By Jack Nicas and Don Clark

The latest batch of tech-industry earnings show how two

technology trends -- mobile and the cloud -- are taking root and

delivering big profits for the companies that bet on them.

Facebook Inc. and Google parent Alphabet Inc. last week both

reported surges in their quarterly profits, fueled by users

spending more time on their smartphones and advertisers spending

more money to reach them there.

Meantime, Amazon.com Inc. and Microsoft Corp. beat Wall Street

estimates with results that were lifted by the strength of their

businesses hosting other companies' data on their computer servers,

also known as the cloud.

"The big are getting bigger," said Ben Schachter, an analyst at

Macquarie Group Ltd. "People are using the internet more and more.

They always have it with them because of smartphones, speeds are

getting better...and all that information has to come from

somewhere, and it comes from the cloud."

The strength of these technologies is intertwined. Mobile

devices are increasingly becoming people's primary computers, which

is driving demand for the cloud. On personal computers, data was

often stored on the device itself, but smartphones have less memory

-- and the consumption of data overall has dramatically increased

-- requiring more information to be stored on the cloud.

The link is more than a decade old but has accelerated sharply

in recent years. The original boom in downloaded songs --

frequently from Apple Inc.'s iTunes service to iPods -- has been

supplanted by an explosion in mobile apps, streaming media services

and other mobile offerings that require the cloud.

"We see mobile and cloud infrastructure going hand in hand,"

said Ben Stanton, an analyst at research firm Canalys. "Cloud

infrastructure is pushing more and more of the capability of the

mobile device." Canalys forecasts that corporate spending on cloud

services rose 52% in the second quarter from a year prior, largely

driven by mobile demands.

Meanwhile, the picture for hardware companies is mixed.

The yearslong shift to smartphones from personal computers has

delivered massive profit for Apple, which introduced the first

iPhone nine years ago. But now smartphone sales have plateaued in

many countries, and Apple is feeling the squeeze. The world's most

valuable company said last week that iPhone sales declined for the

second consecutive quarter after an eight-year run of growth,

pushing profit down 27% from a year prior.

Still, some phone makers reported sales growth, including

Samsung Electronics Co. and Huawei Technology Co. Chip maker

Qualcomm Inc. reported a 22% jump in quarterly profit linked

largely to chip sales for Chinese smartphones.

Overall, the mobile era is entering a phase in which the profits

are increasingly going to internet and software companies that

capitalize on people using their phones more.

Two big winners are Google and Facebook, which are reaping the

rewards from the critical mass of mobile users that is attracting

advertisers.

Facebook said mobile ads accounted for 84% of its $6.2 billion

in advertising revenue in the latest quarter, compared with 11% in

2012. Facebook's profit nearly tripled from a year prior to a

record $2.1 billion.

Mobile growth also drove Google's 21% jump in quarterly revenue.

It said advertisers now are increasingly willing to advertise on

phones, partly because their mobile websites have improved, and

because tech companies like Google are offering better mobile-ad

formats. Google also is drawing advertisers by demonstrating the

efficacy of smartphone ads, like tracking users' locations to see

if they visit physical stores after seeing a mobile ad for those

stores.

While Apple's phone sales are shrinking, its smartphone-services

revenue rose 19% to nearly $6 billion in the second quarter. That

revenue includes app sales, Apple Music subscriptions and Apple Pay

fees. Apple CEO Tim Cook said he expects the business to grow so

much over the next year that it would be a Fortune 100 company if

it were independent.

Revenue at Amazon's cloud business grew 58% to $2.89 billion in

the second quarter, helping fuel Amazon's record $857 million

profit, which nearly doubled the company's previous high. The cloud

business is on track to surpass CEO Jeff Bezo's $10 billion revenue

goal this year.

Microsoft, widely seen as the No. 2 cloud provider after Amazon,

is making its cloud business the centerpiece of a transition beyond

selling software. The segment that includes its Azure

cloud-computing service grew 6.6% to $6.71 billion in the latest

quarter, while the segment including Windows software fell 3.7% to

$8.9 billion. Azure revenue alone nearly doubled.

Google also is aggressively pitching its cloud services, and

recently hired Diane Greene, a well-known Silicon Valley

entrepreneur, to run the division. Revenue for the segment that

includes Google's cloud business increased 33% to $2.17 billion in

the second quarter, outpacing past quarters' growth and increases

in its advertising business.

Some of the losers in the latest round of earnings highlight how

smartphones and the cloud are replacing PCs as Silicon Valley's

major growth driver. Intel Corp., the PC-chip kingpin that failed

to get a foothold in smartphones, reported a 51% drop in profit

because of restructuring charges linked to a strategy to reduce its

dependence on PCs.

Other companies linked to PCs are rapidly shifting to mobile.

One example is Logitech International SA, a longtime maker of PC

peripherals that has recently been adding a range of devices linked

to phones, such as home cameras and wireless headphones.

Logitech reported better-than-expected first-quarter financial

results, including a 7% rise in revenue. Logitech CEO Bracken

Darrell said in an interview, "Everything we do is mobile."

Write to Jack Nicas at jack.nicas@wsj.com and Don Clark at

don.clark@wsj.com

(END) Dow Jones Newswires

August 01, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

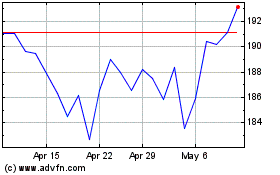

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

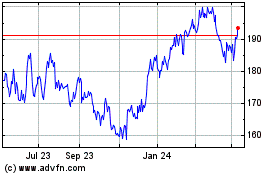

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024