Pound Falls Further as 'Brexit' Shock Lingers

27 June 2016 - 5:50PM

Dow Jones News

Pressure on the British pound intensified on Monday amid a

volatile trading session for currencies in Asia, after the U.K.

voted to leave the European Union on Friday and its currency closed

at its lowest levels in more than 30 years.

In morning trading in Asia, the British pound fell a further

2.1% to 1.3401 against the U.S. dollar. The euro also dropped 1% to

1.1011 against the U.S. dollar.

"Both pairs have been under pressure since the open today on the

back of continuing general uncertainty for the euro and the U.K.

downgrade announced late Friday night," said Simon Winn, Hong

Kong-based head of sales for Asia Pacific at EBS, the electronic

currency-trading arm of inter-broker dealer ICAP. On Friday,

Moody's Investors Service lowered its ratings outlook on the U.K.

to "negative" from "stable."

"Volumes are significantly above usual expectations across the

board," he said, with demand seen for safe-haven currencies like

the Japanese yen.

Currencies in Asia also experienced volatility. The Japanese yen

strengthened 0.3% to 101.907 against the U.S. dollar, while the

Korean won weakened 1.1% to 1,183.4 against the U.S. dollar.

The Chinese yuan fell to its weakest level against the U.S.

dollar since late 2010, after the biggest one-day depreciation of

the currency's daily fixing since last year's shock devaluation in

August. The onshore yuan last traded 0.4% weaker at 6.6388 against

the U.S. dollar.

British Chancellor of the Exchequer George Osborne is due to

deliver a statement to reassure investors before markets in London

open later in the day.

The lack of clarity from the U.K. after the vote undermined

market confidence, said Tim Kelleher, head of institutional

foreign-exchange sales at ASB Bank in New Zealand, a unit of

Commonwealth Bank of Australia.

"The market is still taking a negative view on everything," he

said. "People have had time to think about it, and it's raised more

questions than answers."

The U.K. is facing a vacuum at the top levels of its leadership,

with the ruling Conservative Party currently debating who will

succeed David Cameron as prime minister following his resignationÂ

Friday.

The opposition Labour Party, meanwhile, was facing its own

leadership challenge after 11 members of leader Jeremy Corbyn's

shadow cabinet resigned.

Write to Gregor Stuart Hunter at gregor.hunter@wsj.com

(END) Dow Jones Newswires

June 27, 2016 03:35 ET (07:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

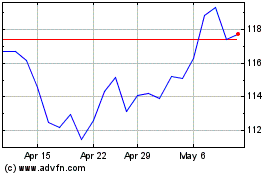

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Apr 2023 to Apr 2024