General Dynamics Raises Guidance as Cost Cuts Lift Earnings

27 July 2016 - 10:54PM

Dow Jones News

By Lisa Beilfuss

General Dynamics Corp. (GD) offered an upbeat outlook Wednesday,

as cost cuts offset a surprise decline in second-quarter revenue,

dragged by lower jet sales.

The Virginia-based aerospace and defense company sells

communication systems, ships and combat vehicles to the government,

in addition to Gulfstream business jets.

Solid demand of the high-end business jet has boosted the

company's results in recent years, providing a reliable source of

revenue even when the government has pulled in defense

spending.

In the second quarter, though, General Dynamic delivered fewer

Gulfstream jets. Aerospace sales slid 5.5% from a year earlier,

pacing a 2.8% overall revenue decline.

The company has worked to trim expenses to support profit, and a

3% drop in second-quarter costs and expenses helped counter the

sales decline and push earnings up slightly from a year

earlier.

Overall, General Dynamics reported a profit of $758 million, or

$2.44 a share, up from $752 million, or $2.27 a share, a year

earlier.

Revenue slipped 2.8% to $7.67 billion.

Analysts projected $2.31 in earnings per share and $7.87 billion

in revenue, according to Thomson Reuters.

For the full year, the company now expects to earn $9.70 a

share, up from previous guidance of $9.20 and above the $9.52

analysts have predicted.

General Dynamic shares, up 5.2% this year, were inactive during

premarket trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 27, 2016 08:39 ET (12:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

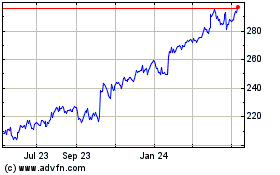

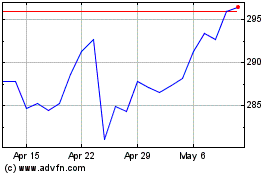

General Dynamics (NYSE:GD)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Dynamics (NYSE:GD)

Historical Stock Chart

From Apr 2023 to Apr 2024