In the SEGMENT INFORMATION table, Revenues – by Segment,

Security division line, Three Months Ended December 31, 2014 should

read $137,005 (instead of $37,005) and Six Months Ended December

31, 2015 should read $190,130 (instead of $90,130).

The corrected release reads:

OSI SYSTEMS REPORTS SECOND QUARTER FISCAL

2016 FINANCIAL RESULTS

OSI Systems, Inc. (NASDAQ: OSIS) today announced financial

results for the fiscal quarter ended December 31, 2015.

“We entered fiscal 2016 with expectations of a challenging first

half followed by a stronger second half. Though this is turning out

to be true, the challenges associated with the global economy

proved to be greater than anticipated leading to disappointing

first half financial results. Despite this, we are encouraged by

our strong first half bookings, which we believe positions us to

rebound nicely in the second half of fiscal 2016,” said Deepak

Chopra, OSI Systems’ Chairman and CEO.

The Company reported revenues of $197 million for the second

quarter of fiscal 2016, a decrease of 23% as compared to the same

period a year ago. Net income for the second quarter of fiscal 2016

was $0.1 million, or $0.01 per diluted share, compared to net

income of $18.2 million, or $0.89 per diluted share, for the second

quarter of fiscal 2015. Excluding the impact of impairment,

restructuring and other charges, net income for the second quarter

of fiscal 2016 would have been $8.1 million, or $0.40 per diluted

share, compared to net income of $19.7 million, or $0.96 per

diluted share, for the comparable quarter of the prior year.

For the six months ended December 31, 2015, the Company reported

revenues of $397 million, a decrease of 17% as compared to the same

period a year ago. Net income in this period was $10.9 million, or

$0.53 per diluted share, compared to net income of $29.5 million,

or $1.44 per diluted share, in the same period a year ago.

Excluding the impact of impairment, restructuring and other

charges, net income for the six months ended December 31, 2015

would have been $19.0 million, or $0.93 per diluted share, compared

to net income of $31.5 million, or $1.54 per diluted share, for the

comparable period in the prior year.

As of December 31, 2015, the Company’s backlog was approximately

$695 million. During the second fiscal quarter, cash flow used in

operations was $5.3 million.

Mr. Chopra stated, “As expected, our Optoelectronics and

Manufacturing division sales decreased year over year. However,

operational improvements, together with a more favorable product

mix and a migration to more profitable customers, resulted in a

9.4% operating margin, excluding the impact of impairment,

restructuring and other charges. This represented our fifth

consecutive quarter of year-over-year operating margin

expansion.”

Mr. Chopra continued, “During the second quarter of the prior

fiscal year, our Security division revenues included approximately

$39 million from a Foreign Military Sale to the U.S. Department of

Defense for use in Iraq, creating a difficult comparison for the

current fiscal year. Our fiscal 2016 second quarter results were

further impacted by the deferral of revenue recognition for

equipment shipped during the quarter. As a result, we began the

process of streamlining certain functions in the Security division.

Actions already completed are expected to result in approximately

$6 million of annual cost savings with further opportunities being

considered. Security division bookings in the first half were up

272% over the prior year. These bookings, together with the ramp up

of our turnkey program in Albania and a solid pipeline of

opportunities, position the division well for a strong second half

weighted to the fourth quarter based upon the anticipated timing of

converting our backlog and opportunities into revenue.”

Mr. Chopra concluded, “During the second quarter, our Healthcare

division sales were well below expectations. A variety of factors

contributed to the performance. Management changes are in process

to ensure we have the right leadership in place in our Healthcare

division. Based upon a detailed review of our funnel of

opportunities and product portfolio, we are optimistic that our

Healthcare division sales will rebound during the second half of

the fiscal year.”

Fiscal Year 2016 Outlook

Based on the information known as of today, the Company’s

updated current fiscal 2016 sales guidance is $900 million - $945

million and earnings guidance is $2.95 to $3.20 per diluted share,

excluding the impact of impairment, restructuring and other

charges. Actual sales and diluted EPS could vary from this guidance

including as a result of the matters discussed under the

“Forward-Looking Statements” section.

Conference Call Information

OSI Systems, Inc. will host a conference call and simultaneous

webcast over the Internet beginning at 1:30pm PT (4:30pm ET), today

to discuss its results for the second quarter of fiscal 2016. To

listen, please visit the investor relations section of the OSI

Systems website, http://investors.osi-systems.com/index.cfm and

follow the link that will be posted on the front page. A replay of

the webcast will be available shortly after the conclusion of the

conference call until February 12, 2016. The replay can either be

accessed through the Company’s website, www.osi-systems.com, or by

telephonic replay by calling 1-855-859-2056 and entering the

conference call identification number '35653465’ when prompted for

the replay code.

About OSI Systems, Inc.

OSI Systems, Inc. is a vertically integrated designer and

manufacturer of specialized electronic systems and components for

critical applications. The Company sells its products and provides

related services in diversified markets, including homeland

security, healthcare, defense and aerospace. The Company has more

than 30 years of experience in electronics engineering and

manufacturing and maintains offices and production facilities in

more than a dozen countries. The Company implements a strategy of

expansion by leveraging its electronics and contract manufacturing

capabilities into selective end product markets through organic

growth and acquisitions. For more information on OSI Systems, Inc.

or any of its subsidiary companies, visit www.osi-systems.com. News

Filter: OSIS-E

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to the Company's current

expectations, beliefs, projections and similar expressions

concerning matters that are not historical facts and are not

guarantees of future performance. Forward-looking statements

involve uncertainties, risks, assumptions and contingencies, many

of which are outside the Company's control and which may cause

actual results to differ materially from those described in or

implied by any forward-looking statement. Forward-looking

statements include, but are not limited to, information provided

regarding expected revenues, earnings and growth in fiscal 2016. In

addition, the Company could be exposed to a variety of negative

consequences as a result of delays related to the award of domestic

and international contracts; delays in customer programs; delays in

revenue recognition related to the timing of customer acceptance;

unanticipated impacts of sequestration and other provisions of the

Budget Control Act of 2011 as modified by the Bipartisan Budget Act

of 2013; changes in domestic and foreign government spending,

budgetary, procurement and trade policies adverse to the Company's

businesses; unfavorable currency exchange rate fluctuations; market

acceptance of the Company's new and existing technologies, products

and services; the Company's ability to win new business and convert

any orders received to sales within the fiscal year in accordance

with the Company's operating plan; enforcement actions in respect

of any noncompliance with laws and regulations including export

control and environmental regulations and the matters that are the

subject of some or all of the Company's ongoing investigations and

compliance reviews; contract and regulatory compliance matters, and

actions, if brought, resulting in judgments, settlements, fines,

injunctions, debarment or penalties, as well as other risks and

uncertainties, including but not limited to those detailed herein

and from time to time in the Company's Securities and Exchange

Commission filings which could have a material and adverse impact

on the Company's business, financial condition and results of

operations. For additional information on these and other factors

that could cause the Company's future results to differ materially

from any forward-looking statements, see the section entitled "Risk

Factors" in the Company's Annual Report on Form 10-K for the fiscal

year ended June 30, 2015 and other risks described in documents

subsequently filed by the Company from time to time with the

Securities and Exchange Commission. All forward-looking statements

are based on currently available information and speak only as of

the date on which they are made. The Company assumes no obligation

to update any forward-looking statement made in this press release

that becomes untrue because of subsequent events, new information

or otherwise, except to the extent it is required to do so in

connection with requirements under federal securities laws.

OSI SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended

December 31,

Six Months Ended

December 31,

2014 2015

2014 2015 Revenues $

257,829 $ 197,339 $ 476,226 $ 397,389 Cost of goods sold

168,555 129,275 312,710

261,354 Gross profit 89,274 68,064 163,516 136,035 Operating

expenses: Selling, general and administrative 47,894 43,141 92,076

83,534 Research and development 13,240 13,045 25,910 24,926

Impairment, restructuring and other charges 2,079

11,097 2,805 11,097 Total

operating expenses 63,213 67,283

120,791 119,557 Income from operations 26,061

781 42,725 16,478 Interest expense and other, net (832 )

(623 ) (1,696 ) (1,417 ) Income before income

taxes 25,229 158 41,029 15,061 Provision for income taxes

6,988 50 11,539 4,148

Net income $ 18,241 $ 108 $ 29,490 $

10,913 Diluted earnings per share $ 0.89 $

0.01 $ 1.44 $

0.53

Weighted average shares outstanding – diluted 20,487

20,386 20,506 20,427

CONSOLIDATED BALANCE SHEETS

(in thousands)

June 30, 2015

December 31, 2015

(Unaudited)

Assets Cash and cash equivalents $ 47,593 $ 79,789 Accounts

receivable, net 178,519 157,799 Inventories 230,421 280,600 Other

current assets 84,988 89,252 Total current assets

541,521 607,440 Non-current assets 438,153 402,951

Total Assets $ 979,674 $ 1,010,391

Liabilities and

Stockholders' Equity Bank lines of credit $ -- $ 55,000 Current

portion of long-term debt 2,801 2,752 Accounts payable and accrued

expenses 114,525 122,960 Deferred revenues 47,787 36,609 Other

current liabilities 84,168 88,294 Total current

liabilities 249,281 305,615 Long-term debt 8,556 7,257 Deferred

income taxes 65,435 65,582 Other long-term liabilities

74,623 64,329 Total liabilities 397,895 442,783 Total

stockholders’ equity 581,779 567,608 Total

Liabilities and Stockholders’ Equity $ 979,674 $ 1,010,391

SEGMENT INFORMATION

(in thousands) (unaudited)

Three Months Ended December 31,

Six Months Ended

December 31,

2014

2015 2014

2015

Revenues – by Segment:

Security division

$

137,005

$ 93,720 $ 250,444 $

190,130

Healthcare division 69,493 55,548 117,327 107,013 Optoelectronics

and Manufacturing division (including intersegment revenues) 65,535

60,560 134,621 123,108 Intersegment revenues eliminations

(14,204 ) (12,489 ) (26,166 ) (22,862 ) Total

$ 257,829 $ 197,339 $ 476,226 $ 397,389

Operating income (loss) – by Segment: Security

division (1) $ 20,401 $ 2,534 $ 37,660 $ 15,169 Healthcare division

(2) 7,489 3,380 7,551 6,318 Optoelectronics and Manufacturing

division (3) 4,366 3,192 8,693 8,753 Corporate (4) (5,733 ) (7,903

) (10,250 ) (13,105 ) Eliminations (462 ) (422 )

(929 ) (657 ) Total $ 26,061 $ 781 $

42,725 $ 16,478 (1) Includes

impairment, restructuring and other charges of $1.7 million and

$1.8 million for the three and six months ended December 31, 2014,

respectively, and $6.3 million for the three and six months ended

December 31, 2015, respectively. (2) Includes impairment,

restructuring and other charges of $0.1 million and $0.2 million

for the three and six months ended December 31, 2014, respectively.

(3) Includes impairment, restructuring and other charges of $0.1

million and $0.2 million for the three months and six months ended

December 31, 2014, respectively, and $2.5 million for the three and

six months ended December 31, 2015, respectively. (4) Includes

impairment, restructuring and other charges of $0.2 million and

$0.6 million for the three months and six months ended December 31,

2014, respectively, and $2.3 million for both the three and six

months ended December 31, 2015.

Reconciliation of GAAP to

Non-GAAP

(in thousands, except earnings per

share data)

(unaudited)

Three Months Ended December 31, Six Months

Ended December 31, 2014 2015 2014

2015 Net income EPS Net

income EPS Net income EPS

Net income

EPS*

GAAP basis $ 18,241 $ 0.89 $ 108 $ 0.01 $ 29,490 $ 1.44 $ 10,913 $

0.53

Impairment, restructuring and other charges, net of tax

1,503 0.07 8,041 0.39 2,016

0.10 8,041 0.39 Non-GAAP basis $ 19,744

$ 0.96

$

8,149

$ 0.40 $ 31,506 $ 1.54 $ 18,954 $

0.93

* Due to rounding, the GAAP basis EPS of $0.53

plus the add-back EPS of $0.39 equals $0.93.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160127006235/en/

OSI Systems, Inc.Ajay VashishatVice President, Business

DevelopmentTel: (310) 349-2237avashishat@osi-systems.com

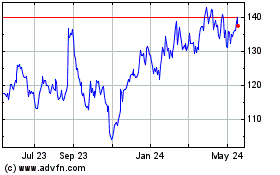

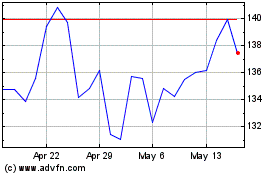

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

OSI Systems (NASDAQ:OSIS)

Historical Stock Chart

From Jul 2023 to Jul 2024