true0000889900PATTERSON UTI ENERGY INC00008899002023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 8-K/A

(Amendment No. 1)

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2023

_______________

Patterson-UTI Energy, Inc.

(Exact name of Registrant as Specified in Its Charter)

_______________

|

|

|

Delaware |

1-39270 |

75-2504748 |

(State or Other Jurisdiction of Incorporation ) |

(Commission File Number) |

(IRS Employer Identification No.) |

10713 W. Sam Houston Pkwy N, Suite 800, Houston, Texas |

|

77064 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 281-765-7100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.01 Par Value |

|

PTEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Introduction

This Amendment No. 1 on Form 8-K/A (this “Amendment”) is being filed by Patterson-UTI Energy, Inc., a Delaware corporation (“Patterson-UTI”), to amend and supplement its Current Reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on August 14, 2023 (the “August Form 8-K”) and September 1, 2023 (the “September Form 8-K” and, together with the August Form 8-K, the “Prior Forms 8-K”). As previously disclosed in the August Form 8-K, on August 14, 2023, Patterson-UTI completed the acquisition of BEP Diamond Holdings Corp., a Delaware corporation (“Ulterra”), from BEP Diamond Topco L.P., a Delaware limited partnership, as sole stockholder of Ulterra (“Ulterra Parent”). As previously disclosed in the September Form 8-K, on September 1, 2023, Patterson-UTI completed the merger with NexTier Oilfield Solutions Inc., a Delaware corporation (“NexTier”).

Patterson-UTI is filing this Amendment solely to supplement Item 9.01 of the Prior Forms 8-K to file (i) the audited consolidated financial statements of NexTier as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020, (ii) the unaudited condensed consolidated financial statements of NexTier as of June 30, 2023 and for the six months ended June 30, 2023 and 2022, (iii) the audited consolidated financial statements of Ulterra Parent as of December 31, 2022 and for the year ended December 31, 2022, (iv) the unaudited condensed consolidated financial statements of Ulterra Parent as of June 30, 2023 and for the six months ended June 30, 2023, and (v) the unaudited pro forma condensed combined financial data of Patterson-UTI as of June 30, 2023 and for the six months ended June 30, 2023 and for the year ended December 31, 2022. Except for the foregoing, this Amendment does not modify or update any other disclosure contained in the Prior Forms 8-K.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

NexTier

The audited consolidated balance sheets of NexTier and its subsidiaries as of December 31, 2022 and 2021 and related consolidated statements of operations and comprehensive income (loss), changes in stockholders’ equity, and cash flows for each of the years ended December 31, 2022, 2021 and 2020, and the related notes thereto, are filed herewith and attached hereto as Exhibit 99.1, and are incorporated herein by reference.

The unaudited condensed consolidated balance sheet of NexTier and its subsidiaries as of June 30, 2023, and the related condensed consolidated statements of operations and comprehensive income, changes in stockholders’ equity, and cash flows for each of the six months ended June 30, 2023 and 2022, and the related notes thereto, are filed herewith and attached hereto as Exhibit 99.2, and are incorporated herein by reference.

Ulterra Parent

The audited consolidated balance sheet of Ulterra Parent and its subsidiaries as of December 31, 2022 and related consolidated statements of operations and comprehensive income (loss), owners’ equity, and cash flows for the ended December 31, 2022, and the related notes thereto, are filed herewith and attached hereto as Exhibit 99.3, and are incorporated herein by reference.

The unaudited condensed consolidated balance sheet of Ulterra Parent and its subsidiaries as of June 30, 2023, and the related condensed consolidated statements of operations and comprehensive income (loss), owners’ equity, and cash flows for the six months ended June 30, 2023, and the related notes thereto, are filed herewith and attached hereto as Exhibit 99.4, and are incorporated herein by reference.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined financial statements of Patterson-UTI as of June 30, 2023, for the six months ended June 30, 2023 and for the year ended December 31, 2022, are filed herewith and attached hereto as Exhibit 99.5, and are incorporated herein by reference.

(d) Exhibits.

|

|

|

99.1 |

|

Audited Consolidated Financial Statements of NexTier as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020 (incorporated by reference to Item 8. “Financial Statements and Supplementary Data” in NexTier’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 16, 2023). |

|

|

|

99.2 |

|

Unaudited Condensed Consolidated Financial Statements of NexTier as of June 30, 2023 and for the six months ended June 30, 2023 and 2022 (incorporated by reference to Item 1. “Financial Statements” in NexTier’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on July 26, 2023). |

|

|

|

99.3 |

|

Audited Consolidated Financial Statements of Ulterra Parent as of December 31, 2022 and for the year ended December 31, 2022 (incorporated by reference to Exhibit 99.1 to Patterson-UTI’s Current Report on Form 8-K, filed with the SEC on July 17, 2023). |

|

|

|

99.4 |

|

Unaudited Condensed Consolidated Financial Statements of Ulterra Parent as of June 30, 2023 and for the six months ended June 30, 2023. |

|

|

|

99.5 |

|

Unaudited pro forma combined financial information of Patterson-UTI Energy, Inc. |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Date: September 5, 2023 |

|

|

|

|

Patterson-UTI Energy, Inc. |

|

|

|

|

|

|

|

By: |

|

/s/ C. Andrew Smith |

|

|

|

|

Name: C. Andrew Smith |

|

|

|

|

Title: Executive Vice President and Chief Financial Officer |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the registration statements on Form S-8 (Nos. 333-126016, 333-152705, 333-166434, 333-195410, 333-217414, 333-219063, 333-231988, 333-256752, 333-272520 and 333-274321) of Patterson-UTI Energy, Inc. of our reports dated February 16, 2023, with respect to the consolidated financial statements of NexTier Oilfield Solutions Inc. and the effectiveness of internal control over financial reporting.

/s/ KPMG LLP

Houston, Texas

September 5, 2023

Exhibit 23.2

Consent of Independent Auditor

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (Nos. 333-126016, 333-152705, 333-166434, 333-195410, 333-217414, 333-219063, 333-231988, 333-256752, 333-272520 and 333-274321) of Patterson-UTI Energy, Inc. of our report dated March 1, 2023, relating to the consolidated financial statements of BEP Diamond Topco L.P., which appears in this Current Report on Form 8-K/A (incorporated by reference to Exhibit 99.1 to Patterson-UTI Energy Inc.’s Current Report on Form 8-K, filed with the SEC on July 17, 2023).

/s/ BDO USA, P.C.

Dallas, Texas

September 5, 2023

Exhibit 99.4

BEP Diamond Topco L.P.

(Parent Company of Ulterra Holdings, Inc. and Ulterra Drilling Technologies, L.P.)

Condensed Consolidated Financial Statements

As of and for the Six Months Ended June 30, 2023

BEP Diamond Topco L.P.

(Parent Company of Ulterra Holdings, Inc. and Ulterra Drilling Technologies L.P.)

Contents

|

|

|

Condensed Consolidated Financial Statements |

|

|

Condensed Consolidated Balance Sheet as of June 30, 2023 (Unaudited) |

|

3 |

|

|

|

Condensed Consolidated Statement of Income and Comprehensive Income (Unaudited) for the Six Months Ended June 30, 2023 |

|

4 |

|

|

|

Condensed Consolidated Statement of Owners’ Equity (Unaudited) for the Six Months Ended June 30, 2023 |

|

5 |

|

|

|

Condensed Consolidated Statement of Cash Flows (Unaudited) for the Six Months Ended June 30, 2023 |

|

6 |

|

|

|

Notes to Condensed Consolidated Financial Statements (Unaudited) |

|

7 |

2

BEP Diamond Topco L.P.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

See accompanying notes to the unaudited condensed consolidated financial statements.

3

BEP Diamond Topco L.P.

Condensed Consolidated Statement of Income and Comprehensive Income

(Unaudited)

(In thousands)

See accompanying notes to the unaudited condensed consolidated financial statements.

4

BEP Diamond Topco L.P.

Condensed Consolidated Statement of Owners’ Equity

(Unaudited)

(In thousands, except unit amounts)

See accompanying notes to the unaudited condensed consolidated financial statements.

5

BEP Diamond Topco L.P.

Consolidated Statement of Cash Flows

(Unaudited)

(In thousands)

See accompanying notes to the unaudited condensed consolidated financial statements.

6

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

1.Organization and Nature of Operations

Organization

BEP Diamond Topco L.P. (the parent company of Ulterra Holdings, Inc. and Ulterra Drilling Technologies L.P.) is a holding company headquartered in Fort Worth, Texas. BEP Diamond Topco L.P. is a Delaware limited partnership that was formed on October 8, 2018. The general partner of BEP Diamond Topco L.P. is BEP Diamond Topco LLC. BEP Diamond Topco L.P. was formed for the purpose of holding an investment in its wholly-owned subsidiary, BEP Diamond Holdings Corp. (“BEP Diamond Holdings”). BEP Diamond Holdings was formed for the purpose of holding an investment in its wholly-owned subsidiary, BEP Ulterra Holdings, Inc. (f.k.a., ASP Ulterra Holdings, Inc.). BEP Ulterra Holdings, Inc. was formed for the purpose of holding an investment in its wholly-owned subsidiary, Ulterra Holdings, Inc. ("Holdings"). Holdings was formed for the purpose of holding an investment in its indirect wholly- owned subsidiary, Ulterra Drilling Technologies, L.P. ("UDT"), a Texas limited partnership formed for the purpose of distributing drilling equipment either directly or indirectly through its subsidiaries. Additionally, UDT holds a 75% ownership interest in Ulterra Arabia LLC (“UA”), which was formed for the purpose of distributing drilling equipment in Saudi Arabia (see Note 2 – Summary of Significant Accounting Policies, Basis of Presentation). BEP Diamond Topco L.P. and its subsidiaries are collectively referred to as the “Company”. These interim condensed consolidated financial statements should be read in conjunction with the annual audited consolidated financial statements and related notes for the year ended December 31, 2022, from which the consolidated balance sheet amounts as of December 31, 2022 were derived.

Nature of Operations

The Company is a manufacturer and global distributor of drilling equipment through its locations in North America and internationally, which are geographically positioned to serve the energy and mining markets in over 20 countries. The Company’s drilling equipment is used in oil and gas exploration and production and in mining operations. The Company has manufacturing facilities located in Fort Worth, Texas, Leduc, Alberta and Saudi Arabia and repair facilities located in Argentina, Colombia, and Oman.

2.Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These financial statements reflect the accounts and operations of the Company and its subsidiaries in which the Company has a controlling financial interest. UA is a joint venture between UDT and Gas & Oil Technologies LLC and was formed on November 15, 2016 to distribute drilling equipment in Saudi Arabia. UDT owns 75% of UA’s shares of stock and, as a result, UA is included in the Company’s condensed consolidated balance sheet, results of operations and cash flows. The 75% stock ownership by UDT and 25% stock ownership by Gas & Oil Technologies LLC is used in the allocation of earnings and equity to the owners of the Company and to the non-controlling interests, respectively. All significant intercompany transactions and accounts have been eliminated.

Use of Estimates

GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

7

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Cash and Restricted Cash

The Company considers all short-term investments with an original maturity of three months or less when purchased to be cash equivalents.

The following table provides a reconciliation of cash and restricted cash reported within the condensed consolidated balance sheet that sum to the total of the same such amounts shown in the statement of cash flows for the six months ended June 30, 2023:

Restricted cash includes amounts restricted as cash collateral for the issuance of standby letters of credit.

Accounts Receivable and Credit Losses

In addition to operating lease receivables, our trade receivables include receivables from equipment sales, and parts and service sales. Under Topic 606 (Revenue from Contracts with Customers), revenue is recognized when, among other criteria, it is probable that the entity will collect the consideration to which it is entitled for goods or services transferred to a customer. At the point that these trade receivables are recorded, they become subject to the current expected credit loss model and estimates of expected credit losses over their contractual life will be required to be recorded at inception based on historical information, current conditions, and reasonable and supportable forecasts.

The Company grants credit to its customers, which operate in the energy and mining industries. Concentrations of credit risk are limited because the Company has a large number of geographically diverse customers, thus spreading trade credit risk. The Company controls credit risk through credit evaluations, credit limits and monitoring procedures and credit insurance. The Company performs ongoing credit evaluations of its customers' financial condition and extends credit to its customers on an uncollateralized basis. In the event of non-performance of the Company's customers, the maximum exposure to the Company is the net outstanding accounts receivable balance.

The Company estimates its provision for losses on uncollectible accounts by incorporating assessments of past collection experience and current market events or indicators to estimate future expected losses. This process consists of a review of historical collection experience, current aging status of the customer accounts, and current market conditions. Based on these factors, the Company will establish or adjust allowances using historical loss rates for overall exposures as well as for specific customers when events or circumstances come to its attention that may indicate future losses may be expected. The Company believes that the allowance for credit losses is adequate to cover potential bad debt losses under current conditions; however, uncertainties regarding changes in the financial condition of its customers, either adverse or positive, could impact the amount of any additional provision that may be required. Balances that remain outstanding after the Company has used reasonable collection efforts are written off through a charge to the allowance and a credit to receivables.

8

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Prepaid Expenses

Prepaid and other current assets consist of the following:

Inventories

Inventories are stated at the lower of cost or net realizable value, with raw material cost being determined on the first- in, first-out ("FIFO") basis and work-in-process and finished goods cost being determined based upon standard costs, which approximates actual. The Company regularly reviews inventory quantities and records a provision for excess and/or obsolete inventory that reduces the cost basis of the inventory.

Rental Equipment

Rental equipment is comprised of drill bits and downhole tools manufactured by the Company and primarily held for rental to customers. Rental equipment is carried at cost, net of accumulated depreciation. Repairs and maintenance costs are charged to expense as incurred. Rental equipment is subject to technological obsolescence and wear and tear, and no salvage value is assigned to it. The Company continues to lease rental equipment after it has been fully depreciated if it remains in acceptable condition and meets acceptable technical standards. The Company derecognizes the cost and accumulated depreciation of fully depreciated assets that are not expected to generate future revenues. The cost and any accumulated depreciation for rental equipment that is retired or sold are eliminated from the respective accounts and any revenues and expenses and gains or losses thereon are reflected in the accompanying condensed consolidated statement of income in the respective period. Rental equipment is depreciated over its estimated useful life.

Depreciation expense on rental equipment totaled $18.6 million, for the six months ended June 30, 2023, and is included in cost of equipment rentals in the accompanying condensed consolidated statement of income.

Estimated useful lives and balances of the major classes of rental equipment are as follows:

9

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Property, Plant and Equipment

Property, plant and equipment is recorded at cost and depreciation expense is computed using the straight-line method over the estimated useful life. Expenditures for major renewals and betterments that extend the useful lives of property, plant and equipment are capitalized. Repairs and maintenance costs are charged to expense as incurred. The cost and accumulated depreciation for assets retired or sold is eliminated from the respective accounts and any gains or losses thereon are reflected in the accompanying condensed consolidated statement of income and comprehensive income in the respective period. Depreciation expense on property, plant and equipment totaled $5.0 million for the six months ended June 30, 2023, and is included in selling, general and administrative expense in the condensed consolidated statement of income.

Estimated useful lives and balances of the major classes of property, plant and equipment are as follows:

|

|

(1) |

Leasehold improvements are amortized over the shorter of the realized estimated useful life of the leased asset or the term of the respective leases. The amortization period ranges from three to seven years. |

Accrued Liabilities

Accrued liabilities consist of:

10

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Impairment of Long-Lived Assets

The Company evaluates the recoverability of rental equipment, property, plant and equipment and amortizable intangible assets for possible impairment whenever events or circumstances indicate that the carrying amount of such assets may not be recoverable. Recoverability of those assets is measured by a comparison of the carrying amounts to the future undiscounted cash flows the assets are expected to generate. If such review indicates that the carrying amount of those assets is not recoverable, the carrying amount of such assets is reduced to fair value. In addition to the recoverability assessment, the Company routinely reviews the remaining estimated useful lives of those assets. If the Company revises the estimated useful life assumption for any of those assets, the remaining unamortized balance is amortized or depreciated over the revised estimated useful life.

There were no events or circumstances during the period ended June 30, 2023, that indicated the carrying amount of rental equipment, property, plant and equipment and amortizable intangible assets may not be recoverable.

Goodwill and Indefinite-Lived Intangible Assets

Goodwill from acquisitions is recorded as the excess of the consideration transferred plus the fair value of any non- controlling interest in the acquiree at the acquisition date over the fair values of the identifiable net assets acquired. The Company performs an annual impairment test of goodwill on a qualitative or quantitative basis for each of our reporting units as of October 1, or more frequently when circumstances indicate an impairment may exist at the reporting unit level. When performing the annual impairment test, we have the option of first performing a qualitative assessment to determine the existence of events and circumstances that would lead to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If such a conclusion is reached, we are then required to perform a quantitative impairment assessment of goodwill. However, if the assessment leads to a determination that it is more likely than not that the fair value of a reporting unit is greater than its carrying amount, then no further assessments are required. A quantitative assessment for the determination of impairment is made by comparing the carrying amount of each reporting unit with its fair value, which is generally calculated using a combination of market, comparable transaction and discounted cash flow approaches. Our reporting units are the same as our three reportable segments.

We also test goodwill for impairment whenever events or circumstances occur which, in our judgment, could more likely than not reduce the fair value of one or more reporting units below its carrying value. Potential impairment indicators include, but are not limited to, (i) the results of our most recent annual or interim long-lived assets impairment testing, in particular the magnitude of the excess of fair value over carrying value observed, (ii) downward revisions to internal forecasts, and the magnitude thereof, if any, and (iii) declines in the oil and gas exploration and development industry or oil and natural gas commodity markets, and the magnitude and duration of those declines, if any. We completed our annual impairment test as of October 1 and determined in our qualitative assessment (step 0) that it is more likely than not that the fair value of each reporting unit is greater than the carrying amount of each reporting unit, resulting in no goodwill impairment. During the six months ended June 30, 2023, we did not identify any indicators that would lead to a determination that it is more likely than not the fair value of any reporting unit is less than its carrying value. There can be no assurances that future sustained declines in macroeconomic or business conditions affecting our industry will not occur, which could result in goodwill impairment charges in future periods.

11

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Revenue Recognition

The Company manufactures and distributes drilling equipment, comprised of drill bits and downhole tools, to customers in the oil and gas exploration and mining industries. All of the Company’s contracts with customers have terms of less than one year. Therefore, the Company does not adjust for any significant financing component or disclose the value of unsatisfied performance obligations related to customer contracts. We recognize revenue in accordance with two accounting standards: 1) Topic 842 and 2) Topic 606.

Revenues from Equipment Rentals (Topic 842)

The Company’s revenues are primarily generated from the rental of drilling equipment and such arrangements contain lease components, as the arrangements provide customers with the right to control the use of identified assets. Generally, the lease terms in such arrangements are for periods of two to three days, and as of June 30, 2023, no agreement had a lease term that extended beyond one month. The contracts can be priced as a fixed dollar amount for a single run or priced as a specified dollar amount per foot drilled. A third category of contracts are priced as a specified dollar amount per foot drilled but include a minimum fee. The arrangements may provide customers with renewal or termination options and the Company incorporates such options in the lease term when it is reasonably certain that exercise will occur. Rental arrangements do not provide customers with options to purchase the underlying asset. The Company determined that no non-lease components are present in its lessor rental arrangements and therefore, separation of lease and non-lease components is not required.

The Company recognizes revenue from the rental of drilling equipment over the term of the lease, as all such arrangements qualify as operating leases. The Company excludes all sales and other similar taxes collected from customers and remitted to the related taxing authority from consideration in the contract and from variable payments.

Revenues from Equipment Sales and Services (Topic 606)

The Company also sells drilling equipment and provides repair services to customers. The Company recognizes revenue from the sale of drilling equipment and repair services in accordance with the five-step model prescribed by Topic 606. The Company does not invoice customers until the Company’s performance obligations have been satisfied. Therefore, the Company’s timing of revenue recognition occurs prior to billings and results in a contract asset in the form of unbilled revenue. Due to the short-term nature of contracts with customers, the amount of unbilled revenue is not material. The Company’s standard payment terms for sales of drilling equipment is 30 days from the invoice date. The Company does not receive payment from customers before a performance obligation is satisfied and therefore does not recognize a contract liability.

The Company sells drilling equipment primarily to customers in international locations through long-term arrangements, which do not include committed volumes until underlying purchase orders are issued. Sales of drilling equipment include engineering services provided while the customer is using the purchased equipment. A purchase order may include multiple drilling tools, for which revenue recognition occurs upon the transfer of control of each individual drill bit or downhole tool to the customer. The related engineering services are not considered a separate performance obligation because they are not distinct. The Company recognizes revenue from the sale of drilling equipment at a point in time when it satisfies its performance obligation by transferring control of the drilling equipment to the customer and engineering services are complete. Control transfers to the customer when it accepts title to and risk of loss of the equipment, which varies by contract.

Since most drilling runs usually last less than one week, the amount of unsatisfied performance obligations at any reporting period-end is not material. As a result, there is no material difference in the nature and timing between equipment sales and equipment sales with engineering services, and the Company does not disclose these revenues separately.

The Company excludes all sales and other similar taxes collected from customers and remitted to the related taxing authority from the transaction price.

12

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Equity Based Compensation

The Company recognized approximately $0.9 million in equity-based compensation expense for the six months ended June 30, 2023.

Employee equity-based compensation is measured based on the grant-date fair value of the awards. The Company grants service-based awards that vest over a specified service period, and performance-based awards that vest when the Company meets specified performance metrics or after a specified period of time, whichever occurs first. For performance-based awards, the Company reviews whether the options will vest based on service or performance on an annual basis to determine the period that the recipient is required to perform services in exchange for the award, or the requisite service period.

The Company recognizes compensation expense using graded vesting for awards with multiple vesting tranches over the requisite service period for each separately vesting tranche of the award as if the award was, in-substance, multiple awards, over the requisite service period.

The determination of fair value of equity-based payment awards on the date of grant using models is affected by the Company’s estimated unit price as well as assumptions regarding a number of highly complex and subjective variables. These variables include, but are not limited to, the expected unit price volatility over the term of the awards, actual and projected employee equity-based compensation exercise activity, risk-free interest rate, expected dividends and expected term. The Company uses the Contingent Claim Analysis method, which allocates total available proceeds to various classes of equity securities at an anticipated exit event in accordance to the rights and distribution preferences of the holders as detailed in the award agreement. The Company has elected to recognize forfeitures in the period in which the forfeiture occurs.

New Accounting Standards

All new accounting pronouncements that have been issued but not yet effective are currently being evaluated and at this time are not expected to have a material impact on our financial position or results of operations.

At June 30, 2023, goodwill was $147.3 million for the United States reportable segment. Accumulated impairment was $122.2 million as of June 30, 2023.

13

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Identified intangible assets by major classification is as follows:

Amortization expense for intangible assets subject to amortization totaled approximately $11.6 million for the six months ended June 30, 2023.

Future estimated amortization expense relating to intangible assets subject to amortization is as follows:

Long-term debt consisted of the following:

14

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

Future debt maturities are as follows:

Term Loan

In 2018 the Company entered into a $415.0 million loan (the “Term Loan”). The Term Loan matures on November 26, 2025 and is secured by a first lien over all assets of the Company. The Company is required to make quarterly principal and interest payments on the Term Loan. During the six months ended June 30, 2023, the Company made required principal payments of $2.1 million.

On June 15, 2023, the Company entered into a second amendment to the term loan agreement dated November 26, 2018, which replaced LIBOR with SOFR. The effective date of the amendment is July 1, 2023. Under the amended term loan, all outstanding borrowings on the Term Loan bear interest, at the Company’s election, as follows: (i) each term SOFR loan bears interest at a rate equal to term SOFR plus the applicable rate and (ii) each base rate loan bears interest at a rate equal to the base rate plus the applicable rate. The term SOFR means the sum of (i) the forward- looking term rate based on SOFR two business days prior to the commencement of an interest period and (ii) the term SOFR credit spread adjustment of 0.10% per annum. The term SOFR rate will be deemed to be 0.00% if the SOFR rate would be less than 0.00%. The base rate means a rate equal to the greatest of (a) the federal funds effective rate plus ½ of 1%, (b) the prime rate and (c) the term SOFR plus 1.00%. The base rate will be deemed to be 1% if the base rate would be less than 1%. The applicable rate means a percentage between 3.00% and 3.50% for a term SOFR loan and between 2.00% and 2.50% for a base rate loan, depending on the Company’s consolidated net leverage ratio for the prior quarterly period. At June 30, 2023, the Term Loan bore interest at 10.44%.

Line of Credit

In 2018, together with the Term Loan, the Company entered into a $50.0 million revolving line of credit (the “Line of Credit”). The Line of Credit matures on August 27, 2025 and is secured, together with the Term Loan, by a first lien over all assets of the Company. At June 30, 2023, no amounts were outstanding under the Line of Credit and the Company had $2.0 million in outstanding standby letters of credit which reduce the availability under the Line of Credit to $48.0 million as of June 30, 2023.

On May 9, 2023, the Company entered into a second amendment to the revolving credit agreement dated November 26, 2018, which extended the maturity date to August 27, 2025 and replaced LIBOR with SOFR. Under the amended line of credit, interest on all outstanding borrowings on the Line of Credit bear interest, at the Company’s elections, as follows; (i) each term SOFR loan shall bear interest at a rate equal to term SOFR plus the applicable rate; (ii) each base rate loan bears interest equal to the base rate plus the applicable rate; and (iii) each swing line loan bears interest equal to the base rate plus the applicable rate. The term SOFR means the sum of (i) the forward-looking term rate based on SOFR two business days prior to the commencement of an interest period and (ii) the term SOFR credit spread adjustment of 0.10% per annum. The term SOFR rate will be deemed to be 0.00% if the SOFR rate would be less than 0.00%. The base rate means a rate equal to the greatest of (a) the federal funds effective rate plus ½ of 1%, (b) the prime rate and (c) the term SOFR plus 1.00%. The base rate will be deemed to be 1% if the base rate would be less than 1%. The applicable rate means a percentage between 3.00% and 3.50% for a term SOFR loan and between 2.00% and 2.50% for a base rate loan, depending on the Company’s consolidated net leverage ratio for the prior quarterly period.

The Company capitalized deferred financing costs of $0.6 million from the amendments to the term loan and line of

15

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

credit agreements which will be amortized over the remaining term of the credit agreements.

The Company is required to make quarterly interest payments on the Line of Credit. The annual commitment fee ranges from 0.375% to 0.50% of the unused portion of the Line of Credit.

The credit facility contains certain representations and warranties, affirmative and negative covenants and events of default. The negative covenants in the credit facility restrict the Company’s ability, subject to certain baskets and exceptions, to (among other things) incur liens or indebtedness, make investments, enter into mergers and other fundamental changes, make dispositions or pay dividends or distributions. The restriction on dividend or distribution payments includes an exception that permits the Company to pay dividends or distributions and make other restricted payments regardless of dollar amount so long as, after giving pro forma effect thereto, the Company has a consolidated net leverage ratio, as defined in the credit facility, within predefined ranges, subject to certain increases following designated material transactions.

The credit facility includes certain springing financial covenants that are only tested if the aggregate principal amount of the Line of Credit and/or letters of credit (excluding up to $5.0 million of letters of credit and other letters of credit that have been cash collateralized or backstopped) exceed 60% of Revolving Credit Commitments. These springing financial covenants restrict the Company from exceeding a consolidated Super Priority Net Leverage Ratio of 1.00 to 1.00 as of the last day of any fiscal quarter end, and a Consolidated Total Net Leverage Ratio not to exceed 4.50 to 1.00. At June 30, 2023, the Company was not subject to these springing financial covenants.

The credit facility prevents the Company from incurring any first lien indebtedness if the Consolidated First Lien Net Leverage Ratio is greater than 3.00:1.00, incurring junior lien indebtedness if the Consolidated Secured Net Leverage Ratio is greater than 3.00:1.00 or incurring unsecured indebtedness if the Consolidated Interest Coverage Ratio is more than 2.00 to 1.00 or the Consolidated Total Net Leverage Ratio is not greater than 3:00:1.00 after giving effect to such transactions.

BEP Ulterra Holdings Inc., a wholly owned subsidiary of BEP Diamond Topco L.P., is the borrower of the Term Loan and the Line of Credit. There are no assets or liabilities held by or operations and cash flows of BEP Diamond Topco L.P., besides the ownership of the borrower and the equity-based compensation, that would generate a material difference between the financial statements of BEP Diamond Topco L.P. and BEP Ulterra Holdings Inc. Equity based compensation expense recognized by BEP Diamond Topco L.P. was approximately $0.9 million for six months ended June 30, 2023.

Interest Rate Swap

In July 2020, the Company entered into an interest rate swap as a cash flow hedge against adverse fluctuations in LIBOR rates which matures on February 29, 2024. The notional value as of June 30, 2023 was $300.0 million. On a quarterly basis, the Company pays a fixed rate of 0.38% and receives the greater of 0% or one-month LIBOR.

The interest rate swap is designated as a cash flow hedge and recognized on the consolidated balance sheet at fair value. If the hedging relationship qualifies as highly effective, the gain or loss on the interest rate swap will be recognized in accumulated other comprehensive income (loss) and reclassified into interest expense in the same period during which the hedged transaction affects earnings. On a quarterly basis the Company uses quantitative information to assess the effectiveness of the hedge.

The fair value of the interest rate swap at June 30, 2023 was $9.9 million and is included in derivative assets in the condensed consolidated balance sheet. The interest rate swap is valued using broker quotations and is classified in the level 2 fair value hierarchy.

16

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

The following summarizes the impact of the interest rate swap on the results of operations, comprehensive income (loss) and accumulated other comprehensive income (loss):

We expect that approximately $9.9 million related to cash flow hedges will be reclassified from accumulated other comprehensive income (loss) as a decrease to interest expense in the next 12 months.

See Note 10 for further discussion on the impact of hedge accounting to the Company’s condensed consolidated comprehensive income (loss) and accumulated other comprehensive income (loss).

The partnership, BEP Diamond Topco L.P., is the shareholder of BEP Diamond Holdings and its subsidiaries. BEP Diamond Topco L.P. is generally not subject to federal income tax and most state income taxes. However, BEP Diamond Topco L.P. conducts certain activities through its corporate subsidiaries which are subject to federal and state income taxes. The Company and its subsidiaries file income tax returns primarily in the U.S. and Canada, including various U.S. state income and Canada provincial returns. The Company is subject to regular examinations by various tax authorities. The Company is not currently under federal or state tax examination, nor has it been notified of such. Tax years that remain subject to examination vary by legal entity but are generally open in the U.S. for the tax years ending after 2017 and outside the U.S. for the tax years ending after 2015. To the extent penalties and interest would be assessed on any underpayment of income tax, such accrued amounts are classified as a component of income tax provision (benefit) in the financial statements consistent with the Company’s policy.

The effective tax rate for the six months ended June 30, 2023, adjusted for discrete items, was 23.0%. The Company’s overall effective rate for the six months ended June 30, 2023, differs from the statutory rate of 21.0% due to foreign qualified business unit income/loss inclusion, lower tax rates earned on income in foreign jurisdictions, tax credits, other permanent differences, and state taxes.

7.Commitments and Contingencies

The Company is involved in various claims, regulatory agency audits and pending or threatened legal actions involving a variety of matters in the normal course of business. In the Company’s opinion, any ultimate liability, to the extent not otherwise recorded or accrued for, will not materially affect the Company’s financial position, cash

17

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

flow or results of operations.

The Company maintains credit arrangements with financial institutions providing for short-term borrowing capacity, overdraft protection and bonding requirements. As of June 30, 2023, the Company was contingently liable for approximately $4.5 million of outstanding standby letters of credit, which is partially collateralized by restricted cash of approximately $3.3 million in the accompanying condensed consolidated balance sheet. The Company does not believe, based on historical experience and information currently available, that it is probable that any amounts will be required to be paid.

The Company’s business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service and mining industries in general, as well as by environmental and safety regulations that specifically apply to the Company’s business. Although the Company has not incurred material costs in connection with its compliance with such laws, there can be no assurance that other developments, such as new environmental laws, regulations and enforcement policies thereunder may not result in additional, presently unquantifiable, costs or liabilities to the Company.

Lessor Arrangements

Total equipment rental revenue was approximately $157.3 million for the six months ended June 30, 2023.

Lessee Arrangements

The Company leases manufacturing and administrative facilities located in the United States, Canada, and internationally under operating lease agreements. The Company also leases equipment and vehicles under operating and finance lease agreements expiring at various dates through 2031, Operating leases are included in right of use assets on the consolidated balance sheet and finance leases are included in property, plant and equipment on the consolidated balance sheet.

The Company determines if an arrangement is a lease at inception. A contract is determined to contain a lease component if the arrangement provides the Company with a right to control the use of an identified asset. Lease agreements may include lease and non-lease components. In such instances for all classes of underlying assets, the Company does not separate lease and non-lease components but rather accounts for the entire arrangement under leasing guidance. Leases with an initial term of 12 months or less are not recorded on the balance sheet and lease expense for these leases is recognized on a straight-line basis over the lease term.

Right of use lease assets and lease liabilities are initially measured based on the present value of the future minimum fixed lease payments (i.e., fixed payments in the lease contract) over the lease term at the commencement date. In instances that the implicit rate of the lease agreement is not readily determinable, the Company will utilize its incremental borrowing rate based on the information available at the commencement date in determining the present value of future minimum lease payments. The Company calculates its incremental borrowing rate using the interest rate that it would have to pay to borrow on a fully collateralized basis an amount equal to the lease payments in a similar economic environment over a similar term and considers its historical borrowing activities and market data from entities with comparable credit ratings in this determination. The measurement of the right of use asset also includes any lease payments made prior to the commencement date (excluding any lease incentives) and initial direct costs incurred.

Lease terms may include options to extend or terminate the lease and the Company incorporates such options in the lease term when it is reasonably certain that the Company will exercise that option. In making this determination, the Company considers its prior renewal and termination history and planned usage, incorporating expected market conditions and economic incentives for extension of the assets under lease.

18

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

For operating leases, lease expense for minimum fixed lease payments is recognized on a straight-line basis over the lease term. The expense for finance leases includes both interest and amortization expense components, with the interest component calculated based on the effective interest method and the amortization component calculated based on straight-line amortization of the right of use asset over the lease term. Lease contracts may contain variable lease costs, such as common area maintenance, utilities, insurance, and tax reimbursements that vary over the term of the contract. Variable lease costs are not included in minimum fixed lease payments and as a result are excluded from the measurement of the right of use assets and lease liabilities. Rather, the Company expenses all variable lease costs as incurred.

The Company's right-of-use lease assets and lease liabilities were as follows:

The components of lease expense were as follows:

Supplemental cash flow information was as follows:

19

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

The table below reconciles the undiscounted cash flows for each of the first five years and total of the remaining years to the operating lease liabilities recorded on our condensed consolidated balance sheet as of June 30, 2023.

The Company’s operations are organized into three reportable segments: United States, Canada and International.

United States

The US operations are supported by a manufacturing facility in Fort Worth, Texas and supply a variety of equipment and technologies used to perform drilling operations throughout the world. In the U.S. market, the Company provides its drill bits on a per run rental basis.

Canada

The Company’s Canadian manufacturing and repair facilities, which are located in Leduc, Alberta, primarily manufactures and repairs steel polycrystalline diamond compact (“PDC”) and matrix drill bits.

International

The international segment includes operations in countries in the Middle East, Latin America and Asia Pacific regions, including Mexico, Australia, Colombia, Oman, Saudi Arabia, Ecuador, United Arab Emirates, Argentina, Kuwait, China, Thailand, Vietnam, Malaysia, and Egypt. The Company operates repair facilities in Argentina, Colombia, Oman and Saudi Arabia. In select international markets, such as Saudi Arabia, the Company sells its drill bits directly to exploration and production (“E&P”) operators, including national oil companies such as Saudi Aramco.

The Company evaluates performance and allocates resources based on revenues and profit or loss from operations before income taxes. Non-segmented revenues and non-segmented costs relate to freight charges and corporate costs and are not allocated to the reportable segments.

20

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

The following tables present selected financial data by reportable segment and include a reconciliation of reportable segment revenue and operating income to the Company's consolidated revenue and operating income (loss):

Entity-wide information - product lines

Drill bits

The Company manufactures a suite of matrix and steel PDC drill bits applicable to most drilling conditions on a global basis. The Company also provides roller cone drill bits for rental or sale as an alternative to PDC drill bits. Drill bits are a consumable wear part, capable of being repaired several times during their useful lives. The Company ensures optimal performance on each run thorough repair and testing over the course of the drill bit’s life.

The Company has only one product line and therefore additional entity-wide information is not presented.

21

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

10.Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive income (loss) includes changes in the fair value of the interest rate swap that qualifies for hedge accounting and foreign currency translation adjustments. The Company’s reporting currency is the U.S. dollar. The Company’s international entities in which there is a substantial investment have the local currency as their functional currency. As a result, foreign currency translation adjustments resulting from the process of translating the entities’ financial statements into the reporting currency are reported in other comprehensive income (loss).

The components of accumulated other comprehensive income (loss) as of June 30, 2023, are as follows:

On July 3, 2023, BEP Diamond Holdings, which indirectly owns all of the outstanding equity interests of Ulterra Drilling Technologies, L.P., and BEP Diamond Topco L.P., a Delaware limited partnership, as sole stockholder of BEP Diamond Holdings (the “Stockholder”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Patterson-UTI Energy, Inc., a Delaware corporation (“Patterson-UTI”), PJ Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of Patterson-UTI (“Merger Sub I”), and PJ Second Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Patterson-UTI (“Merger Sub II”), pursuant to which, upon the terms and subject to the conditions set forth therein, (i) Merger Sub I will merge with and into BEP Diamond Holdings, with BEP Diamond Holdings continuing as the surviving entity (the “Surviving Corporation”) (the “First Company Merger”), and (ii) immediately following the First Company Merger, the Surviving Corporation will merge with and into Merger Sub II, with Merger Sub II continuing as the surviving entity (such merger, together with the First Company Merger, the “Mergers”). Upon consummation of the Mergers and the other transactions contemplated by the Merger Agreement (the “Transactions”), BEP Diamond Holdings will be a wholly owned subsidiary of Patterson-UTI.

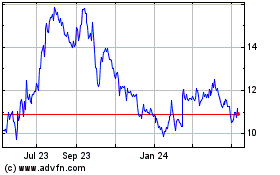

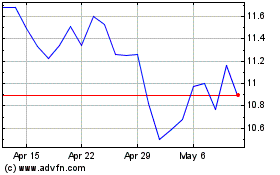

Under the terms and conditions of the Merger Agreement, the aggregate initial consideration to be paid by Patterson- UTI to the Stockholder in the Transactions consists of 34,900,000 shares of common stock, par value $0.01 per share, of Patterson-UTI (“Patterson-UTI Common Stock”, and such shares, the “Shares”) and an amount of cash equal to $370.0 million (such cash consideration, together with the Shares, the “Closing Consideration”), subject to customary purchase price adjustments set forth in the Merger Agreement relating to cash, net working capital, indebtedness and transaction expenses of BEP Diamond Holdings as of the closing of the Transactions (the “Closing”). In addition to the Closing Consideration, the Merger Agreement includes an earnout, providing that, if the trading price of Patterson- UTI Common Stock (determined by reference to the volume weighted average sales price per share calculated for the 30-trading day period ending with the last complete trading day prior to the Closing) is less than $10.90 per share, then the Stockholder may, subject to the terms and conditions of the Merger Agreement, be entitled to receive additional consideration based on the performance of BEP Diamond Holdings during 2024 in an aggregate amount up to $14.0 million.

22

BEP Diamond Topco L.P.

Notes to Condensed Consolidated Financial Statements

(Except as noted within the context of each note disclosure, the dollar amounts presented in tables are stated in thousands)

The Closing is subject to the satisfaction or waiver of certain customary closing conditions, including, among others,(i) subject to specified materiality standards, the accuracy of the representations and warranties of each party, (ii) compliance by each other party in all material respects with their respective covenants, (iii) the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act having expired or been terminated, (iv) there being no law, injunction or order by a governmental body prohibiting the consummation of the Mergers, (v) there being no Material Adverse Effect (as defined in the Merger Agreement) with regard to BEP Diamond Holdings and (vi) the approval for listing of Patterson-UTI Common Stock to be issued in accordance with the terms of the Merger Agreement on the Nasdaq.

On August 10, 2023, the Company terminated the interest rate swap for cash proceeds of $8.9 million.

Events subsequent to June 30, 2023 and through August 10, 2023, the date the condensed consolidated financial statements were available to be issued, have been evaluated for possible recognition or disclosure in the consolidated financial statements and no additional subsequent events requiring financial statement recognition or disclosure were noted.

23

Exhibit 99.5

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

On September 1, 2023, Patterson-UTI Energy, Inc., a Delaware corporation (“Patterson-UTI”), and NexTier Oilfield Solutions Inc., a Delaware corporation (“NexTier”), consummated the transactions contemplated by the Agreement and Plan of Merger, dated as of June 14, 2023 (as amended, the “NexTier merger agreement”), among Patterson-UTI, NexTier and certain subsidiaries of Patterson-UTI. Pursuant to the NexTier merger agreement, (i) a direct wholly owned subsidiary of Patterson-UTI merged with and into NexTier, with NexTier continuing as the surviving entity (the “first merger” and the surviving entity, the “surviving corporation”), and (ii) immediately following the first merger, the surviving corporation merged with and into a second direct wholly owned subsidiary of Patterson-UTI, with such second subsidiary surviving the merger as a direct wholly owned subsidiary of Patterson-UTI (the “second merger” and, together with the first merger, the “NexTier mergers”). Upon consummation of the NexTier mergers on September 1, 2023, NexTier became a wholly owned subsidiary of Patterson-UTI.

On August 14, 2023, Patterson-UTI and two of its wholly owned subsidiaries consummated the transactions (the “Ulterra acquisition”) contemplated by the merger agreement, dated as of July 3, 2023 (the “Ulterra merger agreement” and, together with the NexTier merger agreement, the “merger agreements”), with BEP Diamond Holdings Corp. (“Ulterra”), which indirectly owned all of the outstanding equity interests of Ulterra Drilling Technologies, L.P., and BEP Diamond Topco L.P., a Delaware limited partnership, as sole stockholder of Ulterra (the “Ulterra stockholder”). Upon consummation of the Ulterra acquisition and the other transactions contemplated by the Ulterra merger agreement on August 14, 2023, Ulterra became a wholly owned subsidiary of Patterson-UTI.

The following unaudited pro forma condensed combined financial statements (the “pro forma financial statements”) have been prepared from the respective historical consolidated financial statements of Patterson-UTI, NexTier and Ulterra and have been adjusted to reflect the completion of the NexTier mergers and the Ulterra acquisition (referred to collectively as the “combination transactions,” and Patterson-UTI, after giving effect to the combination transactions, is referred to as the “combined company”). The pro forma financial statements have been prepared in accordance with Article 11 of the SEC’s Regulation S-X, as amended by the final rule, Release No. 33-10786 “Amendments to Financial Disclosures about Acquired and Disposed Businesses.” The unaudited pro forma condensed combined balance sheet gives effect to the combination transactions as if they had been completed on June 30, 2023, while the unaudited pro forma condensed combined statements of operations for the six months ended June 30, 2023 and the year ended December 31, 2022 are presented as if the combination transactions had been completed on January 1, 2022. The information presented herein is based on and should be read in conjunction with the historical audited and unaudited consolidated financial statements and related notes of Patterson-UTI filed with the SEC and the historical audited and unaudited consolidated financial statements of NexTier and Ulterra and related notes filed herewith as Exhibits 99.1 – 99.4 to this Current Report on Form 8-K/A.

Upon consummation of the combination transactions, Patterson-UTI determined the value of the purchase consideration using the Patterson-UTI common stock closing price and the number of shares of Patterson-UTI issued on the closing date of each respective transaction. Additionally, after completing the combination transactions, Patterson-UTI identified the assets acquired and liabilities assumed from NexTier and Ulterra and determined the respective fair values using relevant information available at that time. As a result of the foregoing, the pro forma adjustments with respect to the combination transactions are preliminary and are subject to change as additional information becomes available and as additional analysis is performed. Any increases or decreases in the fair value of assets acquired and liabilities assumed upon completion of the final valuations may be materially different from the information presented in the pro forma financial statements.

The pro forma financial statements are presented for illustrative purposes only and are not necessarily indicative of the operating results and financial position of the combined company that would have occurred had the combination transactions occurred on the dates indicated. Adjustments are based on information available to management during the preparation of the pro forma financial statements and assumptions that management believes are reasonable and supportable. Further, the pro forma financial statements do not purport to project the future operating results or financial position of the combined company following the combination transactions. Patterson-UTI's actual financial position and results of operations following completion of the combination transactions may differ materially from these pro forma financial statements.

1

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET AS OF JUNE 30, 2023

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

|

|

|

|

|

|

|

|

As of |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

|

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

|

|

|

|

|

June 30, |

|

|

2023 |

|

|

2023 |

|

|

NexTier |

|

2023 |

|

|

2023 |

|

|

Ulterra |

|

2023 |

|

|

|

|

|

NexTier |

|

|

|

|

|

|

|

|

|

Pro Forma |

|

|

Ulterra |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Historical |

|

|

|

|

|

Financing |

|

|

|

Combined |

|

|

(Historical |

|

|

|

|

|

Financing |

|

|

|

|

|

|

Patterson- |

|

|

as |

|

|

Transaction |

|

|

and |

|

|

|

for |

|

|

as |

|

|

Transaction |

|

|

and |

|

|

|

Pro |

|

|

UTI |

|

|

adjusted |

|

|

Accounting |

|

|

Other |

|

|

|

NexTier |

|

|

adjusted |

|

|

Accounting |

|

|

Other |

|

|

|

Forma |

|

|

(Historical) |

|

|

in Note 2) |

|

|

Adjustments |

|

Notes |

Adjustments |

|

Notes |

|

Merger |

|

|

in Note 2) |

|

|

Adjustments |

|

Notes |

Adjustments |

|

Notes |

|

Combined |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

150,288 |

|

|

$ |

310,166 |

|

|

$ |

(158,360 |

) |

A |

$ |

— |

|

|

|

$ |

302,094 |

|

|

$ |

72,478 |

|

|

$ |

(375,739 |

) |

A |

$ |

— |

|

|

|

$ |

119,240 |

|

|

|

|

|

|

|

|

|

(61,558 |

) |

B |

|

|

|

|

|

(61,558 |

) |

|

|

|

|

|

(7,620 |

) |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(174,140 |

) |

F |

|

95,000 |

|

E |

|

|

(79,140 |

) |

|

|

|

|

|

(56,275 |

) |

F |

|

325,000 |

|

E |

|

|

|

Accounts receivable, net of

allowance for credit losses |

|

491,049 |

|

|

|

443,741 |

|

|

|

— |

|

|

|

— |

|

|

|

|

934,790 |

|

|

|

70,464 |

|

|

|

— |

|

|

|

— |

|

|

|

|

1,005,254 |

|

Inventory |

|

68,036 |

|

|

|

73,415 |

|

|

|

— |

|

|

|

— |

|

|

|

|

141,451 |

|

|

|

31,430 |

|

|

|

— |

|

|

|

— |

|

|

|

|

172,881 |

|

Other current assets |

|

91,954 |

|

|

|

49,571 |

|

|

|

(4,665 |

) |

I |

|

— |

|

|

|

|

136,860 |

|

|

|

23,322 |

|

|

|

(9,943 |

) |

I |

|

— |

|

|

|

|

150,239 |

|

Total current assets |

|

801,327 |

|

|

|

876,893 |

|

|

|

(398,723 |

) |

|

|

95,000 |

|

|

|

|

1,374,497 |

|

|

|

197,694 |

|

|

|

(449,577 |

) |

|

|

325,000 |

|

|

|

|

1,447,614 |

|

Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

2,263,581 |

|

|

|

780,036 |

|

|

|

275,678 |

|

C |

|

— |

|

|

|

|

3,319,295 |

|

|

|

60,211 |

|

|

|

71,001 |

|

C |

|

— |

|

|

|

|

3,450,507 |

|

Operating lease right-of-use

assets |

|

18,771 |

|

|

|

29,178 |

|

|

|

— |

|

|

|

— |

|

|

|

|

47,949 |

|

|

|

8,588 |

|

|

|

— |

|

|

|

— |

|

|

|

|

56,537 |

|

Finance lease right-of-use

assets |

|

— |

|

|

|

93,565 |

|

|

|

— |

|

|

|

— |

|

|

|

|

93,565 |

|

|

|

6,538 |

|

|

|

— |

|

|

|

— |

|

|

|

|

100,103 |

|

Intangible assets, net |

|

5,140 |

|

|

|

48,373 |

|

|

|

687,627 |

|

D |

|

— |

|

|

|

|

741,140 |

|

|

|

238,598 |

|

|

|

81,402 |

|

D |

|

— |

|

|

|

|

1,061,140 |

|

Goodwill |

|

— |

|

|

|

192,780 |

|

|

|

758,803 |

|

A |

|

— |

|

|

|

|

951,583 |

|

|

|

147,314 |

|

|

|

303,492 |

|

A |

|

— |

|

|

|

|

1,402,389 |

|

Deposits on equipment

purchases |

|

14,222 |

|

|

|

16,161 |

|

|

|

— |

|

|

|

— |

|

|

|

|

30,383 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

30,383 |

|

Other assets |

|

10,128 |

|

|

|

13,654 |

|

|

|

(2,247 |

) |

I |

|

— |

|

|

|

|

21,535 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

21,535 |

|

Deferred tax assets, net |

|

4,027 |

|

|

|

112,926 |

|

|

|

(112,926 |

) |

H |

|

— |

|

|

|

|

4,027 |

|

|

|

512 |

|

|

|

— |

|

|

|

— |

|

|

|

|

4,539 |

|

Total assets |

$ |

3,117,196 |

|

|

$ |

2,163,566 |

|

|

$ |

1,208,212 |

|

|

$ |

95,000 |

|

|

|

$ |

6,583,974 |

|

|

$ |

659,455 |

|

|

$ |

6,318 |

|

|

$ |

325,000 |

|

|

|

$ |

7,574,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

245,562 |

|

|

$ |

347,589 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

$ |

593,151 |

|

|

$ |

23,488 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

$ |

616,639 |

|

Accrued liabilities |

|

204,006 |

|

|

|

215,876 |

|

|

|

— |

|

|

|

— |

|

|

|

|

419,882 |

|

|

|

13,247 |

|

|

|

— |

|

|

|

— |

|

|

|

|

433,129 |

|

Current maturities of long-term

operating lease liabilities |

|

4,753 |

|

|

|

9,930 |

|

|

|

497 |

|

K |

|

— |

|

|

|

|

15,180 |

|

|

|

2,642 |

|

|

|

(23 |

) |

K |

|

— |

|

|

|

|

17,799 |

|

Current maturities of long-term

finance lease liabilities |

|

— |

|

|

|

52,605 |

|

|

|

13,833 |

|

K |

|

— |

|

|

|

|

66,438 |

|

|

|

4,409 |

|

|

|

220 |

|

K |

|

— |

|

|

|

|

71,067 |

|

Current maturities of long-term

debt |

|

— |

|

|

|

14,176 |

|

|

|

(2,165 |

) |

F |

|

— |

|

|

|

|

12,011 |

|

|

|

4,150 |

|

|

|

(4,150 |

) |

F |

|

— |

|

|

|

|

12,011 |

|

Total current liabilities |

|

454,321 |

|

|

|

640,176 |

|

|

|

12,165 |

|

|

|

— |

|

|

|

|

1,106,662 |

|

|

|

47,936 |

|

|

|

(3,953 |

) |

|

|

— |

|

|

|

|

1,150,645 |

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term operating lease

liabilities, less current

maturities |

|

17,287 |

|

|

|

17,856 |

|

|

|

895 |

|

K |

|

— |

|

|

|

|

36,038 |

|

|

|

6,021 |

|

|

|

(52 |

) |

K |

|

— |

|

|

|

|

42,007 |

|

Long-term finance lease

liabilities, less current

maturities |

|

— |

|

|

|

21,479 |

|

|

|

5,648 |

|

K |

|

— |

|

|

|

|

27,127 |

|

|

|

1,818 |

|

|

|

91 |

|

K |

|

— |

|

|

|

|

29,036 |

|

Long-term debt, net of debt

discount and issuance costs |

|

822,408 |

|

|

|

340,327 |

|

|

|

(327,737 |

) |

F |

|

95,000 |