Yen Falls Amid Risk Appetite

23 December 2014 - 8:51PM

RTTF2

The Japanese yen weakened against the other major currencies in

the early European session on Tuesday, as traders await a slew of

U.S. reports on durable goods orders, personal income and spending,

new home sales and revised GDP figures due later in the day.

The crude oil and gold also rallied along with the European

shares.

The U.K.'s FTSE 100 index is currently up 0.19 percent or 12.80

points at 6,589, France's CAC 40 index is up 0.13 percent or 5.67

points at 4,260 and Germany's DAX is up 0.02 percent or 2.24 points

at 9,868.

Economists expect the U.S. GDP to rise 4.3 percent in the

July-September quarter, up from its previous estimate of 3.9

percent.

Meanwhile, trading volumes were thin and expected to remain so

this week, ahead of the Christmas holiday and the New Year's

holiday.

The Japanese market remains closed in observance of the

Emperor's Birthday holiday.

In the Asian session, the yen held steady against the other

major currencies.

In the early European trading, the yen fell to a 2-week low of

120.17 against the U.S. dollar and a 1-week low of 122.25 against

the Swiss franc, from early highs of 119.95 and 121.88,

respectively. If the yen extends its downtrend, it is likely to

find support around 121.92 against the greenback and 124.00 against

the Swiss franc,

Pulling away from early highs of 146.71 against the euro and

187.35 against the pound, the yen depreciated to 147.10 and 186.94,

respectively. If the yen extends its downtrend, it is likely to

breach yesterday's multi-day lows of 147.11 against the euro and

187.53 against the pound.

Against the NZ and Canadian dollars, the yen slipped to 93.02

and 103.42 from early highs of 92.65 and 103.08, respectively. On

the downside, 93.74 against the kiwi and 104.75 against the loonie

are seen as the next support levels for the yen.

The yen retreated to 97.57 against the Australian dollar, from

an early high of 97.17. Continuation of bearish trend may lead the

yen to a support around the 98.50 mark.

Looking ahead, Canada GDP for October and U.S. durable goods

orders for November, U.S. final third-quarter GDP data, house price

index for October and personal income and spending data for

November are due to be released in the New York session.

At 9:55 am ET, U.S. Reuters/University of Michigan's final

consumer sentiment index for December is due to be released.

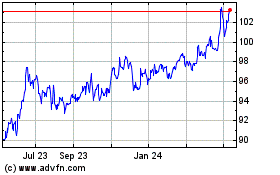

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

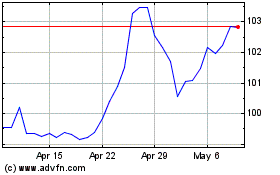

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024