Company’s

Securities and Exchange Commission filings. All forward-looking

statements are current as of the date of this release, and the

Company undertakes no obligation to update any statement in light

of new information or future events.

OSI SYSTEMS, INC. AND

SUBSIDIARIES

Consolidated Statements of

Operations

(in thousands, except per share

data)

Three Months Ended June

30,

Year Ended June 30, 2008

2009 2008

2009 Revenue $ 171,173 $ 139,063

$ 623,088 $ 590,361 Cost of goods sold 111,631

91,497 404,049 388,910 Gross

profit 59,542 47,566 219,039 201,451 Operating expenses:

Selling, general and administrative 37,105 30,291 150,050 137,939

Research and development 11,852 9,408 45,361 36,862 Restructuring

and other charges 1,333 1,123

4,688 7,123 Total operating expenses

50,290 40,822 200,099

181,924 Income from operations 9,252 6,744 18,940

19,527 Interest expense, net (1,050 ) (595 )

(4,469 ) (2,936 ) Income before income taxes and

minority interest 8,202 6,149 14,471 16,591 Income tax

expense 2,556 1,844 579 5,393 Minority interest of net earnings of

consolidated subsidiaries 108 20 32 46

Net income $ 5,538 $ 4,285 $ 13,860 $ 11,152

Diluted income per share $ 0.31 $ 0.24

$ 0.78 $ 0.63 Weighted average shares

outstanding – diluted 18,142 17,630

17,735 17,596

Consolidated Balance

Sheets

(in thousands)

June 30, 2008

2009 Assets Cash and cash

equivalents $ 18,232 $ 25,172 Accounts receivable, net 156,781

110,453 Inventories 144,807 150,763 Other current assets

36,635 36,855 Total current assets 356,455 323,243

Non-current assets 151,186 151,585 Total assets $

507,641 $ 474,828

Liabilities and Stockholders'

Equity Bank lines of credit $ 18,657 $ 4,000 Current portion of

long-term debt 6,593 8,557 Accounts payable and accrued expenses

89,594 68,813 Other current liabilities 46,653 54,265

Total current liabilities 161,497 135,635 Long-term debt 49,091

39,803 Other long-term liabilities 17,804 22,310

Total liabilities 228,392 197,748 Minority interest 1,228 1,080

Shareholders' equity 278,021 276,000 Total

liabilities and stockholders’ equity $ 507,641 $ 474,828

Segment Information

(in thousands)

Three Months Ended June 30,

Year Ended June 30, 2008

2009 2008

2009 Revenues – by Segment

Group: Security Group $ 61,760 $ 58,672 $ 225,836 $ 240,919

Healthcare Group 68,645 49,362 256,695 214,260 Optoelectronics and

Manufacturing Group including intersegment revenues 53,130 42,685

187,624 181,123 Intersegment revenues elimination (12,362 )

(11,656 ) (47,067 ) (45,941 ) Total $ 171,173

$ 139,063 $ 623,088 $ 590,361

Operating income (loss) – by Segment Group: Security Group

(i) $ 3,725 $ 3,182 $ 5,365 $ 14,324 Healthcare Group (ii) 3,357

2,419 12,918 5,106 Optoelectronics and Manufacturing Group 4,567

3,258 13,114 14,501 Corporate (iii) (2,331 ) (2,021 ) (12,258 )

(13,844 ) Eliminations (66 ) (94 ) (199

)

(560 ) Total $ 9,252 $ 6,744 $ 18,940 $

19,527 (i) Includes non-recurring restructuring and

other charges of $0.2 million and $0.8 million for the three months

ended June 30, 2008 and 2009, respectively; and $2.3 million and

$1.3 million for the year ended June 30, 2008 and 2009,

respectively. (ii) Includes non-recurring restructuring and

other charges of $1.1 million and $0.1 million for the three months

ended June 30, 2008 and 2009, respectively; and $2.0 million and

$3.3 million for the year ended June 30, 2008 and 2009,

respectively.

(iii) Includes non-recurring

charges of $2.3 million during the year ended June 30, 2009.

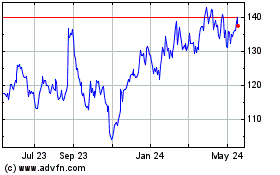

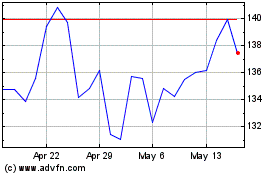

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024