Filed by: HomeStreet, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: HomeStreet, Inc.

Commission File No.: 001-35424

The following transcript of a HomeStreet employee call was made in connection with the proposed transaction between HomeStreet, Inc. and FirstSun Capital Bancorp

TRANSCRIPT

HMST Employee Call with Mark Mason and Neal Arnold

1:00 pm PST Thursday, January 18, 2024

Mark Mason

All right.

Good afternoon and welcome to our first employee call of 2024, where we have big news to discuss. A few reminders before we begin As always during the call today - everyone's camera and microphone will be muted. I'm certain there will be many questions and if you would like to ask one, make sure you do, so through the WebEx by clicking the chat pane to the right of your screen anytime during the call or through email at asktheceo@homestreet.com. If you would prefer to remain anonymous, please say, so at the beginning of your question or comment, and I won't make the mistake of sharing your identity. This is an exciting week for us here at HomeStreet.

And I'm proud to be joined today by Neal Arnold CEO and president of FirstSun. At the closing of this deal, Neal will become our CEO and he will personally address you in a few minutes after I share my prepared remarks and then Neal and I are going to take your questions. Well, we're going to do our best to do so.

On Tuesday morning, you all received an email from me announcing that HomeStreet has entered into a strategic merger agreement with FirstSun to create a premier regional bank. With this transaction, our combined company will create a bank with seventeen billion dollars in total assets and one hundred and twenty-nine branch locations across some of the most attractive markets in the United States.

It will accelerate our strategic plans, broaden our market reach, and create exciting growth opportunities for all of us. Each party brings the presence in large dynamic markets that are already experiencing above average growth for HomeStreet, The depth and density of our business and the Pacific northwest and in Southern California provide a substantial opportunity

HomeStreet Inc, employee call with CEO

for FirstSun, specifically in commercial and industrial banking since our markets offer entry into more Western growth markets. For HomeStreet, FirstSun offers our real estate lending businesses and the addition of trust and wealth management for our customers together. We will have an attractive and comprehensive product suite, a more diversified loan portfolio and increased lending capabilities across asset classes, geographies, and industry verticals.

Let me continue by telling you a bit more about FirstSun, formally referred to as FirstSun Bancorp, they are the financial holding company for Sunflower Bank, which also operates

under the brands First National 1870 and Guardian Mortgage. Sunflower Bank, like HomeStreet, has a very relationship focused approach to banking. FirstSun is seven point eight billion dollars in assets and their branch network includes Texas, Kansas, Colorado, New Mexico, and Arizona as well as mortgage capabilities in 43 states.

I heard this morning that a number of their mortgage employees used to be with us here at HomeStreet and that feels great. Additionally, there are growth opportunities both organic and through acquisitions that is impressive, so is their profitability through this challenging interest rate cycle, which has been driven by a strong and interest margin due to strong asset yields and low deposit costs and high fee income as a result of their focus on treasury and deposit services. The combination with HomeStreet results in a very balanced bank in products services, loan portfolio, diversification, and interest rate risk. And through all of their previous acquisitions, they've always made it a point to identify and keep the best talent.

So this transaction makes a lot of sense for HomeStreet. By extending and formalizing our partnership with FirstSun, we will collectively have new growth areas to focus on and a comprehensive suite of products and services to offer our customers. In short, this transaction is a win-win. This week's exciting news is also the result of our collective efforts here at HomeStreet, We have become a trusted community bank with a great brand name and loyal customers, and because of that, we are an attractive partner. Conversely, one of the great benefits of this transaction for us is the stability and continuity FirstSun offers HomeStreet today. With the closing of the merger, we immediately change our focus from defense to offense -- moving past the interest rate cycle challenges we've endured this last year.

The FirstSun leaders recognize our best in class operations, outstanding customer service, and of course our dedicated employees, all of you who make us who we are. Additionally, because we have no current regional overlap, there will be no branch closures as a part of this merger. FirstSun also believes in our deep commitment to community service and being

good corporate citizens. Last, but not least, FirstSun will maintain HomeStreet’s brand in our markets as recognition of the respect for our brand and customer loyalty we've built over a century. I've already heard the customers of voice their appreciation for preserving the HomeStreet name.

HomeStreet Inc, employee call with CEO

I'll be staying with the combined company as the executive vice chairman of the board. As I shared with you all this week, as a member of the board and part of the executive leadership team, I will continue to be deeply involved in the direction of the company. Additionally, two other HomeStreet directors will also join the FirstSun board. I've led the company since 2010 through our turnaround, our IPO, and our growth to this point. So, this is very personal for me. I want to express my commitment to this combination and assure you that it will be good for HomeStreet employees, customers, and the communities we serve.

Let's briefly discuss the terms of the transaction as well as the approval process:

HomeStreet and FirstSun entered into a definitive a merger agreement with unanimous votes from the board of directors at each company. All of the HomeStreet Board members, which includes me, believe the strategic combination with FirstSun is in the best interest of HomeStreet and its stakeholders, including our valuable employees. And members of both of our boards have signed agreements to vote our HomeStreet and FirstSun shares for the transaction. For shareholders, we believe the transaction will provide significant value at the merger date and well, beyond. Under the terms of the agreement, HomeStreet shareholders will receive 0.4345

FirstSun shares for each share of HomeStreet stock. Based upon the recent price of FirstSun stock, the purchase price represents a premium of approximately thirty seven percent over HomeStreet’s closing price on January, the 12th , the last trading day prior to Tuesday's announcement.

The transaction which we expect to close in the second half of this year is subject to certain conditions, including a vote of our shareholders and regulatory approval. What's the transaction is complete HomeStreet shares will no longer trade on NASDAQ and HomeStreet Inc. and HomeStreet Bank will merge with and into FirstSun Bancorp and Sunflower Bank, respectively. The combined entity is expected to be listed on the NASDAQ under the FSUN ticker symbol at closing.

During this transition period, I understand you all will have many questions and some anxiety about the future. This is completely normal. I promise you the implementation team is going to work as quickly as possible to answer unknown questions. You may have, like,

oWill my position be impacted and how will it affect my day-to-day responsibilities?

oWill my reporting structure change?

oWho will be leading each of the key departments?

oWhich systems will be using? The HomeStreet or the Sunflower Bank system?

oWill the account numbers change for our customers?

oWhat does the FirstSun benefits package look like?

HomeStreet Inc, employee call with CEO

There’s lots of questions….

It's important though that we all just stop take a deep breath, exhale, and settle down. We are going to move quickly to answer these questions. It's important to remember, we have only just announced the signing of the merger agreement. Decisions about how we will combine the companies have not yet been made in detail and until the deal closes, we will continue to operate as separate independent companies. But, we do know we will not be closing any HomeStreet Bank branches or discontinuing any HomeStreet loan products. Related to origination and support groups will continue with integration with FirstSun. A great deal of thought will go into the integration of infrastructure units as the combined bank will go over ten billion dollars in assets, our infrastructure and risk management must comply with the higher regulatory expectations of a ten billion dollar bank. In the next few weeks leaders from both companies will be planning the integration of our operations, including staffing decisions. We are combining with the goal of retaining the best performing functions and staff between the two companies.

As soon as we are able, we will provide information to our employees about continued employment. I commit to being as transparent as possible with you. I appreciate your patience as we carefully work through this process, but we need a little time to get it right. You want that, too. A merger resources center page has been created on my HomeStreet, so you may easily reference merger-related communications that have already been shared. The link is on the right hand side of the screen on the internet homepage. In the coming days, we we will be posting FAQs for both employees and customers to help you navigate the merger. These and other communications - including customer communications - will be continuously available on the Sharepoint site to assist you.

And so, while we remain separate and independent in the short term, there will be no impact on how we do business operationally, it remains business as usual - only better - for us here at HomeStreet. All right, before I turn the floor over to Neal, I want to share with you that I am extremely excited about this combination in case you haven't guessed it yet. I believe that the merger will improve our customer's experience and create new opportunities for all of us. I look forward to our bright future together. Now I'll turn it over to Mr. Neal Arnold.

Neal Arnold

Thank you, Mark. Really appreciate the invite to be able to share with you all today and you know, as I've gotten to know Mark, this has been a journey that has been one of great pleasant surprises and I want to share that first of all, Mark very quickly gave us access to your executive team and probably one of the highlights that we shared with our board was the strength, the experience and tenure of your executive leadership team. I would tell you as an outsider, I think it's a remarkable when an organization goes through difficult times that you guys have kept your

HomeStreet Inc, employee call with CEO

entire team and people have stayed focused on the things that made your company strong and so my hat's off to you. What matters to us and our organization is continuity. If you look at the map, we're not just right around the corner, so it's going to be vital that we continue to work together to run a great franchise on the west coast of the US. We're going to need your help in Hawaii. I've only been to Hawaii on vacation, so, you know, we're going to need a little help.

But, I guess a couple things I want to say that we looked at when we started to negotiate a deal with Mark and, you know, merger negotiations can often times be adversarial and I never felt that from Mark. He was looking out for what was the best interest of all the stakeholders of HomeStreet, who would respect what was going on here and well, we recognize that the needed capital. Let me walk through a couple things that from my vantage point we saw the strength that shine through during these discussions. First of all your core deposit franchise is remarkable. I can tell you, I've looked at a lot of banks during my career and I can say this is one of the best deposit bases I've seen, and when I got to spend time with your leadership team, you know, it was clear the passion that you have in your branches to not only take great care of your customers, but ensure that we had stability in a really rocky year last year for the whole industry. Secondly, you're asset quality and loan portfolio. I told our team yesterday your loan quality might even be better than ours. I love the composition. I think your team has done a great job in that process, and so we're encouraged that your expertise is complementary, but parallel to what we have. And so combined, we think we do have some leverage and synergy to, to achieve and again, Mark and I both arrived at those conclusions. On the fee income side, you guys are doing some unique things and and tell you as I watched from afar while Mark and I were negotiating, I was hoping that some of those things would stay intact and the fact that they have our combined fee income will be at or above all the peer group, almost every bank. I've looked at, in this size

category has a lot less fee income and so when we look at all those pieces.

First of all the strength of your people, the core deposit, the credit quality and the fee income, we can't think of a better partner for Sunflower Bank. You know, there will be things, we

through, but I would just say I want to commend your management team and each of you for really doing a great job in a difficult season for your organization. As Mark and I started visiting, I said, Mark, you know, it's not any fun playing defense. We want to help you get back to offense. We want your shareholders to win. I don't like deals where one party wins and the other party loses, that's not what we were after. And so as we look at crossing ten billion dollars together, I know you're going to strengthen a lot of our staff areas to help be a lot stronger organization together. So I promise you that Mark and I are going to work through very quickly to build that game plan. We have a whole team coming next week to begin to spend time mapping out those decisions. I think as Mark said, and he's been very focused on making sure that we're all transparent as quickly as possible. So, our high priority is to work through a lot of the HR issues. A lot of the timetable issues so that we can be very clear with each of you what we can do

HomeStreet Inc, employee call with CEO

together. But again from my chair, I’m very excited about the opportunity here. I think we're really going to strengthen each other and we look forward to working with you and building the partnership together. So, thank you Mark.

Mark Mason

Thanks, Neal. I know that my folks really appreciate the kind comments about the institution and the customer base and all the things that my folks have built over the years. The other comment that Neal keeps making to me is how surprised he is with a tenure we have at the institution. And I know it's significant - though I have to say - when I got here, it was even more significant. We've had many thirty-to-forty-year employees retire. The average tenure has actually creeped down a little bit. But I shared with Neal that this is because our people really enjoy working for this company. They enjoy the culture, they enjoy our commitment to be a good corporate citizens, and being a part of our communities And being highly focused on doing the right thing for the customer. I know Neal and his team share the same values and I think this is going to feel very natural when we put the companies together.

All right, so Neal, are you ready for this? Let's open up the floor for some questions, understanding that we may not be able to answer all of them in

the detail that you might want, but we're going to do our best.

So, let me stop here for a second. Get my screen organized. Let's see how well you do today.

First question.

These questions from.

Teddy Schindler asked is it possible that the org chart for commercial banking could be made available for us, so we can understand how the banks currently organized.

I think that it's going to be more meaningful to see the organization chart when we determine what the combined org chart is going to be. We have been operating in a certain format for a while. That's worked for us, but when we put the banks together, it necessarily has to change somewhat. So instead of confusing folks, why don't we put a pin in that one and when it comes time to talk about the organization, we'll, we'll show it to everyone.

This question from Sarah Linton, are we going to continue to have these meetings? I thought that might be the first question, and I warned Neal about that one. Neal -- What do you think?

Neal Arnold

Yeah, no, I love the format Mark and you’re a much better DJ than I am.

HomeStreet Inc, employee call with CEO

But I would tell you, I think one of the most important things when you go through mergers and I’ve done thirty eight of them in my career…. One of the most important things that I’ve emphasized to our team is communication -- honest clear communication, what we can tell you when we can tell. We don’t want to be reckless and rush things, but we also want you to have clear transparency. So I’m in, I don’t have a face for Webex, but maybe we can use this format, so I, I love it.

Mark Mason

All right, this one’s anonymous, but you’re going to love it Neal. What’s the average tenure at FirstSun.

Neal Arnold

I have Laura our HR person in the room here, so I'm going to, yeah, there's ten years. Yeah, five years. Okay, five years it's the average and the reason is because we've grown so much organically from where we started. We've grown Phoenix from the ground up. We've grown Dallas from the ground up.

We're still building a team in Houston so for us, this has been less acquired in some of our big markets and it's been more recruiting. So that's probably the biggest difference if you went to the old Kansas original franchise, we probably have a tenure that looks a lot like yours.

Mark Mason

Next question, and I know this is one that it's unlikely we can answer completely right now and I'll use your name Tina because you didn't say anonymous, asked will single family lending operate under the HomeStreet Bank name, or will they be adapting to the guardian mortgage name?

Neal Arnold

It's too early and I know a bunch of you know each other. I was getting text shortly after the announcement, so Mark and I had a chuckle, you know, that, we're going to all be in the same family. no matter what the brand is. So we'll figure that out.

Mark Mason

And because both of those names have had a good strong following, I don't know that it's going to matter necessarily and it could be regional still, like we're operating. We're expected to operate in at the bank level.

Neal Arnold

Yeah, we're not going to jump to conclusions, yes.

HomeStreet Inc, employee call with CEO

Mark Mason

I'm just going to say this one's anonymous retail banking has lost some FTE. Will this merger allow us to get some FTE back.

Well, look - I will say we constantly have about forty retail positions open that we're trying to fill and I think the reality is, we want to make sure that our branches have sufficient FTE to serve our customers and to allow the branch managers to get out of the office and do the marketing and sales. They know that’s what they want to do, and so you have our word that we are going to be fully staffed. I will tell you it is hard to stay fully. I'm sure Neal your organization is experiencing the same challenge...

Neal Arnold

We'll have a priority on growing deposits and to do that, you must have the team. I’ll tell you our HR is very actively involved in recruiting with the retail bank team.

Mark Mason

These questions are getting detailed. Tyler Morra asks how many single family mortgage loans does Guardian currently service. I can't answer that question for us.

Neal Arnold

I can tell you our servicing portfolios are over five billion today.

The average loan is probably about two hundred eighty thousand. So I guess I'd have to do that math in my head, but that's the size. We have retained servicing on the bulk of our originations.

Mark Mason

Similar to HomeStreet.

Neal Arnold

In both cases.

Mark Mason

Yes, we have sold servicing a couple of times in the past. Most significantly, when we downsized our mortgage business, but it is a competitive advantage to service your own.

Neal Arnold

We wholeheartedly agree with that.

Mark Mason

HomeStreet Inc, employee call with CEO

Anonymous question. Will there be merit increases in light of the merger. Well, we told you, it's business as usual. Increases will be business as usual.

Neal Arnold

Yes, agree.

Mark Mason

These questions are from Mark Schaller, one of our great mortgage loan officers. Is there any discussion whether we can close any of their portfolio products on the mortgage landing side as a correspondent to the merger closes.

Great question and that question relates not just to mortgage, but on the commercial side as well.

We're going to have those discussions so we can't give you absolute answer today, but that's one of the opportunities pending the merger.

That we could do some joint business or referred business and we'll know, and in due course that we will answer, but that's a great question.

Neal Arnold

And I love the thought and I would just tell you, we have done it in past deals as a way to allow each other to leverage these great opportunities together, even before closing.

Mark Mason

But Mark is really referring to, as, you know, the mortgage side because we've been trying to manage our balance sheet.

Suspended lending on perm single family and single closed construction loans, too. And I know that's important to Mark and his practice.

Neal Arnold

You bet.

Mark Mason

This question from Samuel Camilon. Once this merger is complete, where do you see this company in five years now?

Neal Arnold

HomeStreet Inc, employee call with CEO

Yeah, great question. I would tell you, I doubt this is our last deal. But I would tell you as I've told our team, you know, we could have a ten billion dollar bank in just Dallas. [inaudible text] we could have a four billion dollar bank. Two or three billion dollar bank in Arizona. We think there's so much growth within our current footprint. And now with Pacific Northwest and Southern California. You know. think about how successful players in recent memory that have gone away. I would tell you, we think there's great opportunity to continue to grow. We aren't going to bump our head on market share in any of our markets, and so I think the ability to continue to pursue. Growth is one of the hallmarks of this deal. You know, I tell people market share doesn't show up in the stock charts. It's actually revenue growth.

Mark Mason

And then it shows up in the stock chart.

Neal Arnold

Yeah, exactly.

Mark Mason

All right, next question from Michael Kearl. This will be a good one for you. Do you expect a further build out the C&I team franchise on the West coast?

Neal Arnold

Absolutely.

I can tell you we're already getting names. I got called in the last two hours. We're getting names from some of our friends already. We want to leverage that we have a great asset- based lending team. We have some technology on what I'll call as a service business, we're not venture lenders for those of you who are concerned. Our focus is on the monthly check technology business, we've done some of the fiber to home players in, in this space. So I just see a lot of opportunity to leverage what we have together.

Mark Mason

This is anonymous, what is the FirstSun stance on remote work. Is this something they also practice.

Neal Arnold

A great question. Here's what I'd say. We don't have everybody in the headquarters.

By and large we all travel and connect, but our goal is to have as many people in the office as possible because geographically, we try to function as teams and so our goal is to leverage the teamwork that you can only get when you're working together.

HomeStreet Inc, employee call with CEO

But, certainly other functions I recognize can be done remotely, so we will work with you and, and help you understand where we go, you know, both hybrid and, and flexible work program.

Mark Mason

And I've shared with Neal, the amount of remote work that we have been utilizing here.

Neal Arnold

How...

Mark Mason

Has been, and the challenges, particularly for the Seattle headquarters. folks of travel public transportation. And the, like, and despite how disperse it's been how effective we've been, that's just another one of the questions of integration that we will deal with.

This is an easy one. Anonymous will our seniority carryover. That's absolutely, yes.

Neal Arnold

Absolutely.

Mark Mason

Service time is your service time.

Anonymous questioned does Guardian Mortgage have an affinity program. Well Neal and I have spent a great deal of time talking about our affinity program and, and what a secret weapon it is in the banking world. Neal, you want to tackle that.

Neal Arnold

I can tell you the things that you've done that are successful, you know, we're going to work to make sure those carry forward. So I love that you've done an affinity program and I think together we, we can probably leverage some of what you've learned out of it.

Mark Mason

[Name] is asking about whether we anticipate full integration of the company's technology platforms are conversional, you know, there's going to be some conversion, let's just

let's just admit it up front that, and it's not a bad thing. Remember several years ago. we spent a lot of time getting rid of a bunch of duplicative technology. Efficiency, it's good for workflow and inevitably. We're going to have several pieces of conversion.

HomeStreet Inc, employee call with CEO

Neal Arnold

But I was impressed, we have more commonality and synergy, which is an important piece. Yeah, I think our folks think you guys have done a better job utilizing that I know Black Knight on the, the mortgage side, you utilize, so yeah, there are lots of common crossover areas, you know, don't assume they're all going to ours even on the risk side. People said your vendor program's probably better than ours, you know, so people are going through that initial inventory, but we will work together, You know, this is not going to be a decision, that's one sided, It's going to be one where as Mark said our goal is best system best athlete.

Mark Mason

Next question for Mr. Will Hicks, what does Mr. Arnold think about Homestreet's residential construction business in our markets as well as the FirstSun markets.

Neal Arnold

I can tell you, I'm not deep enough into that program at this point, we've done it in a number of our markets. So we certainly will roll up sleeves and work together on it, but, you know, you've been judicious about where you've done it, and what size of those pieces you've done. So I think that's something we can tackle together.

Mark Mason

Anonymous question, I'll paraphrase it somewhat because anonymous is written a very long question for me.

What is your first impression of our support operations departments?

How are your thoughts about what the integration will be like.

Neal Arnold

Let me see. I got to meet Troy and Mark had given me some Troy's background. I'm very impressed with the team that he's built, but also just the depth. And if you think about this organization, we're going to have to have multiple centers, so it's not going to be in either or system.

There will be multiple and to service the West coast, I think we're going to move a bunch of those pieces, so I would just anticipate it's going to be multiple centers to run the operation for the command organization and the specialty areas that you guys have, we'd be foolish to change those.

HomeStreet Inc, employee call with CEO

Mark Mason

Question, I'm sure this one's around the tip of your tongue, what's Sunflower’s, Net promoter score.

Neal Arnold

Oh, I have a zero on that one. I don't know the answer. That was one of the things that impressed me. I got a chance to see some of the measurement that you're doing through your marketing and online, and I love it.

Mark Mason

All right.

Jennifer Aquino asks or states HomeStreet Bank is a relationship bank and that is our niche. We're hoping to keep that same culture and not follow other banks who are moving to the bank of the future layout. Any thoughts on that deal.

Neal Arnold

Yeah, yeah, I love that question.

My whole career has been focused on building the niche that the big banks don't do. Well, and the best thing you can do is be a relationship if you look at our org structure, we're organized around geography because we want relationship, we want a team of people working directly with the market and I found in my career, every market's different and it has some perks, you have different competitors, there's certainly local knowledge that's important. So I will just say to you that relationships, the top of the food chain when we deal with customers.

I probably spend about forty percent of my time out on client calls.

Mark Mason

Excellent next questions on benefits will we have to reapply? Is there a 401(k) - obviously there's going to be a transition of benefits to one company's plan that happens in the normal course. Yes, FirstSun has a 401(k) Plan. Neal, can you give our folks a- a view on the basic tenants of your 401(k).

Neal Arnold

Yeah, in fact with Laura sitting here, I'm going to give her the opportunity to speak up, but I will tell you when we are going through diligence it was remarkable and Mark and I even talked about it. Ours is similar so Laura, do you want to make any comments as it relates to 401(k)?

Laura Frazier

HomeStreet Inc, employee call with CEO

The biggest, the biggest part of our 401(k) plan that everybody wants to know is we do a six percent match on the plan and employer match. It's matched every pay period and it is a full

six percent match, so it's not like the first hundred percent is, you know, or the first three percent is a hundred percent, it's actually, the first six percent is a full hundred percent. You are a hundred percent vested at the time that you go into the program. So there is no vesting period.

Our normal entry would be ninety days into that plan, but obviously when you transition it, it's automatically going and rolling into that plan. So you used to have to be twenty- one years older, twenty- one years or older to enter into the plan, some great plan.

Mark Mason

Happy to say, given the merger, that's just the match is a little better than ours.

Mark Mason

Fantastic.

Elizabeth Cooper has a question regarding marketing.

We're going to be marketing ahead of this merger instead of asking the question. Let me just kind of give you the answer, we have to be careful. We have certain restrictions on what we say ahead of our shareholder vote, the term is gun jumping and we don't want to get in trouble for gun jumping. So we have to be careful with our marketing, but we are surely going to be talking about the advantages of the merger with our customers.

Anonymous question.

Will there be more types of positions as we grow with the company. I think that's an easy Yes.

Same thing we've talked about is about growth and opportunity for everyone, and I'm comfortable saying there's going to be lots of opportunity.

Neal Arnold

Agreed.

Mark Mason

Pat Mcclelland wants to know. Are we looking to broaden our footprint in Northern California? We have not to date pursue growth in Northern California, at least in HomeStreet’s view the Southern California market is larger than we could hope to accomplish our goals and

participating our resources between the two didn't seem to make sense. I'm a little biased since I came from Southern California.

HomeStreet Inc, employee call with CEO

Also look at the math. Southern California is about twice the size of Northern California Neal. What's your view?

Neal Arnold

Yeah, I, I share Mark's view there, you know, to me, it's about having the teams, you know, the right people always make the market better.

So our focus clearly in the near term is building out a team in southern Cal.

Mark Mason

All right, some of these have, we've already answered this one. This FirstSun have a standardization department for instructions procedures and guides. That's a technical one.

Neal Arnold

We have a standardized approach department sounds like bureaucracy. So I'm all, I'll say is we, we've worked very hard to standardize a lot of pieces, but I'd also say we have a rule that if someone's now working, we fix it.

Mark Mason

Here's an anonymous question for new employees to HomeStreet. I'm assuming there will be a layoff should we worry about, it would be looking for another job. I think the easy answer there is no. you were hired for a reason and you were hired for indeed, bear with us as we determine what changes will be made in integrating the companies in the, in the merger, but you should not assume simply because you're new to HomeStreet that you're at the top of the consideration list. That's just not correct.

Neal Arnold

Totally agree.

Mark Mason

Anonymous and I don't know how anonymous knows this FirstSun’s customer service team. Oh, they don't know that is it handled in one center or spread out across their territory.

Neal Arnold

it's spread out between Kansas and Texas, and so we would anticipate to have certainly, as I said, earlier, other pods.

Mark Mason

HomeStreet Inc, employee call with CEO

Next question will wages change now, I wondered how long that would take first of all, absolutely, not.

Everyone will come over in the merger at their existing compensation and for at least a year at incentives, no less than current incentives. We have to be competitive, right? I mean, thinking

mergers based on cutting wages that might be fun in the movies, but it doesn't work well in business. Neal.

Neal Arnold

I would just tell you, I've spent my career where in our industry is known as overhead ratio, I've watched our competitors try to get there on expense cuts. We've always gotten there on revenue growth. I tell people if you're math person, I'd rather work on the

fly wheel and the big fly wheel is revenue in our industry.

Mark Mason

Exactly,

Question will we continue paid volunteer time Neal? We allow people two days a year of paid volunteerism. Do you have a similar program?

Neal Arnold

Absolutely, yes, we do.

Mark Mason

Kathy Marvick wants to know if you and your team are going to come to Southern California any time to meet their team.

Neal Arnold

Yes, yeah, Mark and I are mapping out are travel introduction and I, I will tell you we will have a market timing tour mapped out next week.

Mark Mason

Thank you, Clara Wagner, oh, turn it was it supposed to use your name forget that?

What will happen to our HomeStreet stock. There was an ESAP previously, that is correct. Our HomeStreet stock is going to be exchanged for FirstSun stock, add an exchange ratio of 0.4345 . I do remember that number shares FirstSun stock for each share of HomeStreet.

Neal Arnold

HomeStreet Inc, employee call with CEO

Agreed we want you to win. We think it's great for everybody.

Mark Mason

Max what's to know about relative to gun jumping will there be guidance on what you can and cannot say to customers and referral partners and absolutely, we're going to be providing guidance.

Important that when people ask about the merger for now simply refer them to the press release and it is long it's detailed and it has everything they need to know at this structure. There's also an investor relations deck that was posted at the same time, and we're make those available again to you on the SharePoint site. You're welcome to share them liberally with your customers. We're very proud of them.

Letton wants to know if our involvement with communities is going to stay the same and she's talking about community events, sponsorship, et cetera.

Neal Arnold

Yes, absolutely we are big on community. I was at a function even today, so yes, we're big.

Mark Mason

[name] would like to know when is the shareholder vote? That is a HomeStreet question. I can tell you it's going to be within ninety days. We have to now prepare a joint proxy with the folks at FirstSun that will be used for, to communicate with both of our shareholders FirstSun is actually is completed.

Shareholder vote because so much of their share ownership is represented by board of directors and so their vote is essentially done that we're able to do it via consent direct consent we will be holding a shareholder's meeting a special meeting to conduct a vote on the proposed merger.

Again, sometime within ninety days, I think that's a good estimate because it's going to take us a few weeks to prepare the proxy. There's notice provisions and so on.

And you will see it publicly when we file it.

Guatearama wants to know if it benefits will be changing. I think I covered that if, so we still be covered under Kaiser, We, we need to walk through all the benefits issues. I think it's more likely than not that Kaiser will be an option in certain markets and we have through all of the reasons for that, with the folks, but I think that's more likely than not in, in the regions that we feel we

HomeStreet Inc, employee call with CEO

have to have it. I have shared with, with Neal and his team, the background on our very strong relationship with Kaiser with their employees and how important that relationship is.

Neal Arnold

Yeah.

Mark Mason

Frank Alvarado, one of our fantastic retail district managers and branch managers wants to know how does Sunflower Bank currently onboard and train new retail bank employees. Do they have a training program or they do they go directly into the branch or otherwise.

Neal Arnold

I'm going to let Laura answer that, but yes, so when we bring on new retail employees, we're really flexible out how we bring them on, but we have a mentorship program as well as a training team that goes out on site, sometimes in the branch or sometimes in other local areas, but they'll actually go through a, a.

Laura Frazier

Program train and then have those mentors that are assigned to them for a couple of weeks until they're, they're fully functional.

Mark Mason

Next anonymous question. Do we know what will happen to our corporate headquarters? Well, I can tell you for sure. It's going to change some way.

Exactly how much and what the timing or extent of that is going to be, is part of what we have to work out. We have a lot of real estate here.

For sure too much. So downsizing, at least to the real estate or at least the extent of the space I think is an absolute and then the rest of the questions will be answering as we work on the integration.

This question we're going to be having some changes to the medical plans, currently our plans have some LGBTQ coverage, but will that change, And I think that what anonymous is referring to is domestic partner coverage.

So anonymous, I think you can feel comfortable that those same opportunities will exist going forward.

HomeStreet Inc, employee call with CEO

Nathan Smith. Another question on training.

FirstSun have a training department or program. It's more of an open ended question.

Neal Arnold

So by function, there is training for all new employees.

As Laura said, either mentorship or specific dedicated training, I would say on the retail side very extensive, but also as the rest of the organization, there's a significant amount of training that we do.

Mark Mason

As, as you all know our folks, we, we do a lot of training online through BAI.

What is, what is the vacation policy for FirstSun?

Neal Arnold

Laura tackle, I'm glad I brought her.

Laura Frazier

Our current vacation policy is called Personal Personalized paid time off, it's not unlimited, but it acts like an unlimited program. There's a guideline out there that says, Hey, if you have this in the years of service, you can expect to get, at least this amount of time off. We're very flexible with time off.

If it says you normally get five weeks, you know, then fine you can take five weeks, you can give or take a little bit sometimes people run a little bit over based on the, the necessity of that year, sometimes they run shorter, but we try to make it super flexible so that you're not pinned to exactly to the hour. That's what.

Paid time off is, but everybody gets at least a minimum of three weeks.

Mark Mason

We're going to like to hear that. That is more flexible than our program. We do have more flexibility in the higher officer ranks. We have higher expectations, so they don't take as much.

Neal Arnold

HomeStreet Inc, employee call with CEO

Yeah, no, Laura's done a great job, really trying to be competitive, you know, we, we certainly understand what's gone on, in the labor market and we're growing the workforce, so we have to be focused on.

Mark Mason

Joan Reed would like to know Neal when you're going to be in Seattle so that you can meet the staff.

Neal Arnold

Be there Monday night.

Mark Mason

Next week.

Neal Arnold

Yeah, no, we have a whole team coming to begin to map out the planning and Mark and I, but yeah, we, we will be there next week. The fun part is at least now I don't have to do it clandestinely.

Mark Mason

Exactly Melissa Haas asks she. I think she misunderstood my comments. She heard them to say two additional executives will be retained. No, that's board members in my comments. I shared that I will be joining the FirstSun board and two of our board members will be joining the FirstSun and Sunflower Bank board.

Kelsey Herschberger asked, this is very wide. open Kelsey, what's the next set of decisions or information? We expect to hear. I can't give you detail. I can just tell you it will be constant, but it will build over time, right? We need a few weeks to make some decisions.

Before we can start communicating on those decisions and how they'll be implemented. So Kelsey, if you would be a little patient with us, you'll start to hear a lot more pretty quickly after that Renee Preuss wants to know if we will continue being closed on Saturdays. I'll ask Neal that, but I, I think from our standpoint. Currently this is a competitive issue and if our competitors in markets are not opening on Saturdays, we're trying to avoid it for all the obvious reasons. Neal, what are your thoughts?

Neal Arnold

So I know we have some that are open, but it's not across the board.

Mark Mason

HomeStreet Inc, employee call with CEO

All right, we already answered this vacation question.

Question on sick time? Is that part of your pay time off program or is it separate?

Neal Arnold

It's part of the pay the personalized paid time off and there are also, you know, certain state laws and rules around sick time. So there is some sick leave banks based on state laws, but most of it is in your personalized paid time off.

Mark Mason

I know this is a popular question, The retail system, our retail system is very sales oriented and we have a fairly extensive set of incentives to encourage that similar incentive plans for your retail branch employees.

Neal Arnold

We are very sales oriented in the branches and certainly incentives across the board.

Mark Mason

So obviously we'll be reconciling all of that when we know he'll know.

Neal Arnold

Agree agreed.

Mark Mason

Who is your 401(k) plan? I don't know if it's administrator or if it's the, the plan operator ours is with Charles Schwab.

Neal Arnold

Ours is with Principal.

Mark Mason

Got it, all right.

Anonymous does FirstSun sponsor an NFL team and if so.

How do you see that fitted in with our culture.

This is a regional question.

Neal Arnold

HomeStreet Inc, employee call with CEO

Yeah, no, I get it. Mark has shared what you've done. The Broncos have been down lately, so we didn't dare sponsor the.

Mark Mason

Say something about the quarterback.

Neal Arnold

Exactly.

Mark Mason

Well, Neal knows because I've spoke a great deal about our very close relationship with the Seahawks and

we're not going to do anything to endanger that.

Neal Arnold

Agree agreed.

Mark Mason

Here's a question on the retail.

Reporting structure, I, I'm just going to table that til later when we can tell you more.

Little too much detail that we can't really speak too much on right now.

Who are your health care providers, detail, but I'm sure people are interested.

Laura Frazier

Our medical health plan is all Blue Cross blue shield Anthem, Blue Cross Blue Shield and then Delta Dental is who we use and Americas for vision.

Lots of time to talk about that later.

Six time question.

But there's a lot of NFL founds anonymous will we be continuing to sport our local sports teams or will we be required to root for the cowboys.

Neal Arnold

I love that question. No they have to earn your loyalty. Is my stance.

HomeStreet Inc, employee call with CEO

Mark Mason

I called Jerry Johns on that.

We answered that one. Oh, here's here's what I've gotten a couple times this morning. It really starts with a mortgage business for many many years. We've had a President's Club program.

Or a sales award trip for high performers.

Not just in the mortgage area, but across the company, do you have anything similar.

Neal Arnold

In fact, it's mid February they're headed to Key West, but yes, there's a- what do we call Sales Excellence Award trip every year and we have.

Laura Frazier

We also have Presence Club on mortgage site.

Mark Mason

Oh, got it. So you have two different programs.

Neal Arnold

Yes, mortgages, yes.

Mark Mason

About that, and yeah, as you can imagine, given the challenges of the last year or so we, we suspended that, that trip or this year.

No, wonder, I'm getting lots of questions. That's great answer. Thank you.

Neal Arnold

Absolutely.

Mark Mason

On the vacation policy, these are super detailed. I'm sorry, the minimum three week vacation allocation. Do you have to be with the company? A certain amount of time to take vacation time or can you, I guess go negative as a

phrase we used to use.

Neal Arnold

HomeStreet Inc, employee call with CEO

So you only have to be here thirty days before you can start taking PTO. if you are a non- officer, if you're an officer, you can start taking it right away.

We do not accrue the time it's actually, so yes, you can be negative. Yes, you can take it whenever you want again, it's super flexible program. so you don't actually accrue the hours. It's just, we do have you log it so we can see that you're taking time off, but again, it's.

You don't have to worry. You don't have to worry about being negative. Yeah.

Mark Mason

All right.

So here, in your, your PTO program, I assume, correct me if I'm wrong, you probably don't have any carryover of time.

Neal Arnold

Correct, you don't have any carryover of time, but again, you can start, you can take a week off in December and even though we've flipped to a new year, you can take time off in January again, it's, it's so you can be as flexible as you can be and take time off when you need it.

Mark Mason

And then if our merger occurs mid year as we expect answer another question here, well, people's vacations sick time transfer over.

Yep, I guess we have to at least for the remainder of the year.

Neal Arnold

You won't lose it in a stub here.

And we would roll over forty hours into the next year until that goes out. So.

Mark Mason

Well, I have about four or five of the same question that was popular...

Oh, gosh.

Oh, back to a business question benefits. George Wright, who's in our, with who takes care of our facilities. Wants to know we anticipate any hurdles with gaining regulatory approval for the merger. George, I think that's, that's a, that's an absolute no.

HomeStreet Inc, employee call with CEO

In preparing and negotiating for this merger, you know, each of us talked a great deal about any concerns about approvals shareholder regulatory or otherwise, and I'm happy to say that both of these institutions are squeaky clean with respect to their regulatory relations and so we don't expect any challenges, In fact, we do expect expedited treatment.

In getting a fast approval that has not occurred with a lot of bank mergers over the last couple of years, but there's a clear and important need for this to be done sooner with respect to.

HomeStreet, and so we expect fast approval.

So here's kind of a detailed question. This, we might have to deal with later. I know this is another vacation sick time question, but some of our people have a lot of sick of a vacation time built up. I think the sick time is not that significant because it gets reestablished each year.

And vacation time carry over has a certain limit, but given the difference in the plans, we'll have to figure out how that transition will work. Can I just put a pin in that answer the accruals and anonymous obviously will get back to everyone.

Does FirstSun have a leadership or development program or rotation for its employees.

Neal Arnold

Some leadership and development program, we don't have a rotation program across the board, but we do have some mentorship programs, like in the lines of business, you can start in a certain area and, and float into different parts of that area and learn those different roles.

Do a lot of coaching.

Mark Mason

Anonymous would like to know if vacation time already approval will be honored after the merger. I think that's.

I love this one. Is there a dress code at Sunflower.

Neal Arnold

Go ahead Laura. Yes.

Your answer right now.

Neal Arnold

One to be fully dressed every day, so.

HomeStreet Inc, employee call with CEO

Code is, is pretty relaxed in the, in certain areas in our retail branches. We actually, let people wear logo wear and they can wear a nice pants organs and nice shoes.

Usually, because they're behind the line in our back offices. It's the same thing logo wear pants or jeans night. As long as they're nice. No holes rips tears things like that if you're out, it's dressed for your client if you're out going to a construction site, then obviously dress for the construction site, if you're, you know.

We do suits and ties for certain things, you know, in business where, for, for certain client meetings, but it's more about know who your audience is know who your customer is and dress accordingly.

Mark Mason

That's just like our dress code that should be.

Well, HomeStreet be able to service Sunflower branches and vice versa. Clearly not until conversion will we be able to easily do intra- bank transfers.

Neal Arnold

Deposit...

That will be something that the conversion team works on, they will try, you know, we're far enough apart that likely won't be impacted, but we will, we will certainly figure out how to honor.

Mark Mason

I get this question almost every time I talk to folks, will we be opening a more branches in Hawaii.

Neal Arnold

But I recognize the opportunity for deposit growth in Hawaii. So we'd love to continue to grow there.

Mark Mason

Oh, this does Sunflower have any customer service surveys.

Customers randomly receive after a branch visit like.

Neal Arnold

HomeStreet Inc, employee call with CEO

Do tracking on customer service surveys for I think a significant amount of all of our business lines.

Mark Mason

Here's another question on remote work. I think that's a question of organization. All of those are going to have to be answered in due course.

Here's an anonymous one. Is there a guarantee that all HomeStreet employees will have a job after the merger. The reality of that question is, there will be some positions that are discontinued and that's because of redundancy, right? When we put together.

Two institutions there are redundant functions now given that we have no regional overlap and we have very distinct lending programs, the level of redundancy is not nearly as large as in most bank mergers. That's a good thing from a job standpoint, and so we're expecting

number of jobs that will not continue as much less the normal, but you're going to have to wait till we work through all of that before we will tell every single person the expectation for their position.

Neal Arnold

I would just add Mark some of the job loss will be on Sunflower side, you know, that's the reality of some of the staff areas there. Some that you're going to be better than ours and so don't assume, just because you're in the staff side, the redundancy impacts you. I, I would tell you, we went into that.

Going in with that expectation. We already know some of that.

Mark Mason

Thank you.

Question about matching for non- profit donations or volunteer grants. Well, this program exists or the volunteer grants from HomeStreet continue, we have a small grant program that has.

Some requirements that folks be doing volunteer work with an organization and so on. Do you have any similar program?

Neal Arnold

Not that I'm aware of today, but we do have, you know, certainly charitable contributions, We don't have the foundation that others have used.

Mark Mason

HomeStreet Inc, employee call with CEO

Apologize for Neal. I haven't gone over all these things with, so he doesn't know the detail of our programs. We'll be discussed. It's not a big program because our employees don't take complete opportunity.

Of our, increasing the number of volunteer hours from a.

standpoint and making some small donations and well.

About that.

Neal Arnold

No agree.

Mark Mason

Okay.

[Name] asking what she thinks is a nitpic question and I think she's right. What counts is nice shoes, I'm going to leave that to your good judgment. How about.

Neal Arnold

Yes.

Mark Mason

If you need to ask, you probably shouldn't wear them.

Sarah Linton wants to know what will happen with the HomeStreet Bank SWAG and will you be converting to Sunflower Bank swag.

Sunflower Swag.

Well, look fortunately we're not going to have to throw that stuff out because...With our name and our market areas, but.

Neal Arnold

Or Sunflower, if you want it.

Mark Mason

Stuff, we could probably arrange that too.

Josh Armstrong would like to know what part of Kansas you operate and he's a native Kansa himself.

HomeStreet Inc, employee call with CEO

Neal Arnold

So essentially all the way across interstate Seven and down to, which does, so we kind of do the interstate across Kansas in east west and south through to which time.

Mark Mason

Thank you anonymous. Would like to know if they can bring their dog to work now.

We don't allow that.

Neal Arnold

We don't either.

Mark Mason

How does FirstSun view performance incentives? Do they offer profit share and bonuses for roles, which are not commissioned based.

Neal Arnold

We have sales incentives and we have certain targeted incentives that are connected to business activity. So we'll work through those details with you.

Mark Mason

Now you think, right at the end of these questions, Neal, but these are just the questions in the Q and A panel. We also have a group of questions in an email portal.

Neal Arnold

Okay.

Mark Mason

I haven't started on yet. Are you ready?

How's your time?

Neal Arnold

I probably have fifteen minutes if that's workable on your.

Mark Mason

Well, we're going to go through these quickly because I'll bet we've answered a bunch of them.

What's the total number of employees FirstSun has.

HomeStreet Inc, employee call with CEO

Laura Frazier

To one thousand, two hundred post- to one thousand, two hundred.

Mark Mason

So this is an interesting question.

Anonymous notes that when Bank of America bought Seafirst, they said they would not change the name, but they did, we have said that we're not going to change HomeStreet’s name. Do we see that happening in the future? And I think that, that's a fair question and kind of an important one.

Neal Arnold

Let's say this. We did not change the name of First National in New Mexico. That was in 2017 we did that deal. So if you want to look back in time, we've not done it and we don't intend to do it, so, you know, the future is, is not something focused on, but our, our view is, you have such a strong brand there in the Pacific Northwest, we would be dumb to change it.

Mark Mason

My only footnote to that would be at some point there could be a large rebranding effort of the entire bank.

Neal Arnold

Yeah, and, and certainly, those are things that people look at. It's not a priority right now.

Mark Mason

Right, Sorry, I'm moving through these, some of these quickly because they're

so some of these are a little detailed for right now. I have some detailed mortgage questions. I think they're going to have to answer later.

There's a question on our Fannie Mae multifamily program our U. S. program, what our plans I've talked to a lot about it.

Neal Arnold

We love it and we plan on, continuing it and growing it.

Mark Mason

Maybe you can speak to investments in technology. This is an important infrastructure question. How do you view your investments over the next few years.

HomeStreet Inc, employee call with CEO

Neal Arnold

I would tell you, we've spent considerable amount of money to build out our commercial center on the payment side on, on that side, we're very proud of that and we were able to invest to build that we've built a lot on the wealth management side and I would say we're trying to do more on the retail, so we'll be very curious what you have and, and continue to, to build out on the retail side as everything goes to more mobile kinds of pieces of the puzzle we have mobile banking, but it's, you know, those are the areas where we've tried to be thoughtful about what we're doing.

Mark Mason

Quick question on loan sales any immediate plans for book sales or multi- family or single family loans.

Neal Arnold

Yeah, I, I think we answered this on the investor call. I don't expect any bolks. I also the multi, you know, we certainly look at the balance sheet today and, you know, there's nothing, we have to do, you know, the question is, can we be opportunistic to continue to

make the balance sheet as strong as possible and we'll do that, but

anticipating bulk sales.

Mark Mason

And I'm going to make this the last question this should be easy. What's the size of your retail branch deposits.

Neal Arnold

I would tell you retail is about sixty- five percent of our deposit total. We had that pie chart in the investor that.

Yours, Mark and Ours is about sixty- five percent retail. Our commercial deposits are growing in excess of twenty.

Five percent a year right now, so it's growing faster, but I would say retail is still the core...of our deposits.

Mark Mason

And as Neal knows that's true for us too.

And those great retail customers have been just as loyal and solid as you could imagine and

grateful for them. All right, we are going to have to stop. I told Neal, we'd be done in an hour. That was a lie.

HomeStreet Inc, employee call with CEO

Neal Arnold

All good, great.

Mark Mason

I, I know all of our employees really appreciate you showing up so quickly, not just to share your thoughts, but just being as open and, and transparent as I know you are from dealing with you and I hope that our folks see that we, we already have a great partnership here. We're very enthusiastic.

Mark Mason

About what, what a good match. These two companies make, I hope folks enjoyed having an opportunity to open Mike, the questions with us today Neal, any closing thoughts.

Neal Arnold

I look forward to getting to know you, but my, again, I just want to say the strength of any bank is how strong their employee base is, and you guys deserve an a plus at that, and so my hat's off to you. I look forward to leveraging and taking advantage of the opportunities together.

So thank you.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements can be identified through use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, and include statements related to the expected timing, completion, financial benefits, and other effects of the proposed merger (the "Merger"). Forward-looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to, (1) expected cost savings, synergies and other financial benefits from the Merger not being realized within the expected time frames and costs or difficulties relating to integration matters being greater than expected, (2) the ability of HomeStreet, Inc. (“HomeStreet”) and FirstSun Capital Bancorp (“FirstSun”) to obtain the necessary approval by its shareholders, (3) the ability of FirstSun and HomeStreet to obtain required governmental approvals of the Merger, (4) the ability of FirstSun to consummate their investment agreements to obtain the necessary capital to support the transaction, (5) the failure of the closing conditions in the definitive Agreement and Plan of Merger (the “Merger Agreement”), dated as of January 16, 2024, by and between HomeStreet and FirstSun to be satisfied, or any unexpected delay in closing the Merger. Further information regarding additional factors that could affect the forward-looking statements can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking Statements” (in the case of FirstSun), “Forward-Looking Statements” (in the case of HomeStreet), and “Risk Factors” in FirstSun’s and HomeStreet’s Annual Reports on Form 10-K for the year ended December 31, 2022, and other documents subsequently filed by FirstSun and HomeStreet with the U.S. Securities and Exchange Commission (“SEC”).

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Merger between FirstSun, a Delaware corporation, and HomeStreet, a Washington corporation, FirstSun will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Homestreet and a Prospectus of FirstSun, as well as other relevant documents concerning the proposed transaction. Investors and security holders, prior to making any investment or voting decision, are urged to read the registration statement and proxy statement/prospectus when it becomes available (and any other documents filed with the SEC in connection with the Merger or incorporated by reference into the proxy statement/prospectus) because such documents will contain important information regarding the Merger.

Investors and security holders may obtain free copies of these documents and other documents filed with the SEC on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by (i) FirstSun on its website at https://ir.firstsuncb.com/investor-relations/default.aspx, and (ii) HomeStreet on its website at https://ir.homestreet.com/sec-filings/all-filings/default.aspx.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

PARTICIPANTS IN THE SOLICITATION

FirstSun, HomeStreet and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from shareholders of HomeStreet in connection with the proposed Merger. Information regarding the directors and executive officers of FirstSun and HomeStreet and other persons who may be deemed participants in the solicitation of the shareholders of HomeStreet in connection with the proposed Merger will be included in the proxy statement/prospectus for HomeStreet’s special meeting of shareholders, which will be filed by FirstSun with the SEC. Information about the directors and officers of FirstSun and their ownership of FirstSun’s common stock can be found in FirstSun’s annual

report on Form 10-K, as filed with the SEC on March 16, 2023, and other documents subsequently filed by FirstSun with the SEC. Information about the directors and officers of HomeStreet and their ownership of HomeStreet’s common stock can be found in HomeStreet’s definitive proxy statement in connection with its 2023 annual meeting of shareholders, as filed with the SEC on April 11, 2023, and other documents subsequently filed by HomeStreet with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed Merger filed with the SEC when they become available.

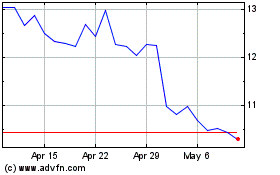

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2024 to May 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From May 2023 to May 2024