VOC Energy Trust Provides Update on Certain Operational Matters and Distributions

23 December 2014 - 2:24AM

Business Wire

VOC Energy Trust (NYSE:VOC) has provided an update on certain

operational matters and expected distributions in 2015. VOC Brazos

Energy Partners, L.P. has reported to the Trustee that it expects

the first announced quarterly distribution in 2015 to be

substantially lower than historical distributions. The expected

diminution in the distribution is primarily the result of increased

development expenses incurred by VOC Brazos associated with its

development efforts in the Kurten Woodbine Unit. If commodity

prices for crude oil remain at substantially reduced levels, VOC

Brazos further expects subsequent distributions in 2015 will also

be substantially lower than historical distributions. VOC Brazos

also reported further details regarding its development of the

upper interval of the “EagleBine” formation within the Kurten

Woodbine Unit, and the horizontal development of the lower

EagleBine interval.

The West Texas Intermediate spot price of crude oil has

decreased from $105.34 per barrel as of June 30, 2014 to $55.96 per

barrel as of December 15, 2014, a 47% reduction. In addition, the

hedges that VOC Brazos implemented in connection with the formation

of the Trust have all expired as of June 2014. As a result,

distributions from the Trust are now fully exposed to the price of

crude oil and natural gas realized by VOC Brazos. Due to

restrictions under the applicable documents governing the Trust,

VOC Brazos is not able to enter into additional hedge contracts for

the benefit of the Trust.

VOC Brazos reported that it has drilled and completed, or

participated in the drilling and completion of, 14 horizontal wells

in the upper interval of the EagleBine formation within the Kurten

Woodbine Unit since 2009. In June 2014, VOC Brazos commenced a

second horizontal drilling development program within the Kurten

Woodbine Unit to attempt to develop the lower EagleBine interval, a

strategy that was not contemplated at the time of Trust formation.

In addition, VOC Brazos has initiated the acquisition of 3D seismic

data covering 40 square miles of the Kurten Woodbine Unit. To date,

VOC Brazos has drilled two horizontal wells in the lower EagleBine

interval, the first of which was completed as a short lateral

(3,000 feet) resulting in an initial 30-day production rate of 166

Boe/d and the second of which was not completed due to mechanical

issues. As a result of mechanical issues encountered in both wells,

which resulted in excess costs in the first well and the

abandonment of the second well, in the fourth quarter 2014, VOC

Brazos elected to defer its development efforts in the lower

EagleBine interval to evaluate best practices with respect to well

integrity issues. Encouraged by the results of offset operators and

the first VOC Brazos short lateral well, VOC Brazos, however,

expects to resume the new development program of the lower

EagleBine interval in 2015, subject to giving consideration to the

commodity prices for crude oil.

In addition, VOC Brazos is evaluating the potential of a new pad

drilling strategy for continued development of the upper EagleBine

interval within the Kurten Woodbine Unit, which was not

contemplated at the time of Trust formation. Pad drilling is the

practice of drilling multiple wellbores from a single surface

location, which wells are then completed in succession and

ultimately all of which are put on production simultaneously to

optimize reserve recovery. Pad drilling would result in the

incurrence of drilling and completion costs associated with all

wellbores on the pad before initiating production from any of the

wells.

VOC Brazos is evaluating the potential economic benefits

associated with development of the lower EagleBine interval and pad

drilling in the upper EagleBine interval similar to strategies that

recently have been employed by other operators in the area. If

these activities are pursued, they would result in increased

development costs burdening the net profits interest of the Trust

relative to historical development costs, thus further temporarily

reducing cash available for distributions by the Trust from the

Kurten Woodbine Unit until anticipated production from these

development efforts can be brought on-line. To address these

emerging opportunities, VOC Brazos will continue in 2015 to

evaluate the appropriate strategy and capital plan to fund

development for the Trust, although it may reduce the pace of

development compared to historical levels, if commodity prices for

crude oil remain at substantially reduced levels.

This press release contains forward-looking statements,

including statements made by VOC Brazos Energy Partners, L.P.

Although VOC Brazos Energy Partners, L.P. has advised the Trust

that VOC Brazos Energy Partners, L.P. believes that the

expectations contained in this press release are reasonable, no

assurances can be given that such expectations will prove to be

correct. The amount of future distributions is based on the amount

of cash received or expected to be received by the Trustee from the

underlying properties on or prior to the record date with respect

to the quarter ended prior to such record date. Any differences in

actual cash receipts by the Trust could affect this distributable

amount. Other important factors that could cause these statements

to differ materially include the actual results of drilling

operations, risks inherent in drilling and production of oil and

gas properties, the ability of commodity purchasers to make

payment, and other risk factors described in the Trust’s Form 10-K

for the year ended December 31, 2013 filed with the Securities and

Exchange Commission. Statements made in this press release are

qualified by the cautionary statements made in these risk factors.

The Trust does not intend, and assumes no obligation, to update any

of the statements included in this press release.

VOC Energy TrustThe Bank of New York Mellon Trust Company, N.A.,

as TrusteeMike Ulrich, 512-236-6599

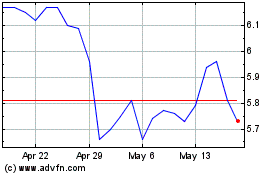

Voc Energy (NYSE:VOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Voc Energy (NYSE:VOC)

Historical Stock Chart

From Apr 2023 to Apr 2024